Glory Tips About Ebitda Calculation From Income Statement

Companies are not required to report ebitda at this time.

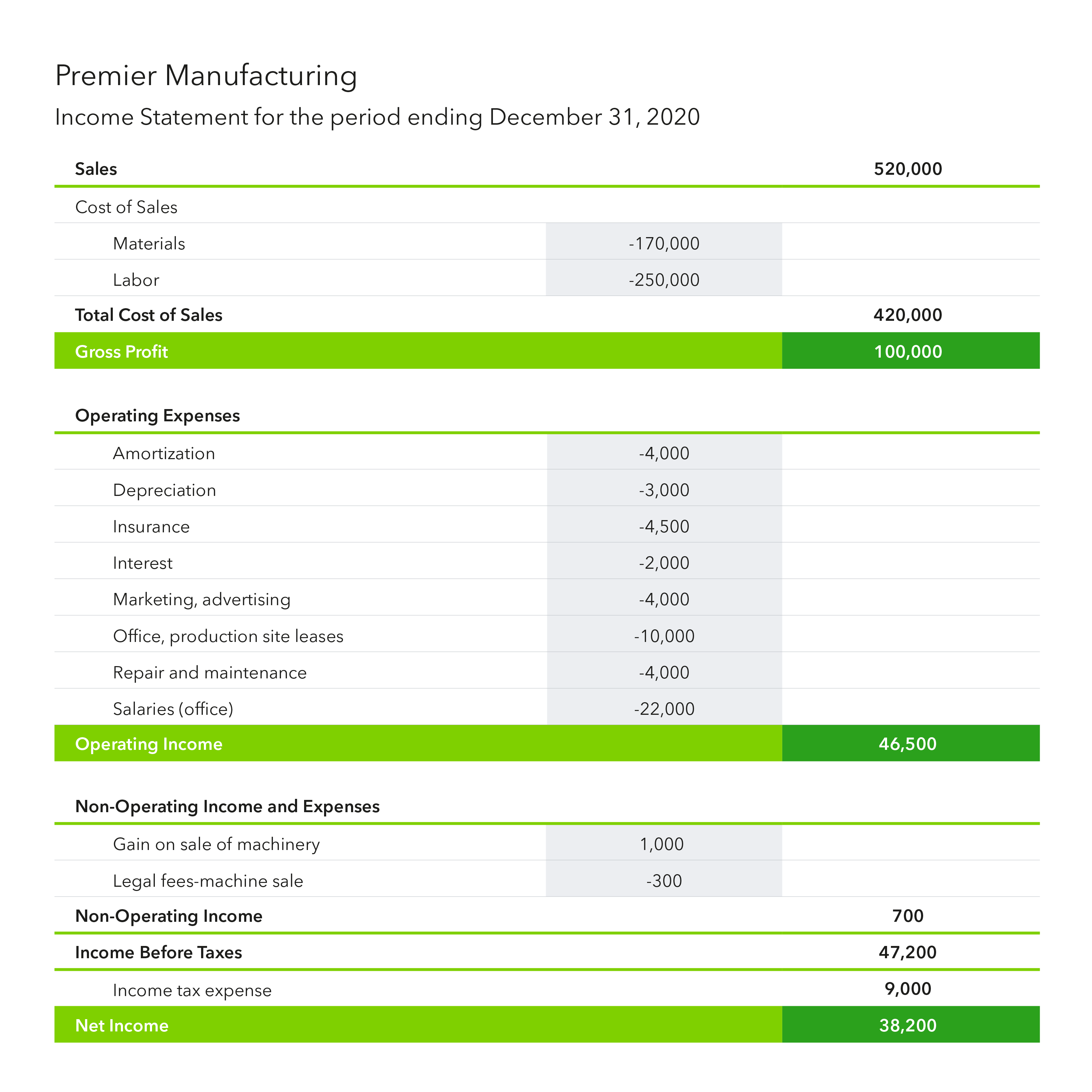

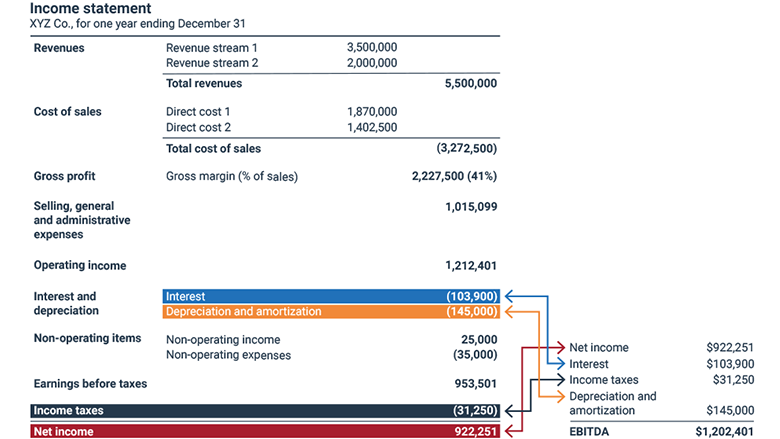

