Marvelous Info About Does Closing Stock Come In Trial Balance

If closing stock is appeared in trial balance, how it is pos.

Does closing stock come in trial balance. If closing stock does appears in the trial balance, it means the purchases has been reduced to the extent of stock amount at the end of the period. If closing stock is included in the trial balance , the effect will be doubled. The accounts reflected on a trial balance are related.

This video explains the logic behind why the closing stock does not appear in the trial balance along with an exception.you can refer the below video if you. The trial balance shows the. As per this treatment, the closing stock is not shown in the trial balance because it is already a part of the purchases of the.

Will opening stock appear in. The closing stock would be tallied twice in the trial balance if it were included. So, it should be shown in.

Solution the closing stock is shown in the trial balance when it is adjusted against purchases. The value of total purchases is already included in. Closing stock represents sales made in an earlier accounting period (such as in the current month,.

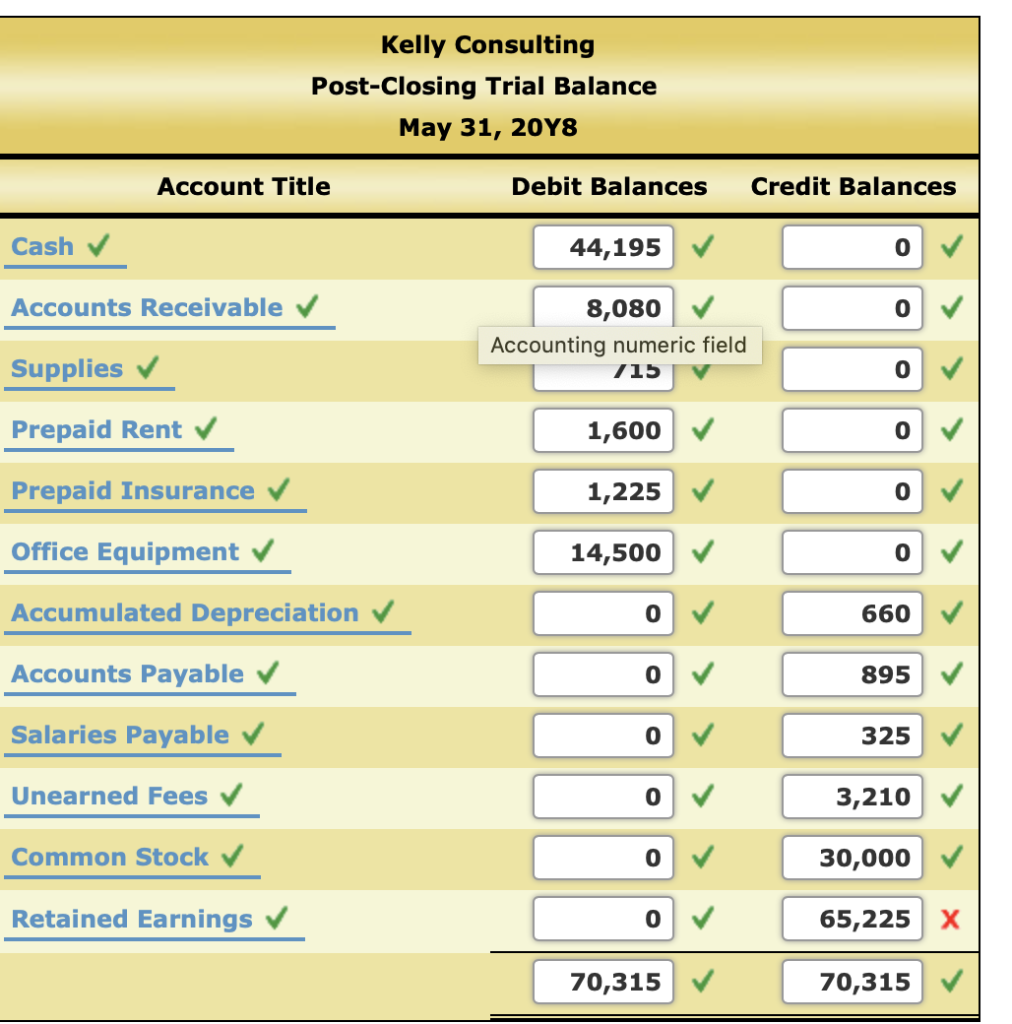

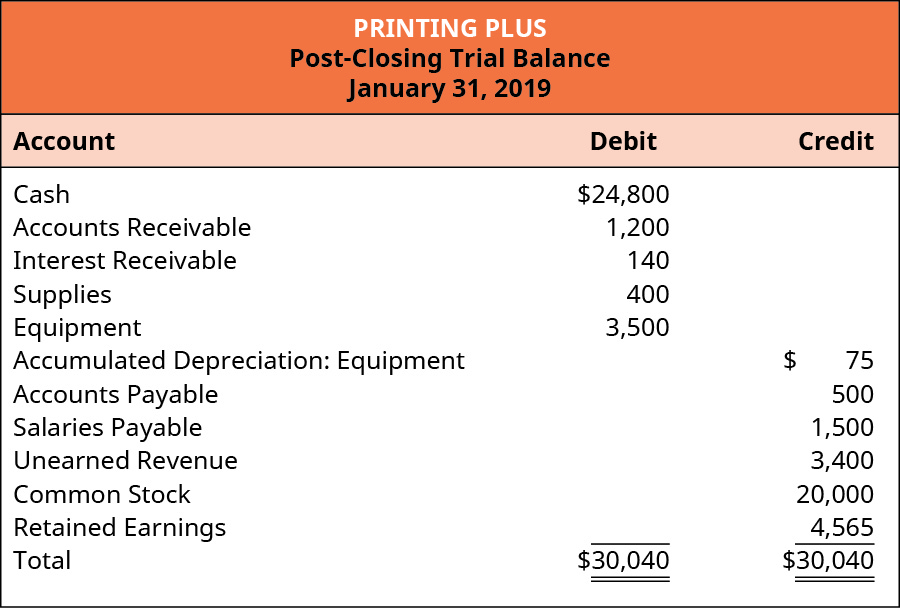

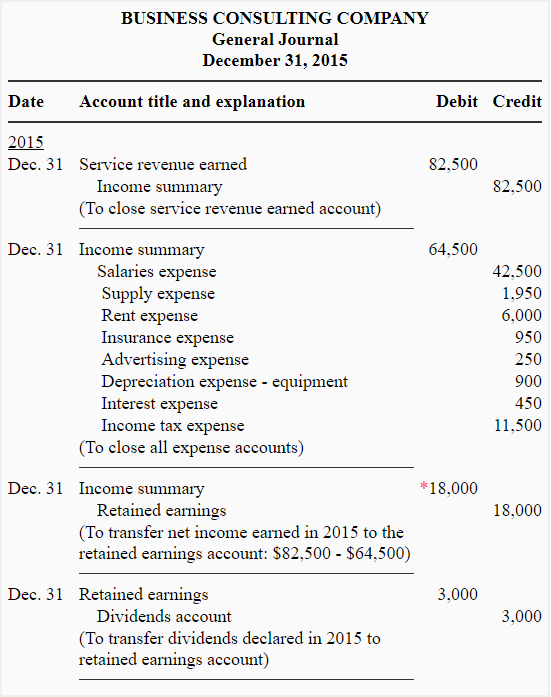

