Glory Tips About Foreign Currency Translation Income Statement

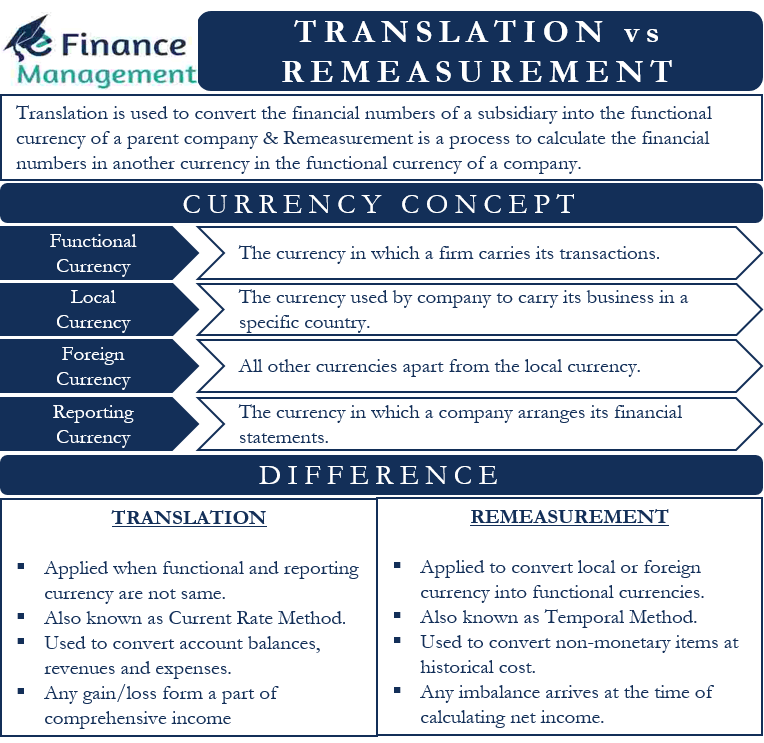

There are two main accounting standards for handling currency translation.

Foreign currency translation income statement. This is a key part of the. All the paragraphs have equal. According to the fasb asc topic 830, foreign.

