Smart Tips About Unadjusted Income Statement

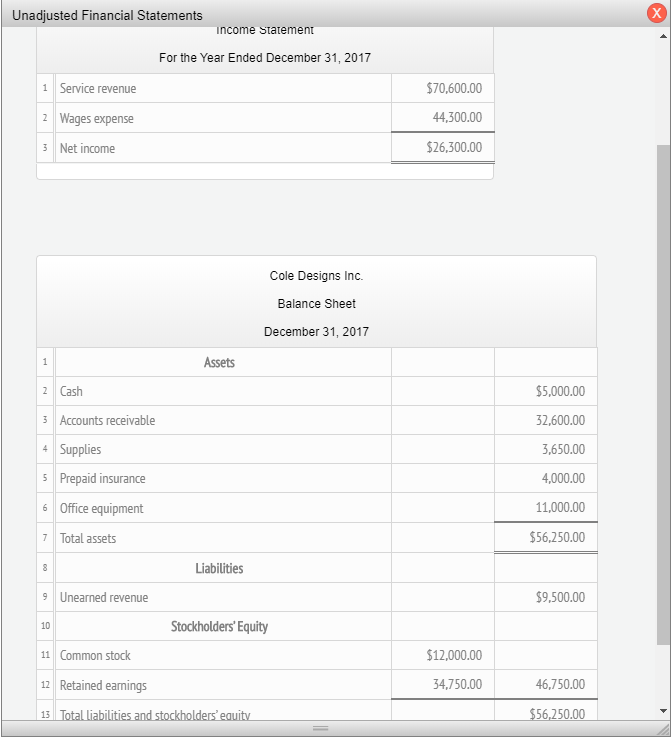

![[Solved] Below is an Unadjusted Statement a SolutionInn](https://img.homeworklib.com/questions/58f517c0-719b-11ea-9b2d-a704eb599cc9.png?x-oss-process=image/resize,w_560)

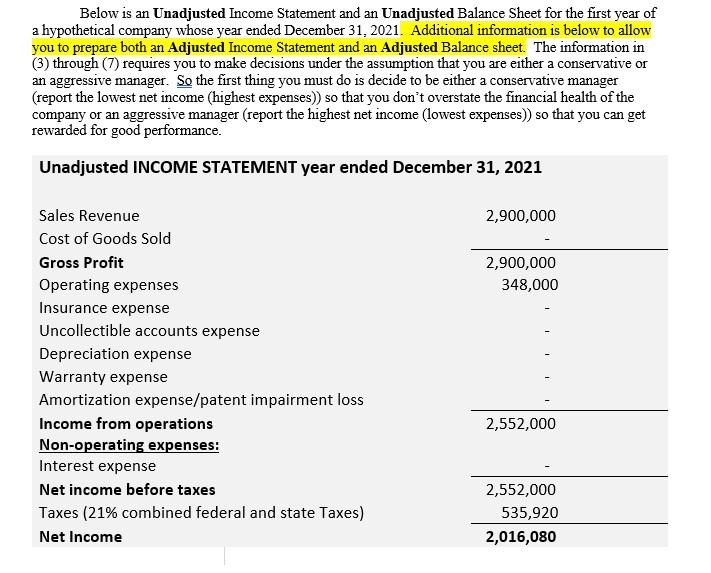

From this information, the company will begin constructing each of.

