Cool Info About Cash Inflow And Outflow From Operating Activities

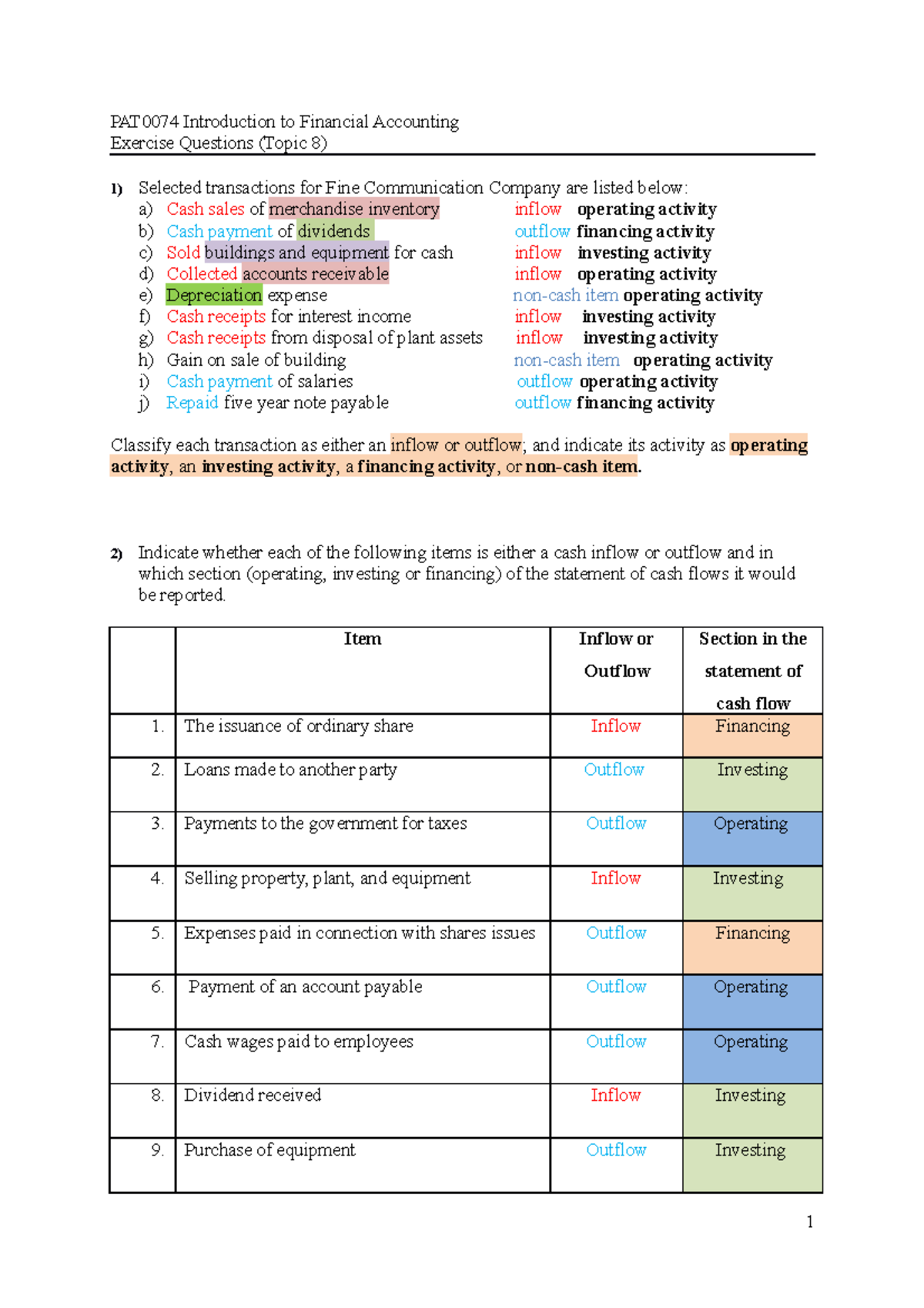

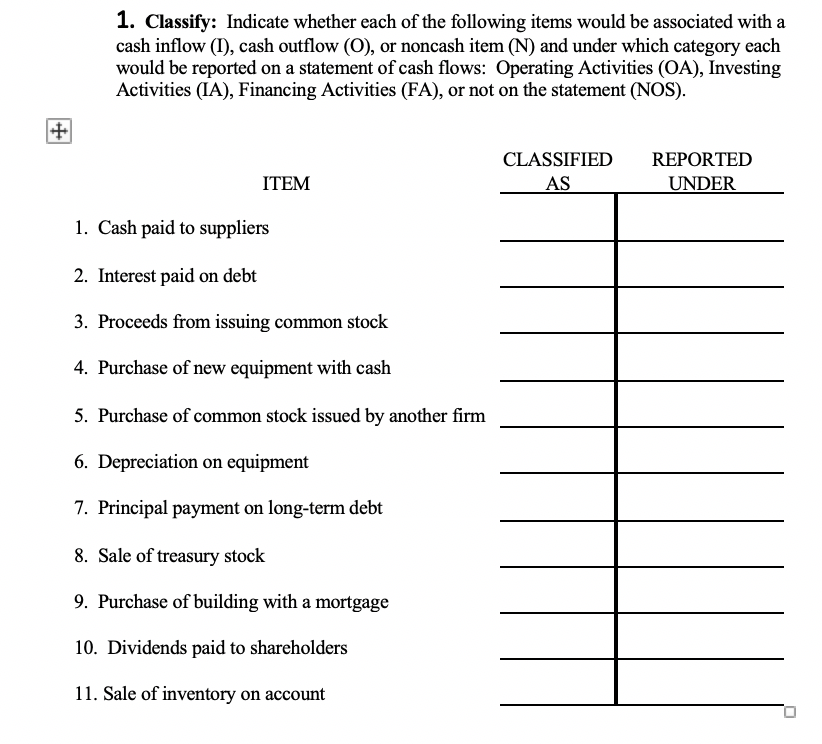

