Neat Tips About Us Gaap Cash Flow Statement

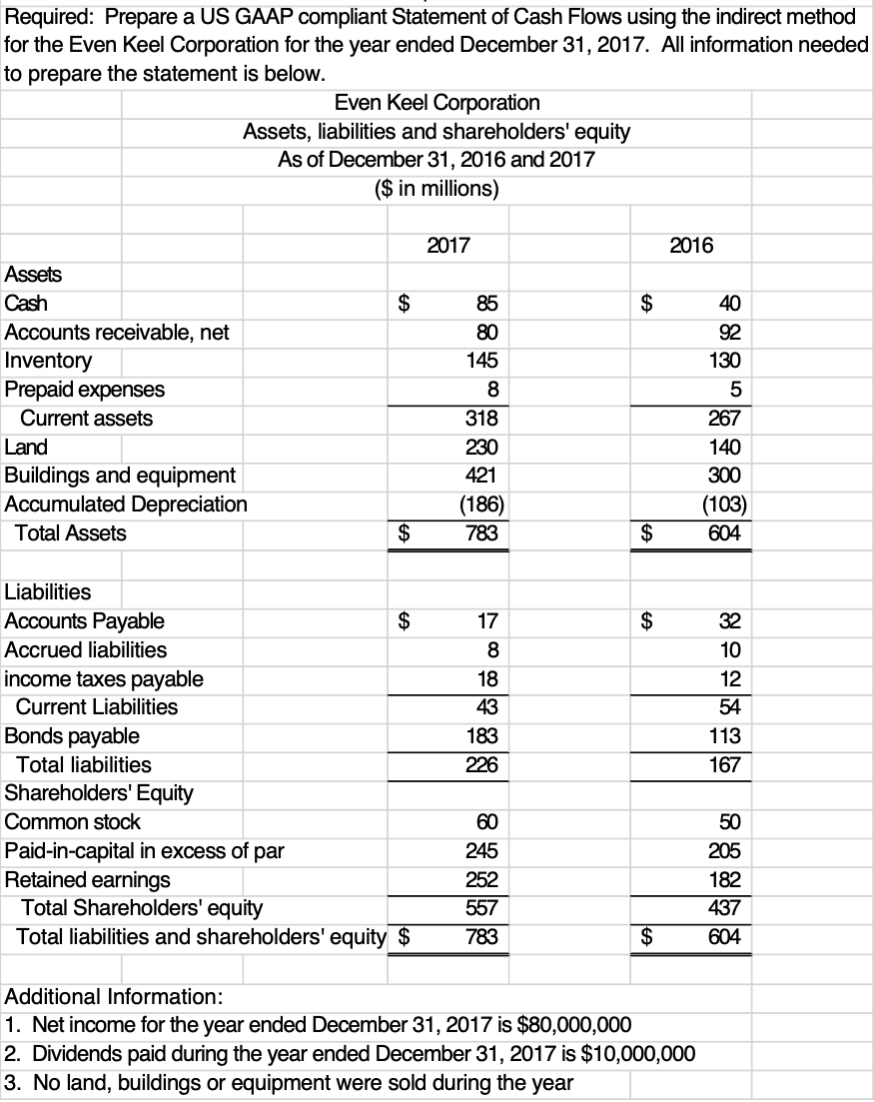

The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business.