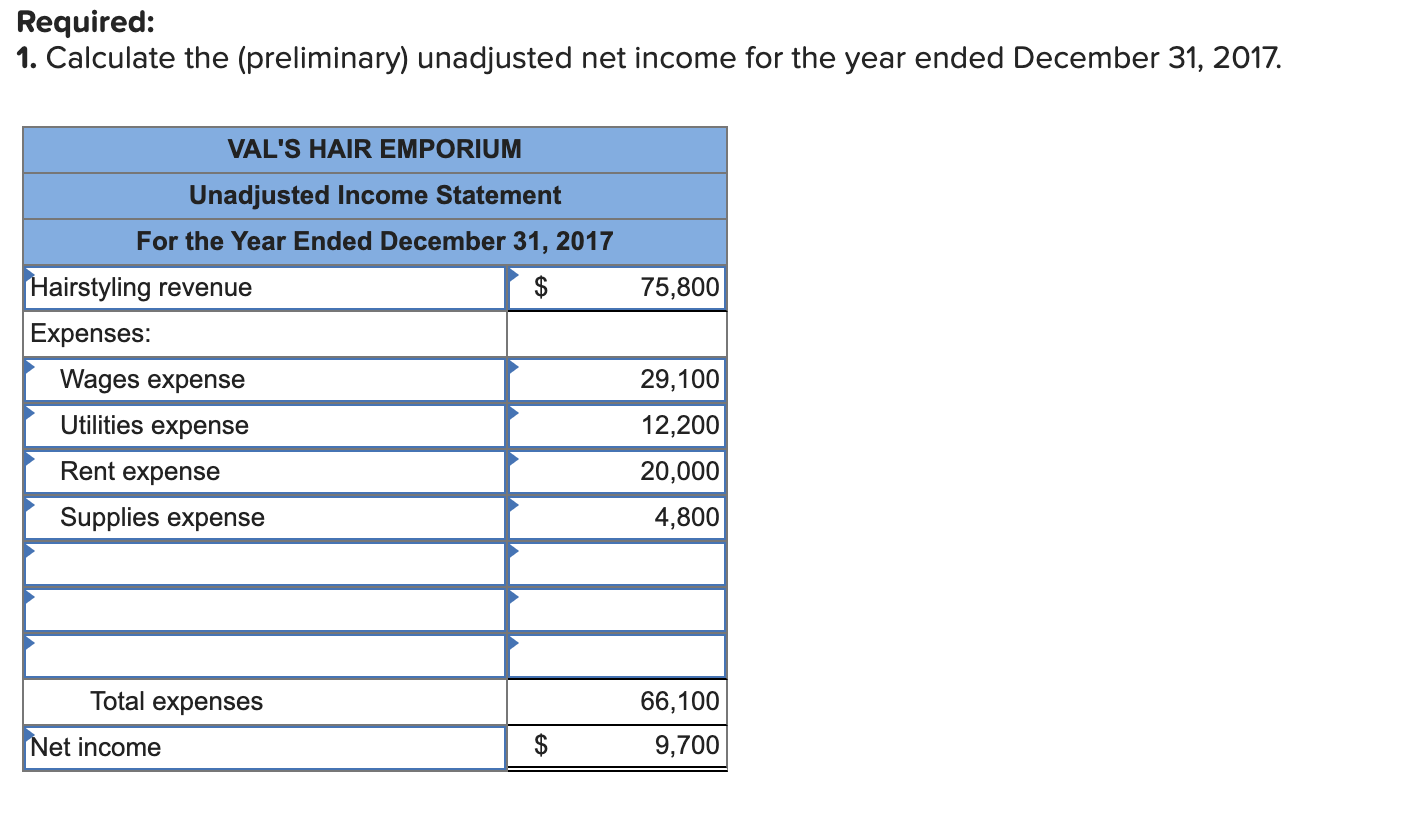

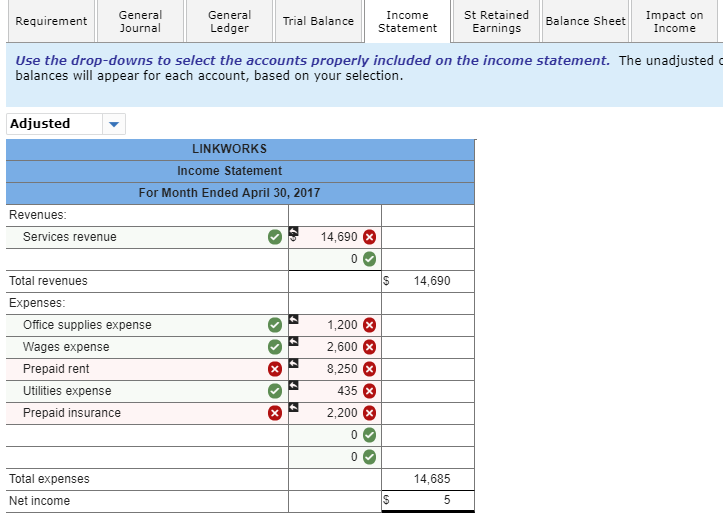

Unadjusted income statement. Does preparing more than one trial balance mean the company made a mistake earlier in the accounting cycle? The adjustments related to inventory levels can impact the cost of goods sold reported in the income statement. Adjusted net income is an indicator of how much a business would be worth to new owners after related expenses are factored in.