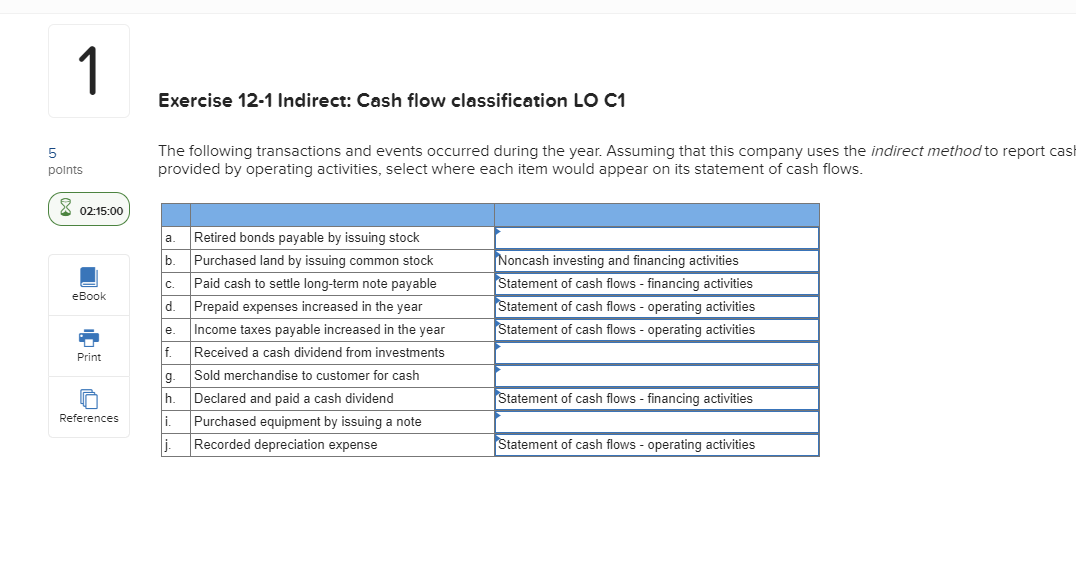

Adjustments and correct terminology for each item (list all inflow/outflow activities).

