Ace Tips About Financial Health Ratio

They provide a snapshot of a company’s financial condition and help investors, analysts, and management make informed decisions.

Financial health ratio. A healthy a1c reading for someone without diabetes is between 4% and 5.7. Financial ratios are the indicators of the financial performance of companies. These ratios can tell you the financial health of your practice.

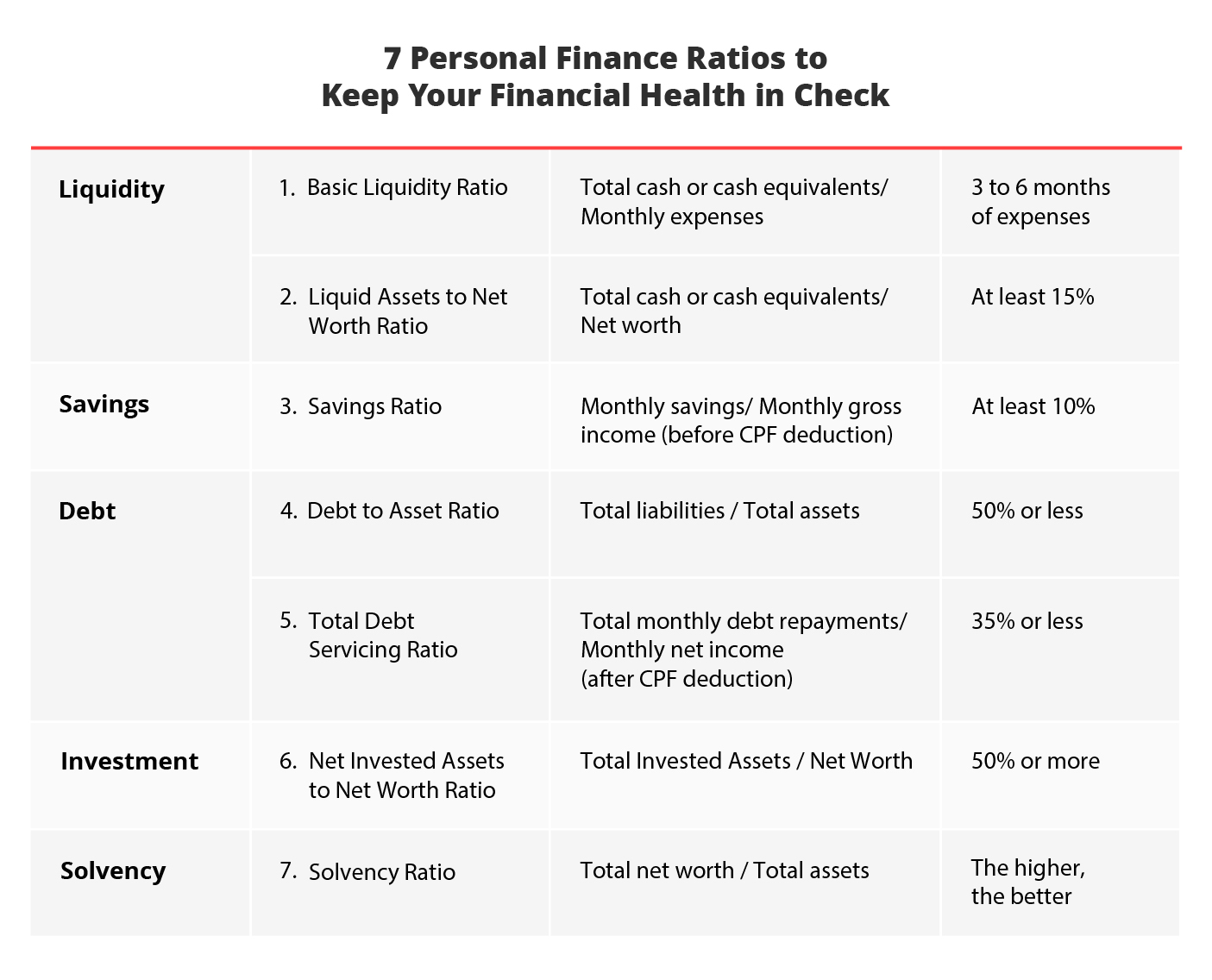

If you have a monthly passive income of $5,000 and your monthly living expenses amount to $6,000, your financial independence ratio would be $5,000 / $6,000 = 0.83. Uses and users of financial ratio analysis. I’ve listed the top five financial metrics that every physician should know and use every month.

