Awe-Inspiring Examples Of Info About Five Basic Financial Statements

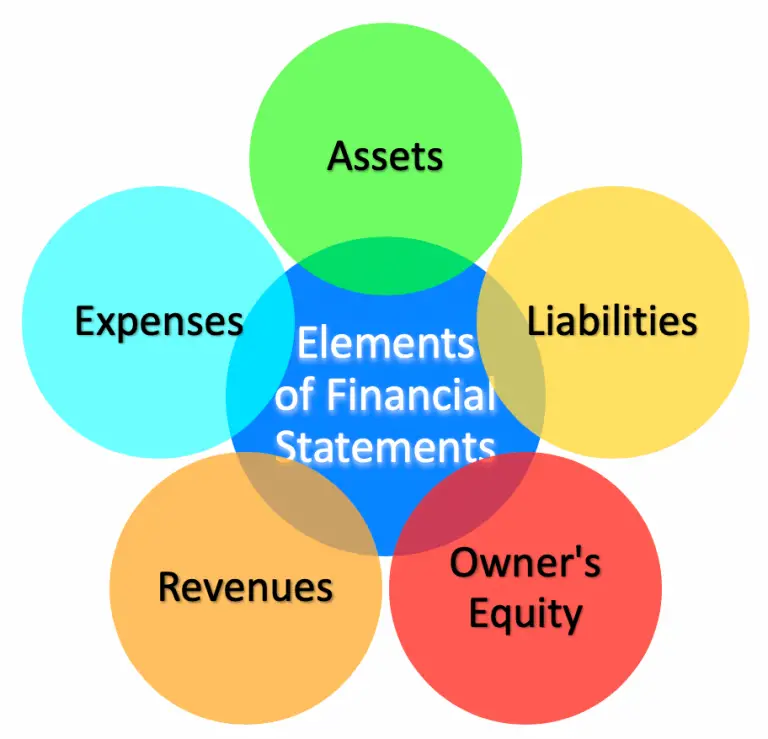

We use assets, liabilities, equity, revenues, and expense.