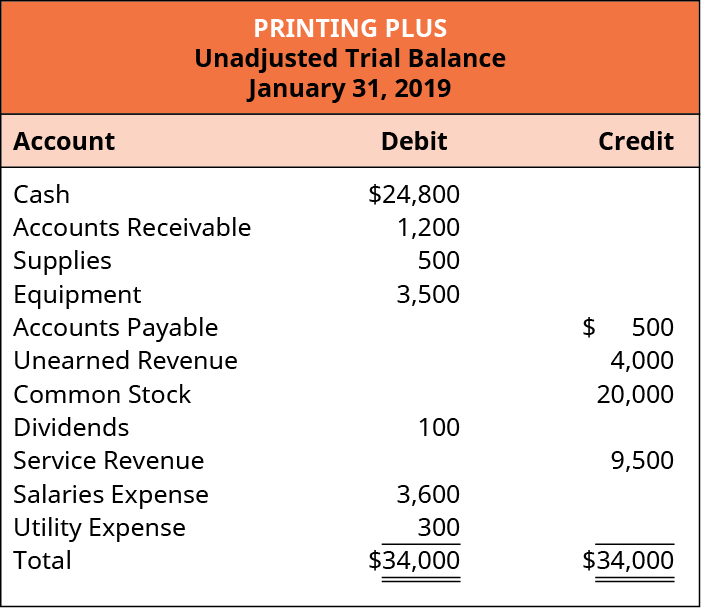

What does unadjusted trial balance mean? To derive net income, first you adjust the balances for things. The totals in your general ledger at the end of an accounting period are the unadjusted trial balance.

Introduction to unadjusted trial balance an unadjusted trial balance is a preliminary financial statement that lists all the general ledger accounts of a company. Identify which financial statement each account will go on: Unadjusted trial balance is used to identify the necessary adjusting entries to be made at the end of the year.² adjusting entries are made mainly due to the usage of.