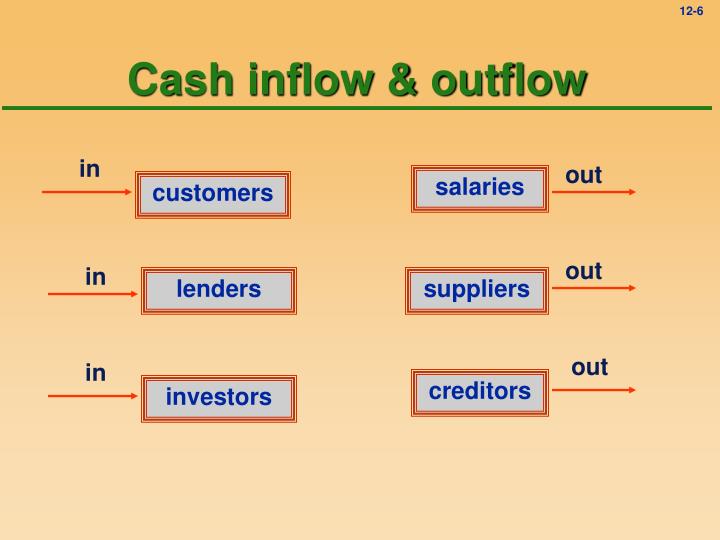

Cash inflow and outflow from operating activities. A cash flow statement, along with the balance sheet and income statement, is one of the primary financial statements used to measure your company’s financial position. Net income for 2023 $40,000. Cash flow from operations is the section of a company’s cash flow statement that represents the amount of cash a company generates (or consumes) from carrying out its operating activities over a period of time.

