Ideal Info About Formula For Net Operating Income

Before you even think about investing in real estate, you must understand cap rate‼️ capital.

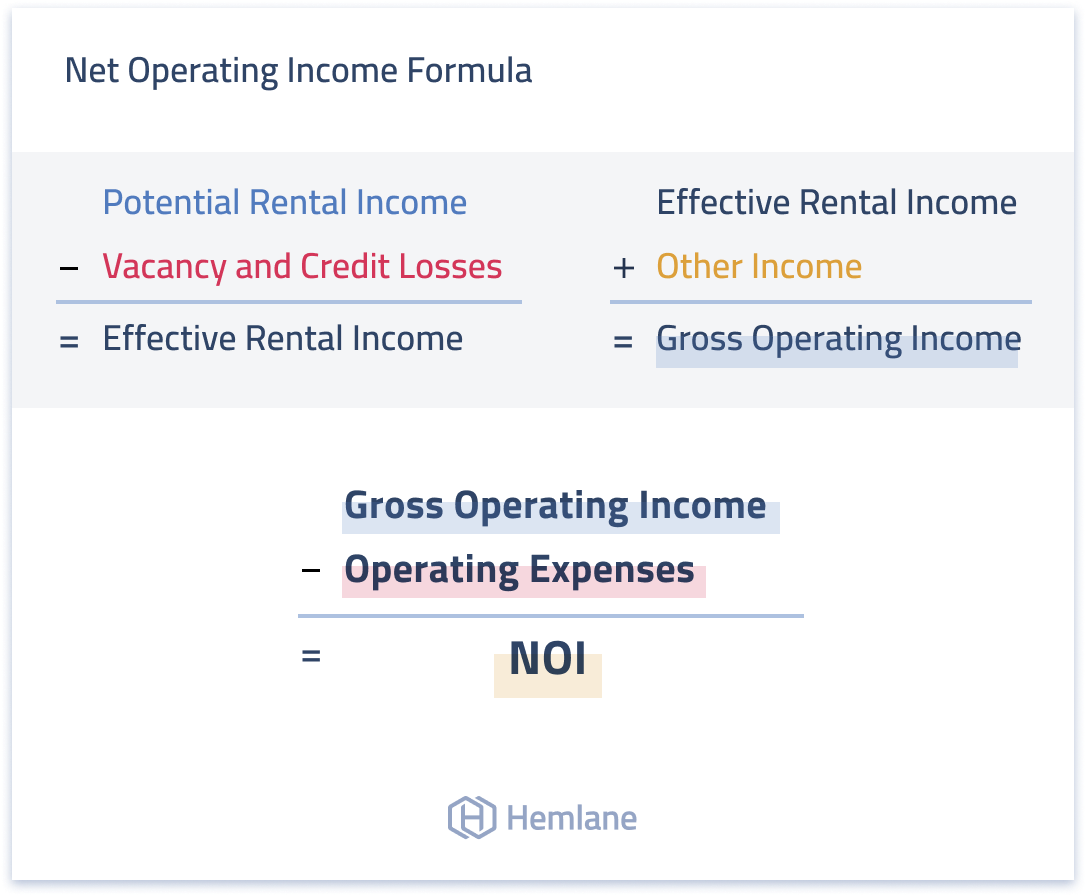

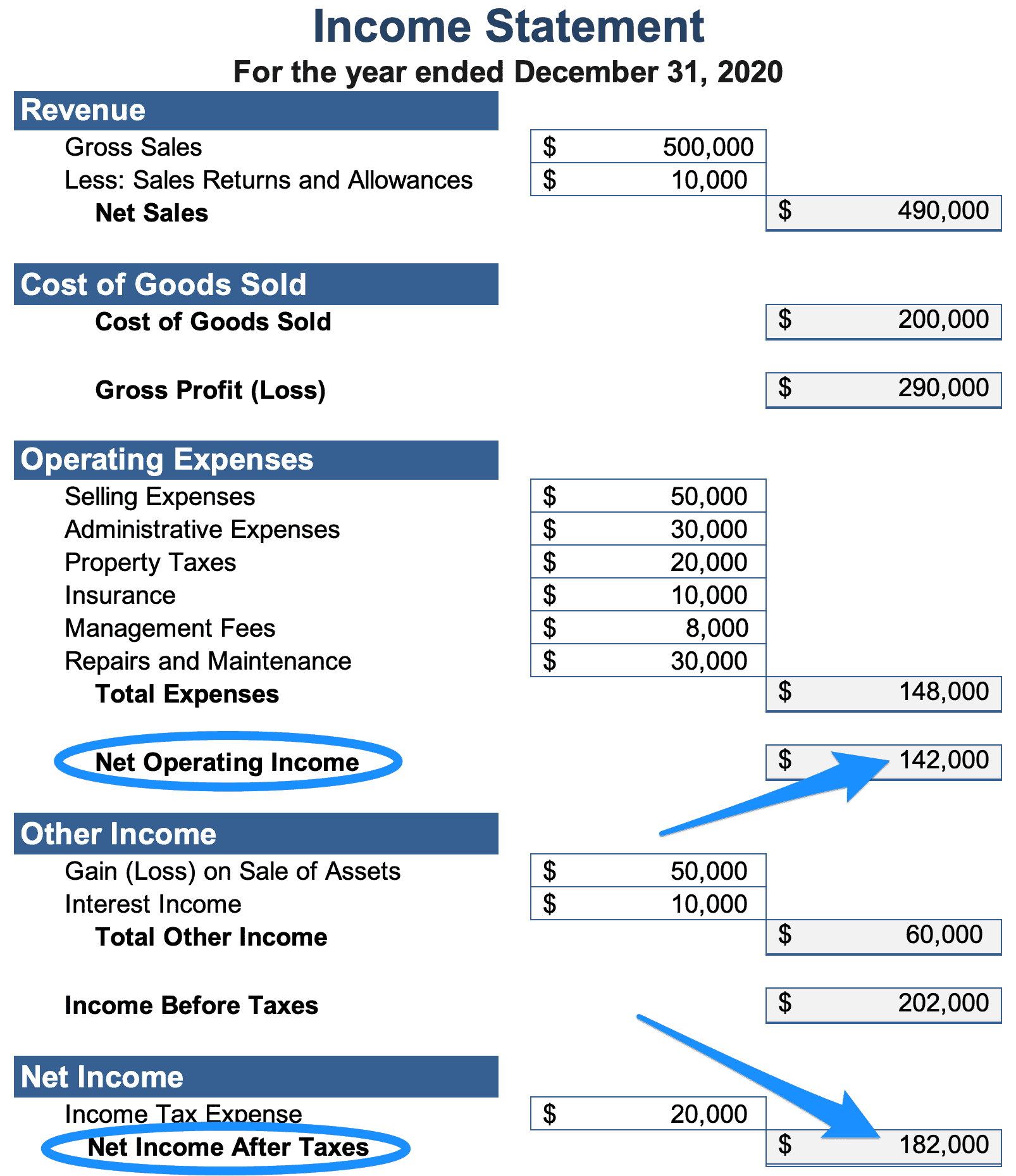

Formula for net operating income. The net operating income (noi) formula is the sum of the property’s rental income and ancillary income, subtracted by