Awe-Inspiring Examples Of Info About Bill Receivable Is Debit Or Credit In Trial Balance

First, debits must ultimately equal credits.

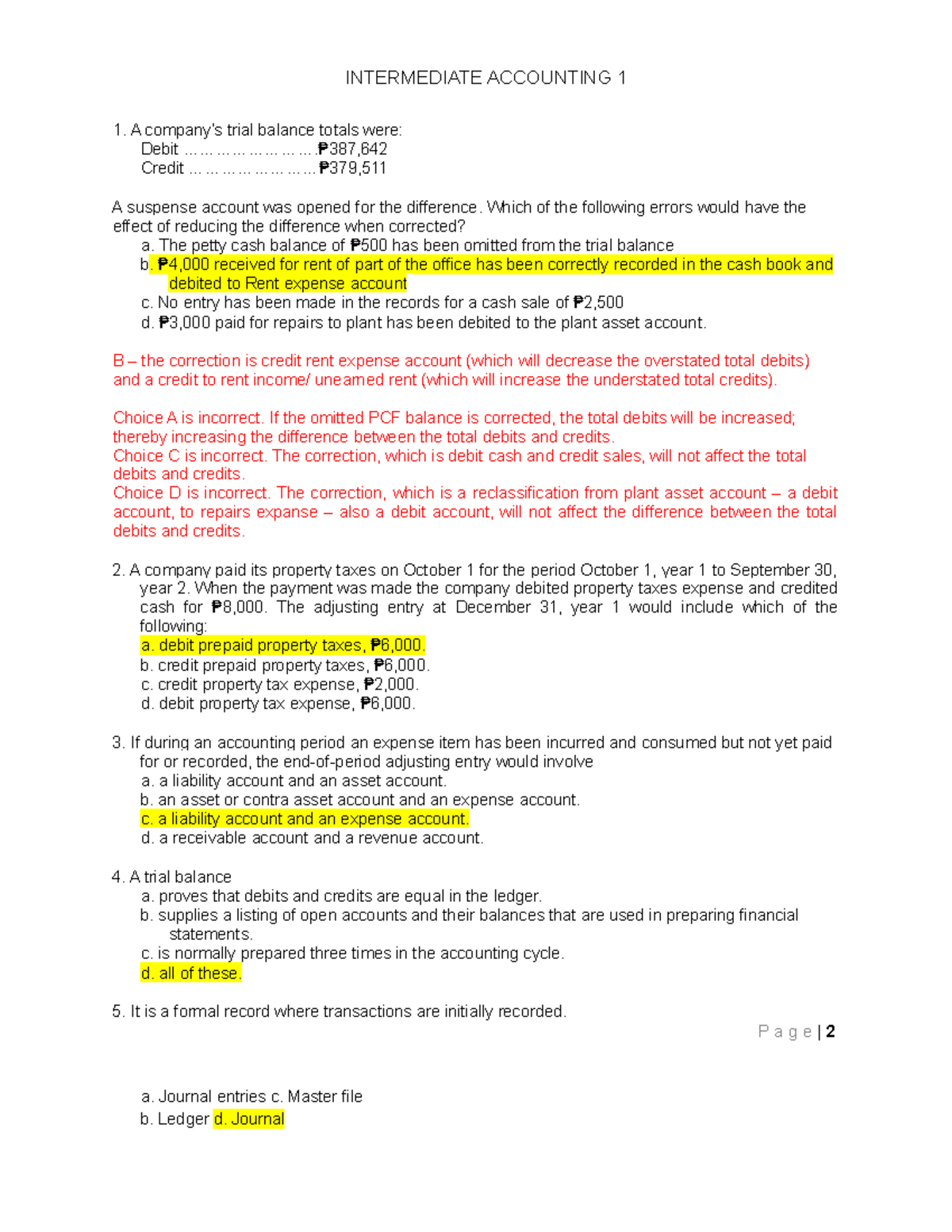

Bill receivable is debit or credit in trial balance. A trial balance is a list of all accounts in the general ledger that have nonzero balances. A trial balance includes all your business accounts that have credits or debits during a given reporting period. Trial balance is a statement that assembles the balances of all ledger accounts in a definite format.

Debit balance while preparing an account if the debit side is greater than the credit side, the difference is called “debit balance”. On a balance sheet, accounts receivable are said to be an asset. On a trial balance, accounts receivable is a debit until the customer pays.

Accounts receivable carries a debit status on the trial balance sheet. So, if debit side > credit side, it is a debit. While this may be confusing at first, and it may be tempting to simply use positive and negative numbers to account for.