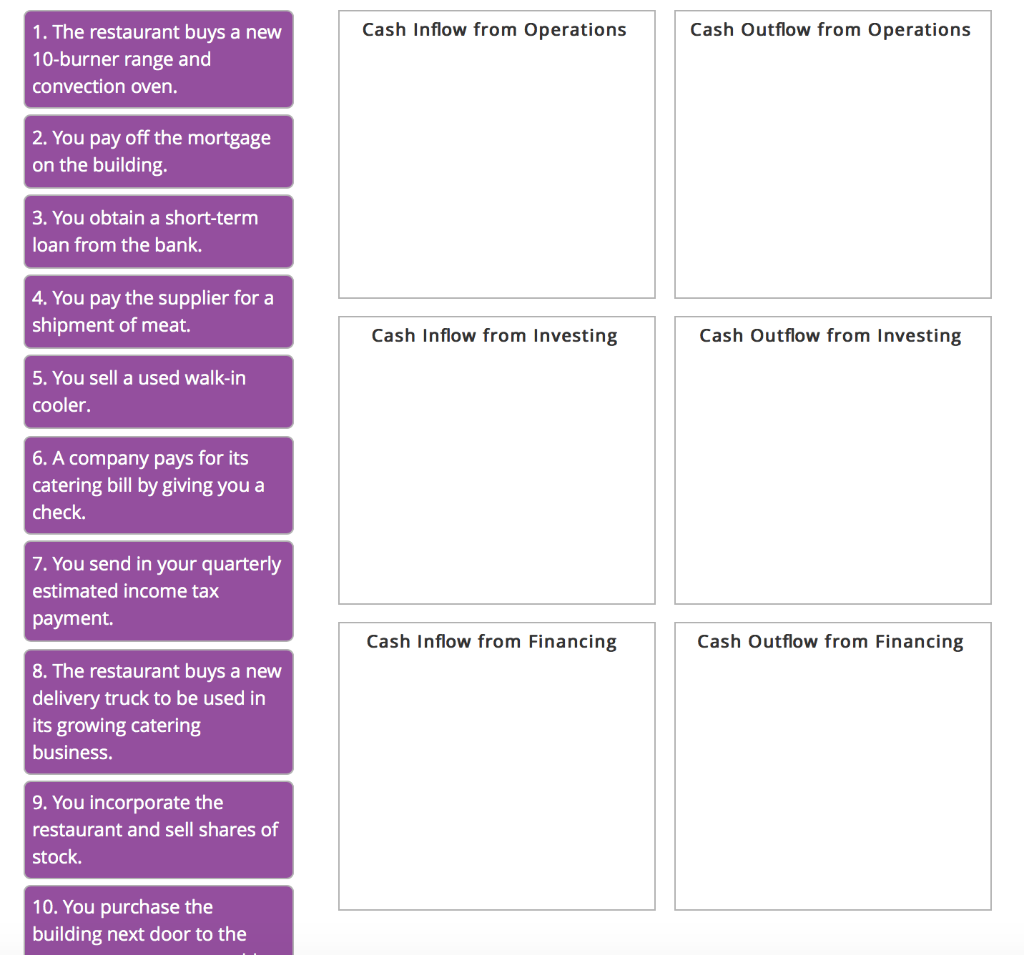

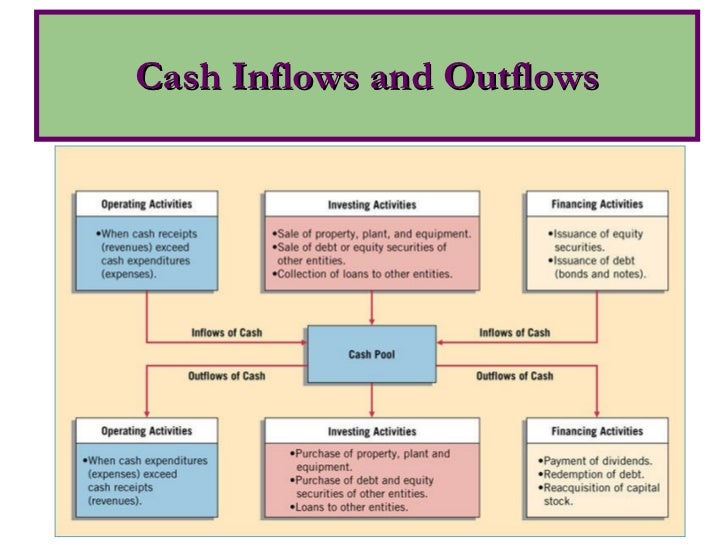

The result was made possible by implementation of the fit for. The 3 main types of cash flow cash flow from operations (cfo) cash flow from investing (cfi) cash flow from financing (cff) what about free. Cash flow from operations is the first of the three parts of the cash flow statement that shows the cash inflows and outflows from core operating the business in an accounting year;

