Impressive Tips About Financial Ratios Of Maruti Suzuki

What is the latest current ratio ratio of maruti suzuki india ?

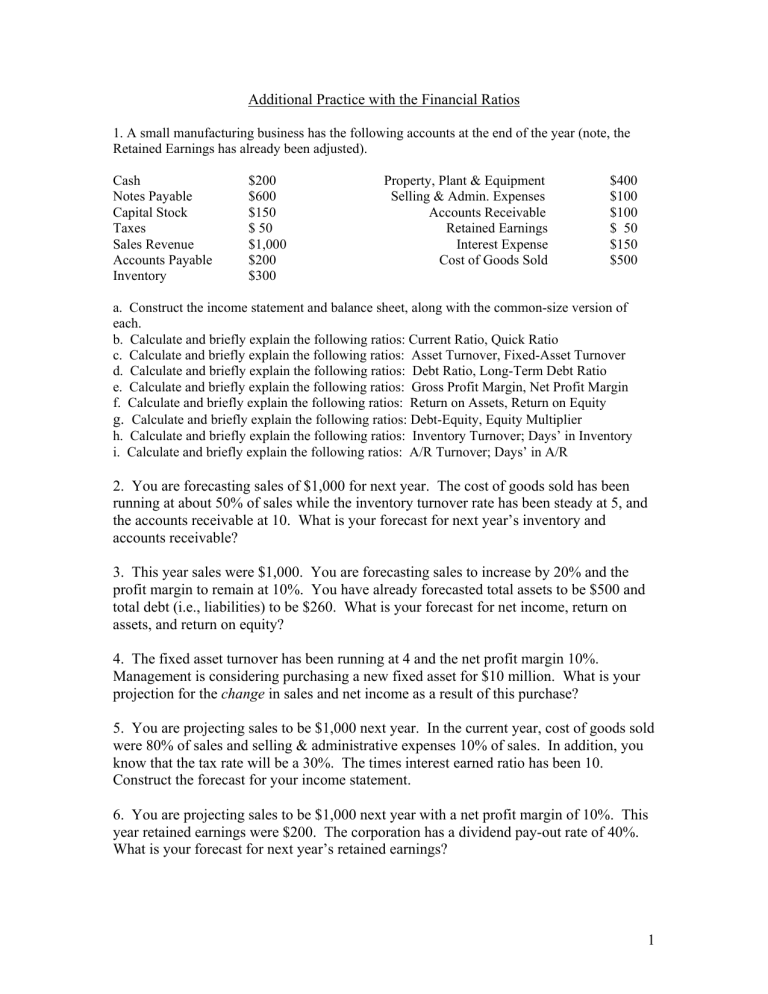

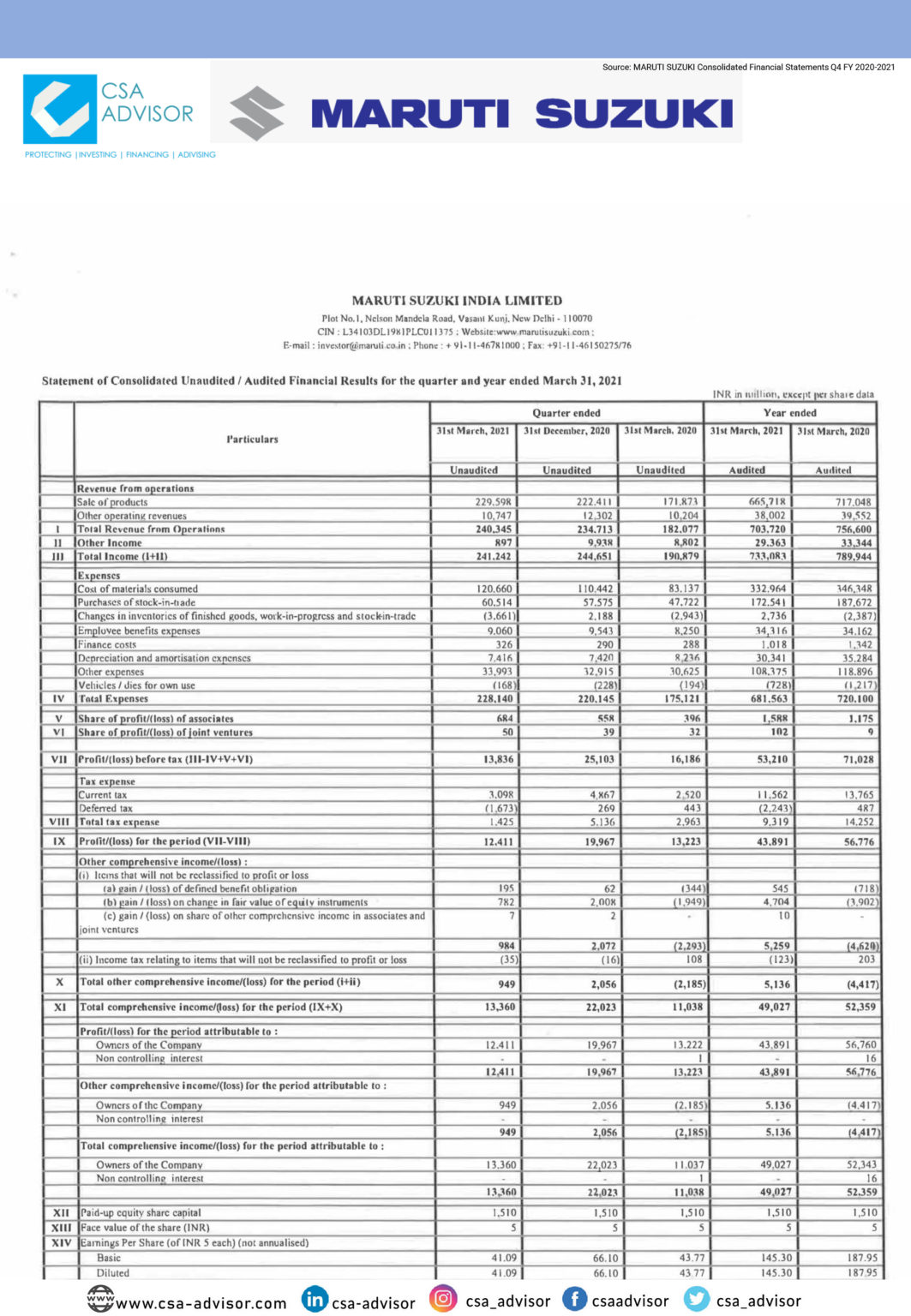

Financial ratios of maruti suzuki. Company, including debt equity ratio, turnover ratio etc. Key financial ratios (% of net sales) parameter q1 fy’22 q4 fy’21 material cost. Maruti suzuki india limited q1fy’22 financial results 28th july, 2021.