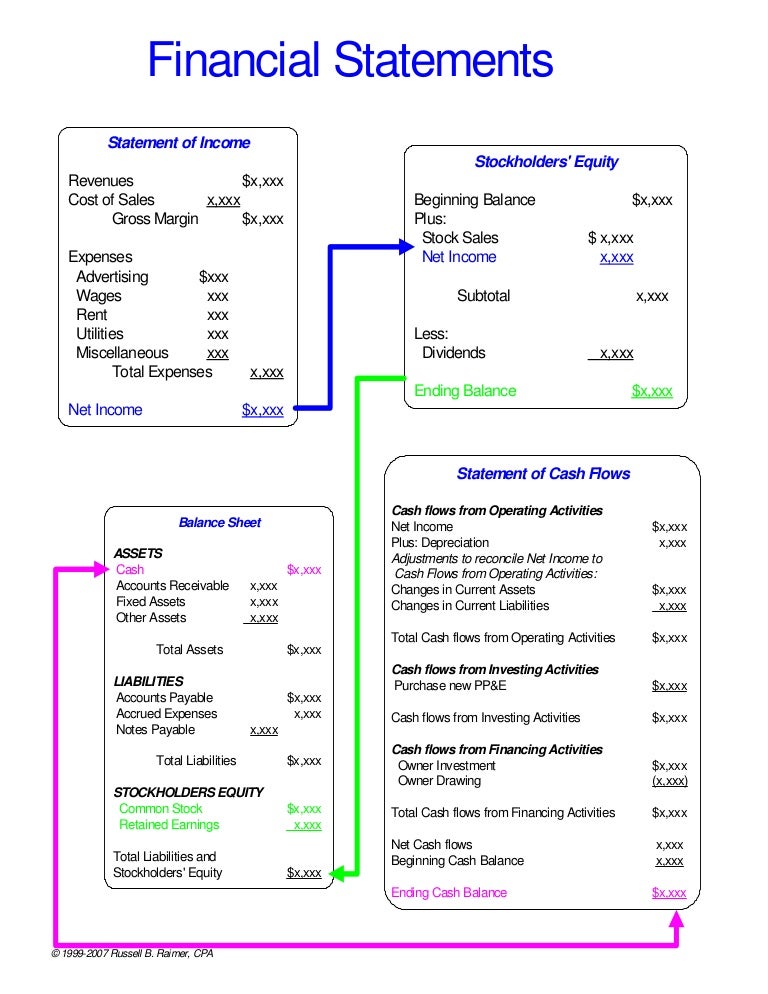

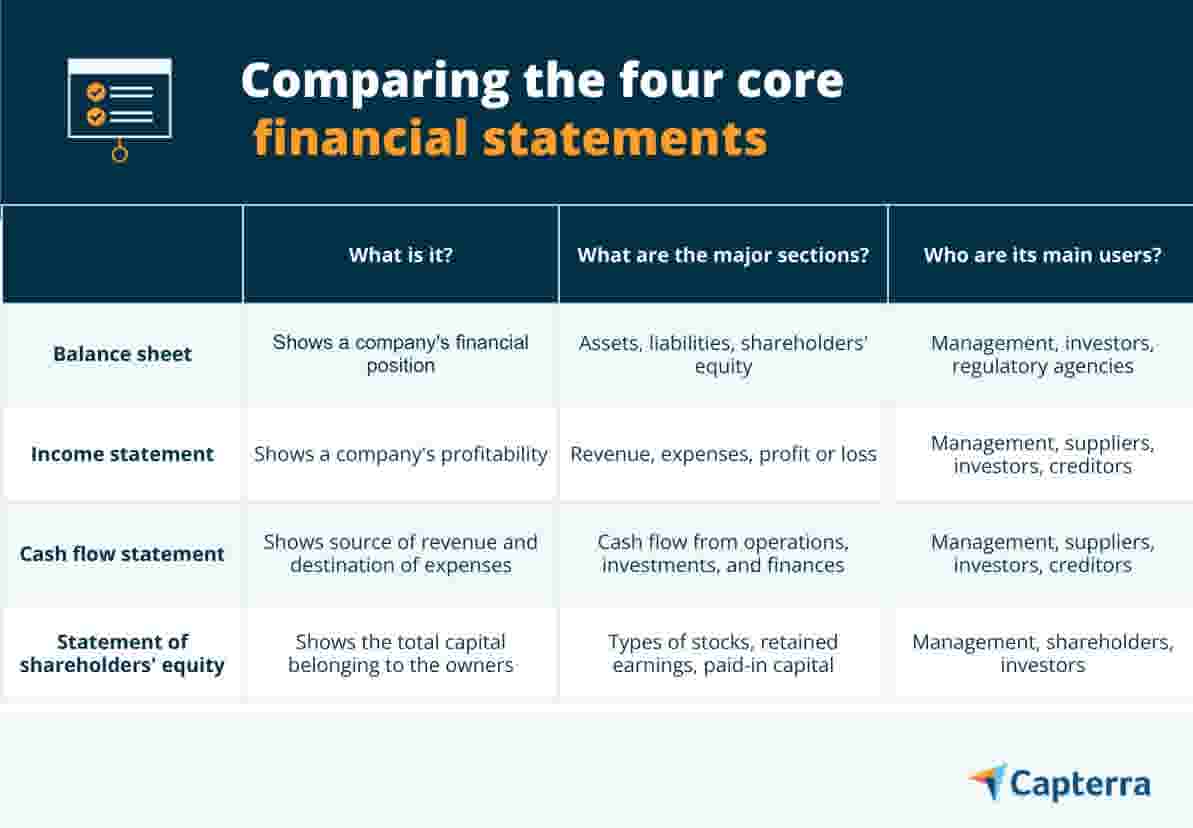

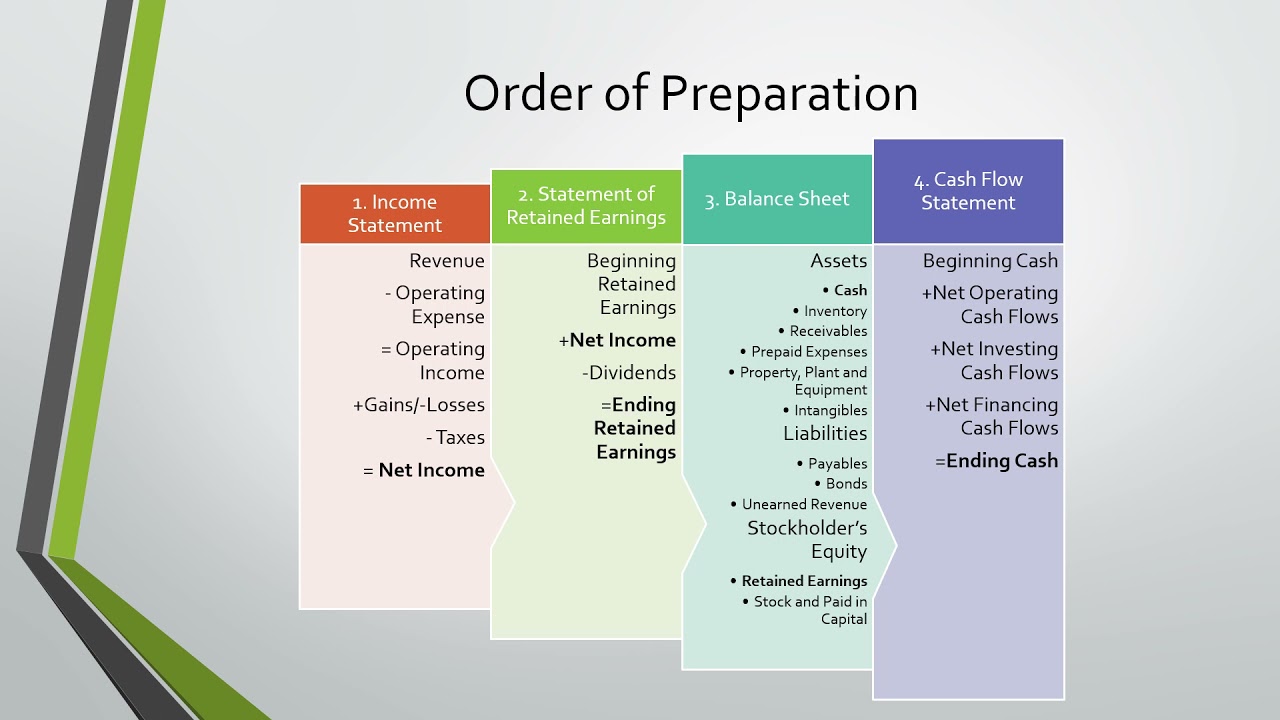

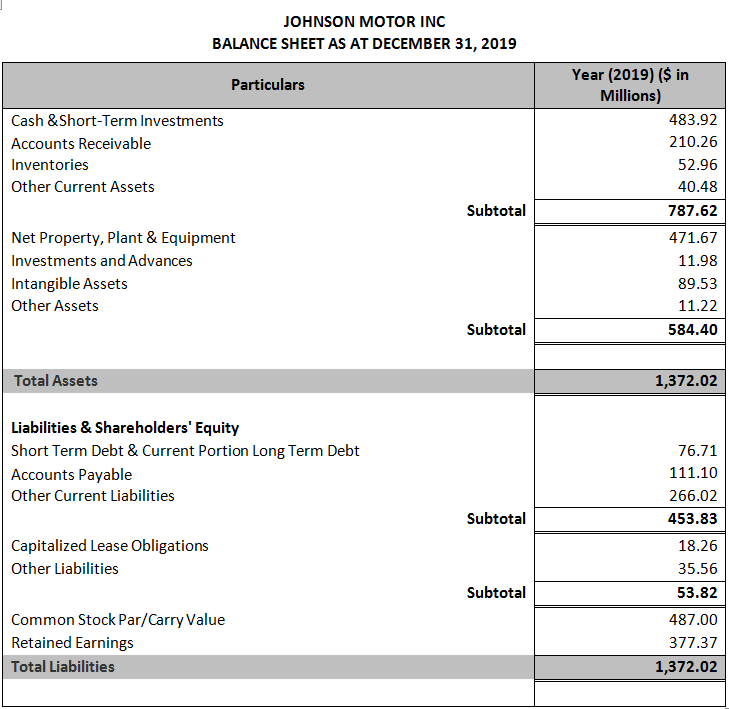

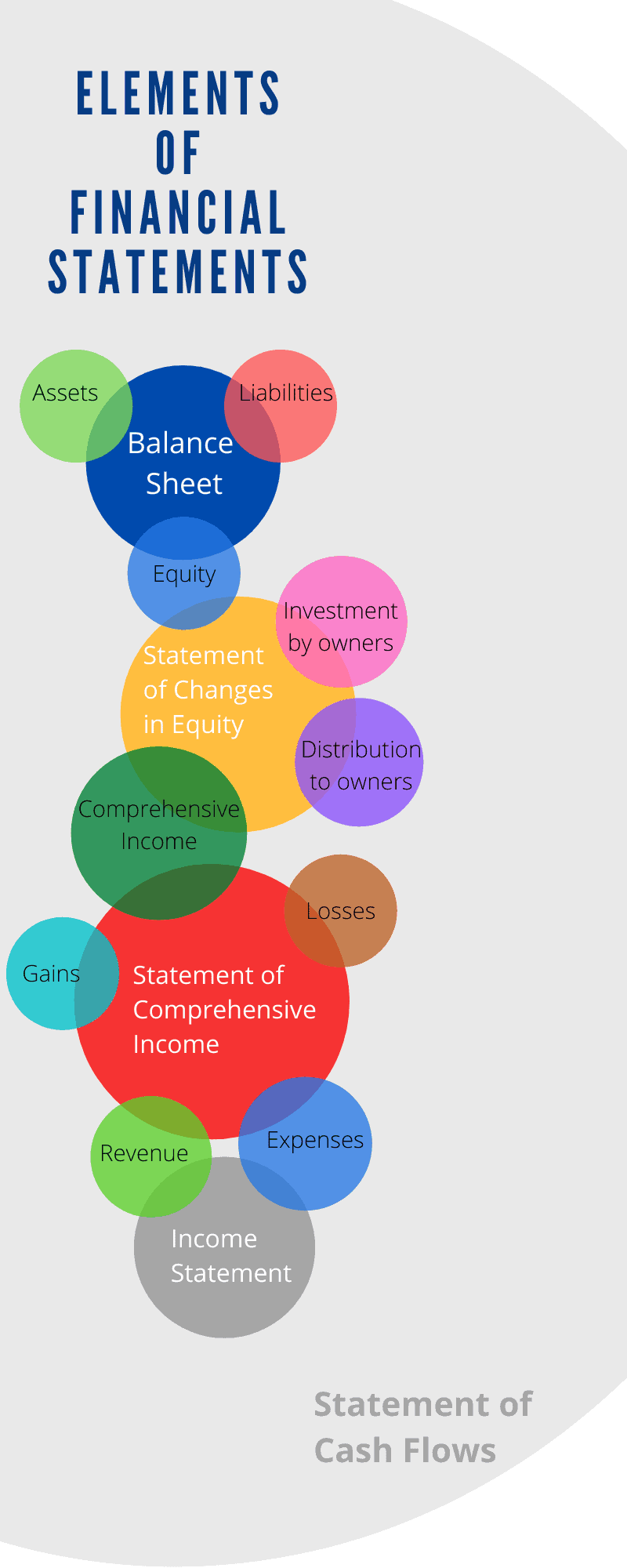

Five basic financial statements. It involves the review and analysis of income statements, balance sheets, cash flow statements, statements of shareholders’ equity, and any other relevant financial statements. Statement of comprehensive income, statement of changes in equity, balance sheet, statement of cash flows, and notes to financial statements. A balance sheet conveys the “book value” of a company.

It allows you to see what resources it has available and how they were financed as of a specific date. It shows its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the amount invested by shareholders). There are four main financial statements.

In this video, we discuss how the 5 types of accounts are used to contruct the basic balance sheet. There are four sections to a company's financial statements: The balance sheet, the income statement, and the cash flow statement.