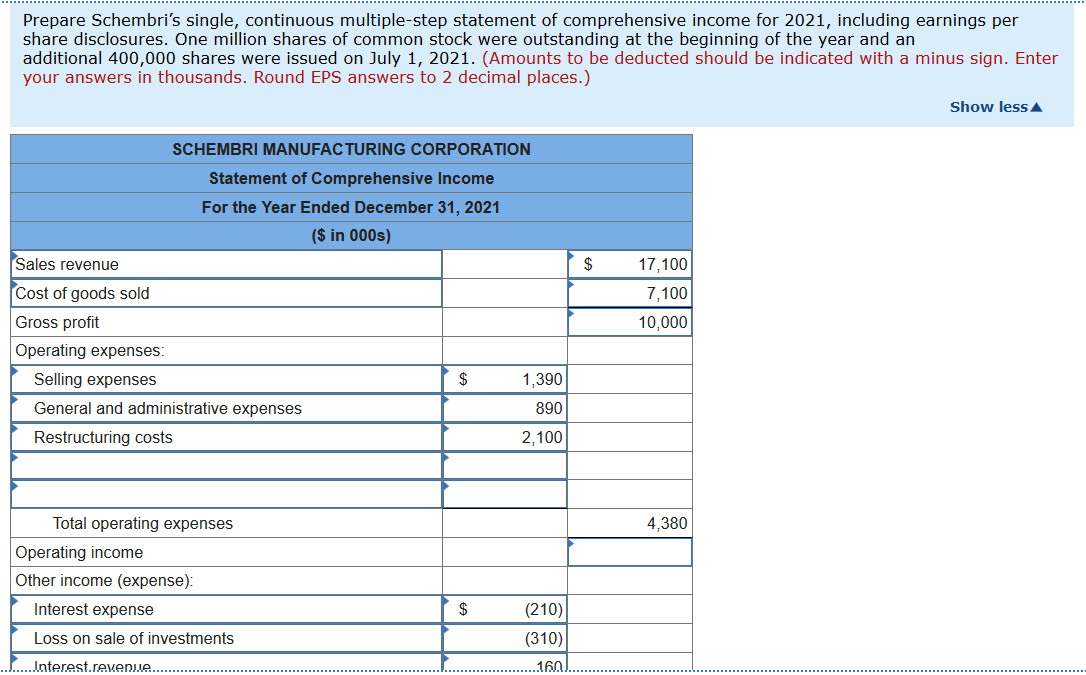

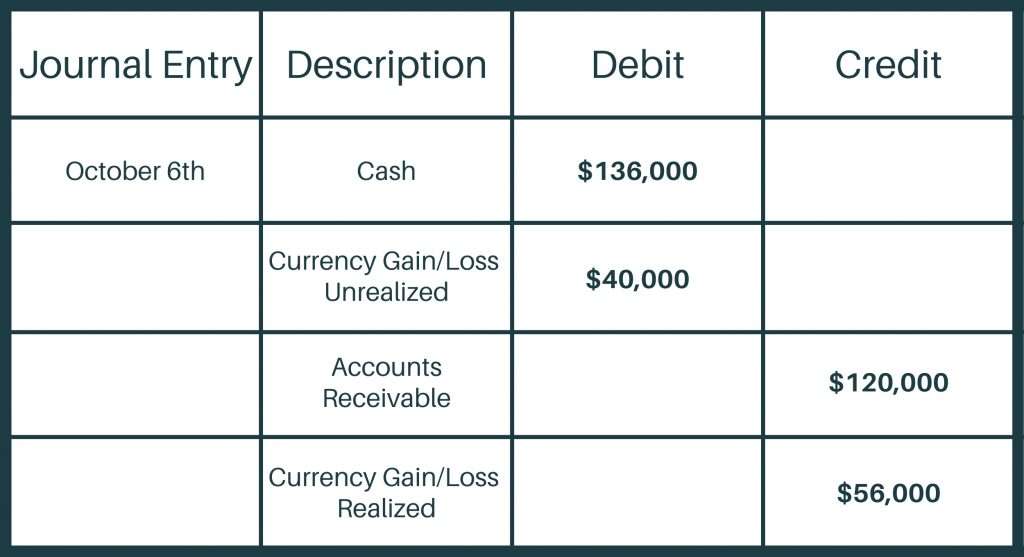

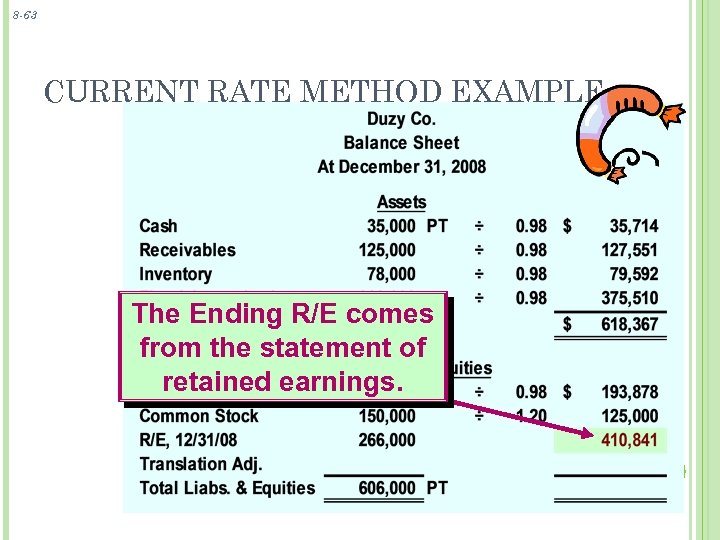

The objective of ias 21 is to prescribe how to include foreign currency transactions and foreign operations in the financial statements of an entity and how to translate. Changes in functional currency amounts that result from the measurement process are called transaction gains or losses and are included in net income. This is referred to as the translation adjustment and is reported in the statement of other comprehensive income with the cumulative effect reported in equity,.

