Ideal Info About Comparative Balance Sheet Of Any Company

Energy and agriculture investors can find a quick view of the markets at bloomberg.com/markets.

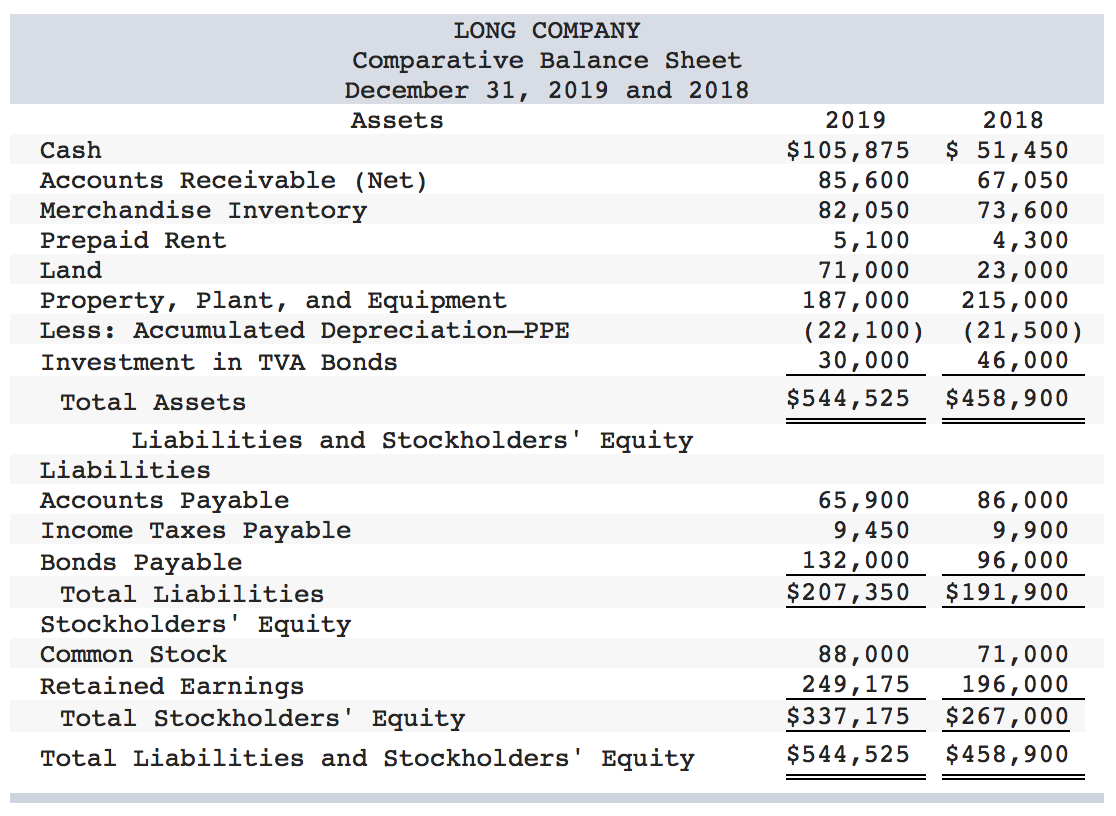

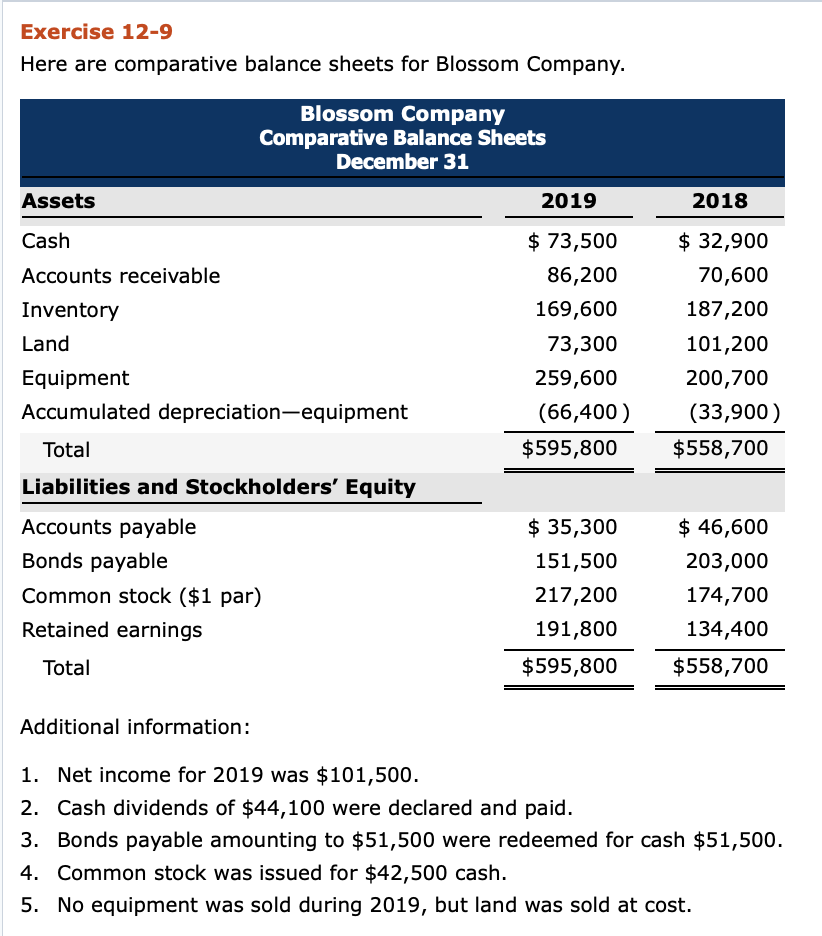