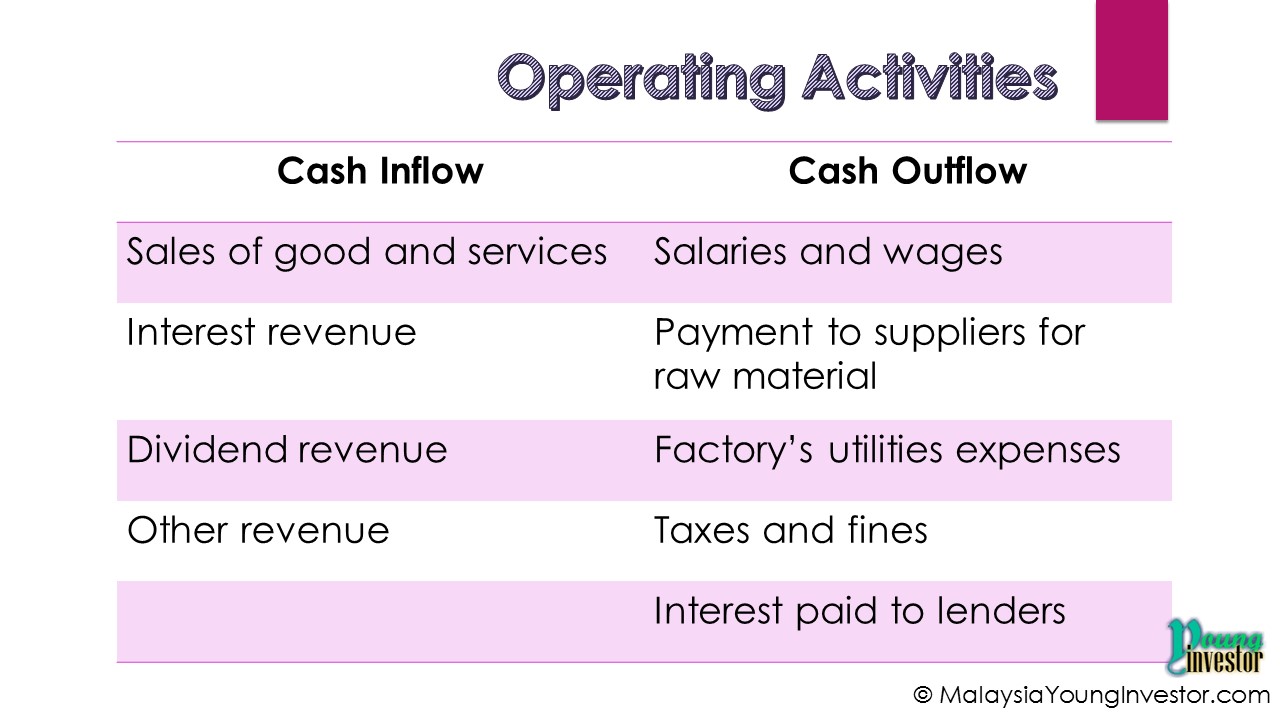

Cash flows from operating activities include anything that a business uses to produce net income, such as inventory, raw materials, or rent. The term “ cash ” refers to both cash and. All cash flows other than investing activities and financing activities are operating activities.

Cash inflow ensures your business doesn’t go bankrupt and can stay afloat. The change in active customers in a reported period captures both the inflow of new customers as well as the outflow of existing customers who have not made a purchase in the last twelve months. Prepare a statement of cash flows for 2023 using the indirect method of calculating the net cash provided/used.

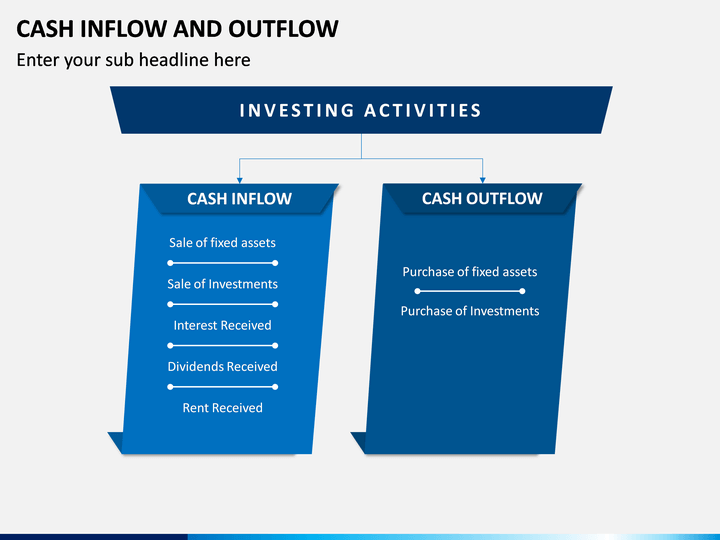

Your company’s cash flow results from three types of activities, each of which can break out into both inflows and outflows: Outflow, note activities that affect cash flow, understand more about financial reporting, and review tips relating to cash flows. These operating activities may include:

Purchase of plant asset show as o a ob cash inflow as an operating activities cash outflow as an investing activities o cash inflow as an investing activities od cash outflow as a financing activities. Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period. We view the number of active.

These items can flip the cash flows negatively if not kept within budgeted limits. Below is an example from amazon’s 2022 annual report, which breaks down the cash flow generated from operations, investing, and financing activities. A good cash inflow doesn’t necessarily mean you have higher profits.

It represents the amount of cash a company spends or earns from carrying out its operating activities over a period. Operating investing financing this article discusses the “ins” and “outs” of the types of cash flow and how they might impact your business. Cash outflow from operating activities refers to the money you spend on your regular activities—the production of goods and services.

Cash receipts from fees, royalties, commissions, and other revenue. Operating activities include generating revenue, paying expenses, and funding working capital. Cash flow from operating activities is the first of the three parts of a company's cash flow statement.

Operating activities in cash flow statement. The company declared $20,000 of cash dividends and paid $18,000. Cash flow from operating activities (cfo) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a.