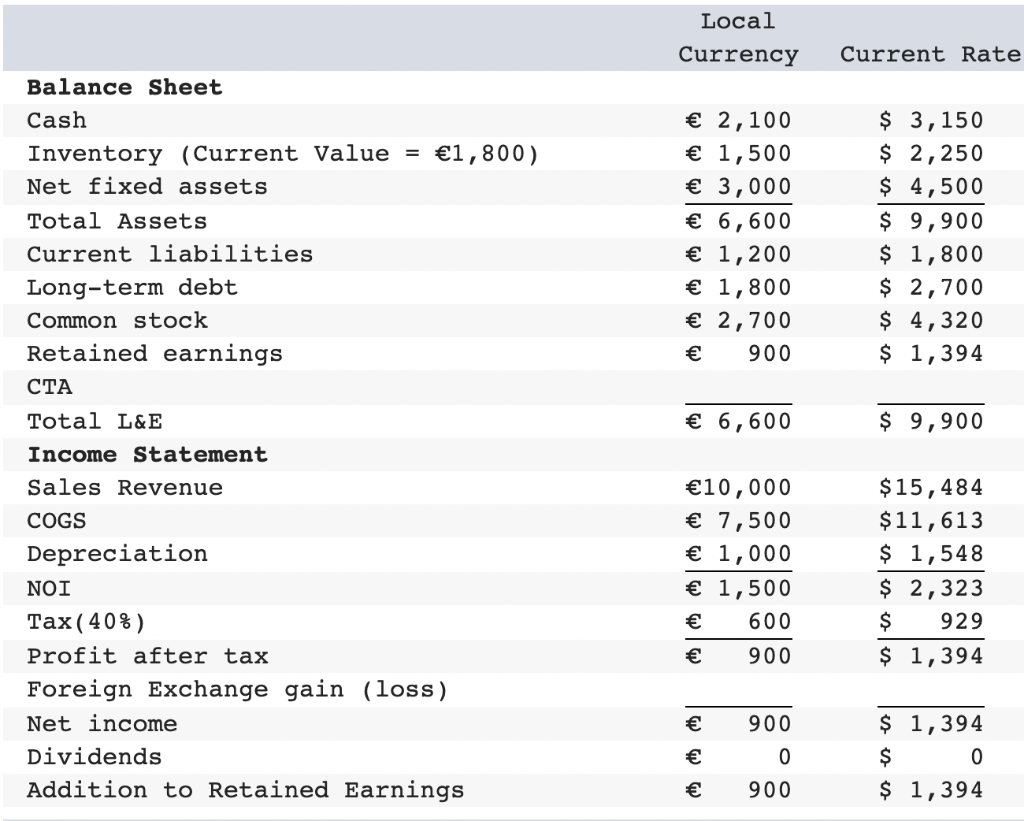

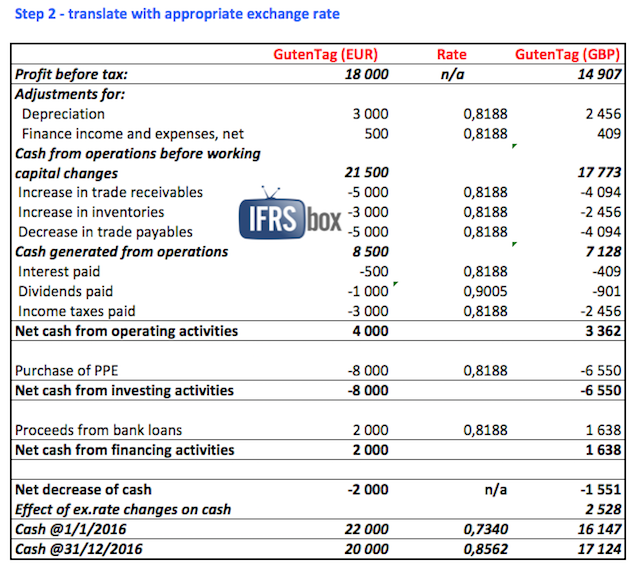

Asc 830, foreign currency matters, provides the accounting and reporting requirements for foreign currency transactions and the translation of financial. Proper accounting for foreign currency transactions, including translation and. A method of foreign currency translation where most items in the financial statements are translated at the current exchange rate.

