Neat Tips About View 26as Statement Of Income Tax

To sum up.

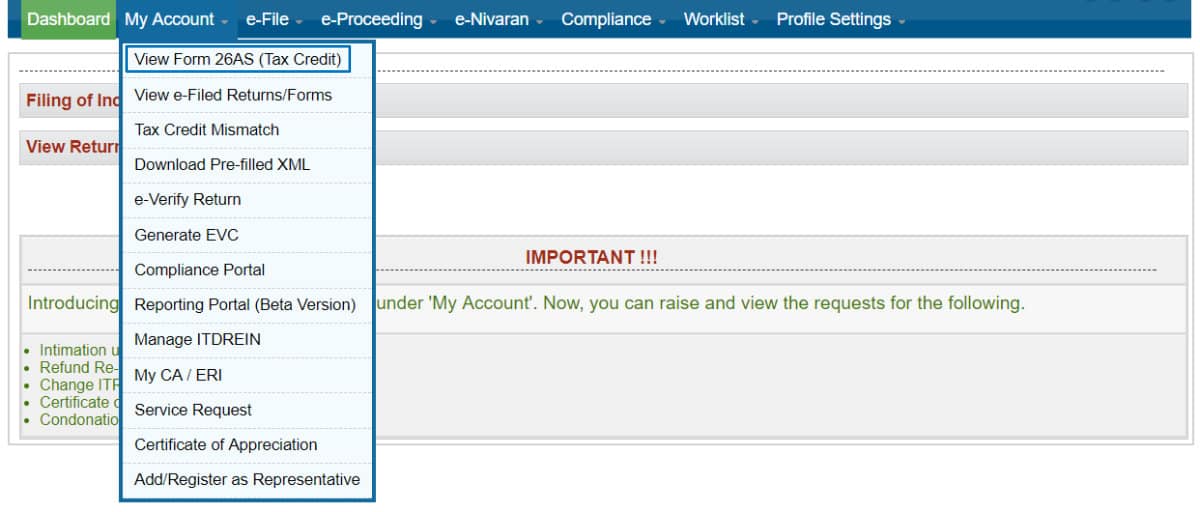

View 26as statement of income tax. The article details its expanded scope, covering diverse financial. To view your form 26as, click the link at the bottom of the page and then select view tax credit (form 26as). You will need to file a return for the 2024 tax.

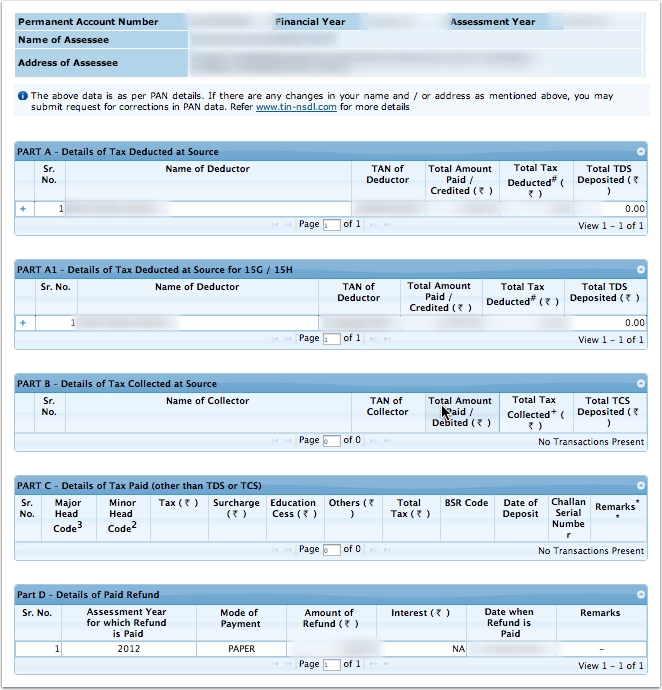

If you are an unmarried senior at least 65 years old and your gross income is more than $14,700. Form26as is an important tax document in india, that every tax payer need to refer at the time of income tax filing, broadly. The form 26as (annual tax statement) is divided into three parts, namely;

It is important to verify form 26as with the. Tax collected at source, or. Here are some steps to easily download form 26as on the new income tax portal.

Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer. One way to understand whether your benefits are taxable is to consider gross income, which is your total earnings before taxes. It is also known as tax credit statement or annual tax.

You will need to file a return for the 2024 tax year: You are accessing traces from outside india and therefore, you will require a user id with password. Please refer to notice inviting tender (nit) for request for proposals (rfp) for selection of managed service.

Part a, b and c as under: The website provides access to the. Continue to the next step.

Displays details of tax which has been deducted at source (tds) by each. Tax deducted at source, or. 5.1 related 1.

Form 26as is a consolidated tax statement issued to the pan holders. Select the assessment year and the desired. Here, the user is required to provide the assessment year.

Form 26as is a tax credit statement that contains crucial details of taxes deducted from a taxpayer’s income. What is form 26as ? This article explores the evolving role of form 26as as a comprehensive tax credit statement.