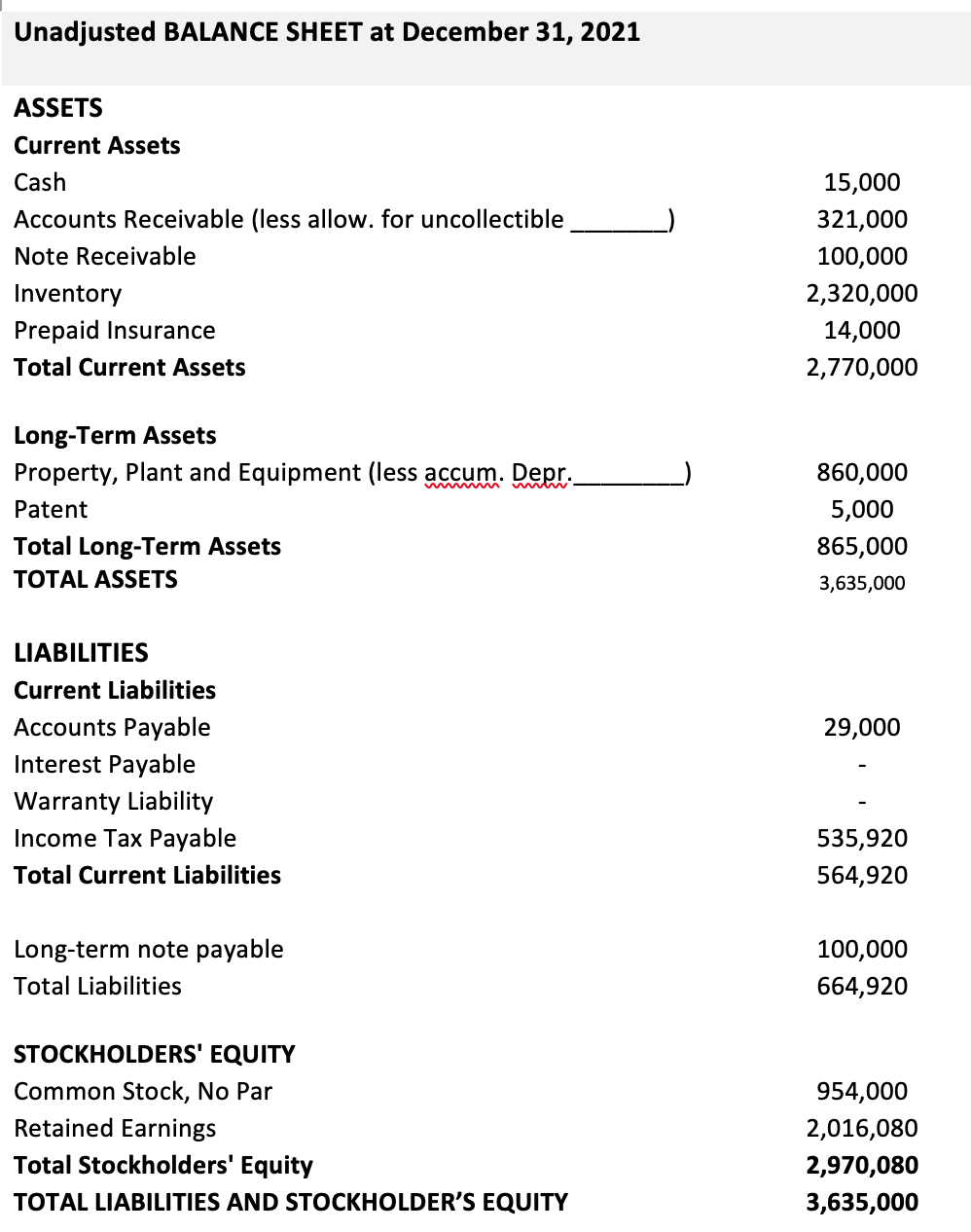

First, the account balances from the general ledger and subsidiary. Therefore, companies use the unadjusted amount to understand. An adjusted trial balance is a list of all accounts in the general ledger, including adjusting entries, which have nonzero balances.

Once you have prepared the adjusted trial balance, you are ready to prepare the financial statements. Unadjusted accounts are the starting amounts from which accounts begin the adjusting process at the end of the fiscal period. What is the purpose of the adjusted trial balance?

Unadjusted accounts do not reflect earned. To prepare the financial statements, a company will look at the adjusted trial balance for account information. Once you have a completed, adjusted trial balance in front of you, creating the three major financial statements—the balance sheet, the cash flow statement and the income.