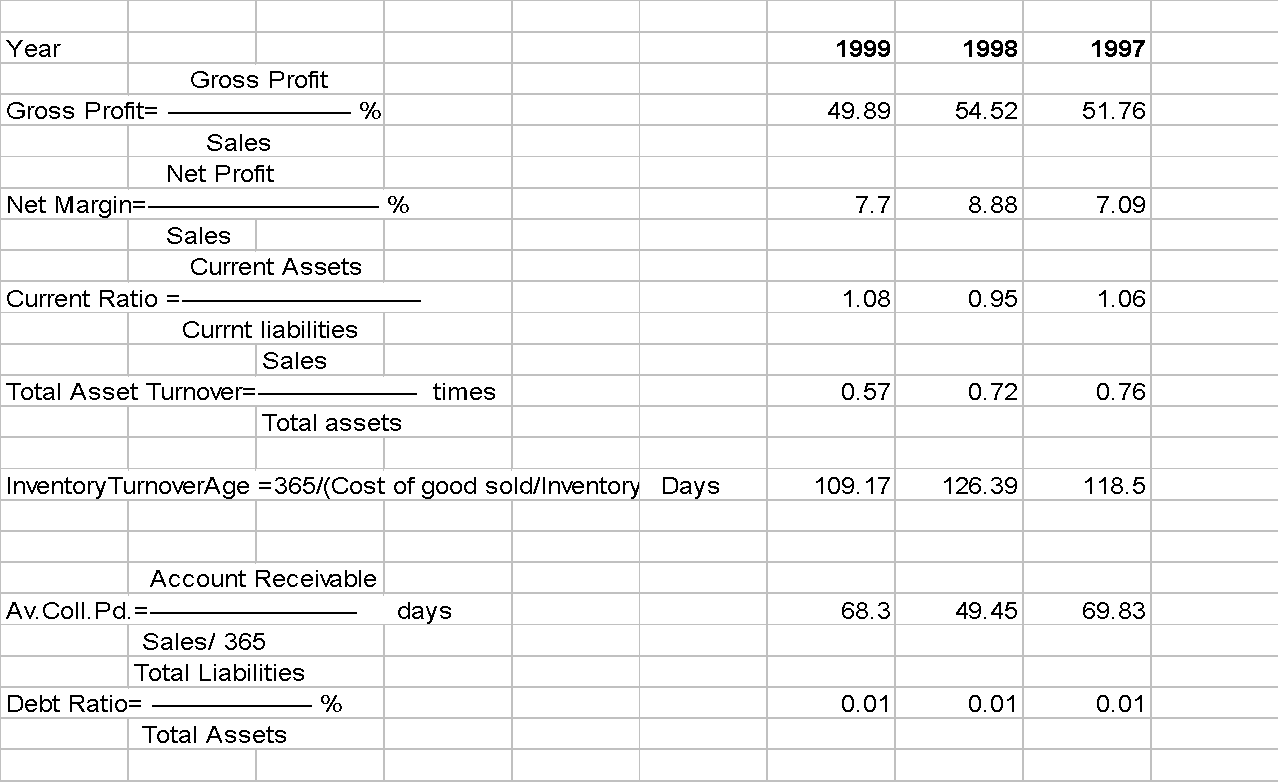

38 rows asset turnover ratio (%) 1.50: 15.32 %13.44 %13.05 %17.64 %17.25 % net profit margin: At the end of 2022 the company had a.

Maruti suzuki india ltd: Check online the investors and company financial reports. The latest current ratio ratio of maruti suzuki india is 0.58 based on mar2023 consolidated results.

Maruti suzuki summary chart analysis peers quarters profit & loss balance sheet cash flow ratios investors documents Reach us financials net sales and pat sales volume note: Price to sales ratio 2.13:

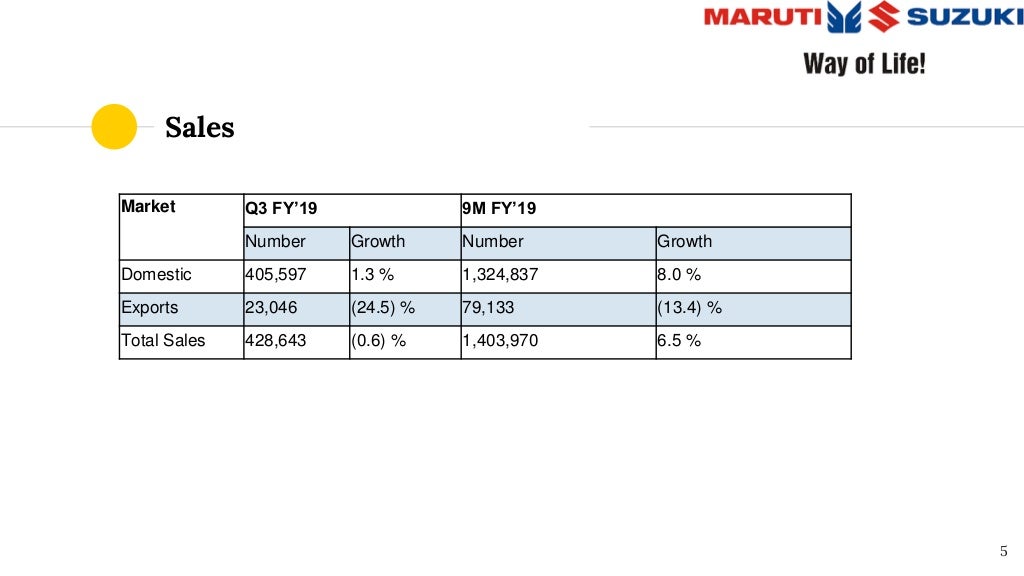

Maruti suzuki financial ratio, profitability ratios, company liquidity ratio, key financial analysis, statutory liquidity ratio on moneycontrol. The company sold a total of 1,652,653 vehicles during the year, up 13.4% over the previous year. Price to cash flow ratio 27.04:

Forcasts, revenue, earnings, analysts expectations, ratios for maruti suzuki india ltd stock | maruti | ine585b01010 Check investor financials report online. Maruti suzuki manufactures the best selling cars in india.

What is the latest working capital/sales ratio of maruti suzuki india ? Price to book ratio 4.05: Financial ratios analysis of maruti suzuki india ltd.

Financial ratios for profitability, valuation, liquidity. Mar 2015 mar 2017 mar 2019 mar 2021 mar 2023 0.0x 0.5x 1.0x 1.5x. 71,595.49 167.06 ( +0.23 %) nifty 50 21,782.50 64.55 ( +0.3 %) nifty bank 45,634.55 622.55 ( +1.38 %)

The ev/ebitda ntm ratio of maruti suzuki india limited is significantly lower than the average of its sector (automobiles): Key financial ratios of maruti suzuki india (in rs. Maruti suzuki india ltd.

8.64 %8.66 %8.19 %10.65 %10.07 % earning per share (diluted) 76.53:.

![Maruti Suzuki Financial ratios, dupont analysis [PDF Document]](https://static.fdocuments.in/doc/1200x630/577ccfe61a28ab9e7890e163/maruti-suzuki-financial-ratios-dupont-analysis.jpg?t=1684910194)