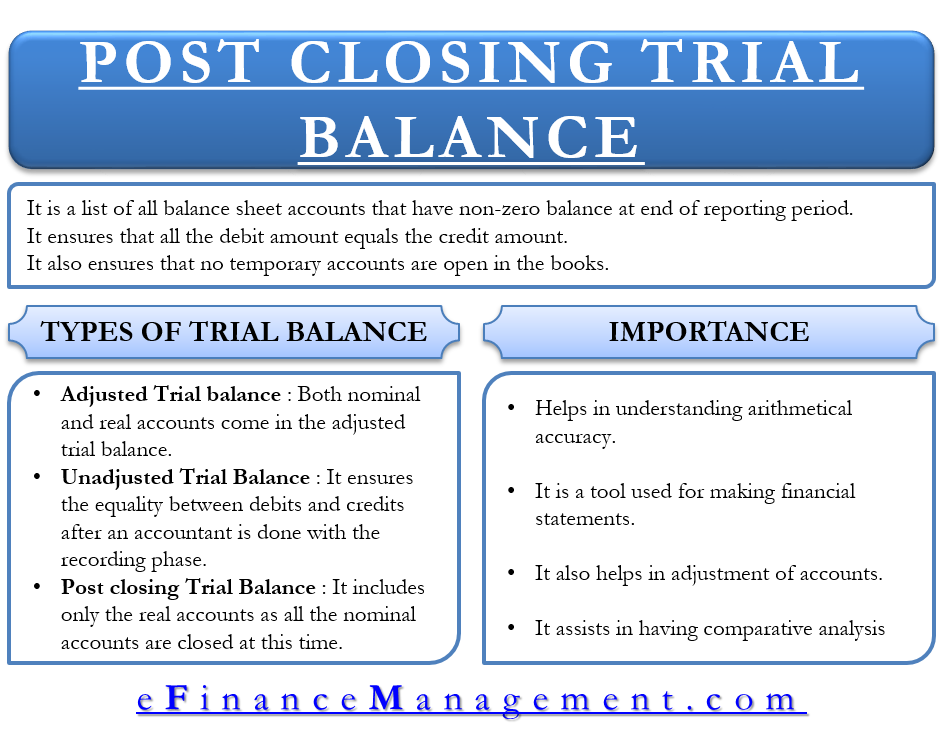

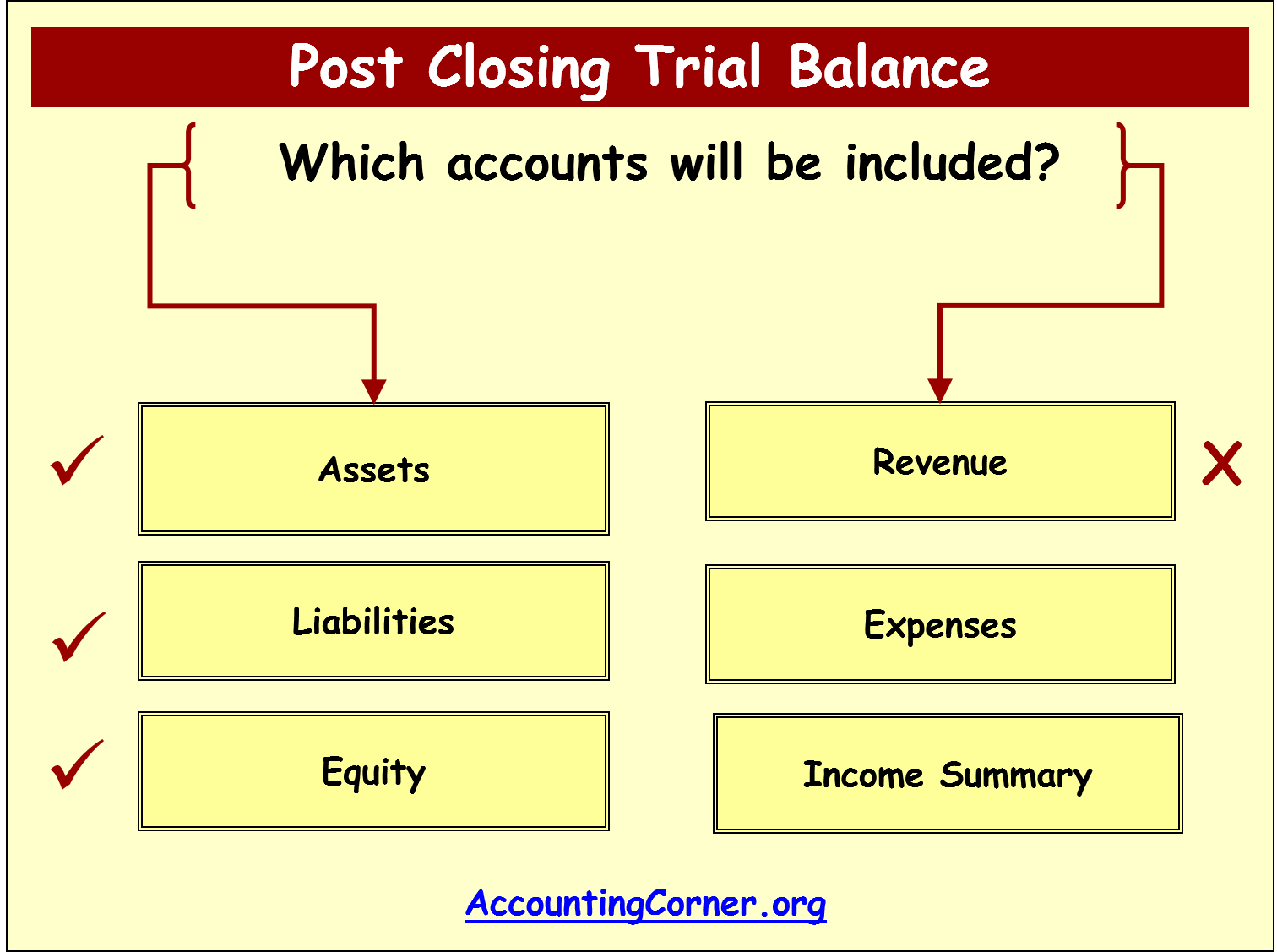

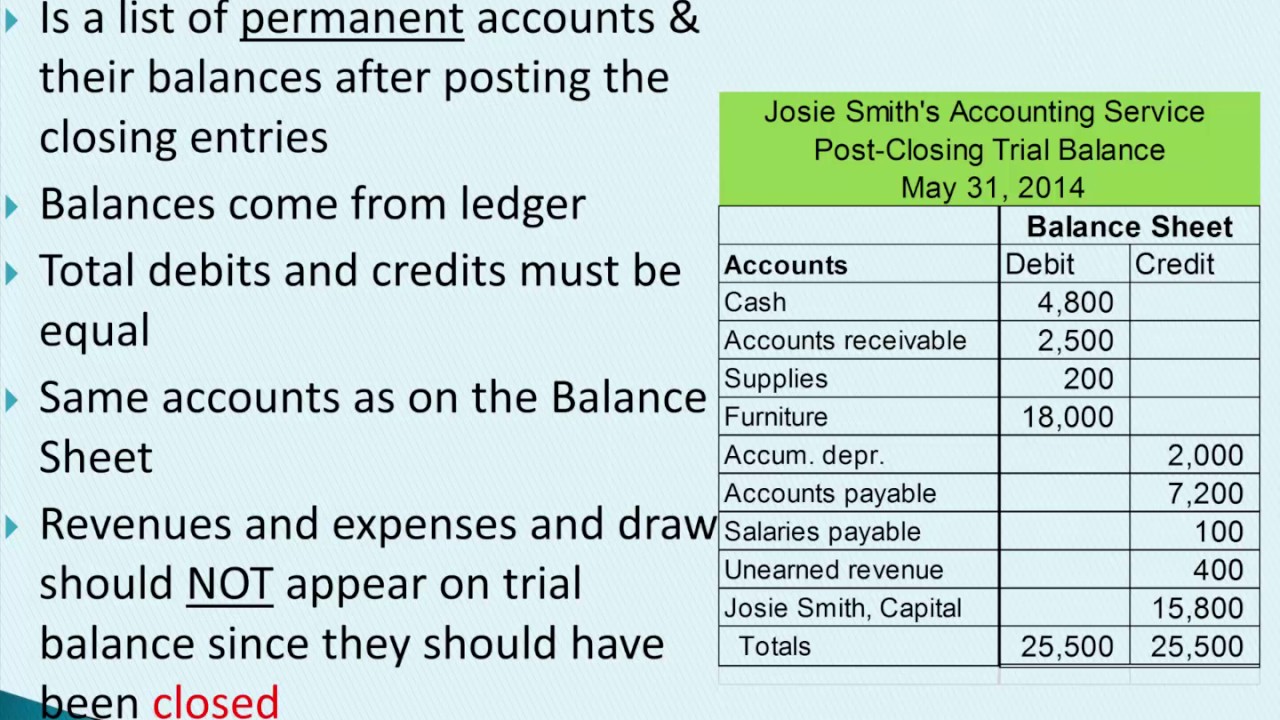

In this session, i've explained what the closing is and why it is not appeared in trial balance. What does closing stock represent in terms of revenue? The balance in dividends, revenues and expenses would all be zero leaving only the permanent accounts for a post closing trial balance.

