Fabulous Tips About Contingency Note In Financial Statements

Contingencies contingencies can be included on the balance sheet as a liability if certain requirements are met.

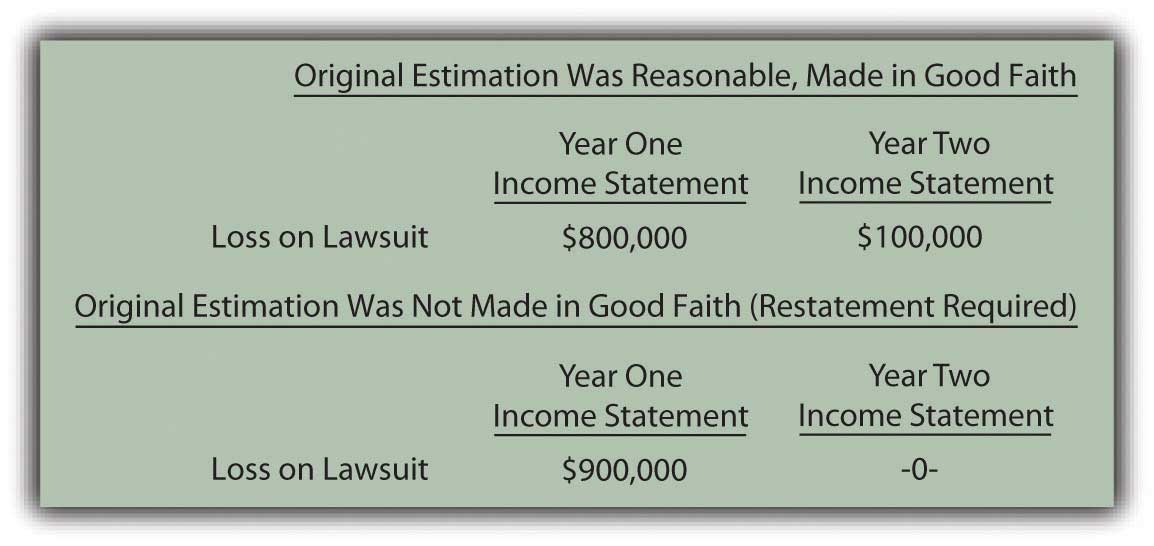

Contingency note in financial statements. For accounting purposes, they are only described in the notes to. Contingencies:.a jury awarded $5.2 million to a former employee of. Legislation3 and increased scrutiny of the disclosure of contingent liabilities from pending litigation, thus magnifying this conflict between auditors and attorneys.