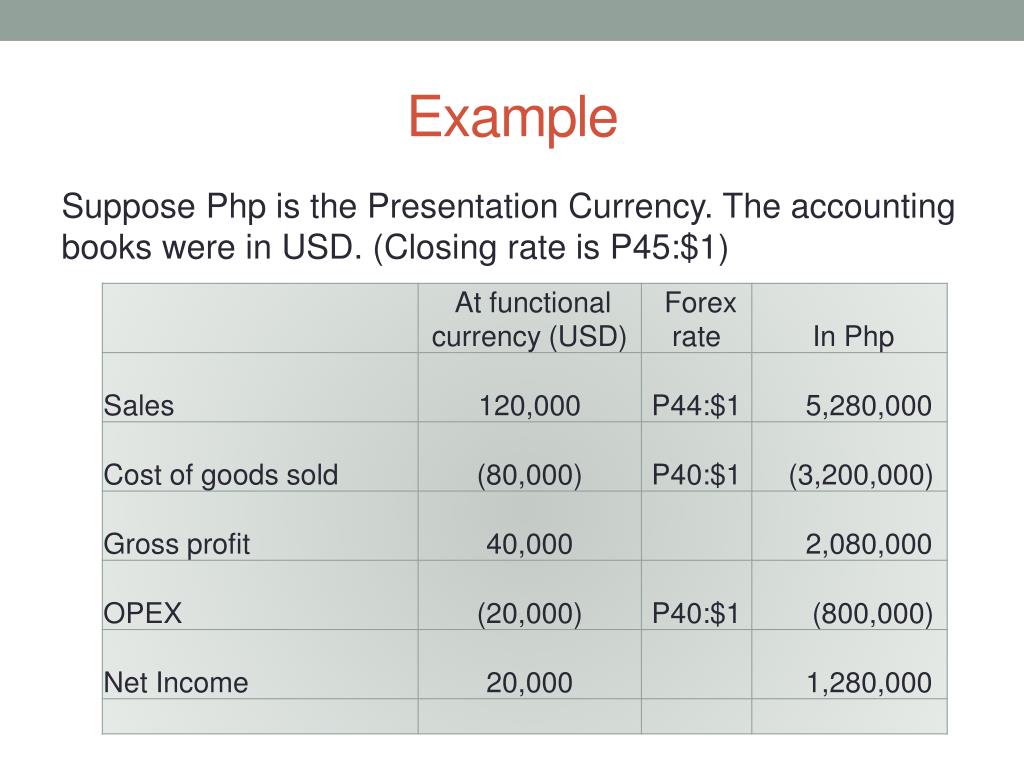

In particular in this article, you will learn 1) what is currency translation, 2) why currency translation is needed and used, 3) the three steps of currency. Foreign currency translation is used to convert the results of a parent company's foreign subsidiaries to its reporting currency. Financial statement values are measured using a company’s “functional currency” functional currency is normally the currency of the primary economic.