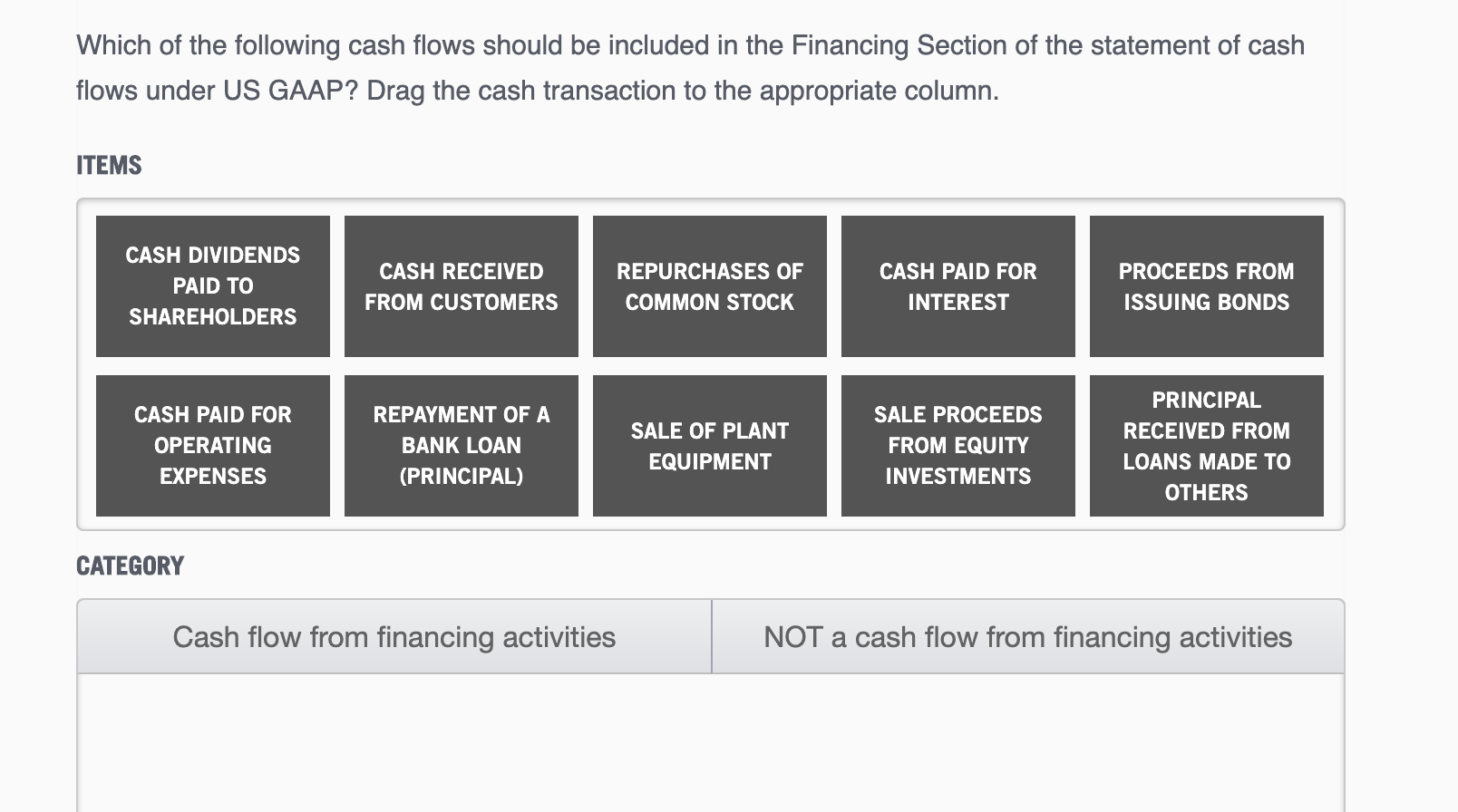

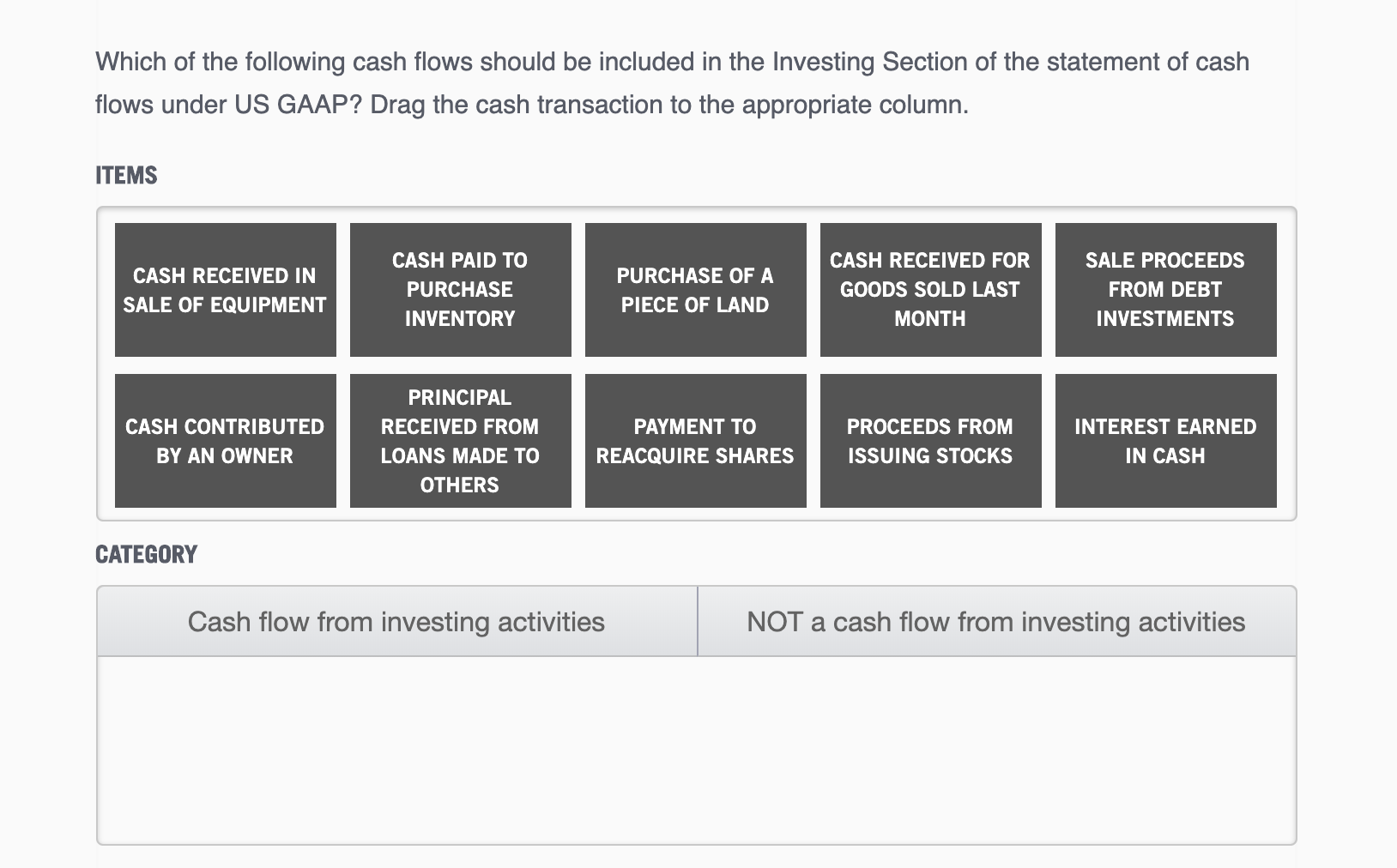

Us gaap cash flow statement. The statement of cash flows. Despite similar objectives, ias 71and asc 2302have different requirements, suc. Classifying in the statement of cash flows of cash receipts and payments as either operating activities, investing activities, or financing activities applying the direct method and the indirect method of reporting cash flows presenting the required information about noncash investing and financing activity and other events

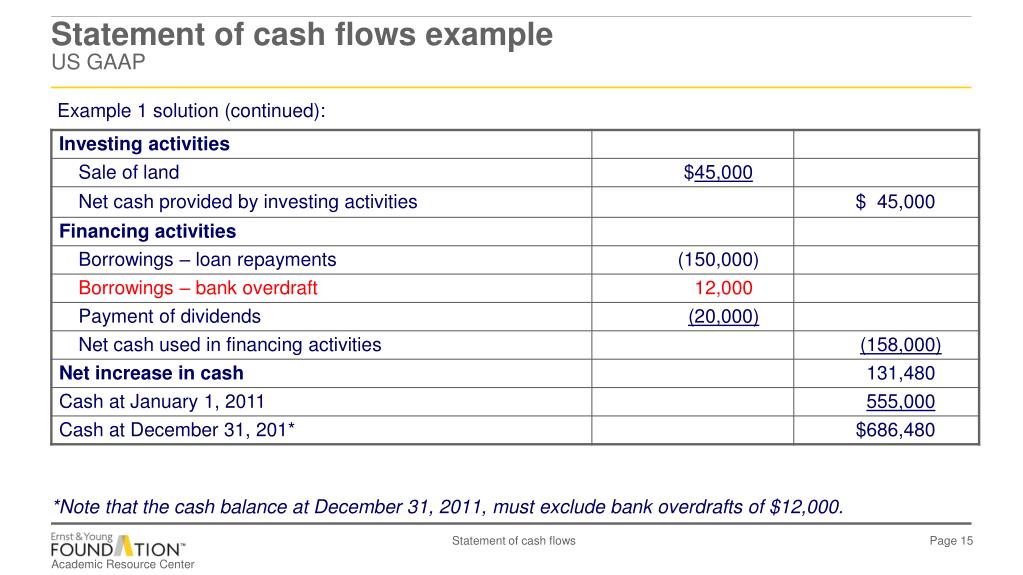

However, ifrs provides greater discretion with respect to which section of the statement of cash flows these items can. 29 nov 2020 us financial statement presentation guide 6.1 this chapter discusses the concepts that guide classification within the statement of cash flows. Pensions and other employee benefits.

Under us gaap, restricted cash is presented together with cash and cash equivalents on the statement of cash flows. Proper presentation begins with understanding what qualifies as cash and cash equivalents, and what does not. Company provides 2024 financial outlook.