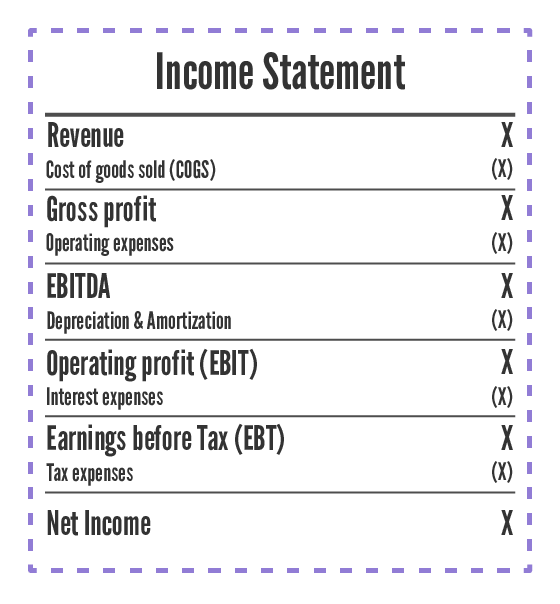

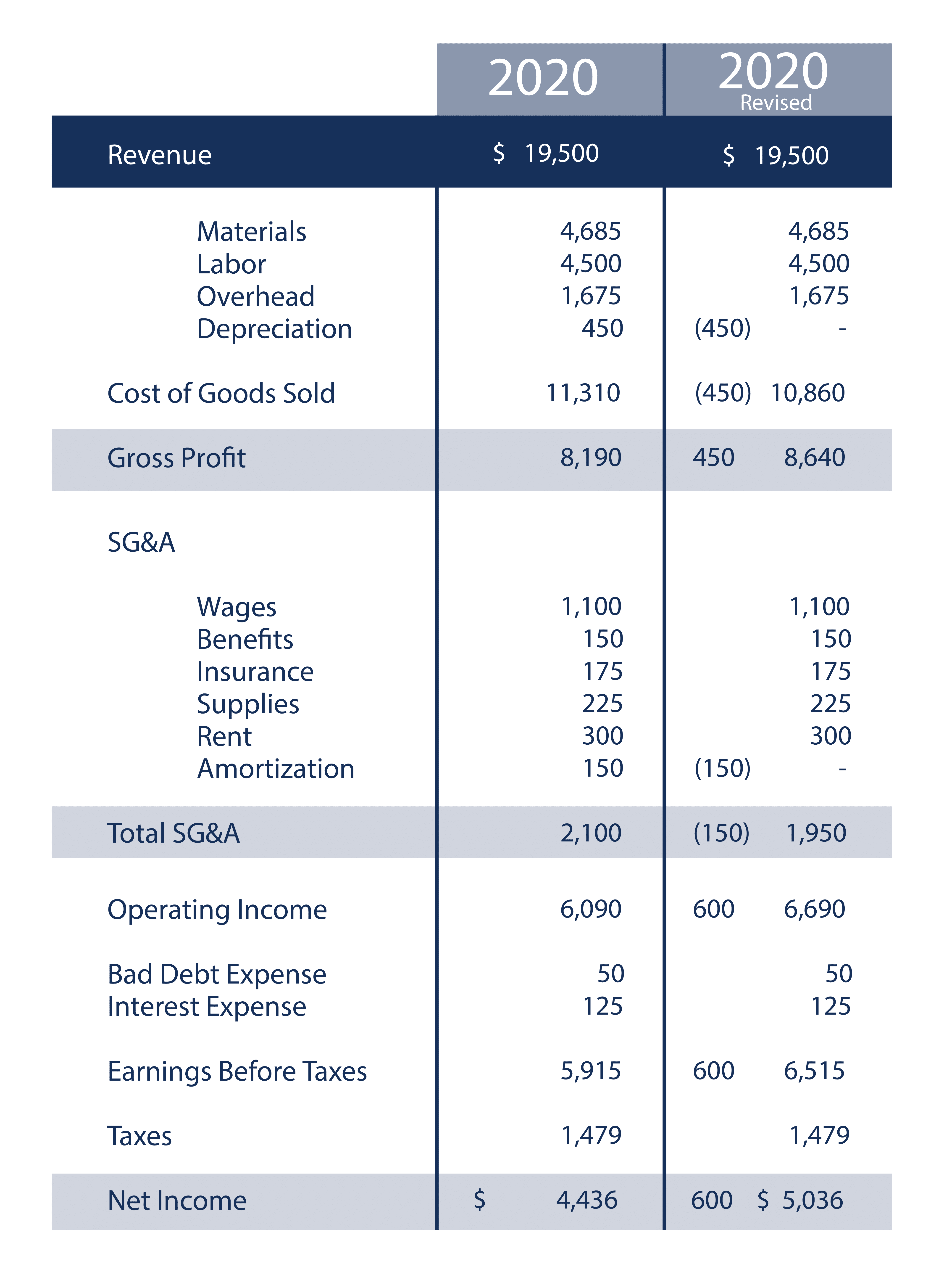

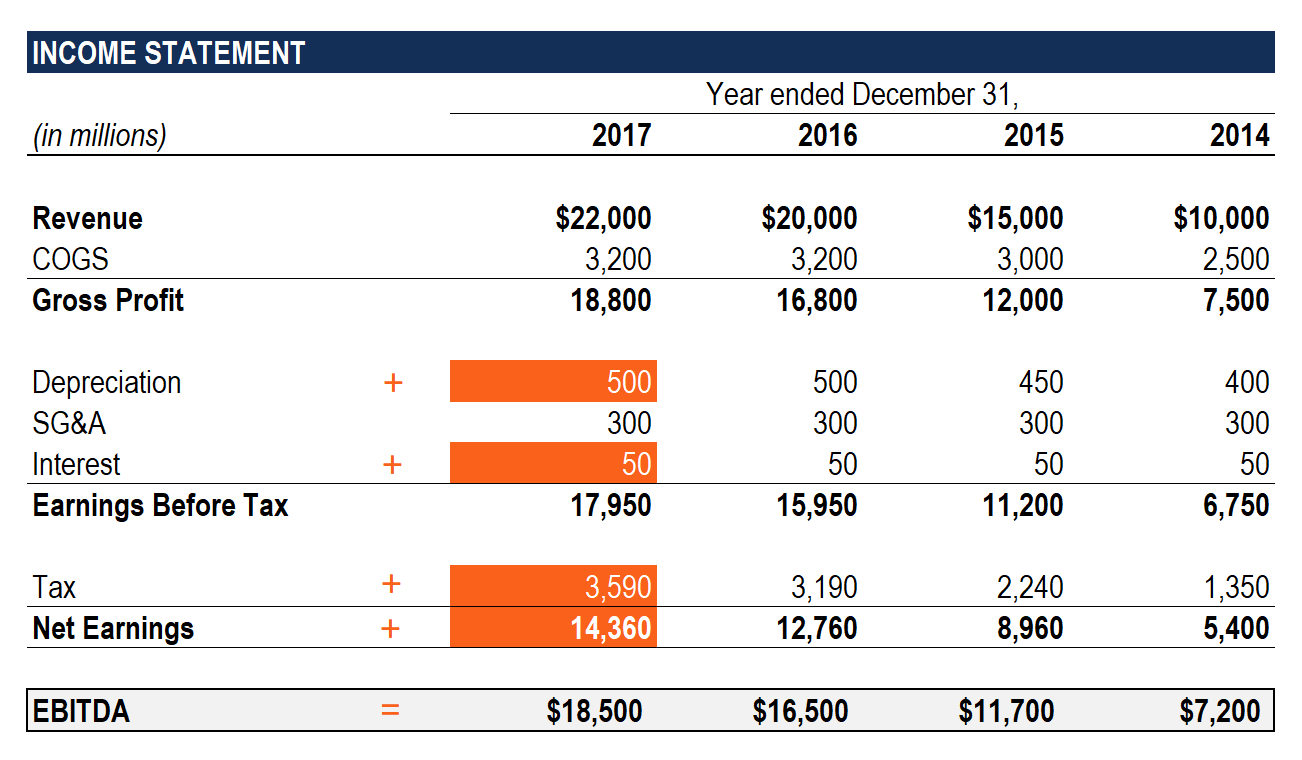

Ebitda calculation from income statement. In fact, all of the information needed is contained within the income statement. The formula for calculating the ebitda margin is as follows. Earnings before interest, taxes, depreciation and amortization do not consider income tax and interest.