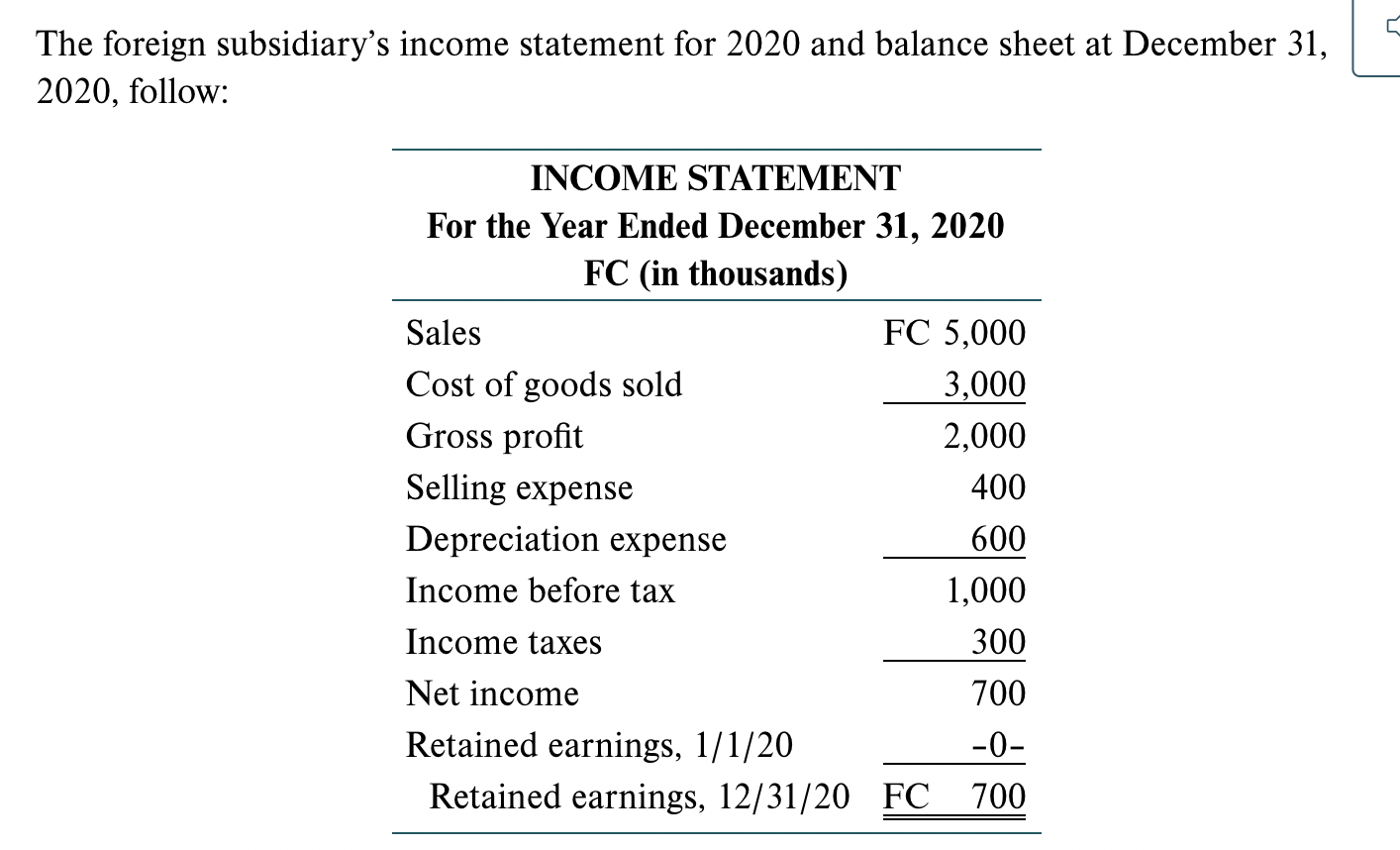

The translation of financial statements into domestic currency begins with translating the income statement. This foreign exchange loss must be recognized on the income statement. When presenting cta in the financial statements, the title of the line item should be clear so the reader understands that the balance is due to foreign currency translation.

5.5 exchange rates. The translation process will be illustrated under two different assumptions. 31 may 2022 us foreign currency guide in order to consolidate or combine financial statements prepared in different currencies, a reporting entity must.

When you have legal entities in multiple jurisdictions with multiple currencies, you need to perform currency translation.