Each of the four basic financial statements offers unique insights, and when analyzed together, they answer some of the most important questions about your business’s operations: These are items of economic benefit that are expected to yield benefits in future periods. The following news release should be read in conjunction with management's discussion and analysis (md&a), the consolidated financial statements and related notes of trican for the year ended.

Each component serves a purpose and helps understand the business’s financial affairs in a summarized fashion. The statement of cash flows shows the cash inflows and outflows for a company over a period of time. Examples are accounts receivable, inventory, and fixed assets.

Some consider the statement of stockholders equity also. Objective and purpose of financial statements. Record adjusted ebitda margin fourth.

That is prepared by an entity monthly, quarterly, annually, or for the period required by management. 21 feb 2024, 5:30 am. Among the five elements of financial statements, assets, liabilities and owner’s equity can be found in the balance sheet while revenues and expenses can be found in the income statement.

The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. Income from operations of $652 million; There are at least five financial statements, three of which are considered “core:” balance sheet, income statement and statement of cash flows.

In the true sense, explanatory footnotes should also be called as financial statements. The balance sheet, the income statement, the cash flow statement, and the explanatory notes. Documents shown during trial ranged from spreadsheets to signed financial statements.

Debt to equity ratio = 10,000 / 25,000 = 0.4. How to read a balance sheet. Balance sheets show what a company owns and what it owes at a fixed point in time.