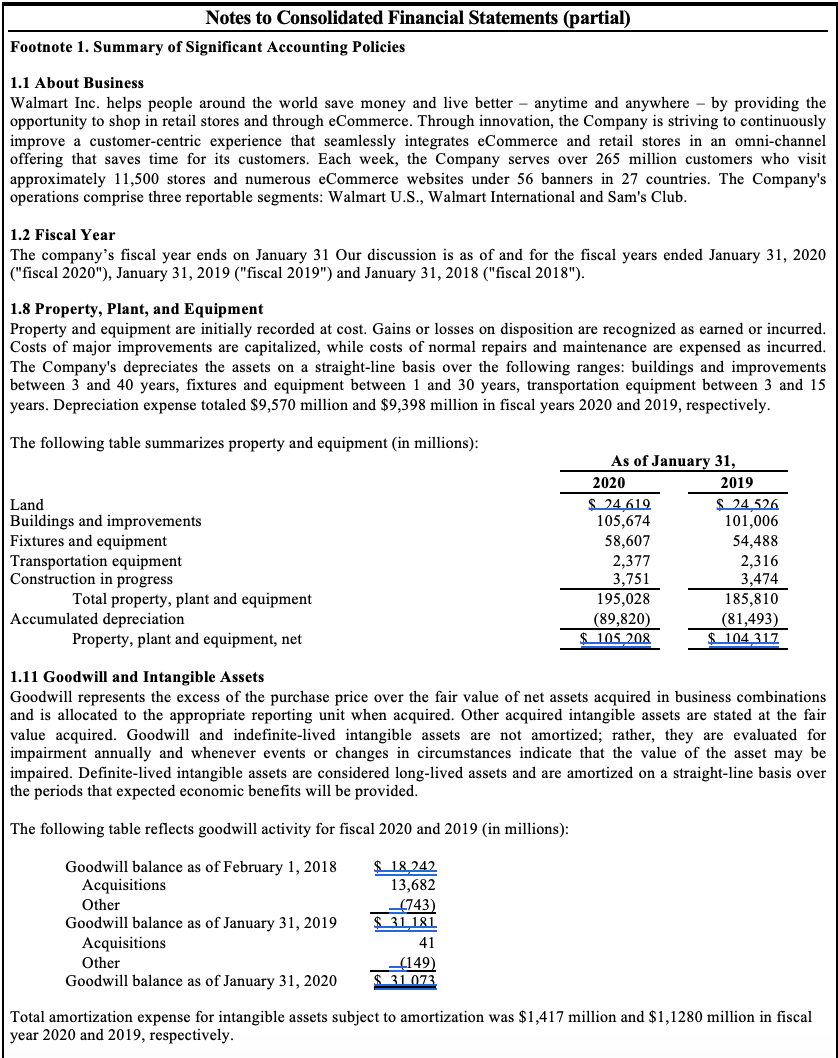

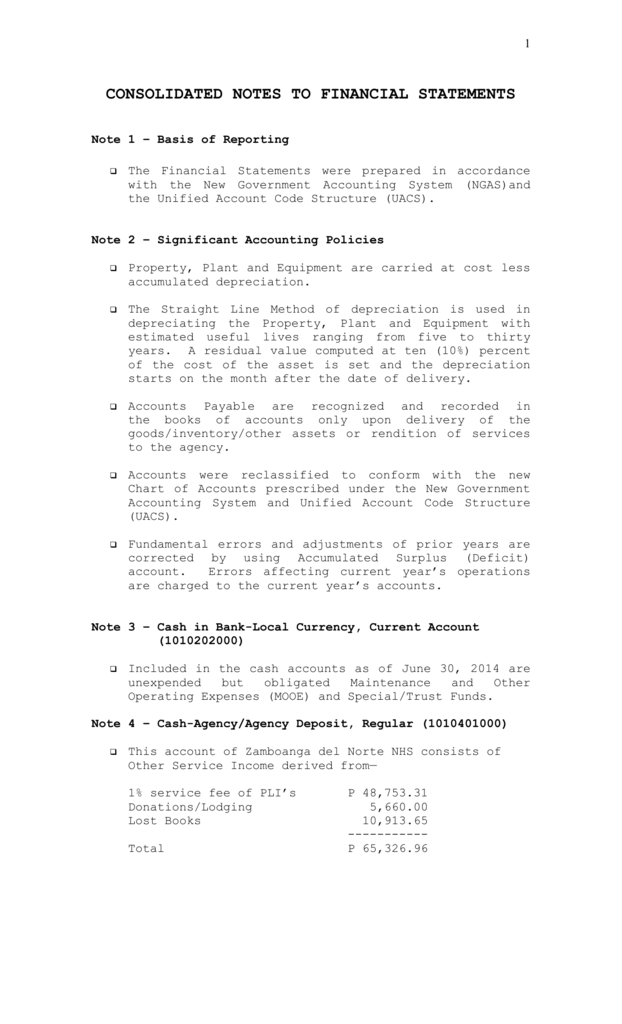

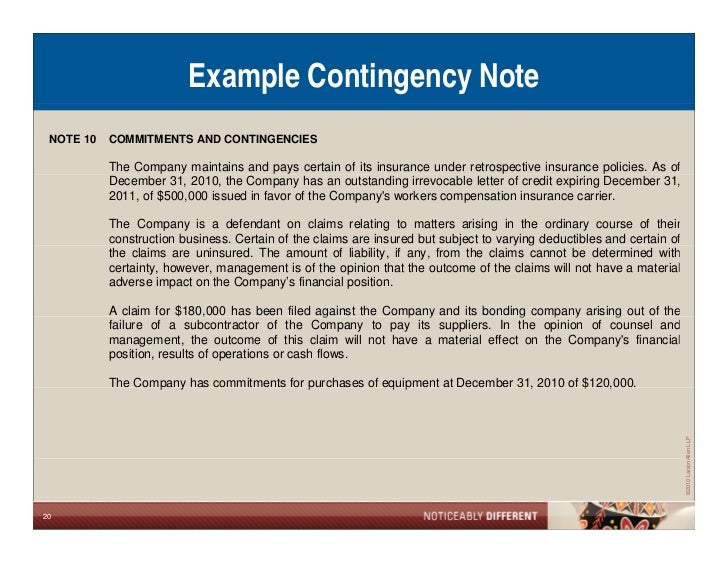

The contingency is the risk of loss assumed by the insurer, that is, the risk of loss from events that may occur during the term of the policy. Instead, firms typically disclose these contingent liabilities in notes to their financial statements. In this case, a note disclosure is required in financial statements, but a journal entry and financial recognition should not occur until a reasonable estimate is possible.