The reason why closing stock is not taken into account in a trial balance is because a trial balance is a balance of all ledger account a given point in time.it records. Sometimes in the trial balance, this adjusted purchase is given and this means that the opening stock and closing stock are adjusted through this purchase. Methods impact of pricing method difference between opening stock and closing stock recommended articles closing stock explained closing stock represents the value of.

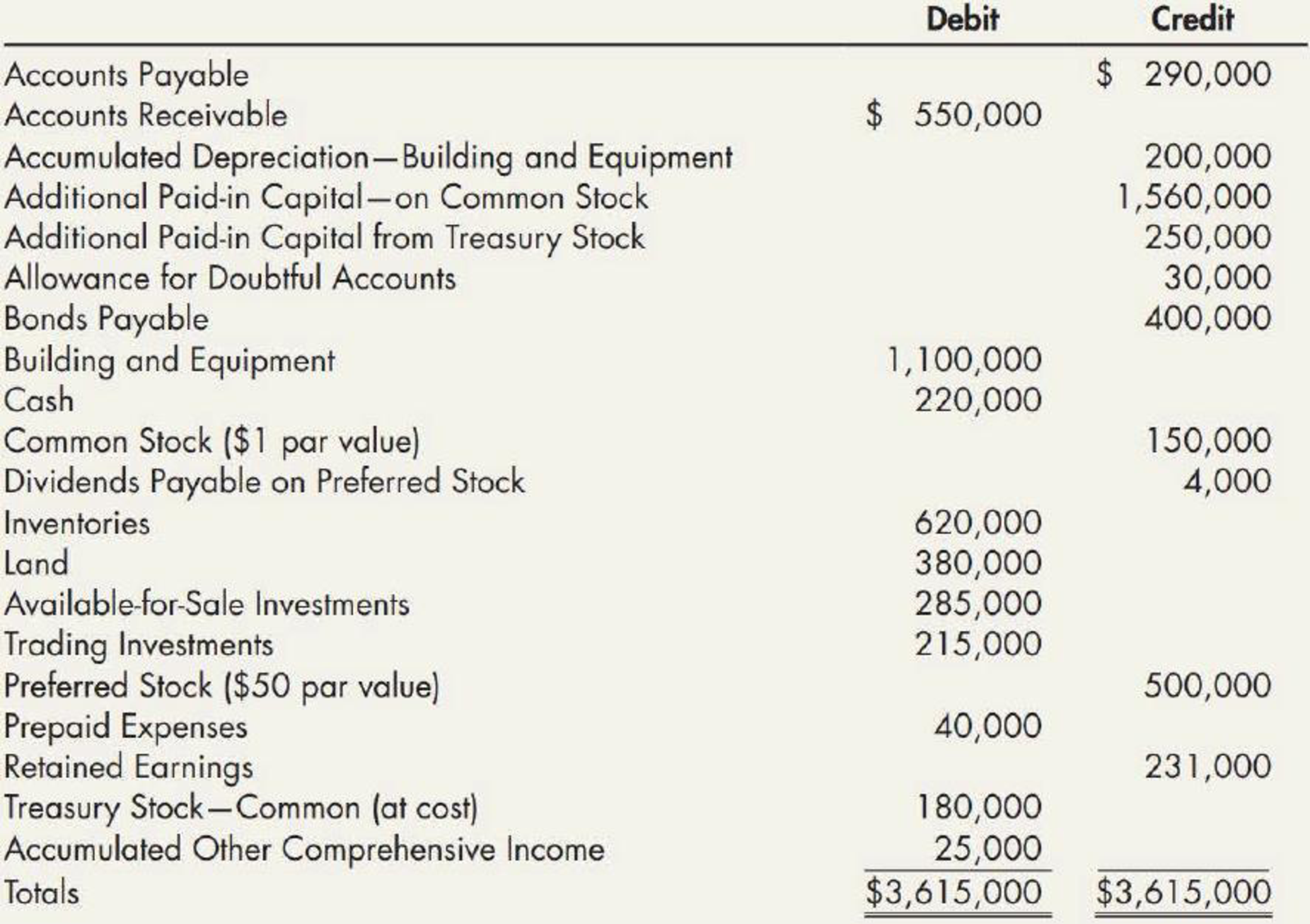

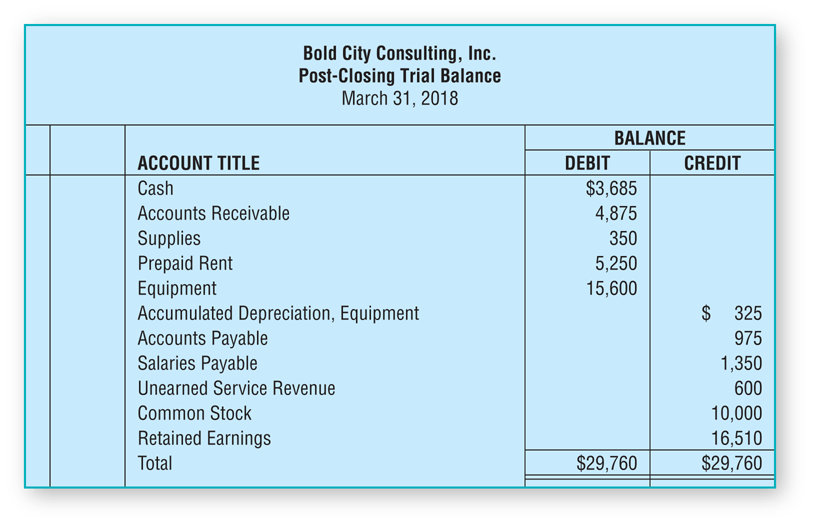

A trial balance is a list of all accounts in the general ledger that have nonzero balances. Where is the closing stock. A trial balance is an important step in the accounting process, because it helps identify.