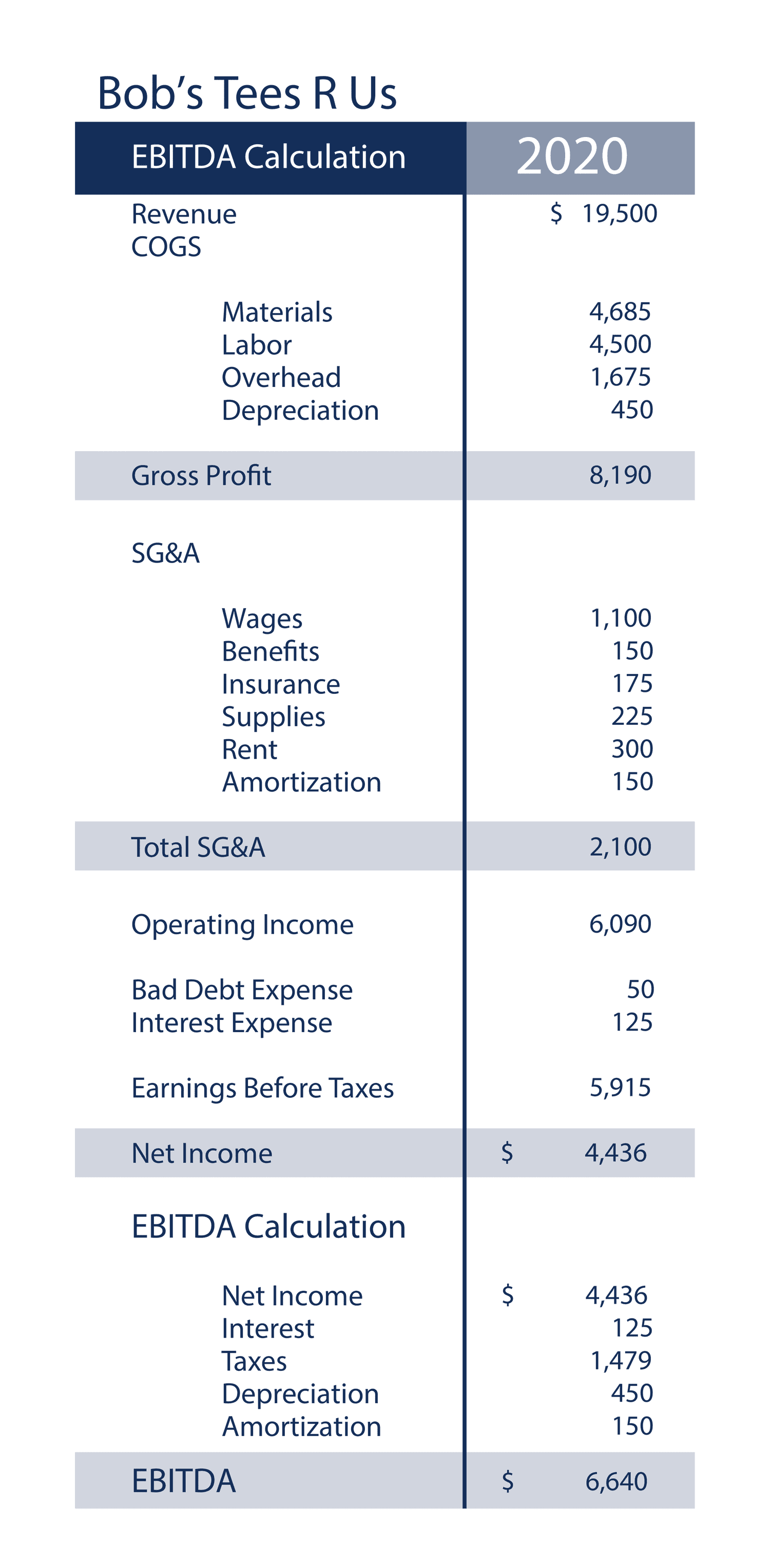

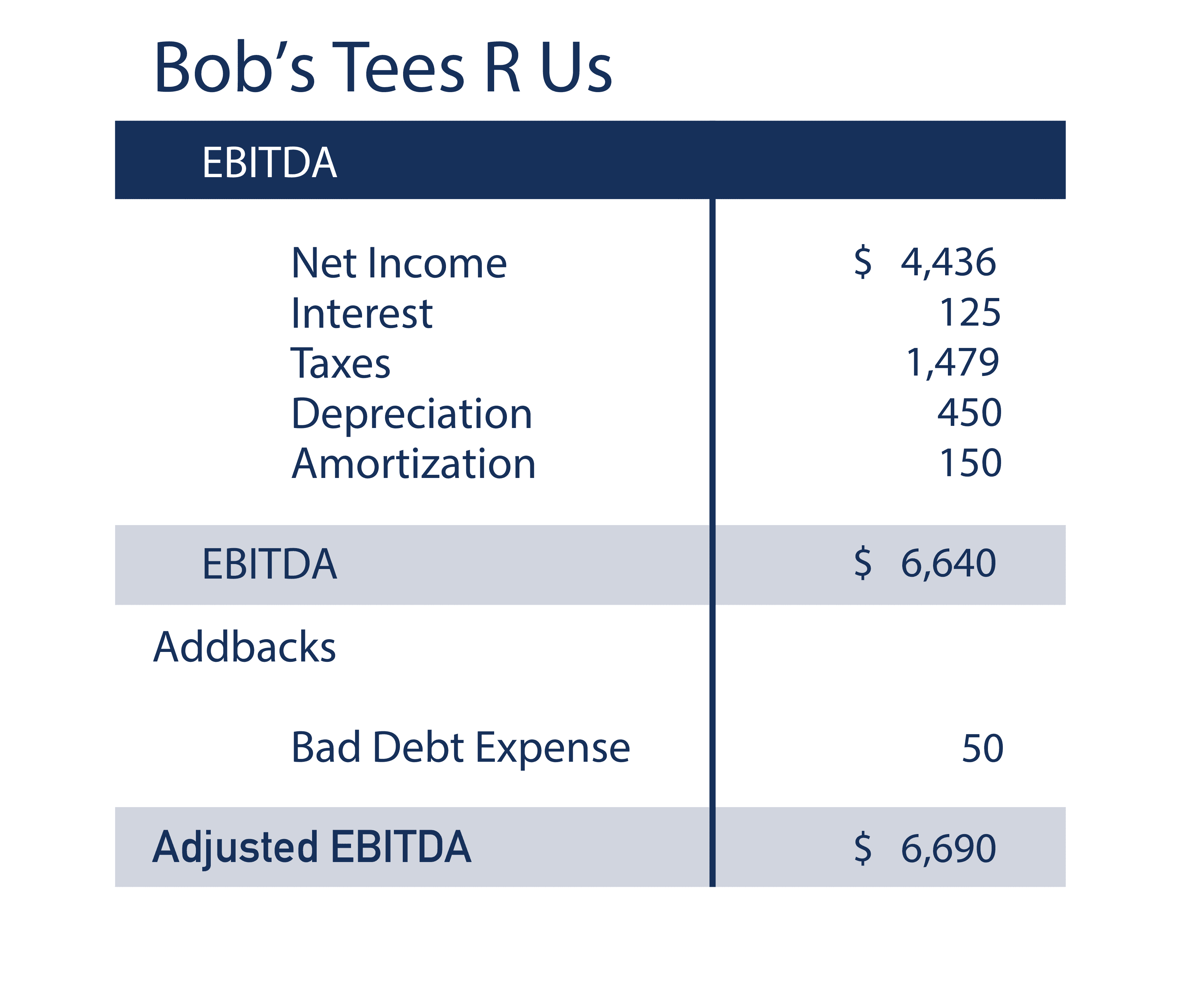

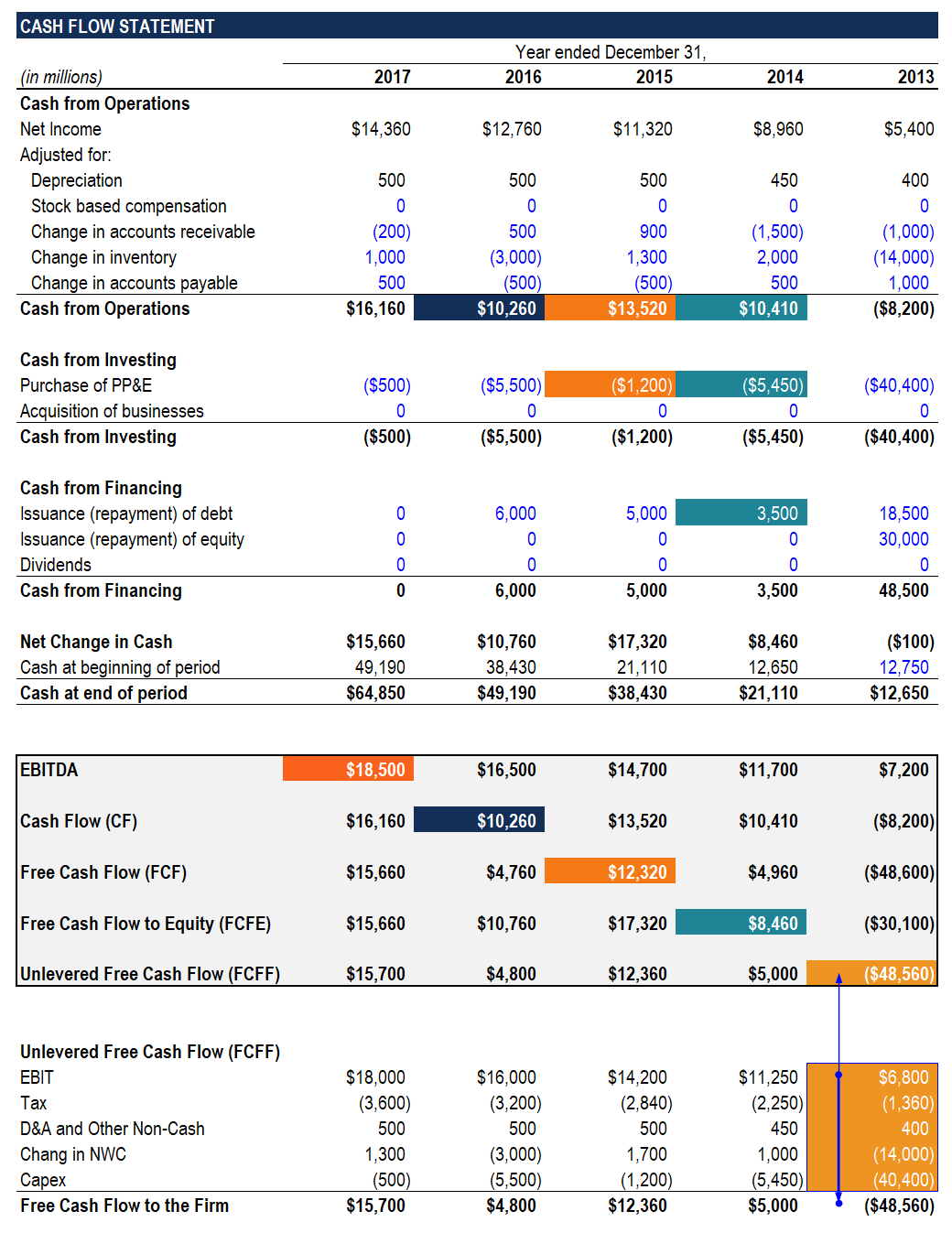

The first method starts with net income and adds back interest on borrowings, such as bank loans and bonds. There are two common ways of calculating ebitda. Next, depreciation and amortization are added.

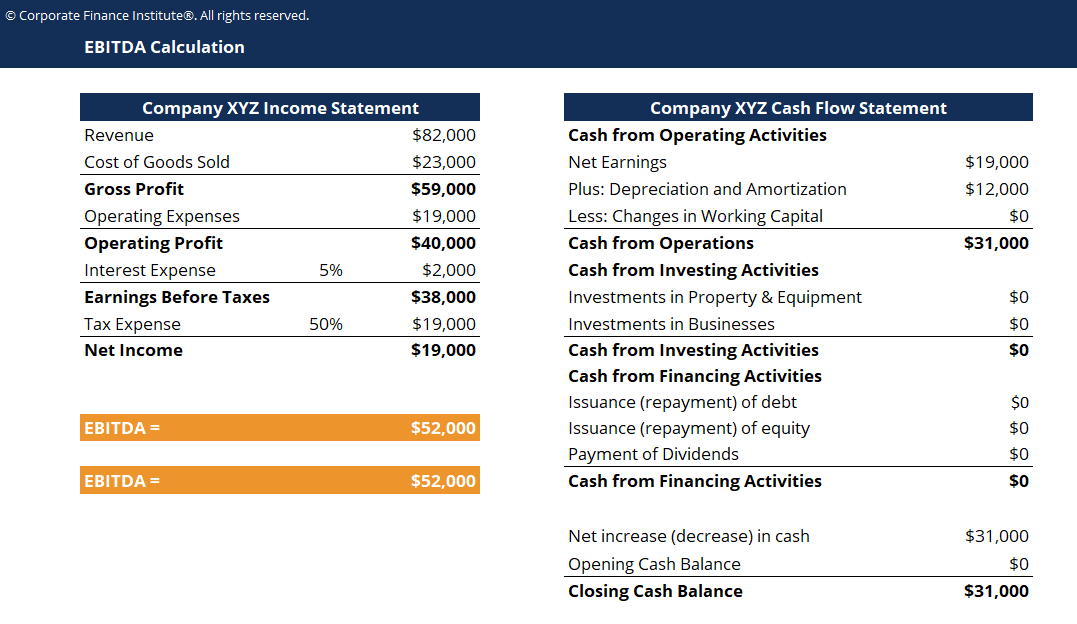

Ebitda margin (%) = ebitda ÷ net revenue. Ebitda= net income + tax expense + interest expense + depreciation & amortization expense = $19,000 +. Ebitda, which stands for “earnings before interest, taxes, depreciation, and amortization,” is a calculation to find the income from the operations of a business by.