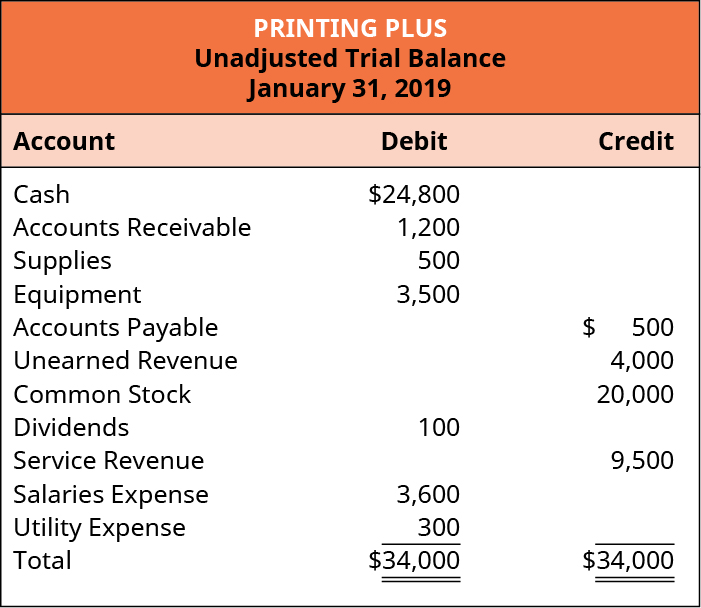

This means the company is waiting for money from customers who bought goods or services. The trial balance may contain columns for unadjusted balance, adjusting entries, and adjusted balance, with debit and credits indicated. Does accounts receivable have a debit or credit balance?

$10,000 (initial assets) + $3,000. Therefore, it is a debit balance because its money. Debit balance indicates the asset, and credit balance indicates the liabilities.

It includes the amounts credited or debited to each account, the. It records both debit balance as well as credit balances from the. An accounts receivable trial balance is a financial report listing individual customer credits and debits, ensuring the total matches the general ledger.

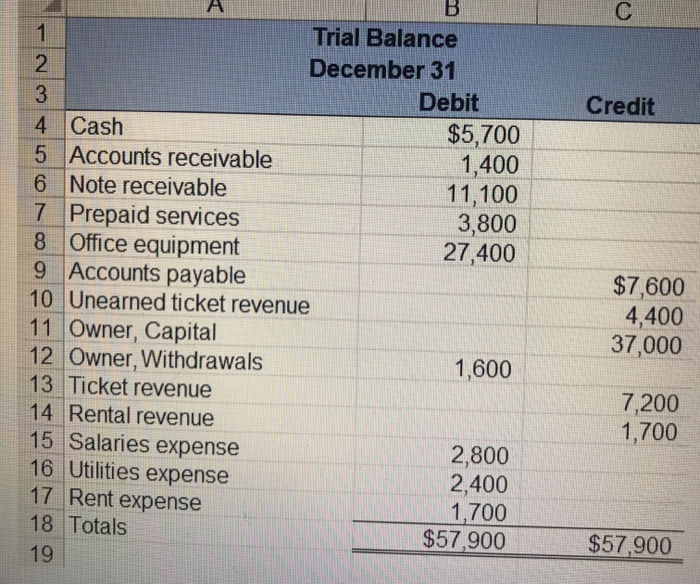

However, it can shift to the credit side under specific circumstances. Once the customer has paid, you’ll credit accounts receivable and debit your cash. At the end of the month, creative designs decides to create a trial balance to ensure the books are balanced:

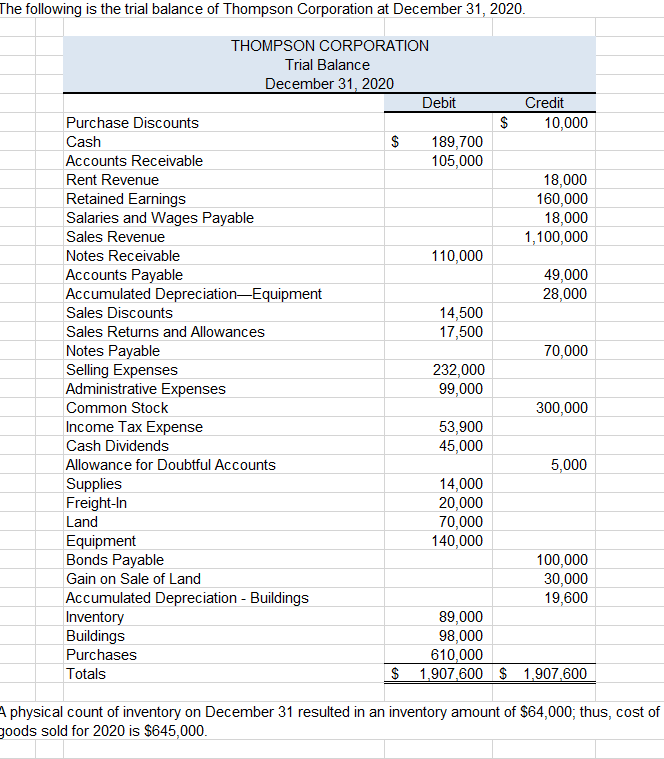

The company's accountant records the invoice amount—$1,000—as a debit, or dr, in the accounts receivables section of the balance sheet, because that is an. A trial balance is a conglomerate of or list of debit and credit balances extracted from various accounts in the ledger including cash and bank balances from. Bills receivable is a document or a bill of exchange that is generated when the seller sells some goods on credit to a customer.

By default, as an asset, accounts receivable is a debit balance. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal.