Awesome Info About Form 413 Personal Financial Statement

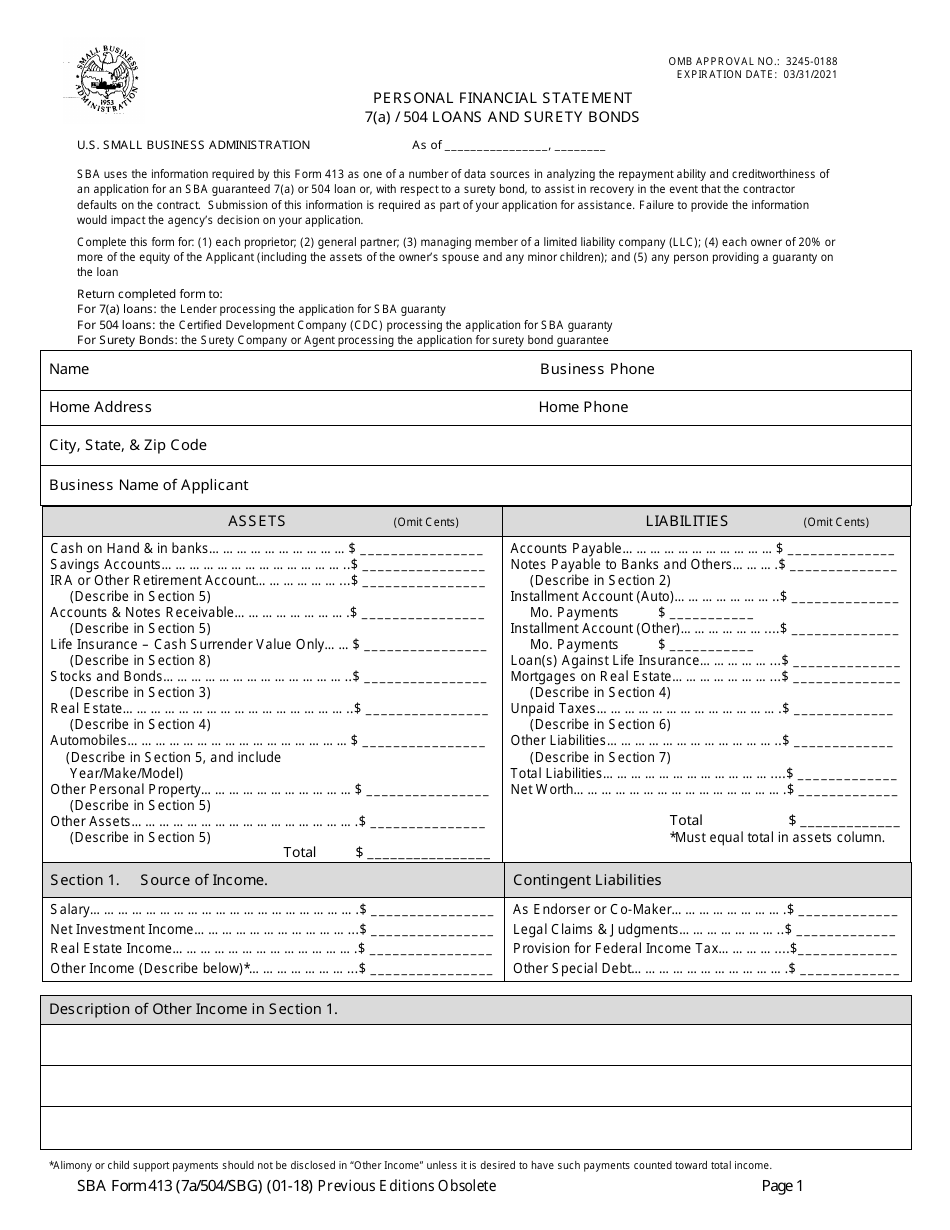

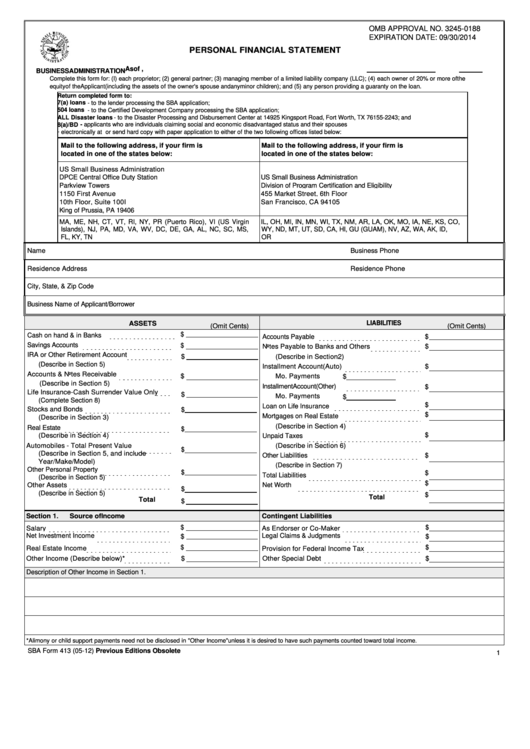

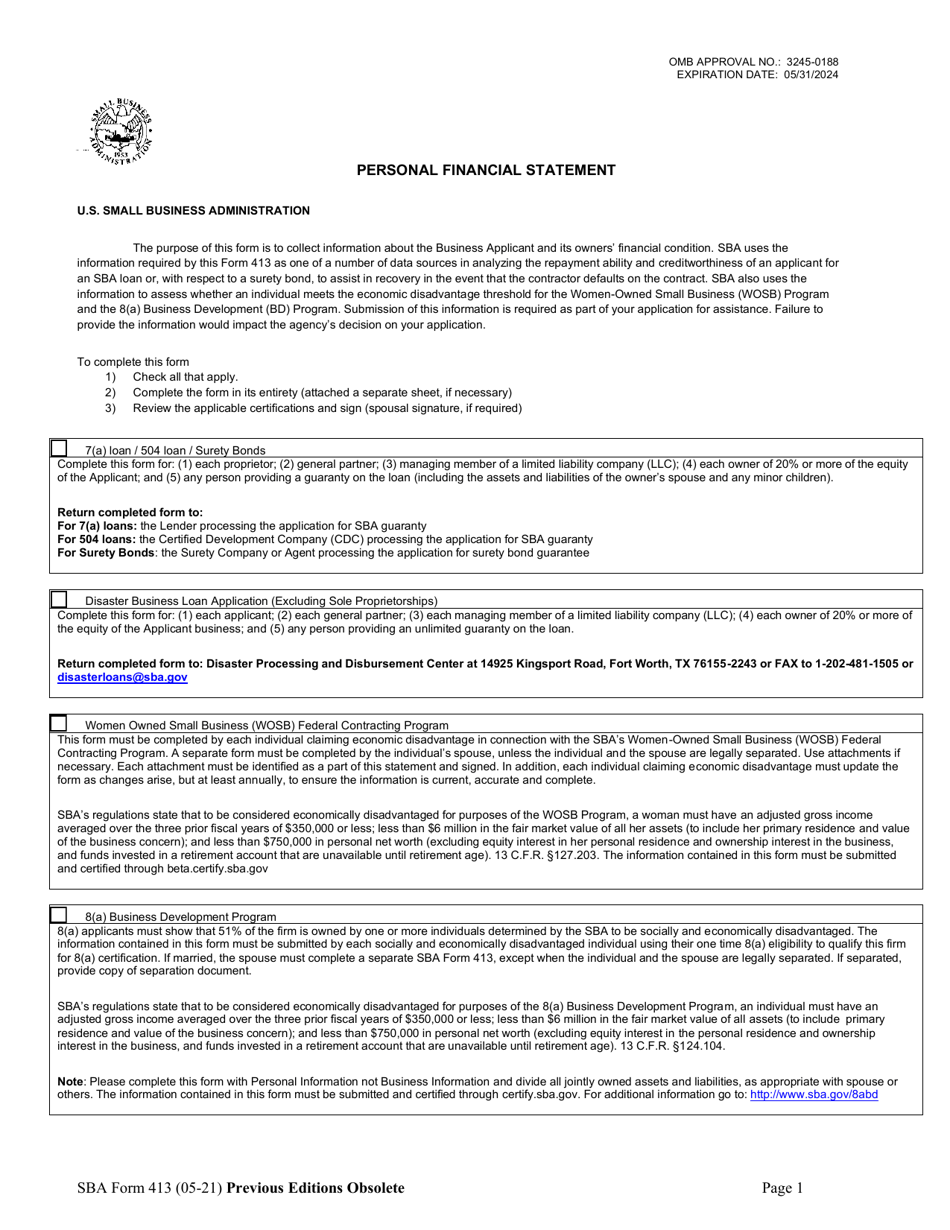

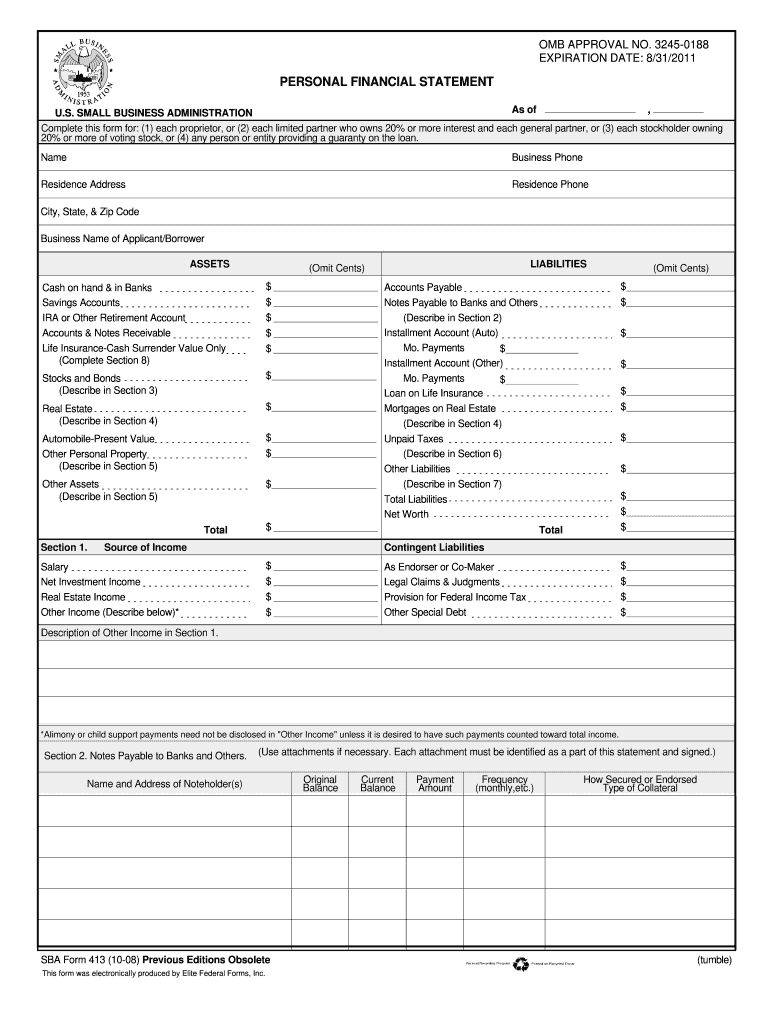

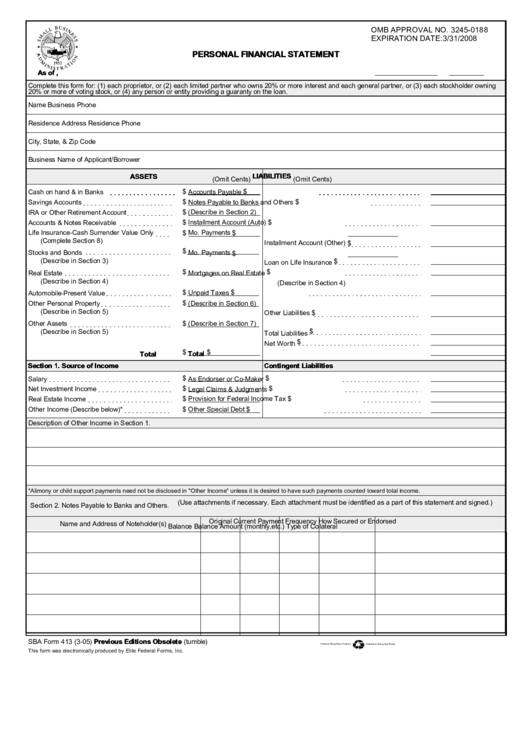

Sba form 413, also known as the personal financial statement, is an essential document for those seeking an sba loan.

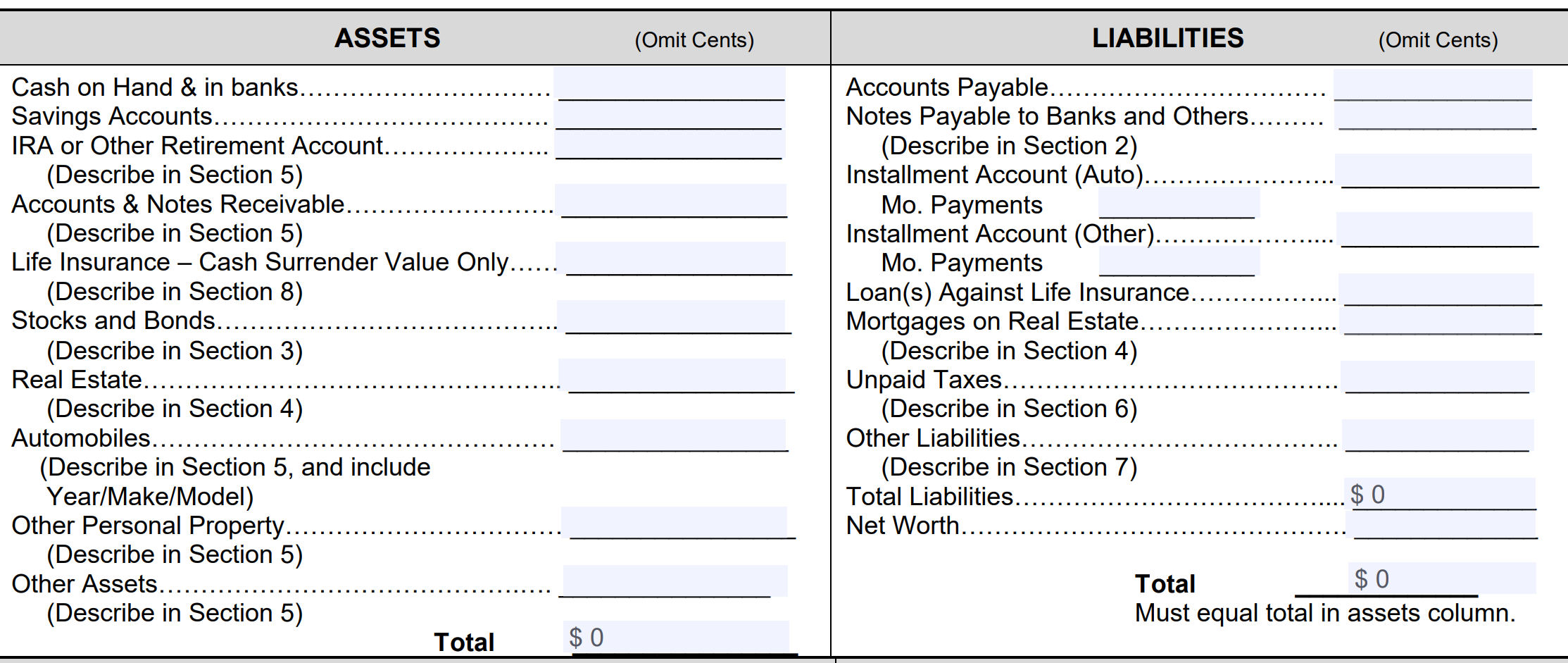

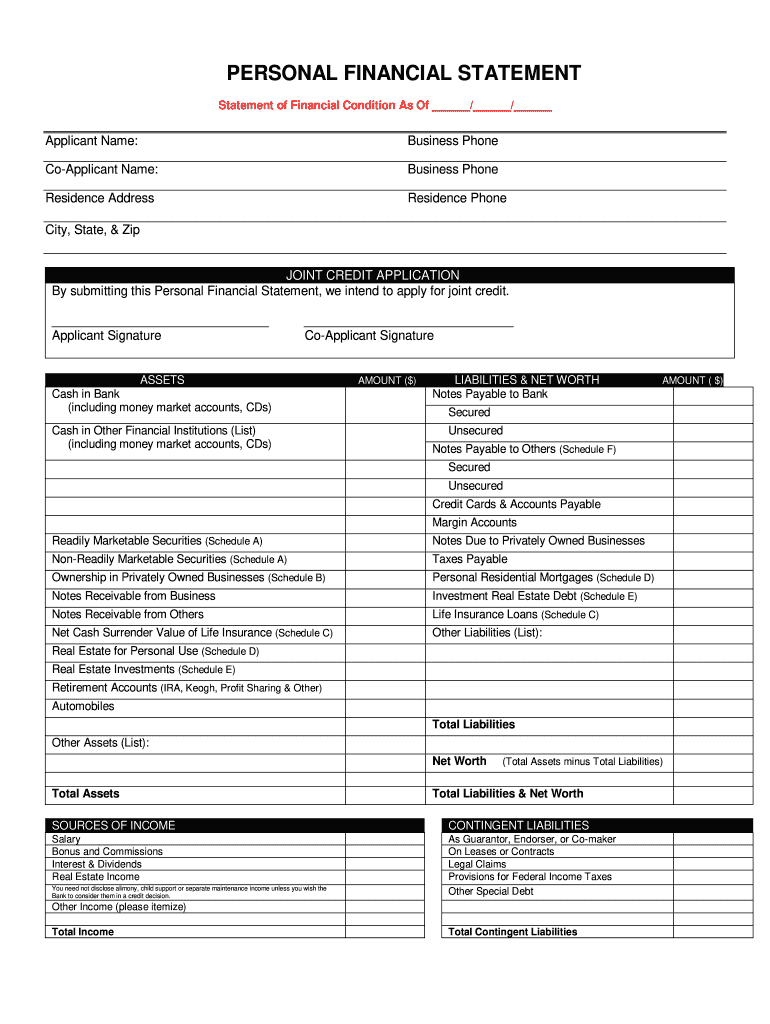

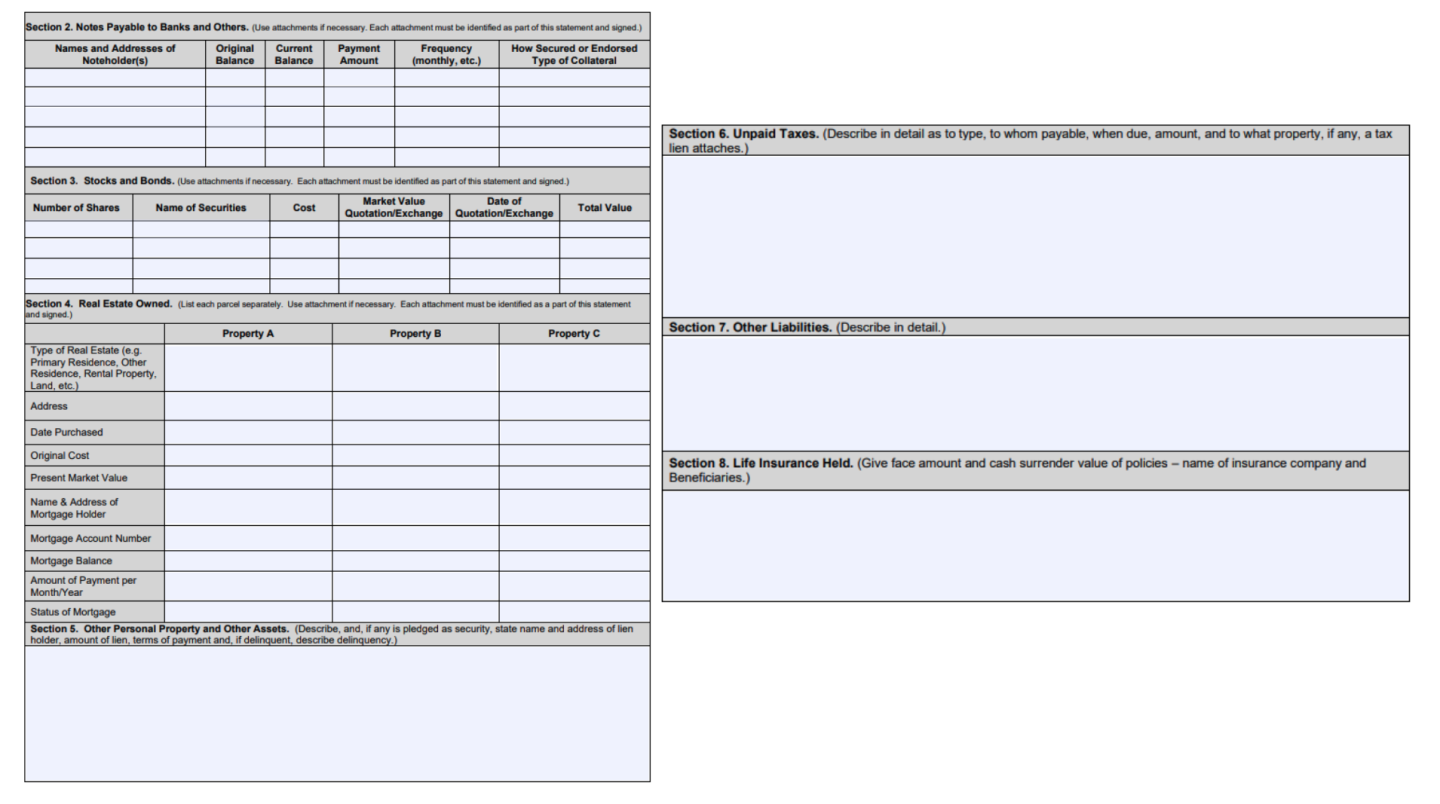

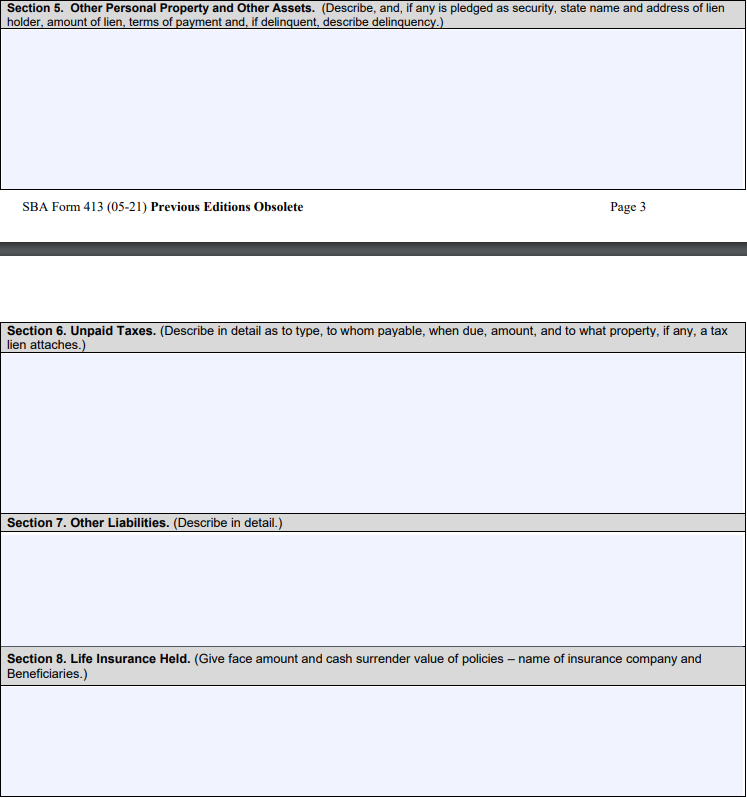

Form 413 personal financial statement. Source of income section 1. The purpose of this document is to provide you with supplemental pages if you need more space when completing sba form 413, which is the sba personal financial. Small business administration (sba) requires that most borrowers complete a personal financial statement, called sba form 413, to establish their.

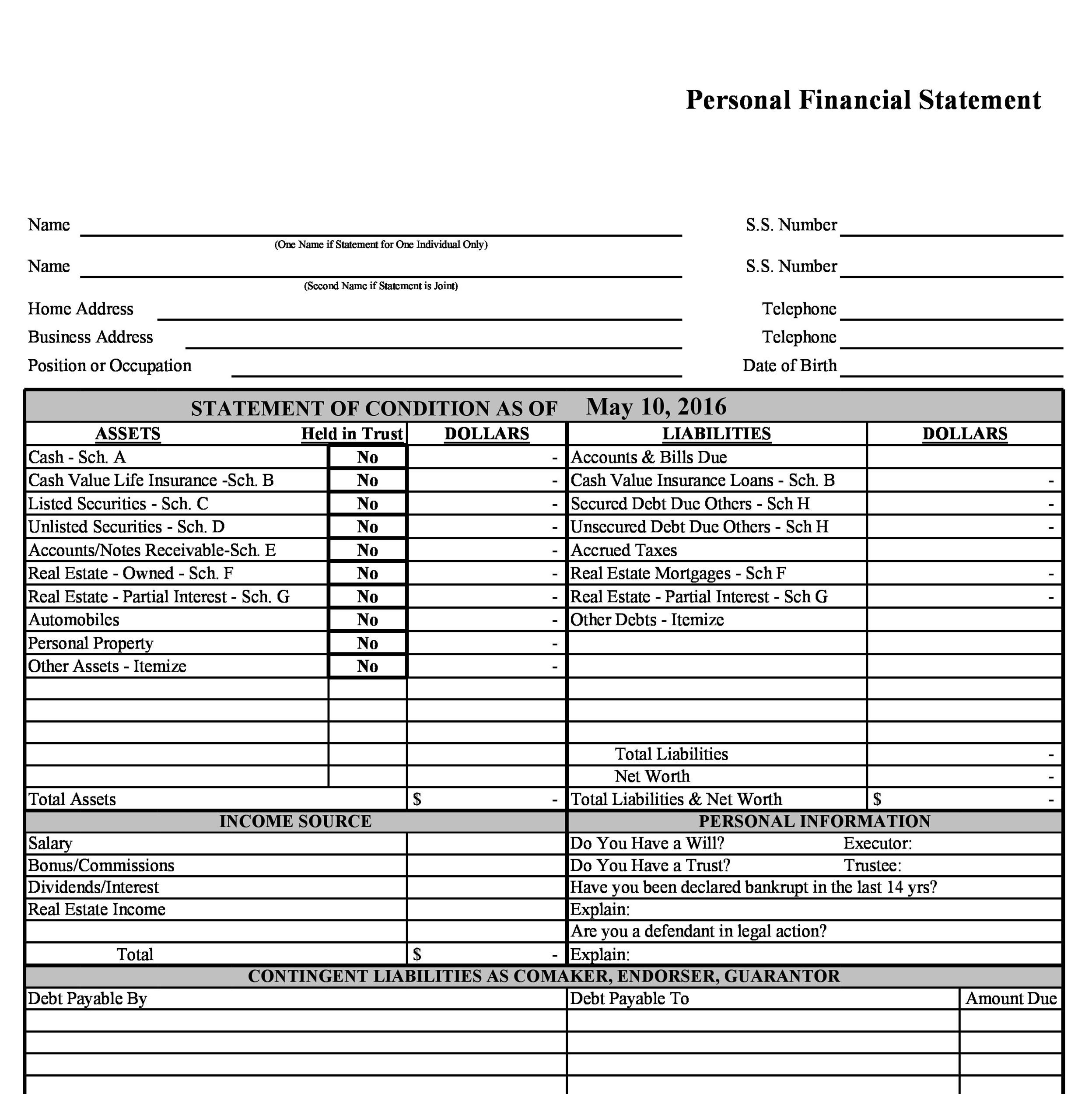

Sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an applicant for. It serves as a tool for lenders to. How to fill out the sba 413 personal financial statement personal information assets & liabilities assets liabilities section 1.

Sba form 413 personal financial statement sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications. The sba required the personal economic statement (sba entry 413) because they use it to calculate your ability at. Kenny bonus, cpa of bonus accounting walks through how to fill out the personal financial statement from the small business administration.

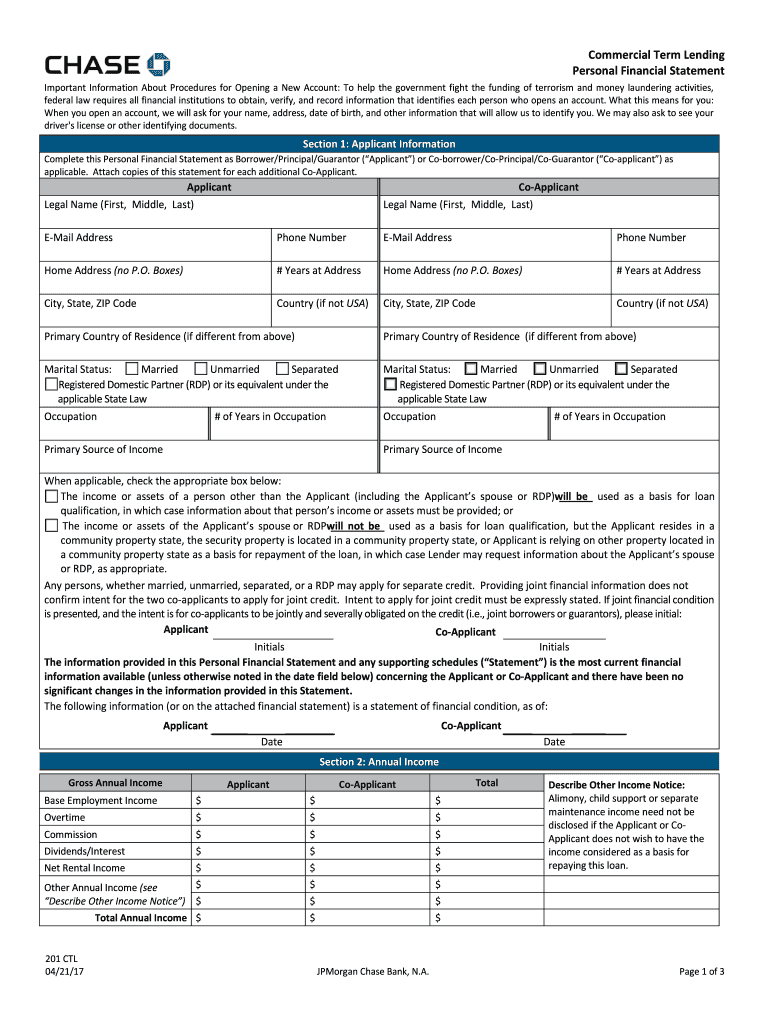

Also called the personal financial statement (pfs), form 413 allows lenders to see what you already owe, and evaluate your creditworthiness. Sba form 413 personal financial statement preview fill pdf online pdf word fill pdf online fill out online for free without registration or credit card what is. Sources of income in this section, you'll be asked to detail the following information about your business and personal sources of income:

Unlike a budget, a financial statement doesn't track every dollar. Small business administration personal financial statement 7(a) / 504. How the sba uses which personal monetary statement.

A personal financial statement is an overview of a person or household's finances.