Impressive Tips About Current Ratio Calculation Example

Very often, people think that the.

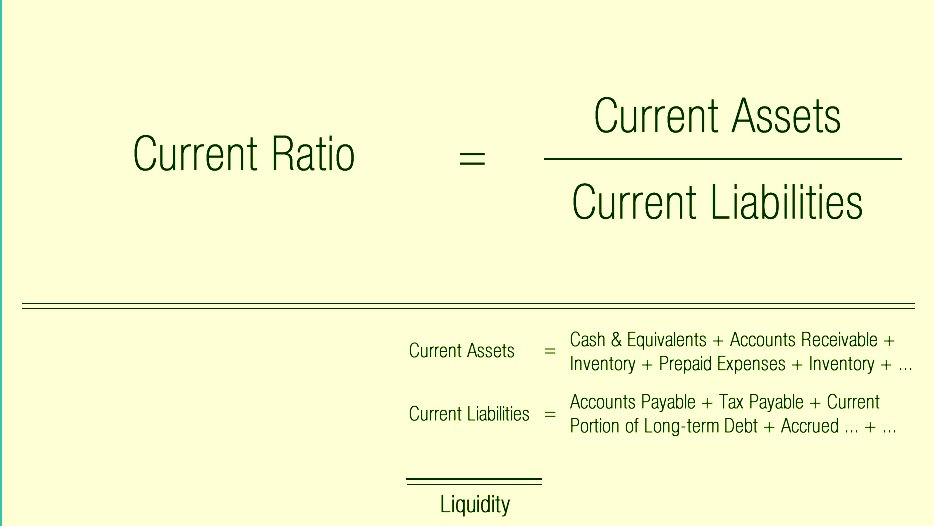

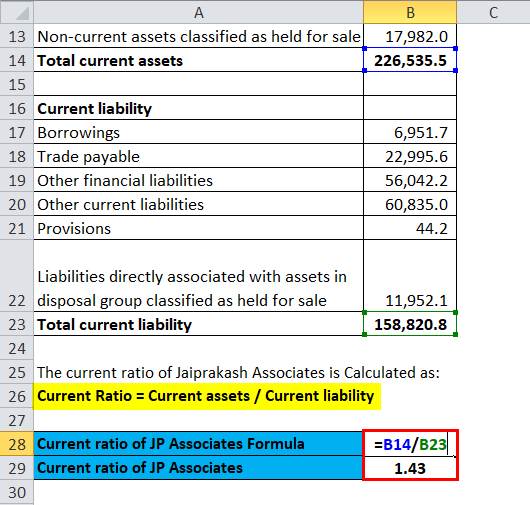

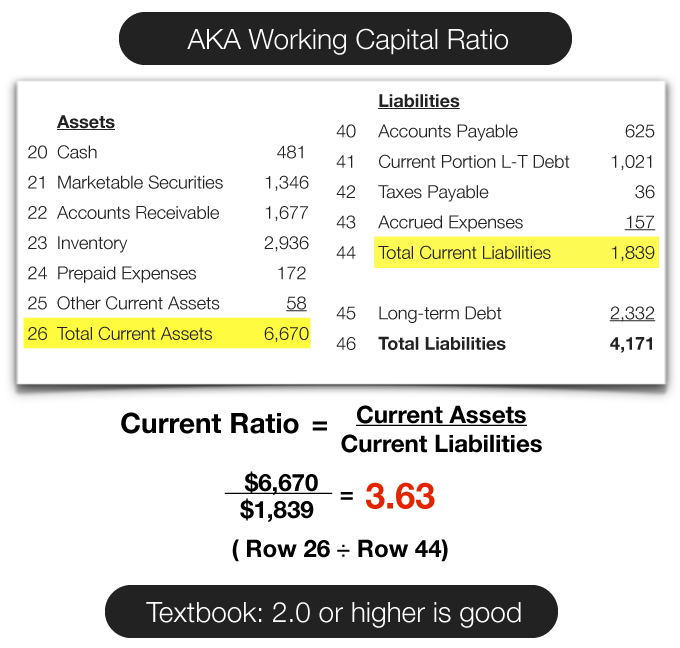

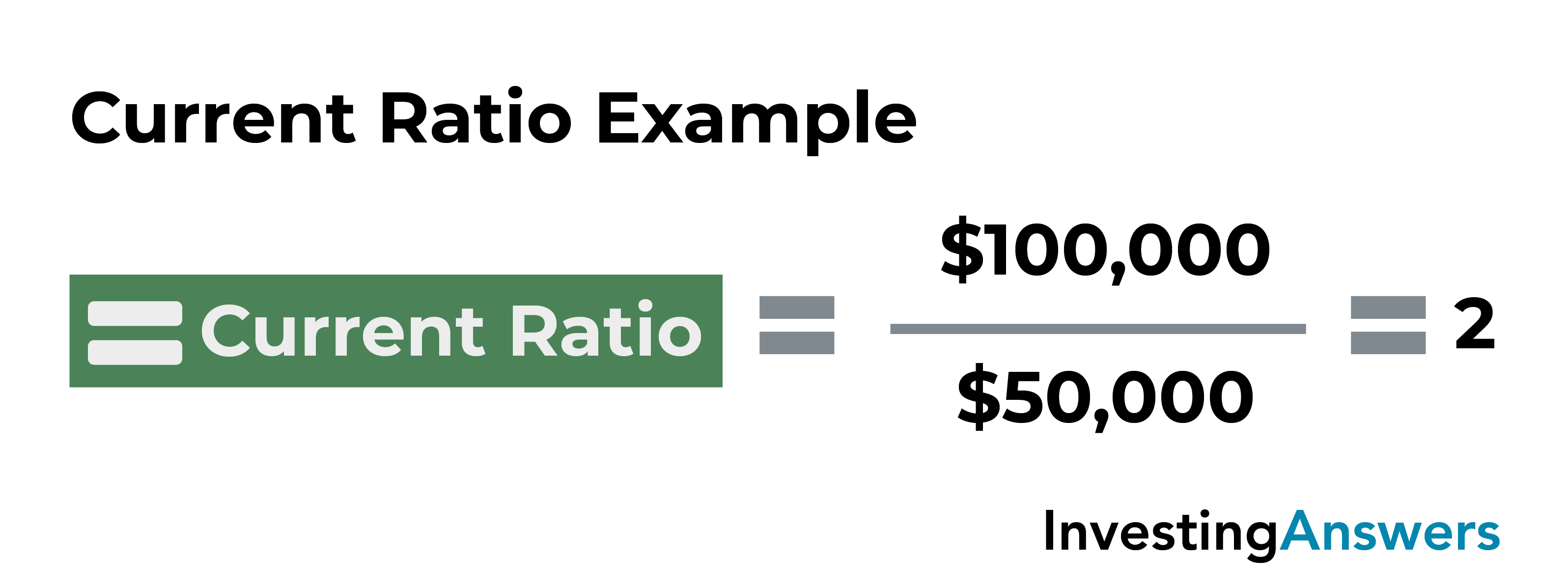

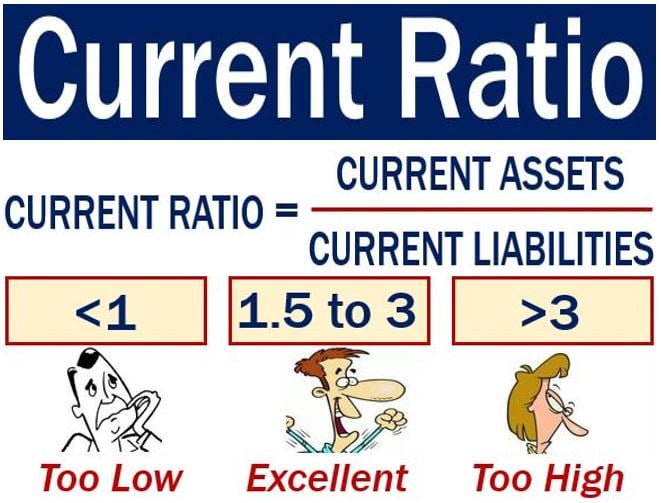

Current ratio calculation example. Current assets include cash, accounts receivable, inventory, and any other assets. Current ratio = current assets / current liabilities. Current ratio example calculation.