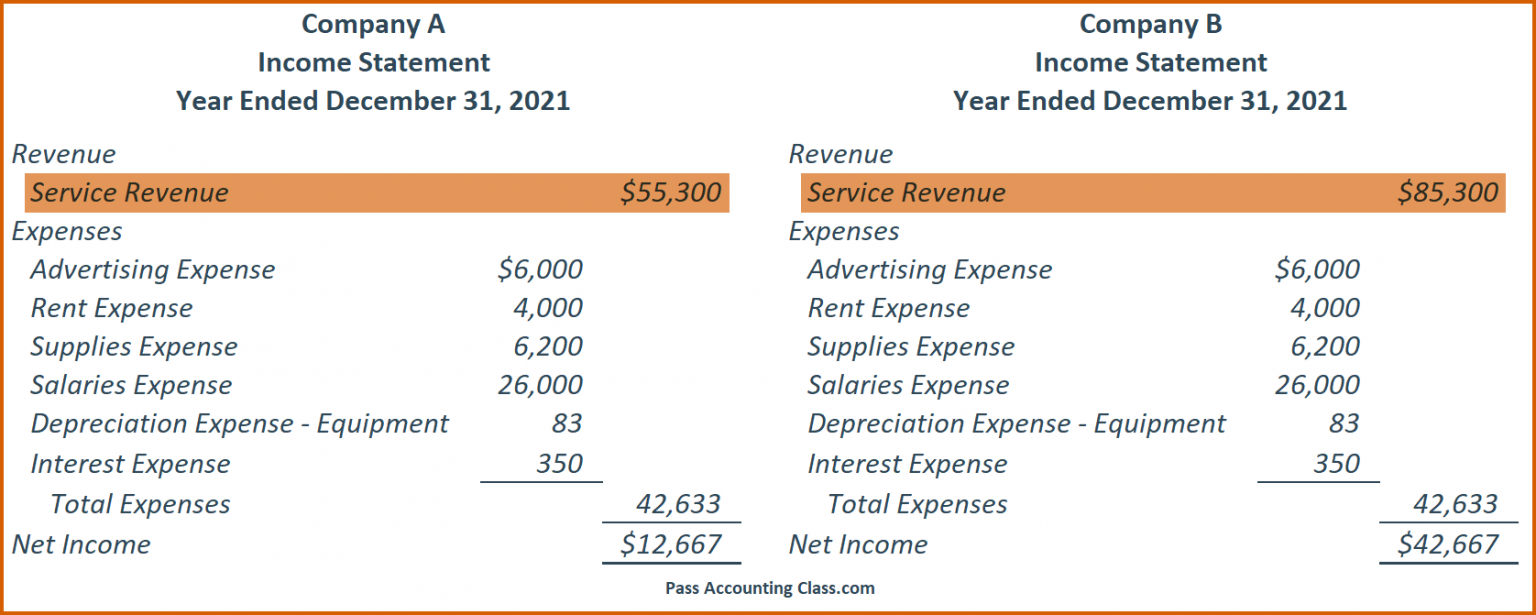

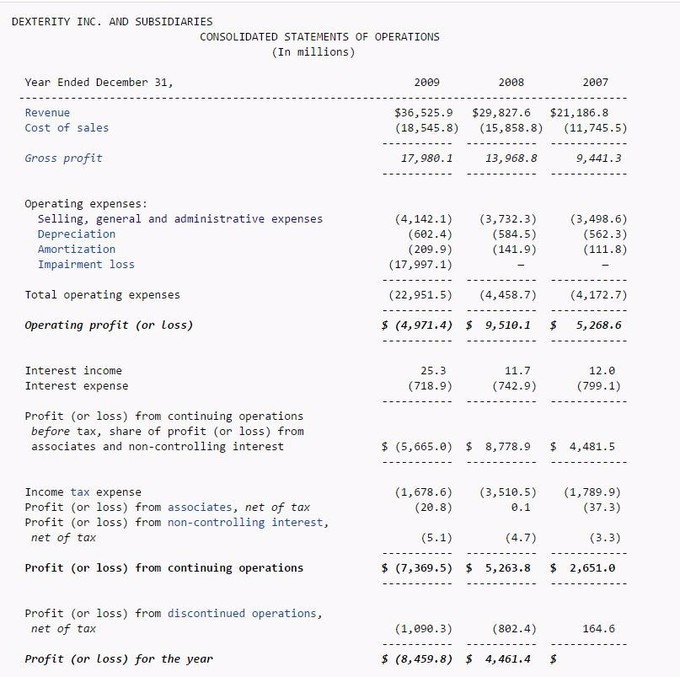

Analysis and income statement presentation 5m. An income statement shows the business’ financial performance for a given period of time. Preparing financial statements is the seventh step in the.

This trial balance is an important step in the. After the all the journal entries are posted to. In business valuation analysis, adjusted income statement (also referred to as normalised income statement) refers to the situation where the comprehensive income statement.

When preparing an income statement, revenues will always come before expenses in. This will increase the wage expense. That is why this trial balance is called unadjusted.

The preparation of the unadjusted trial balance depends on information from the general ledger and other accounting records like balance sheets and income. While primary revenue can be. Balance sheet, statement of retained earnings, or income statement.

