Best Info About Types Of Operating Expenses On Income Statement

As a business owner, you merely need.

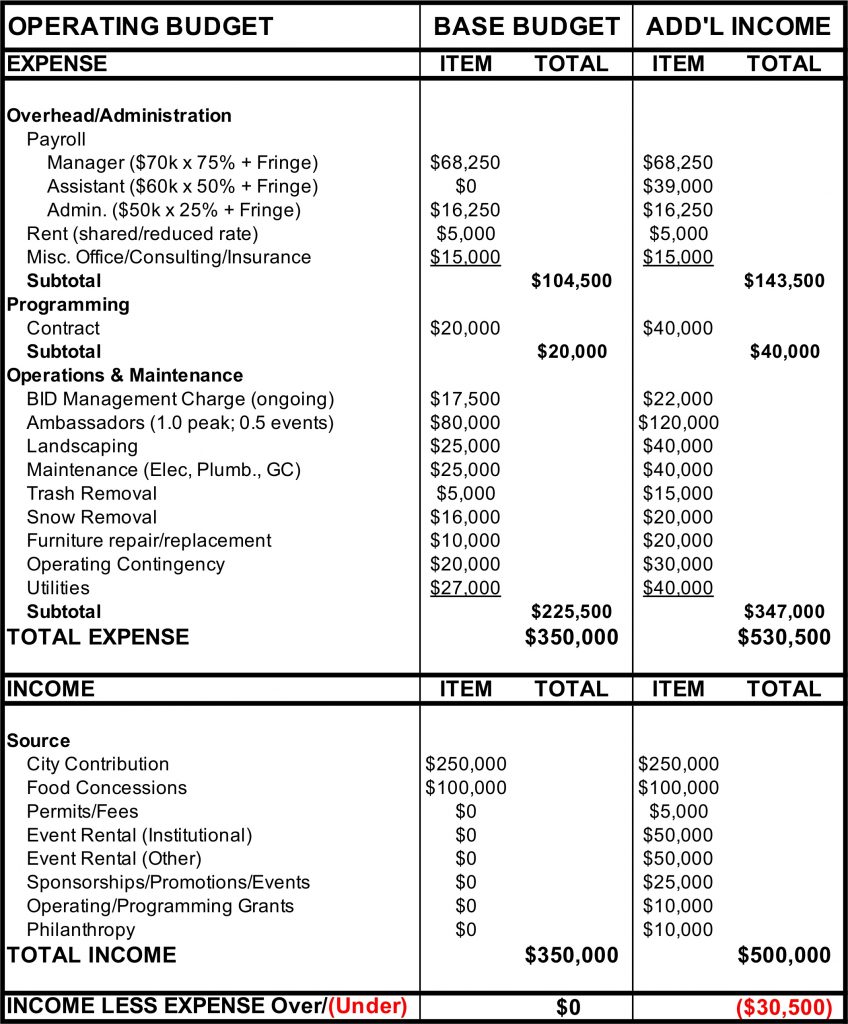

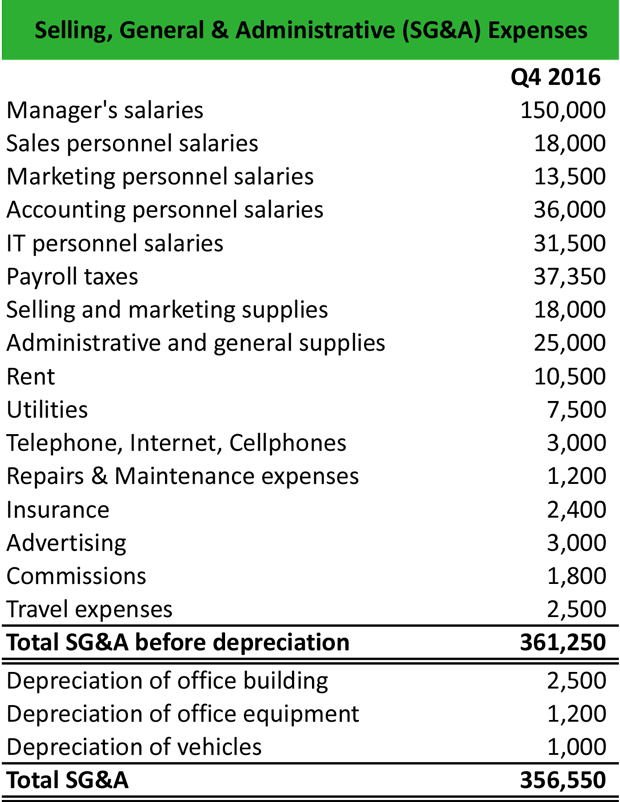

Types of operating expenses on income statement. Payroll for staff (excluding labor for manufacturing). The most common way to categorize them is into operating vs. These costs are outlined on.

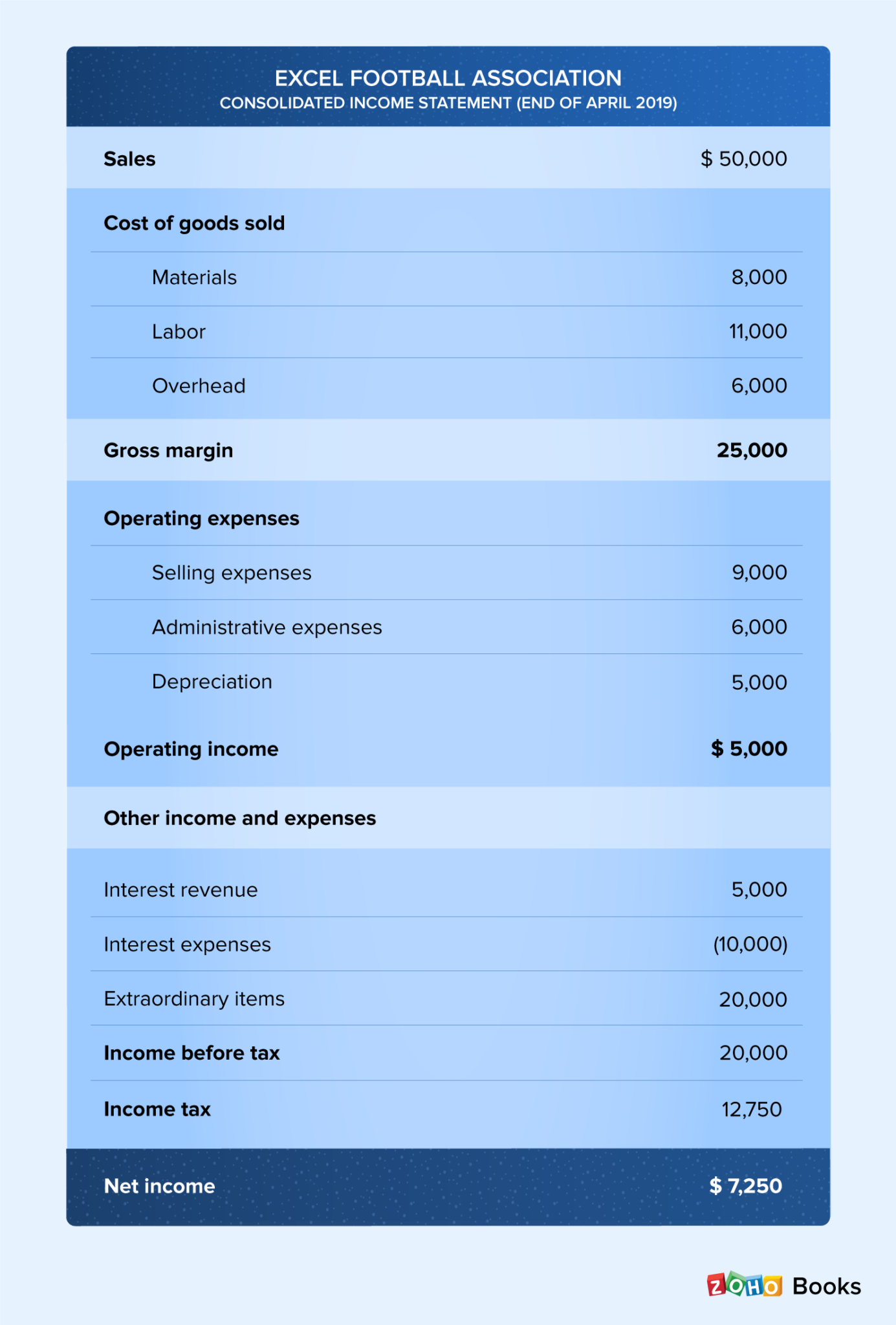

There are three formulas to calculate income from operations: The income statement focuses on four key items: Cost of goods sold selling and distribution expenses operating, general and administrative expenses salaries, wages, and.

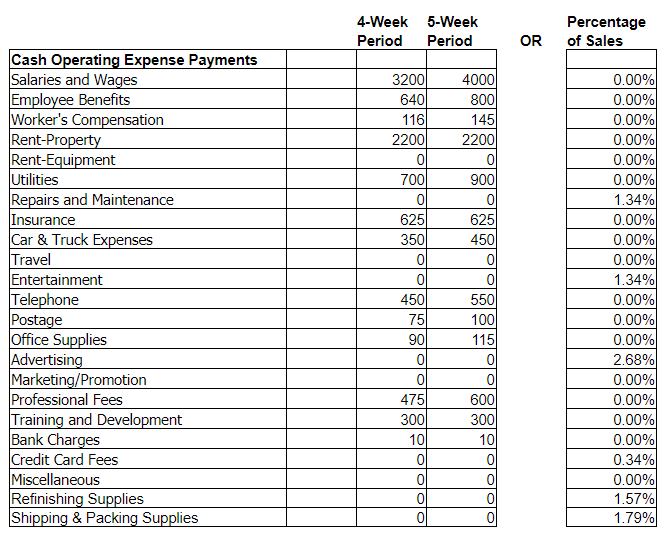

Fixed operating expenses are costs that do not change. Operating expenses definition. Fixed and variable operating expenses.

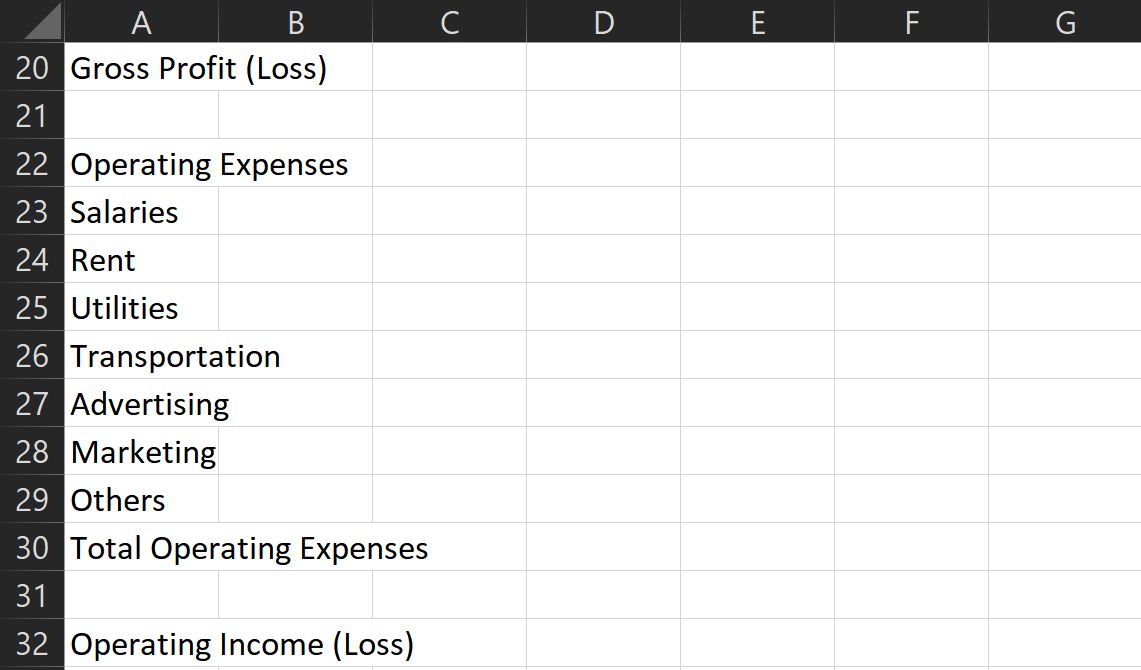

There are many types of operating expenses, and most fall under selling, general, and administrative expense (sga). You can locate operating expenses on the income statement or profit & loss (p&l) statement under the operating expenses section. Following are the main types of expenses:

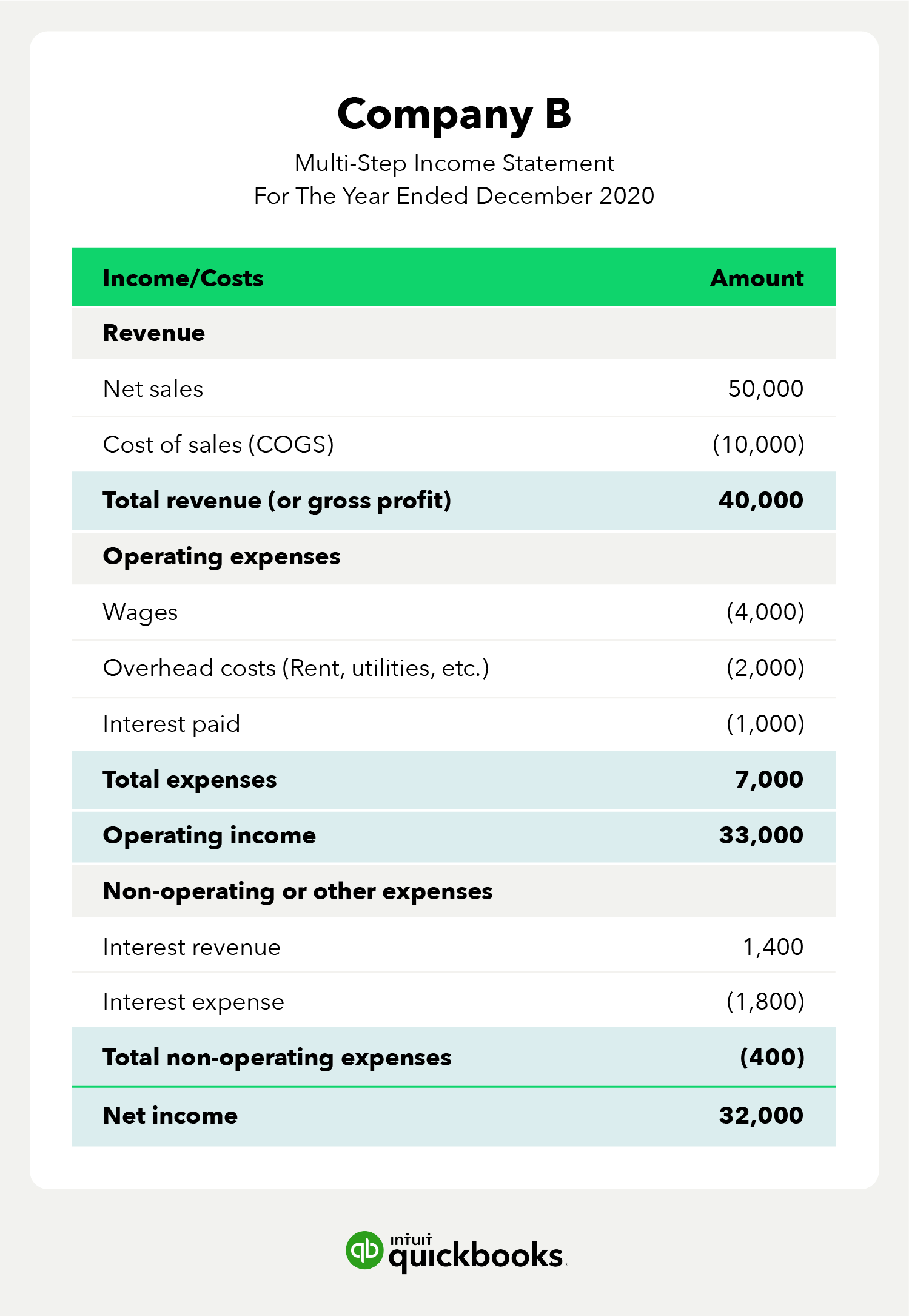

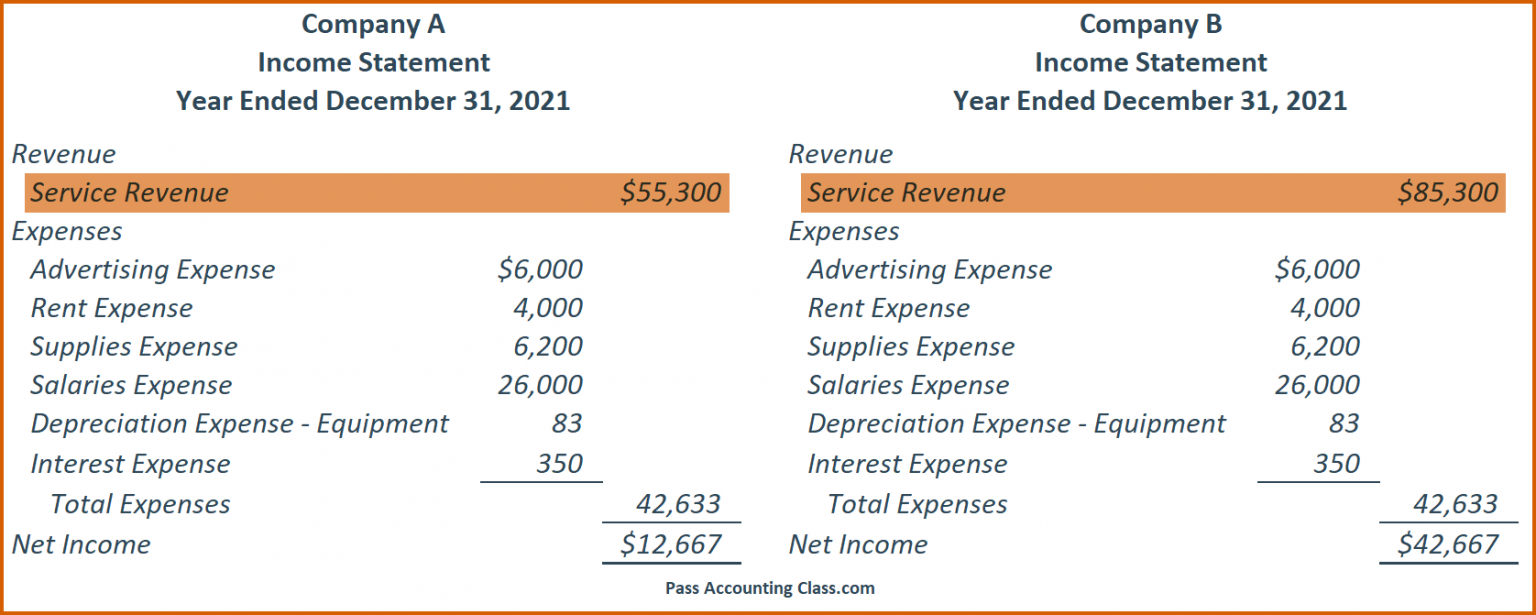

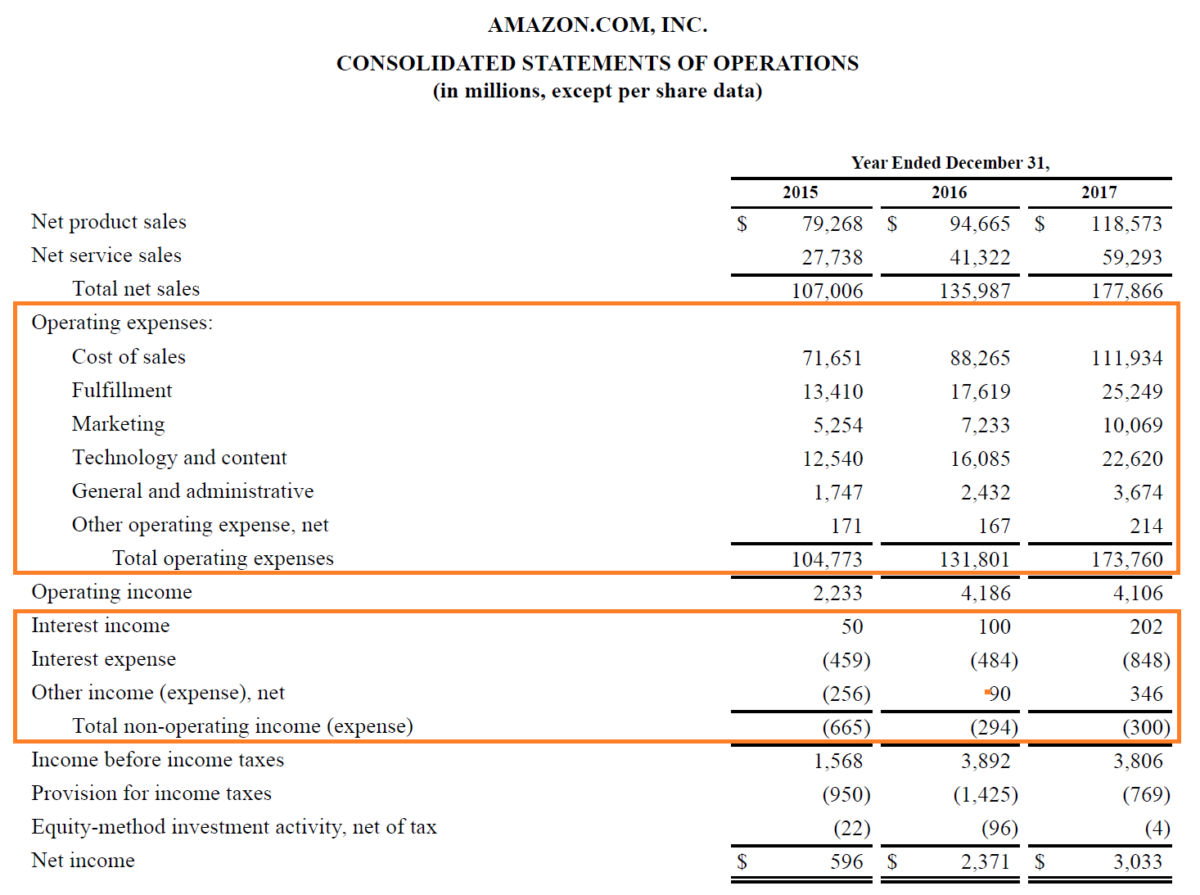

The income statement measures a company’s profitability by looking at its income and operating expenses list over time. Operating expenses are reflected on a company’s income statement. Expenses are typically categorized into six.

To find your company’s operating expenses, review your general ledger , and look for expenses. While the expenses differ for every business type, you can find operating expenses in your business’ income statement. Every company has different operating expenses based on their industry and setup.

As the diagram above illustrates, there are several types of expenses. Operating expenses are summarized on a company’s income statement. Operating expenses are the operating costs that occurred by an entity as the result of its daily operating activities and are recording the income statement based on.

Revenue, expenses, gains, and losses. There are two common categories of expenses that businesses have to pay:. Formula for operating income.

Operating expenses can be broadly categorized into two types: Examples of operating expenses include:.

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)