Keeping track of financial ratios is an essential way for you to examine your company’s financial health. These ratios are a key indicator of the financial health. Financial ratios are quantitative metrics used to assess the financial health and performance of a company or organization.

Wharton has regained its position as the world’s leading provider of mbas in 2024, according to the latest ft ranking of the top 100 global business schools. Compares a company's stock price to its earnings per share (eps). The us business school, part of the.

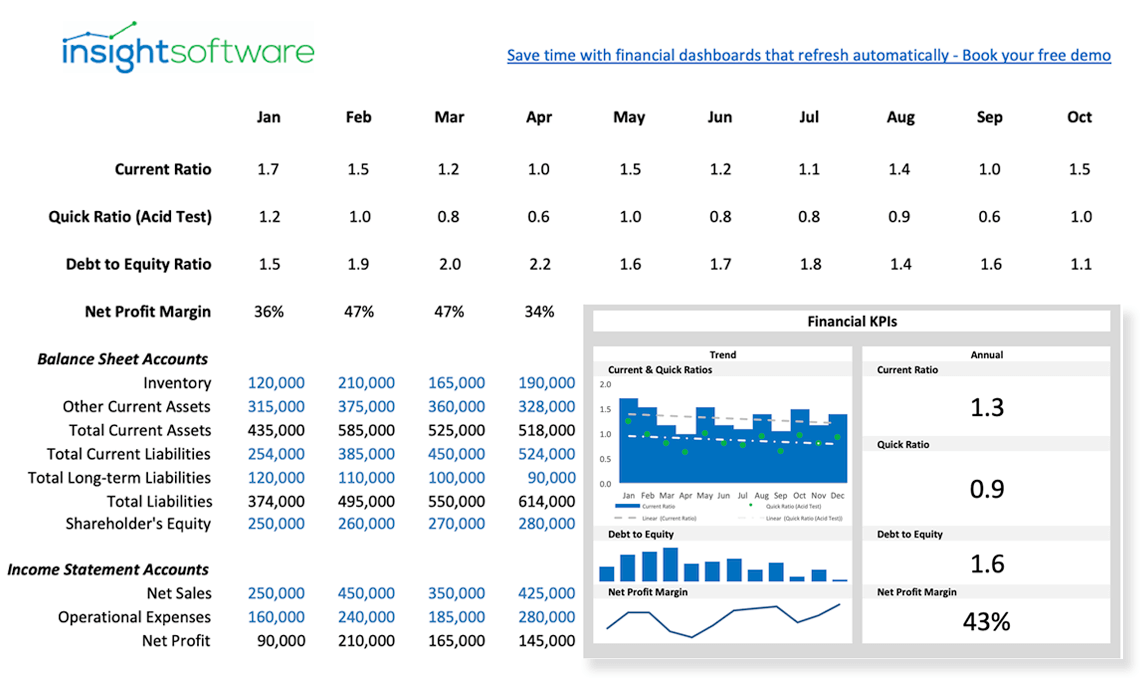

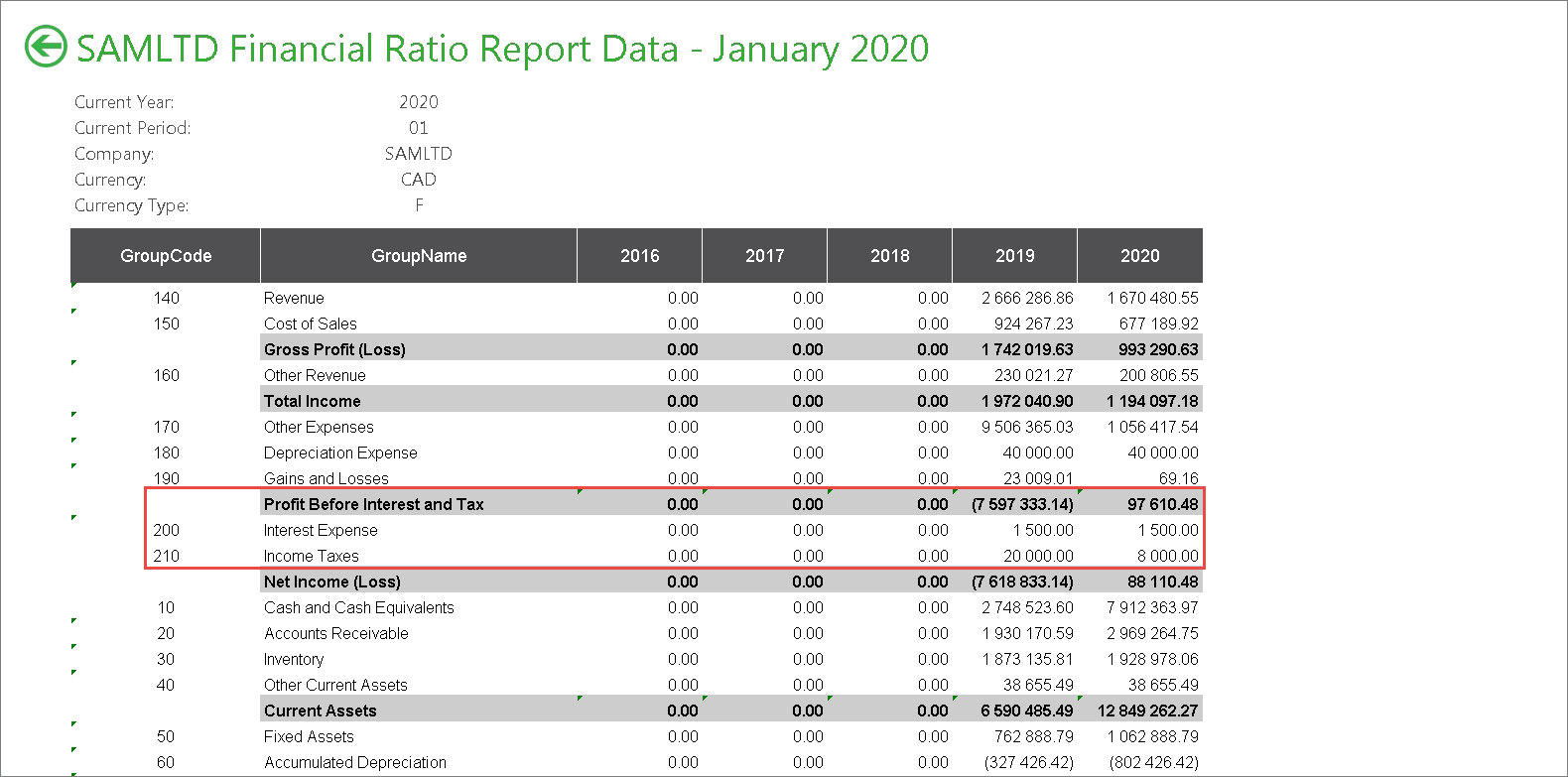

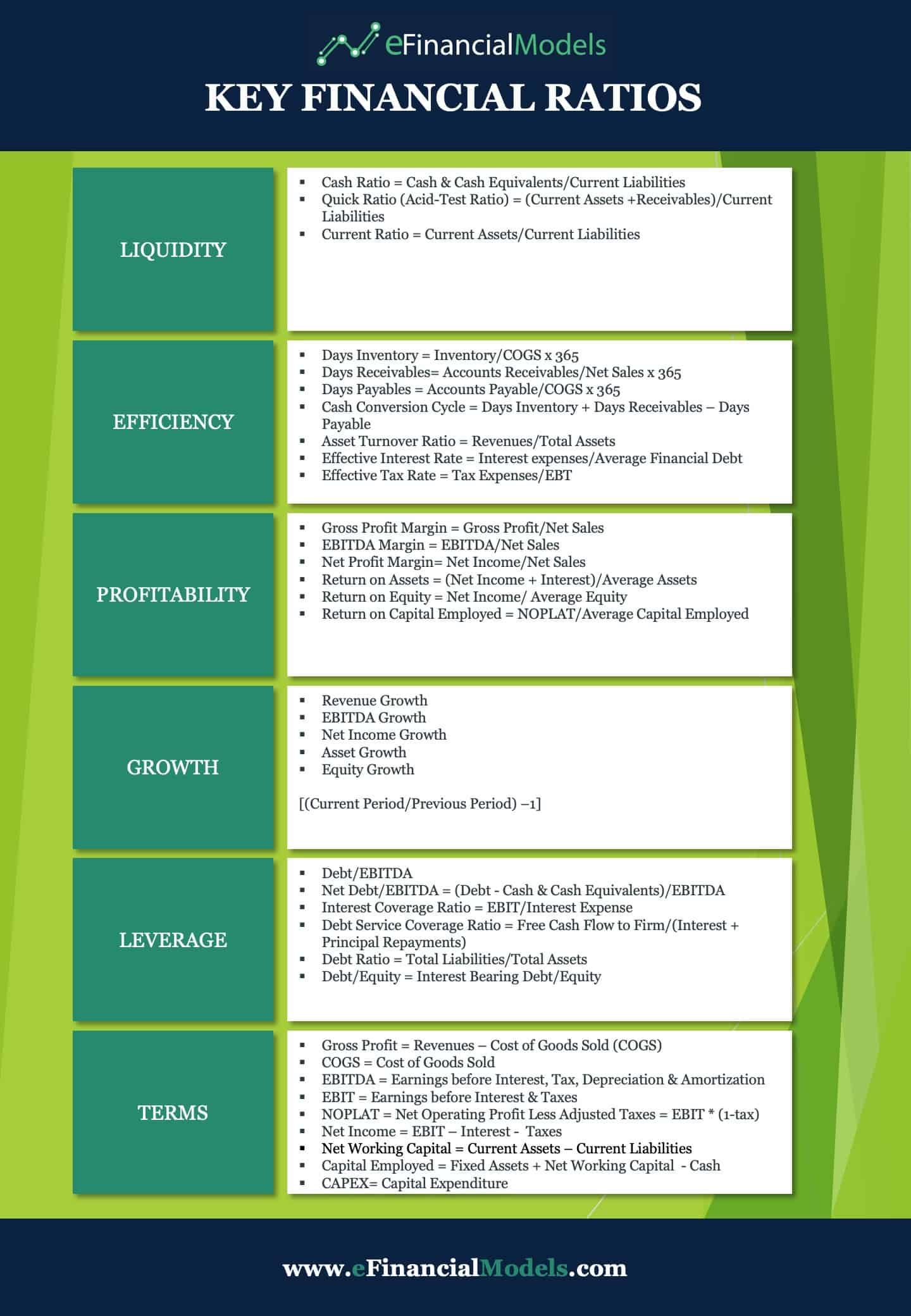

Different financial ratios indicate the company’s results, financial risks, and working efficiency, like the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratios, stability ratios, etc. We’ll talk about how to analyze financial statements, what different financial