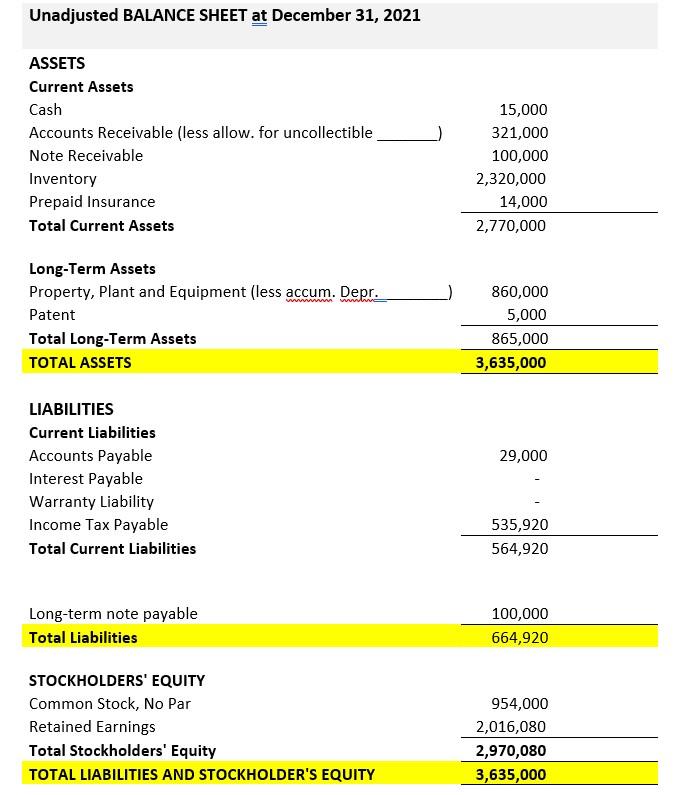

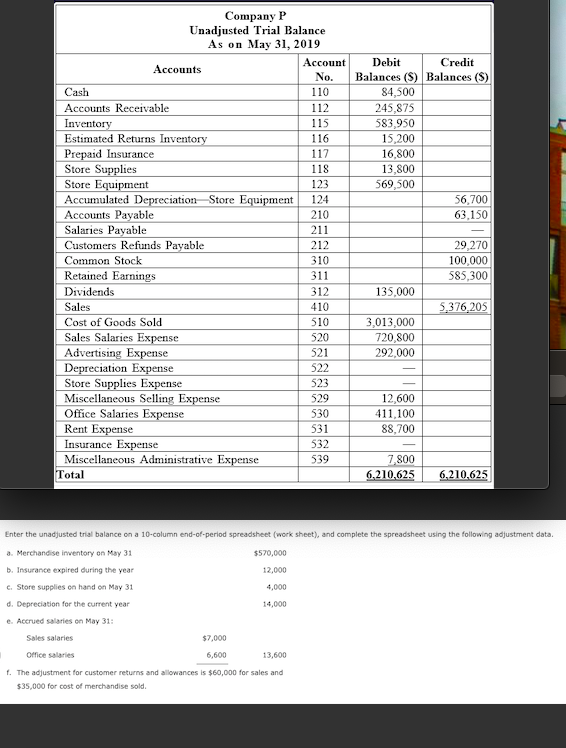

![[Solved] Below is an Unadjusted Statement a SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2022/09/6334193cc4ba3_1664358716146.jpg)