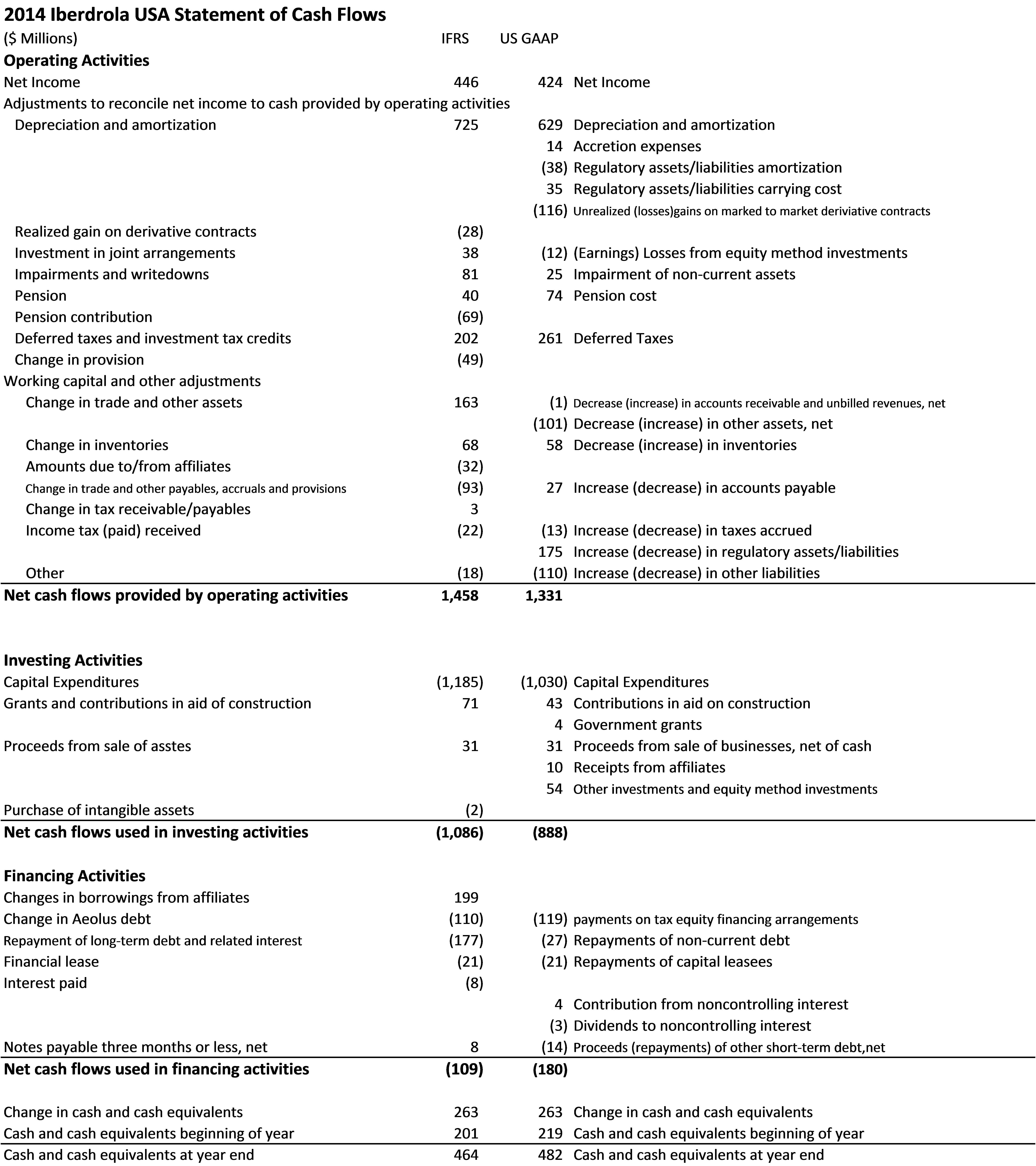

While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time. As a result, an entity must apply judgment when classifying cash flows associated with transactions involving such assets. The most significant difference is that ifrs gives companies more flexibility regarding how interest is paid or received, how dividend paid or received is reported, and.