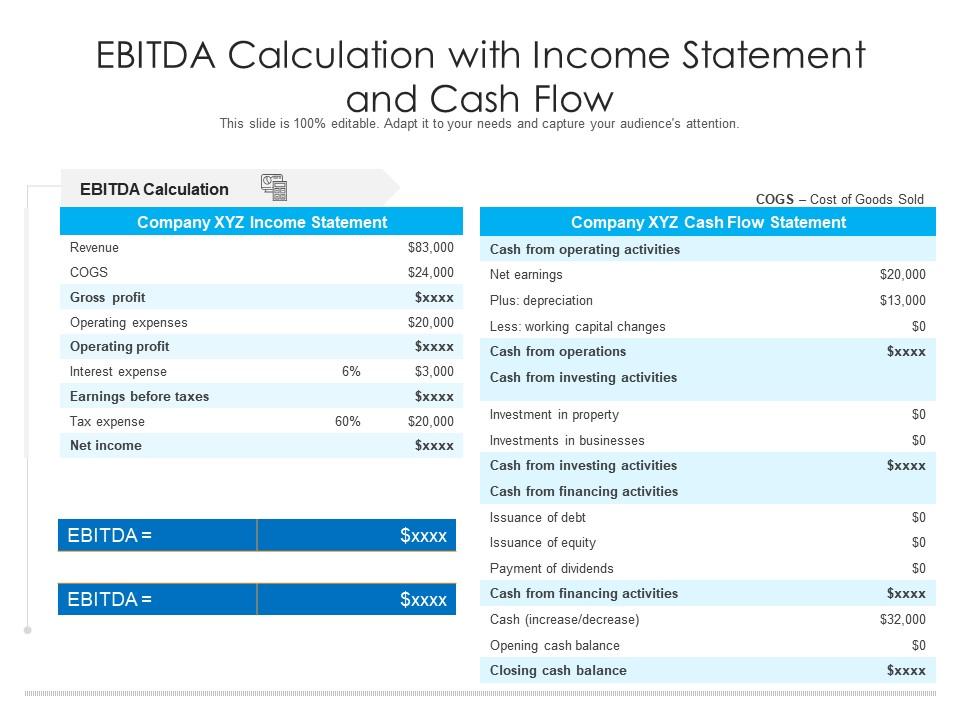

You can also use it to estimate an organization's ebitda. These are usually found on the cash flow statement. Step 1) the ebitda calculation formula is quite simple;

Company xyz accounts for their $12,000 depreciation and amortization expense as a part of their operating expenses. Finance professionals use ebitda, calculated from details reported in annual financial statements, to determine a company’s profitability. It can be easily found in a company’s income statement.

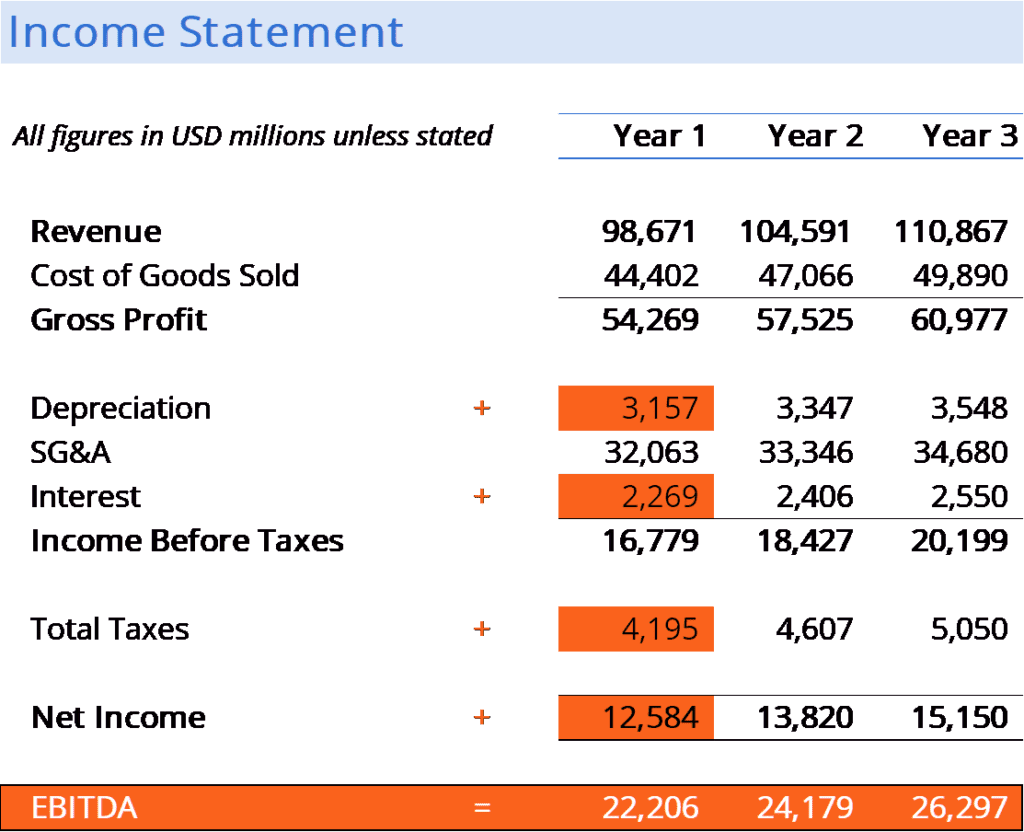

With our income statement complete, we can calculate the ebitda and operating profit margin. Calculate their earnings before interest taxes depreciation and amortization: The first step to calculate.

This free ebitda calculator determines an organization's earnings before interest, taxes, depreciation and amortization. Ebit to ebitda calculation example. Ebitda = net income + interest expenses + taxes + depreciation + amortization the second formula for calculating.