Unique Tips About Financial Statements Cash Flow

It also reconciles beginning and ending cash and cash equivalents account balances.

Financial statements cash flow. The three core financial statements are 1) the income statement, 2) the balance sheet, and 3). The cash flow statement is a financial statement that reports a company's sources and use of cash over time.

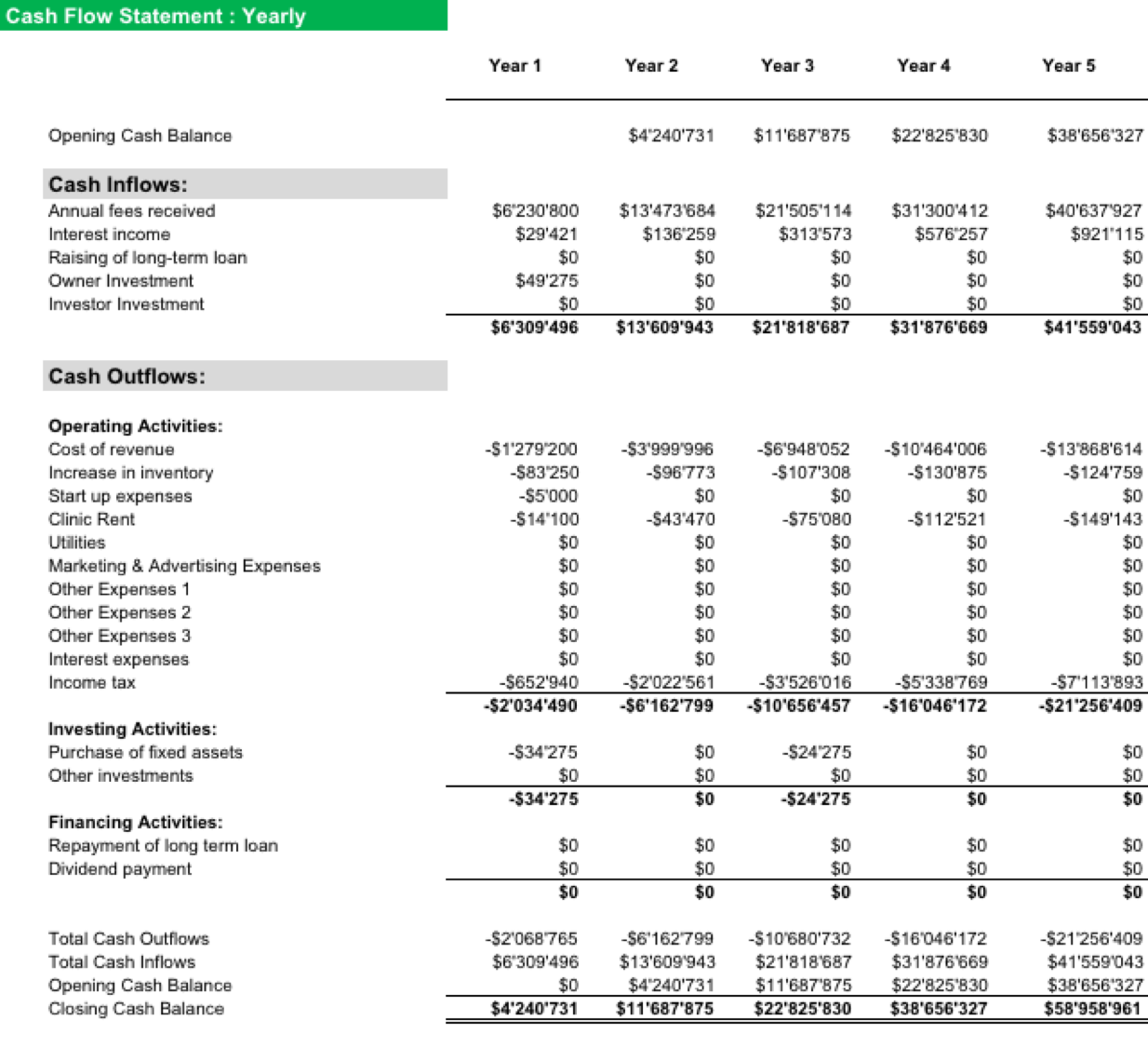

It also breaks down where you've spent that money so you can see if your business is making more money than it spends. June 7, 2022 cash flow is the amount of cash and cash equivalents, such as securities, that a business generates or spends over a set time period. Households typically have budgets, while companies.

Pihlajalinna plc financial statements release 14. The cash flow statement recognises three major business. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.

The cash flow statement (cfs), along with the income statement and balance sheet, represent the three core financial statements. A cash flow statement (cfs) is a financial statement that captures how much cash is generated and utilized by a company or business in a specific time period. The cash flow statement (cfs) tracks how a company uses its cash to pay its debt obligations and fund its operating expenses and investments.

The balance sheet also referred to as the statement of financial position, a. ¹⁾ significant transactions that are not part of the normal course of business, are related to business acquisition or divestment costs (ifrs 3), are infrequently occurring events or valuation items that do not affect cash flow are treated as adjustment items affecting comparability between. Simply put, it reports the cash inflows and cash outflows within your business during a time period, whether that’s over a week, a quarter, or a financial year.

What is a cash flow statement? The cash flow statement provides a view of a company’s overall liquidity by showing cash transaction activities. Investopedia / julie bang understanding.

A cash flow statement is a crucial financial document that details all your sources of cash over a given period of time. A cash flow statement is one of three key documents used to determine a company's financial health. Financials in millions cny.

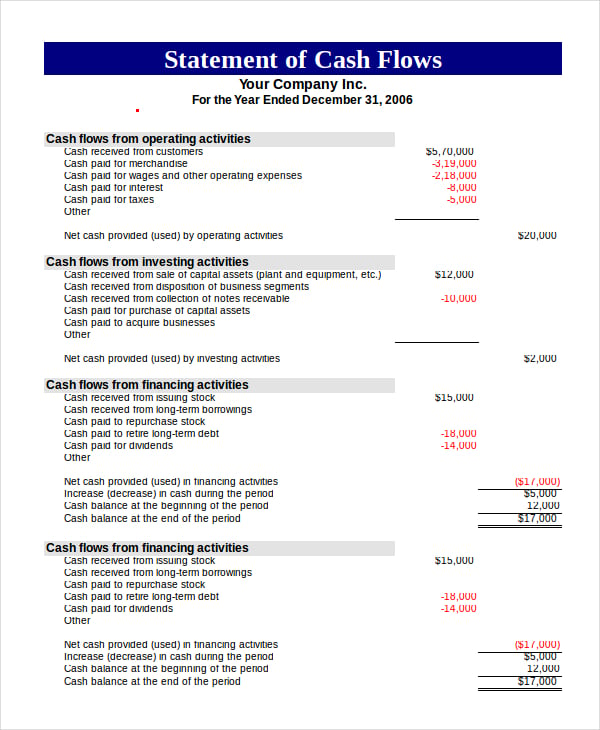

Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories. Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. The main components of the cash flow statement are:

Financial reporting includes collecting and documenting your finances to monitor your business’s financial health. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources.

The three major financial statements are balance sheet, income statement, and summary of cash flows 3 comments ( 28 votes) flag show more. Cash flow statements provide details about all the cash coming into and exiting a company. In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)