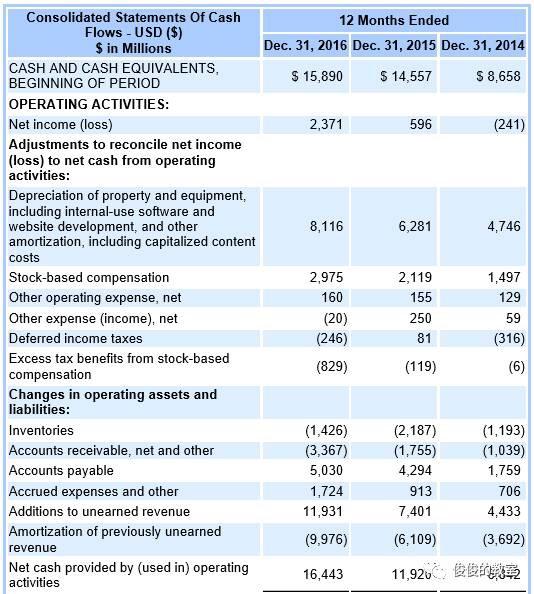

6.1 statement of cash flows—overview publication date: Gaap and ifrs with respect to the statement of cash flows. Cash flow from operations was $11.6 billion for the full year, up 5%;

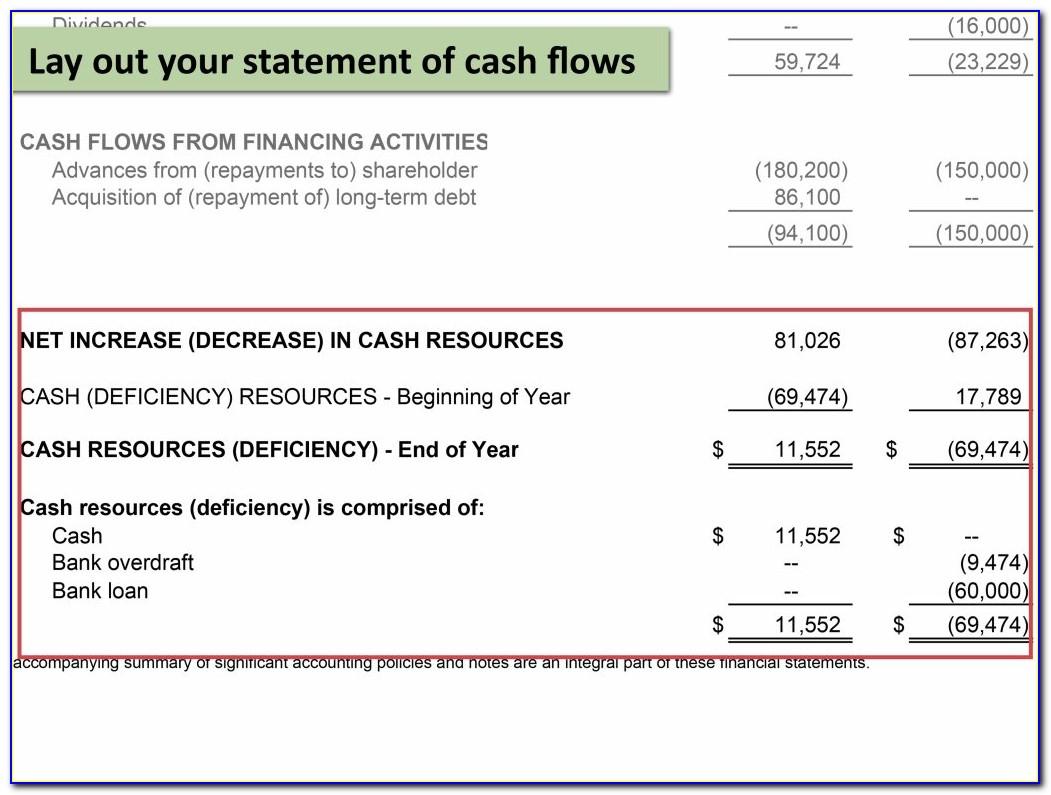

Transfers and servicing of financial assets. The cash flow statement should reflect a financing inflow of $100 million. Preparation of cash flow statement is required by all companies for completing the set of financial statements.

Repayment of the $40 million existing debt is a $40 million financing outflow. However, us gaap allows the chang es in shareholders’ equity to be presented But, some investment companies may not require to prepare cash flow statement that lies under the scope of.

In addition, refer to our u.s. The total amounts of cash and cash equivalents at the beginning and end of the period These are the significant differences between u.s.

Us gaap requires that interest expense, interest income and dividend income be accounted for in the operating activities section, and dividends paid be reported in the financing section. Exceptions exist under us gaap. Statement of cash flows (ifrs vs us gaap) the cash flow statement (cfs) provides information about a company’s cash receipts and payments from operating activities, investing activities and financing activities.

Although it is restricted cash, it is part of the change in cash, cash equivalents, and restricted cash. Several differences exist between how the cash flow statement is prepared under ifrs and us gaap. Potentially misunderstood and often an afterthought when financial statements are being prepared, it provides key information about an entity’s financial health and its.