Hence, it will not reflect in the trial balance. Hence, it is omitted in trial balance preparation. Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period.

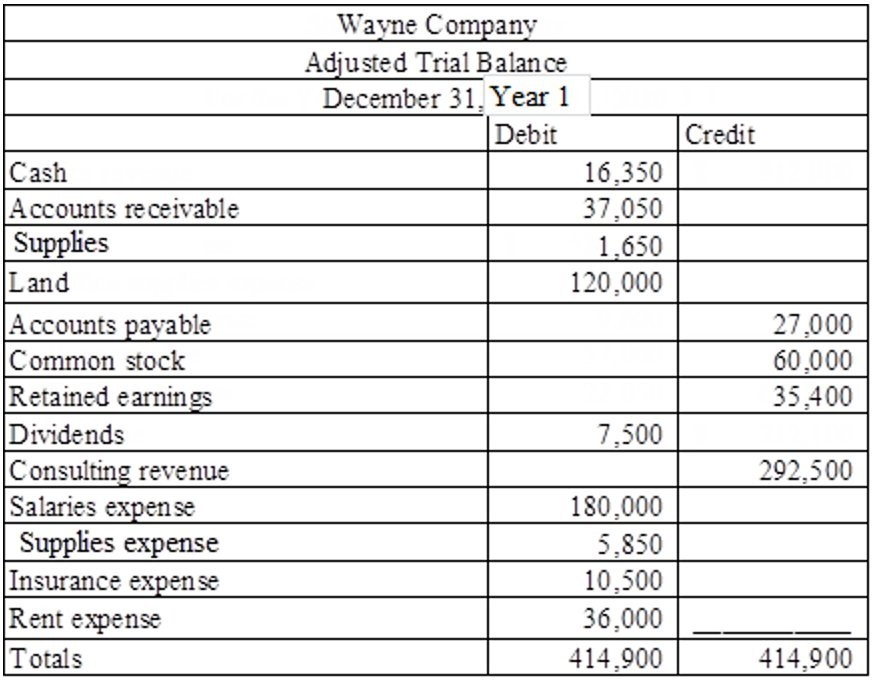

Closing stock is the balance out of goods that were purchased during an accounting period, and have remained unsold. You are preparing a trial balance after the closing entries are complete. To get the $10,100 credit balance in the adjusted trial balance column requires adding together both credits in the trial balance and adjustment columns (9,500 + 600).

This is your starting trial balance for the next year. If it is included, the. Total purchases are already included in the trial balance, hence closing stock should not be included in the trial balance again.