United kingdom (english) united states (english) this chapter discusses the presentation and disclosure. How to account for a contingency. In case of contingencies, they should be shown as notes in the financial statements, which will not depend on the fact that they will result in inflow or outflow of fund or not.

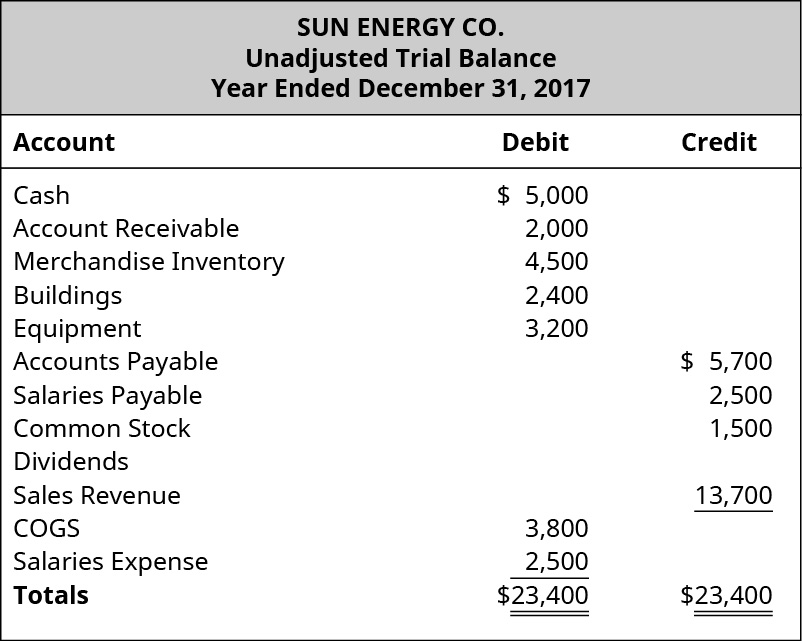

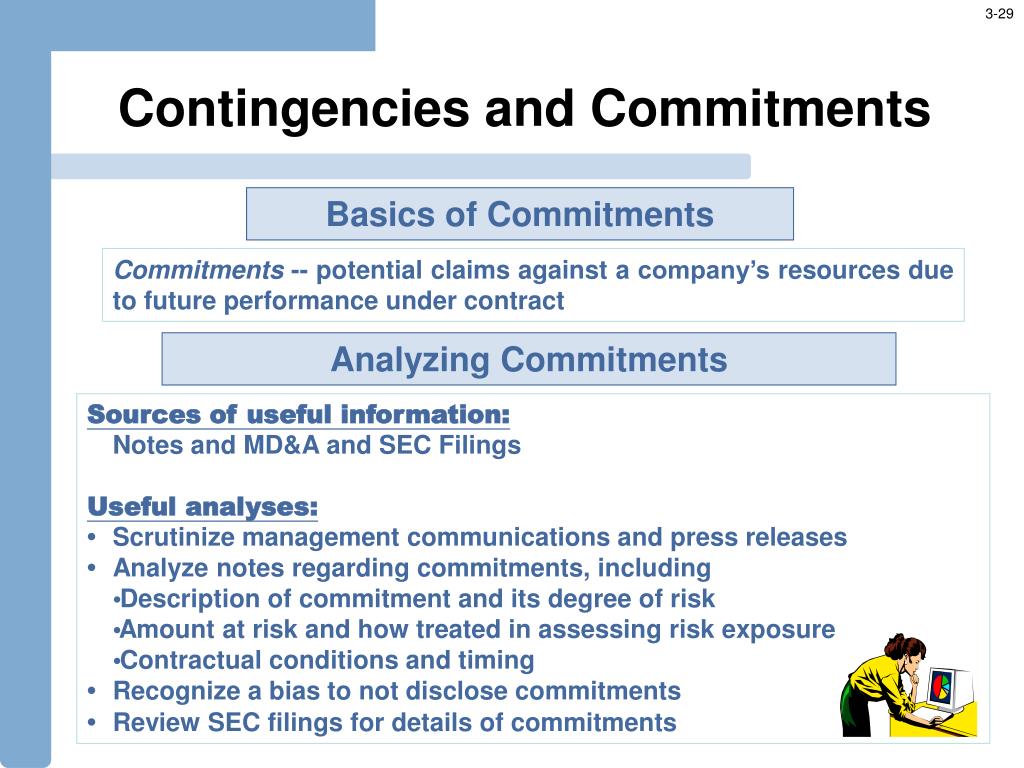

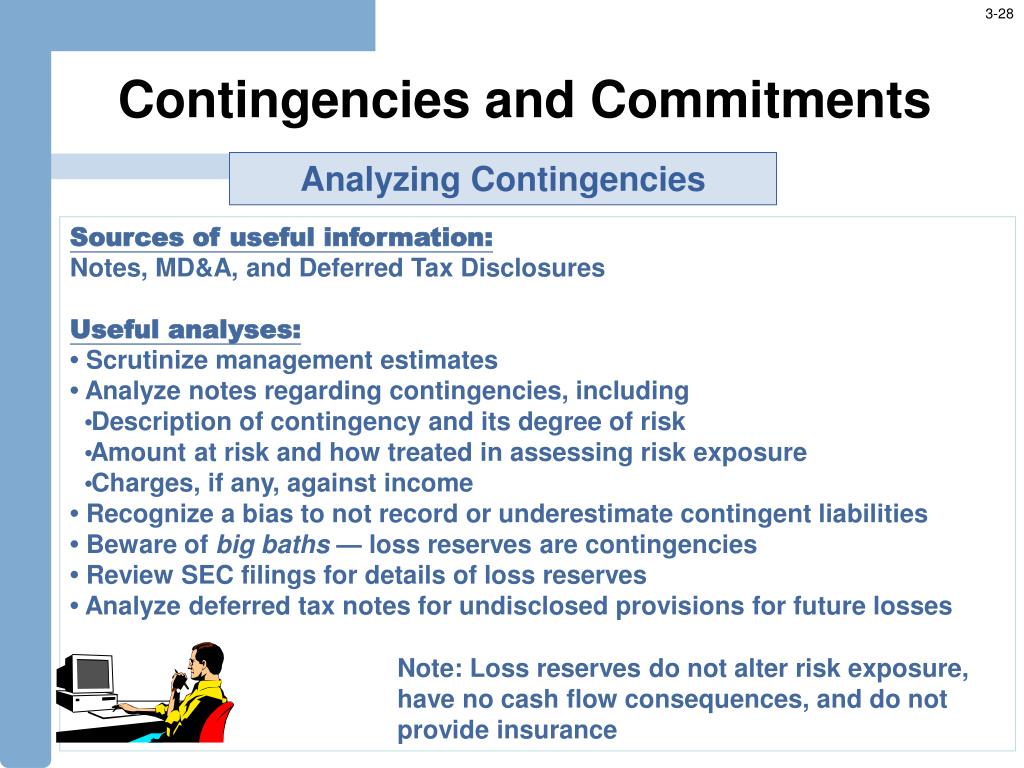

Following the generally accepted accounting principles, commitments are recorded when they occur, while contingencies (should they relate to a liability or future fund outflow) are at a minimum disclosed in the notes to the statement of financial position (balance sheet) in the financial statements of a business. Entities often make commitments that are future obligations that do not yet qualify as liabilities that must be reported. According to ifrs the contingencies whether it results in inflow or outflow of funds are to be disclosed in the notes to the accounts.

In several pages of explanatory material,. A contingency occurs when a current situation has an outcome that is unknown or uncertain and will not be resolved until a future point in time. Notes to the financial statements for the financial year ended 31 december 2005 these notes form an integral part of and should be read in conjunction with the accompanying.

These liabilities must be disclosed in the. This document provides a non. Contingent liabilities must pass two thresholds before they can be reported in financial statements.

First, the likelihood of a loss or claim has to be greater than 50%. A commitment is a vow made by a business to stakeholders and/or parties outside the company as a result of legal or contractual obligations. A contingency arises when there is a situation for which the outcome is uncertain, and which should be resolved in the future,.

Parts ii and iii of. Note 19 to the financial statements provides further details. A “medium probability” contingency is one that satisfies either, but not both, of the parameters of a high probability contingency.

For accounting purposes, they are only described in the. Entities often make commitments that are future obligations that do not yet qualify as liabilities that must be reported. Ias 37 outlines the accounting for provisions (liabilities of uncertain timing or amount), together with contingent assets.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)