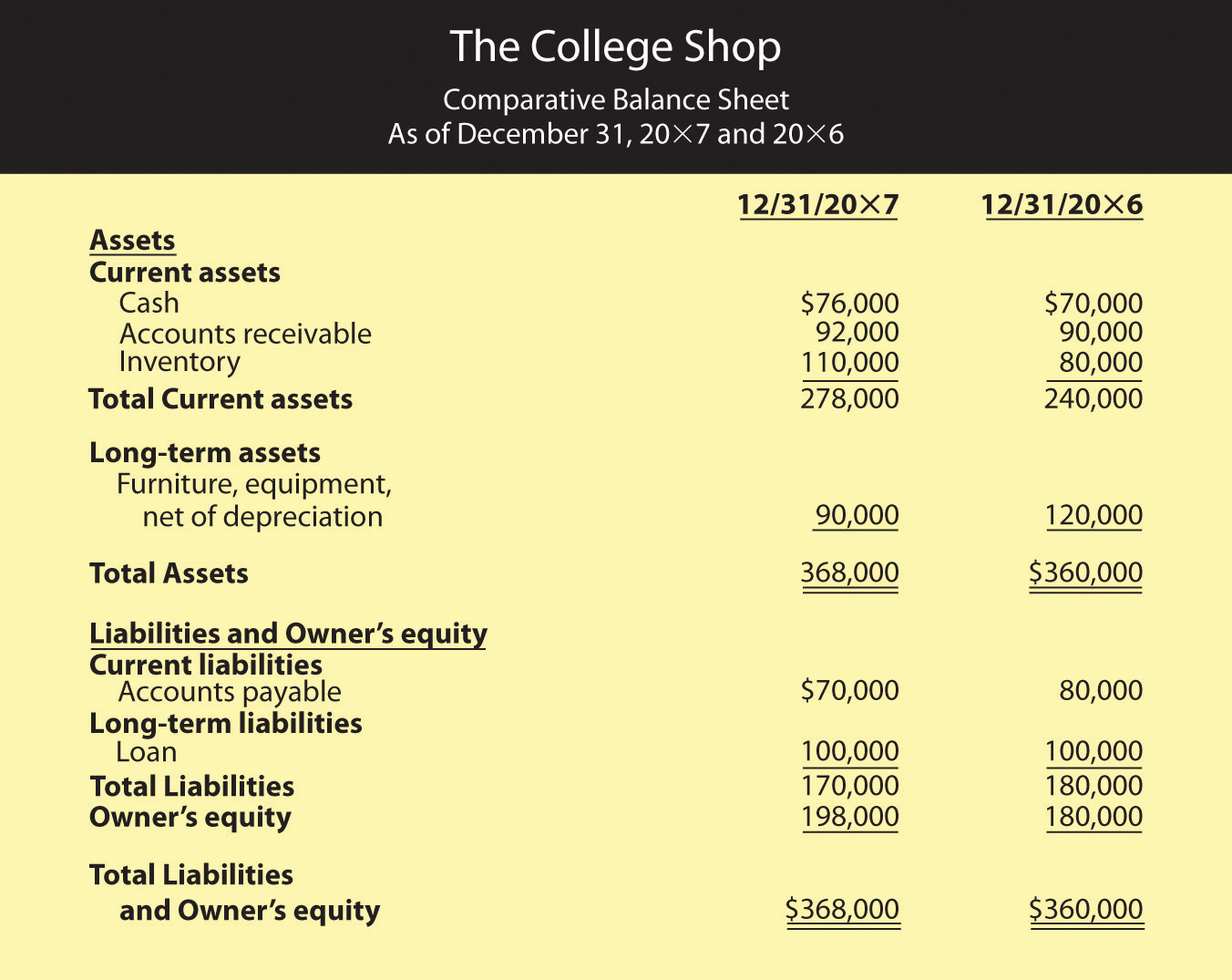

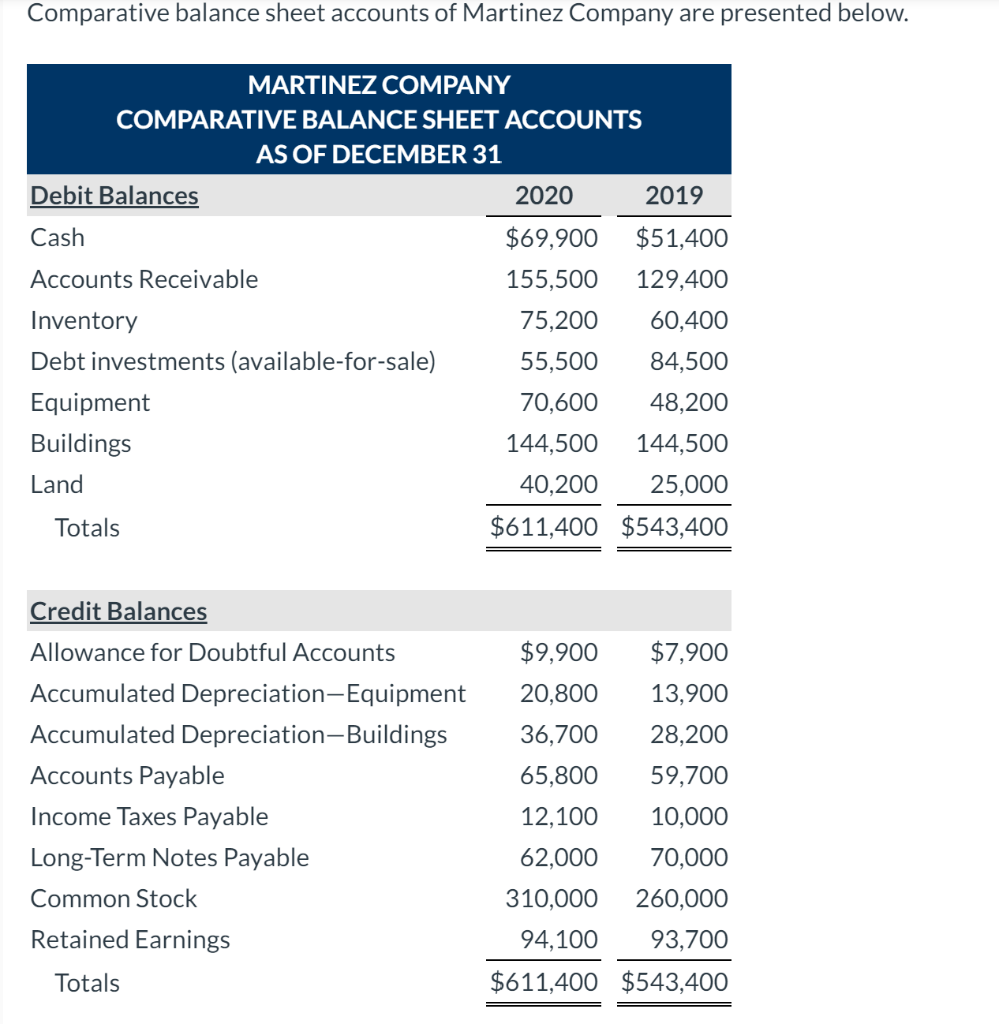

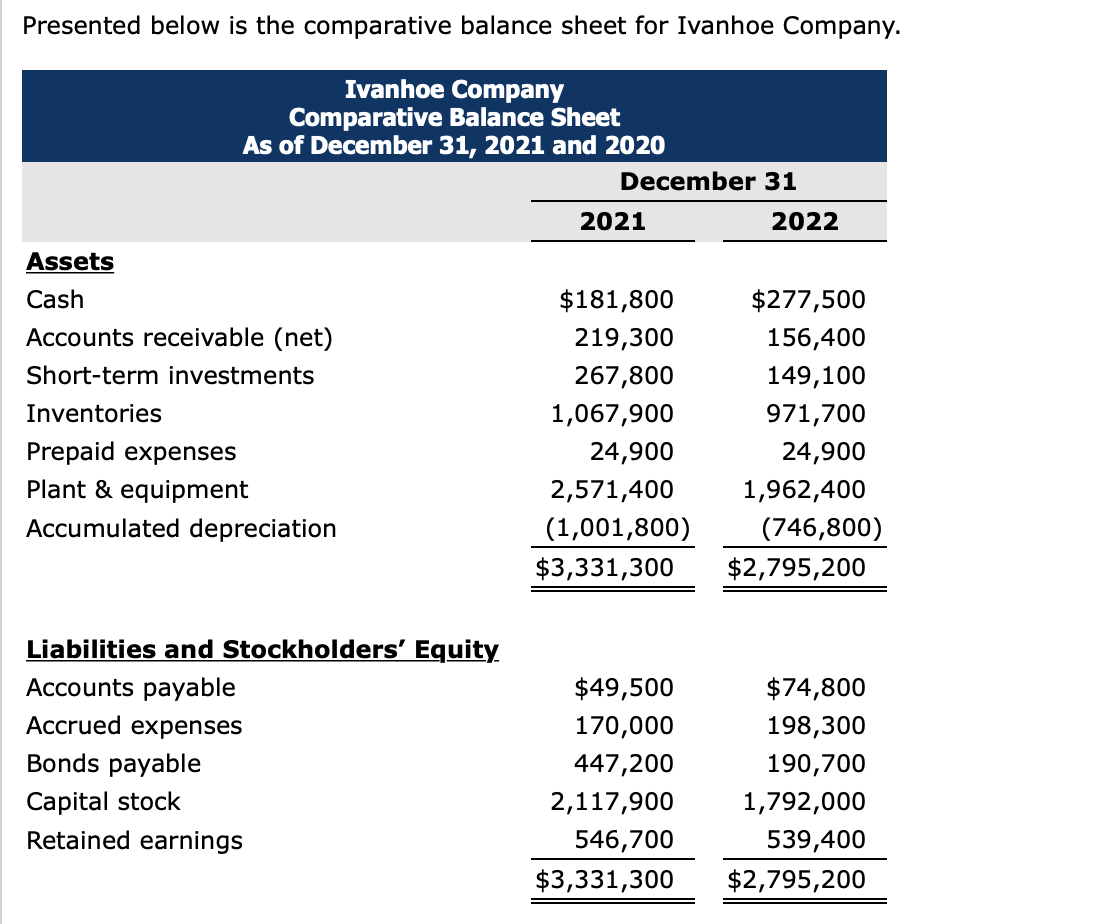

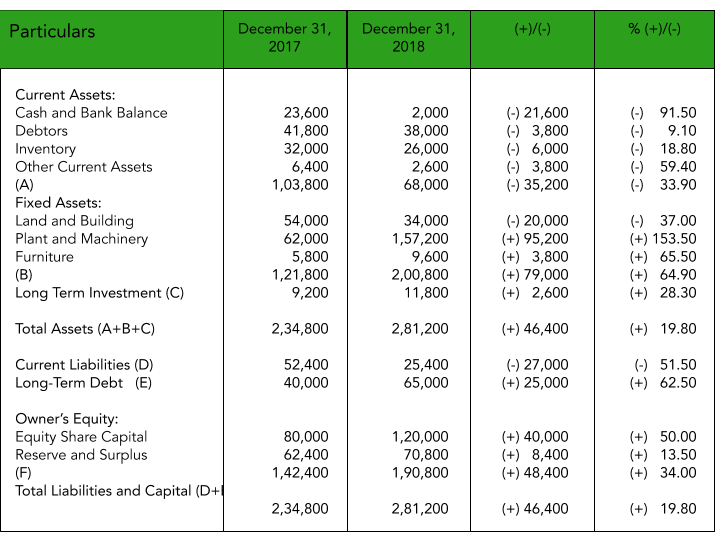

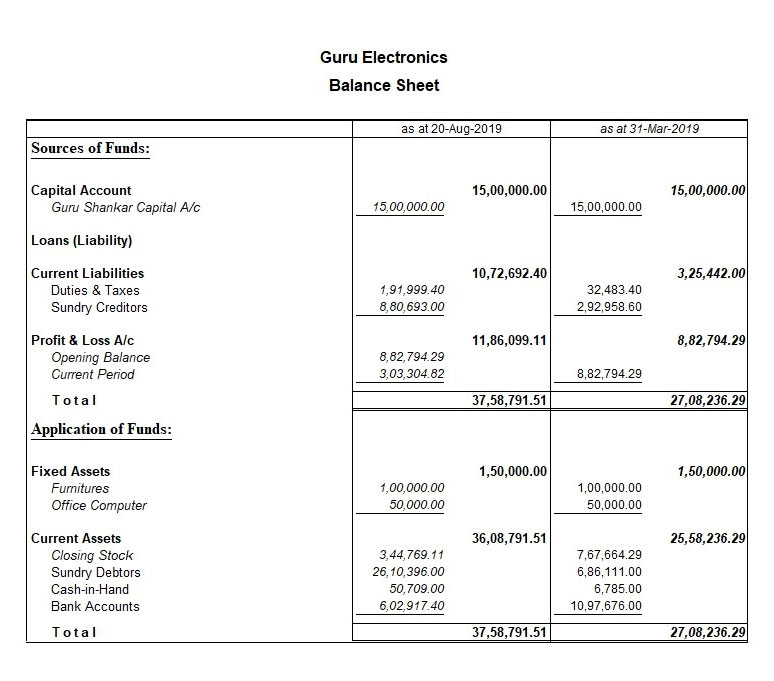

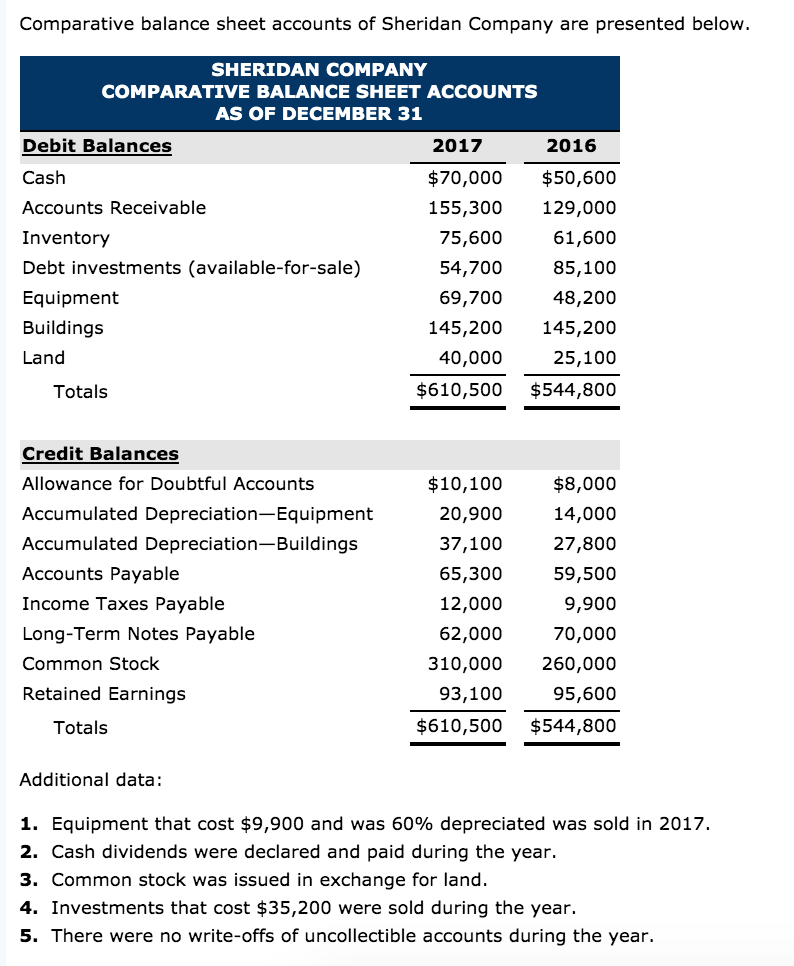

Comparative balance sheet of any company. A comparative balance sheet generally contains two columns of numbers that appear just to the right in. The balance sheet is based on the fundamental equation: Comparative financial statements, as the word suggests, are the statements that show the financial numbers of more than one year (consecutive periods) of an entity.

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Balance sheets provide the basis for. A comparative balance sheet is a statement showing the financial position of an entity for “two or more periods of the same company” or “two or more companies of the same industry” to compare the change, analyze the situation, and take appropriate action.

It can also be referred to as a statement of net worth or a statement of financial position. The financial position is compared with 2 or more periods to depict the trend, direction of change, analyze and take suitable actions. The balance sheet is a reflection of the assets owned and the liabilities owed by a company at a certain point in time.