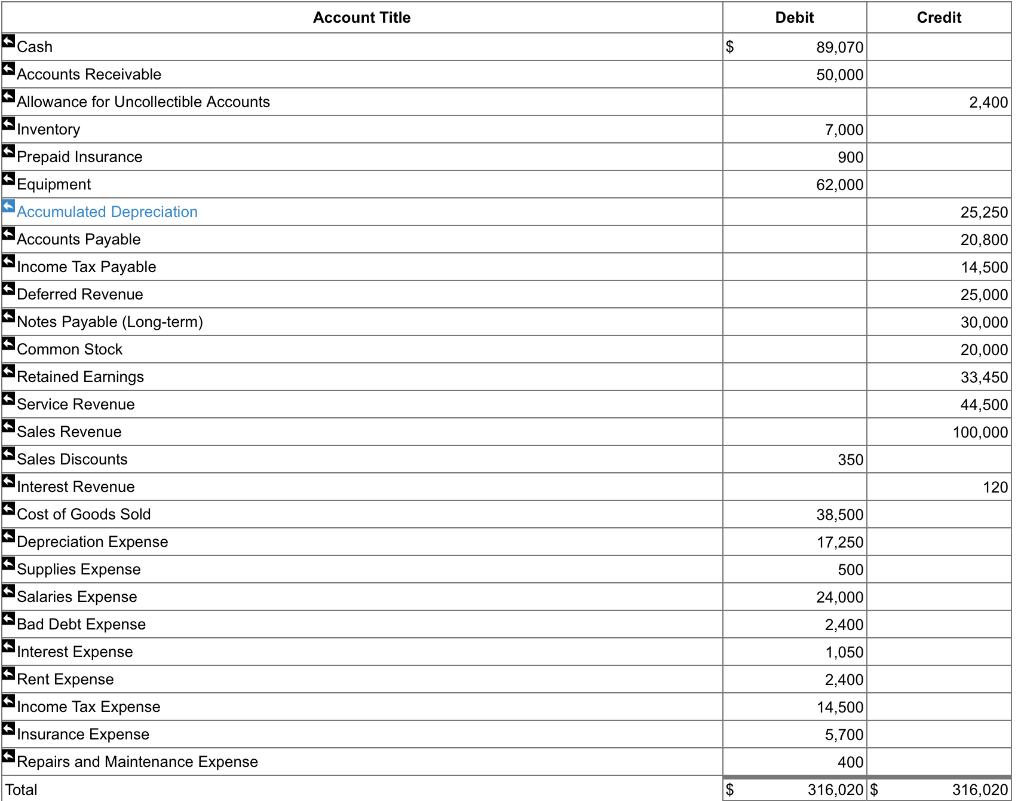

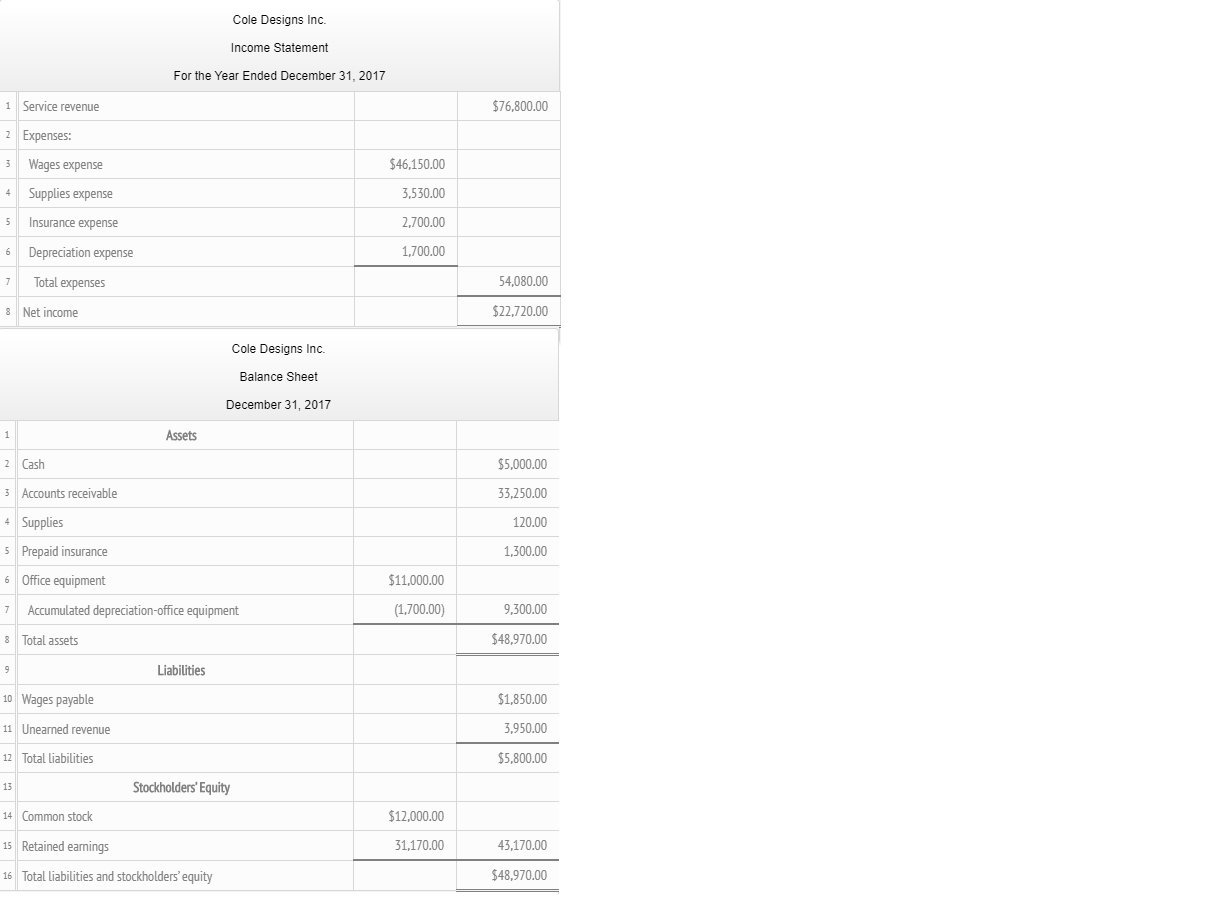

![[Solved] The unadjusted trial balance and s SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1560/3/4/2/9925d00f1d0221221560325988799.jpg)