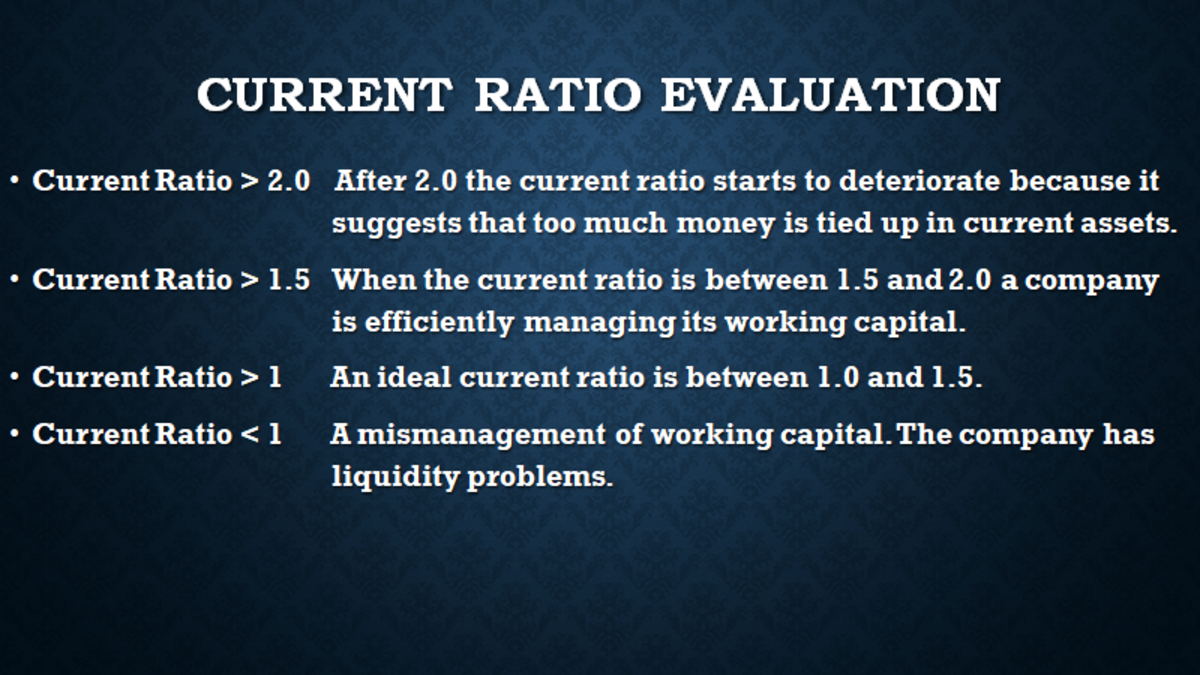

A current ratio equal to 3 means that the company has 3 times more current assets than current liabilities. 31, 2022 balance sheet for walmart inc. Shown below as part of its 2022 annual report.

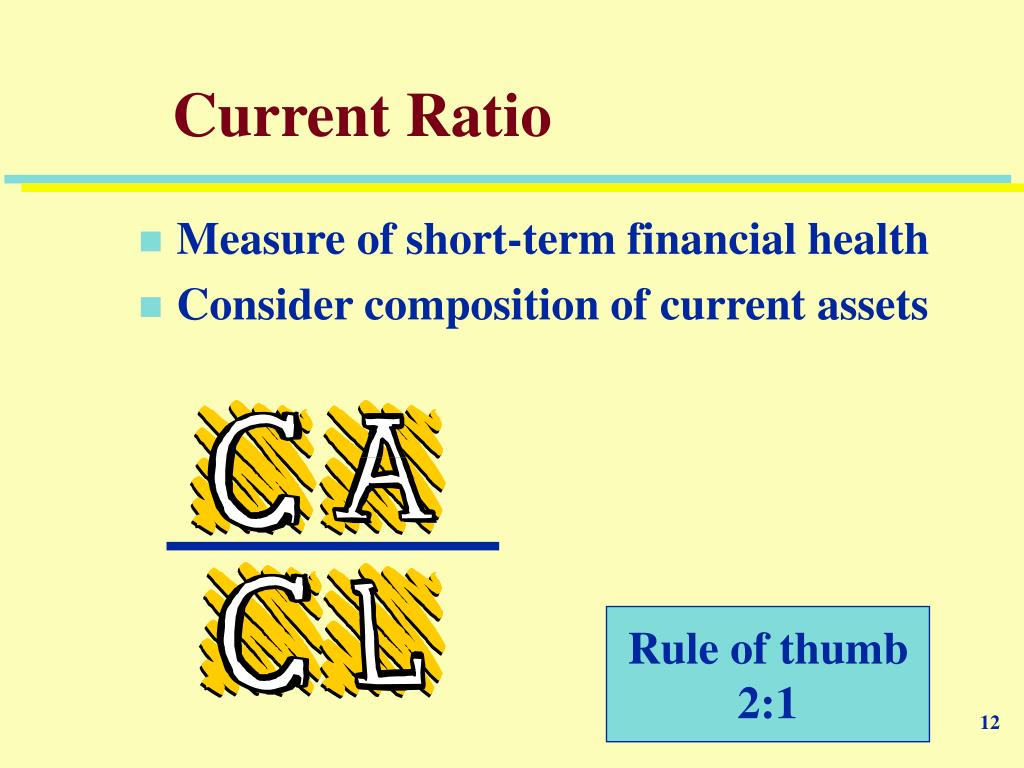

Typically, a 1.0 current ratio is considered to be acceptable as the company has enough current assets to cover its current liabilities. Formula the formula of current ratio calculation is rather straightforward. Reported total current assets of $135.4 billion, slightly higher than its total current assets at the end of the last fiscal year of $134.8 billion.

Marketable securities = $20 million;. Here’s the equation: Current ratio = current assets / current liabilities 1.

However, the company's liability composition significantly changed from 2021 to 2022. Investinganswers expert updated may 25, 2021 what is current ratio? Dictionary what is the current ratio?

To give an example: It tells investors and analysts. In its q4 2022 fiscal results, apple inc.

In this current ratio example, the ratio is less than 1, indicating that the company’s cl exceeds its ca. It is expressed as follows: For instance, assume company a has the following current assets:

Current assets are assets that are expected to be converted into cash within. At the 2022, the company reported $154.0. Let’s imagine that your fictional company, xyz inc., has $15,000 in current assets and $22,000 in current liabilities.

For example, if current liabilities are $40,000 and current assets are $60,000, the current ratio would be: Example of the current ratio formula. It’s a simple ratio calculated by dividing a company’s current assets by its current liabilities.

A liquidity measure that assesses a company's ability to. What is a good current ratio? Current ratio formula and calculation.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)

![Current Ratio Formula + Calculator [Excel Template]](https://media.wallstreetprep.com/uploads/2021/11/27114755/Current-Ratio-Formula.jpg)