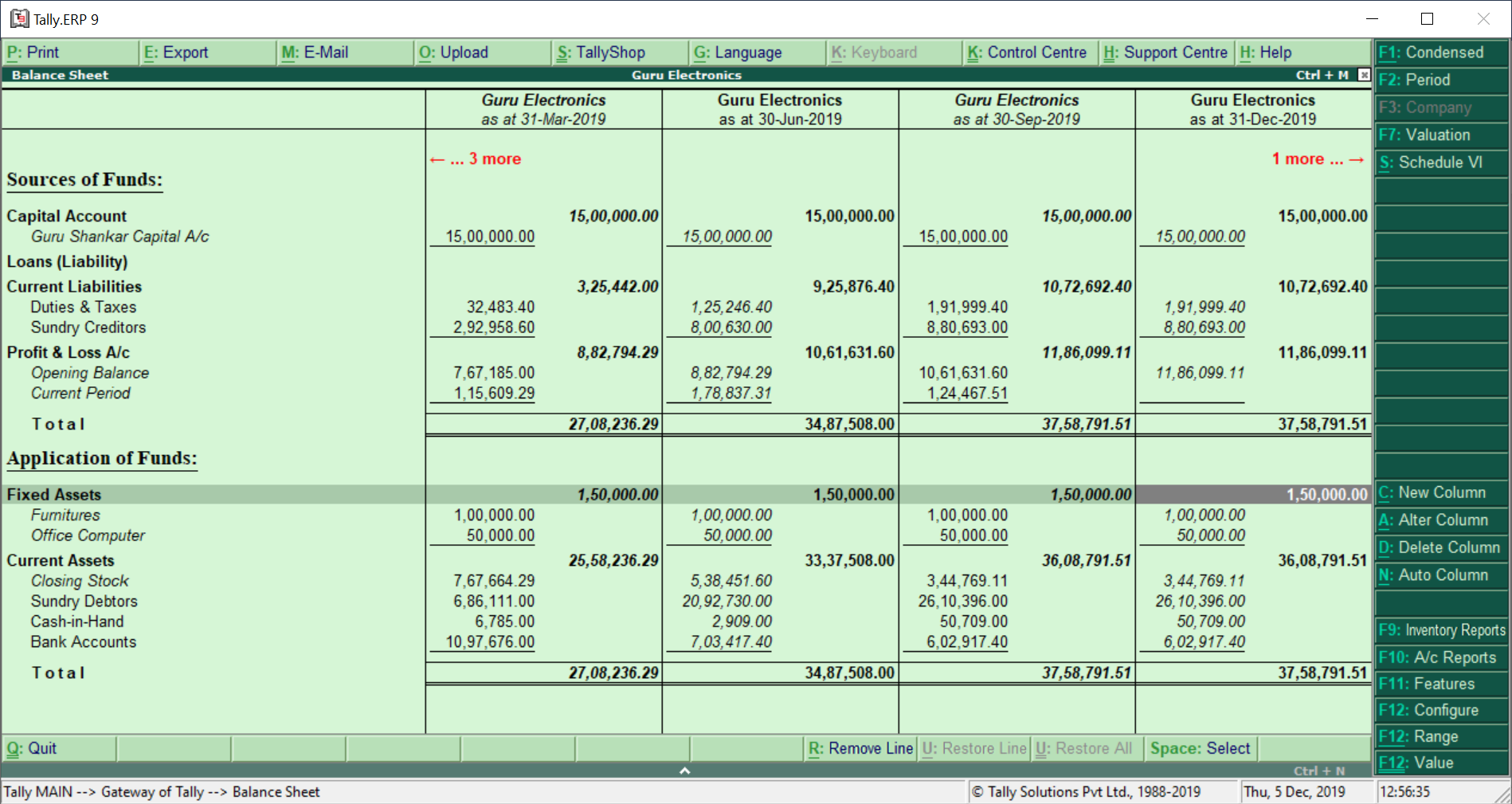

Moreover, such a type of presentation allows the reader to compare the financial performance of the company with previous years. A comparative balance sheet is a statement that shows the financial position of an organization over different periods for which comparison is made or required. A comparative balance sheet typically has two columns of amounts that appear to the right of the account titles or other descriptions such as cash and cash equivalents, accounts receivable, accounts payable, etc.

A comparative balance sheet analysis is a method of analyzing a company's balance sheet over time to identify changes and trends. By kate christobek. What is a comparative balance sheet.

Debt equity ratio 0.04 chg. A market snapshot appears at the top of the page showing u.s., european, and asian market. For example, a comparative balance sheet could present the balance sheet as of the end of each year for the past three years.

What are comparative balance sheets? The comparative balance sheet is a balance sheet that provides financial figures of assets, liabilities, and equities for “two or more periods of the same company,” or “two or more subsidiaries of the same company” or “two or more companies of the same industry” in the same format so that it can be easily understood and analyzed. Changes (increase or decrease) in such assets and liabilities.

Recall that horizontal analysis calculates changes in comparative statement items or totals. Trump was penalized $355 million, plus millions more in interest, and banned for three years from serving in any top roles at a new. Assets and liabilities of business for the previous year as well as the current year;

Comparative balance sheet. The first column of amounts contains the amounts as of a recent moment or point in time, say december 31, 2022. Get tata motors latest balance sheet, financial statements and tata motors detailed profit and loss accounts.

What is comparative balance sheet? They report the business's assets, liabilities and. Presents the key ratios, its comparison with the sector peers and 5 years of balance sheet.