figures mean, and how to use financial ratios to quickly and easily understand how healthy a business is. A reconciliation from apms “underlying earnings” and “combined ratio” to the most directly related line item, subtotal, or total in the financial statements of the corresponding period is provided on pages 25 and 26 of axa’s activity report as of and for the year ended december 31, 2023 (“axa’s 2023 activity report”).

Are your assets greater than your liabilities? 5 key ratios to assess financial health of a company. Solvency is different from liquidity as it measures the ability to pay all the debts of the company.

You can use the current ratio to help determine your company's financial health. Analyzing financial statements is essential for stock investing. Ratios fall under a variety of categories, including profitability, liquidity, solvency, efficiency, and valuation.

As such, the higher the solvency ratio, the stronger your financial position. The current ratio = current assets / current liabilities. By improving one metric, you may be able to improve other metrics.

Financial ratios help you make sense of the numbers presented in financial statements, and are powerful tools for determining the overall financial health of your company. These ratios are important for businesses, investors, creditors, and other stakeholders as they help in evaluating a company's financial health, performance, and.

There are many dimensions to financial health, including the amount of savings you have, how much. These are just a few the financial ratios physicians can perform using income statements and balance sheets provided to them by their accountants and office managers. Has 270 doctors for every 100,000 people in 2022, up from 162 doctors per capita in 1976, according to data from the canadian institute for health information shared in a new report from.