its direct operating expenses. Income from operations of $652 million; The net operating income from the office building is:

So, operating revenue = (rental rate per sq. X building spaces) + vending machine + parking fees. Gross profit represents the income or profit remaining after production costs have been subtracted from revenue.

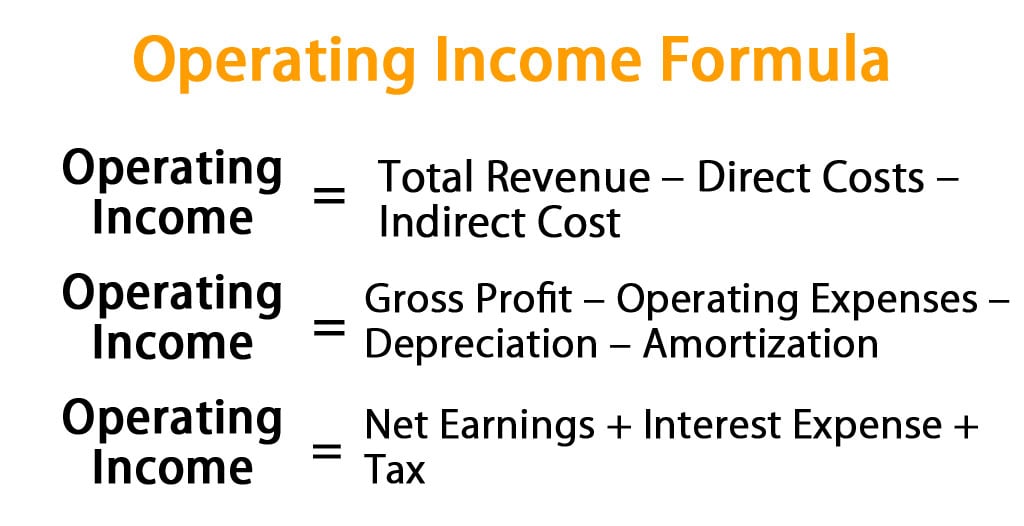

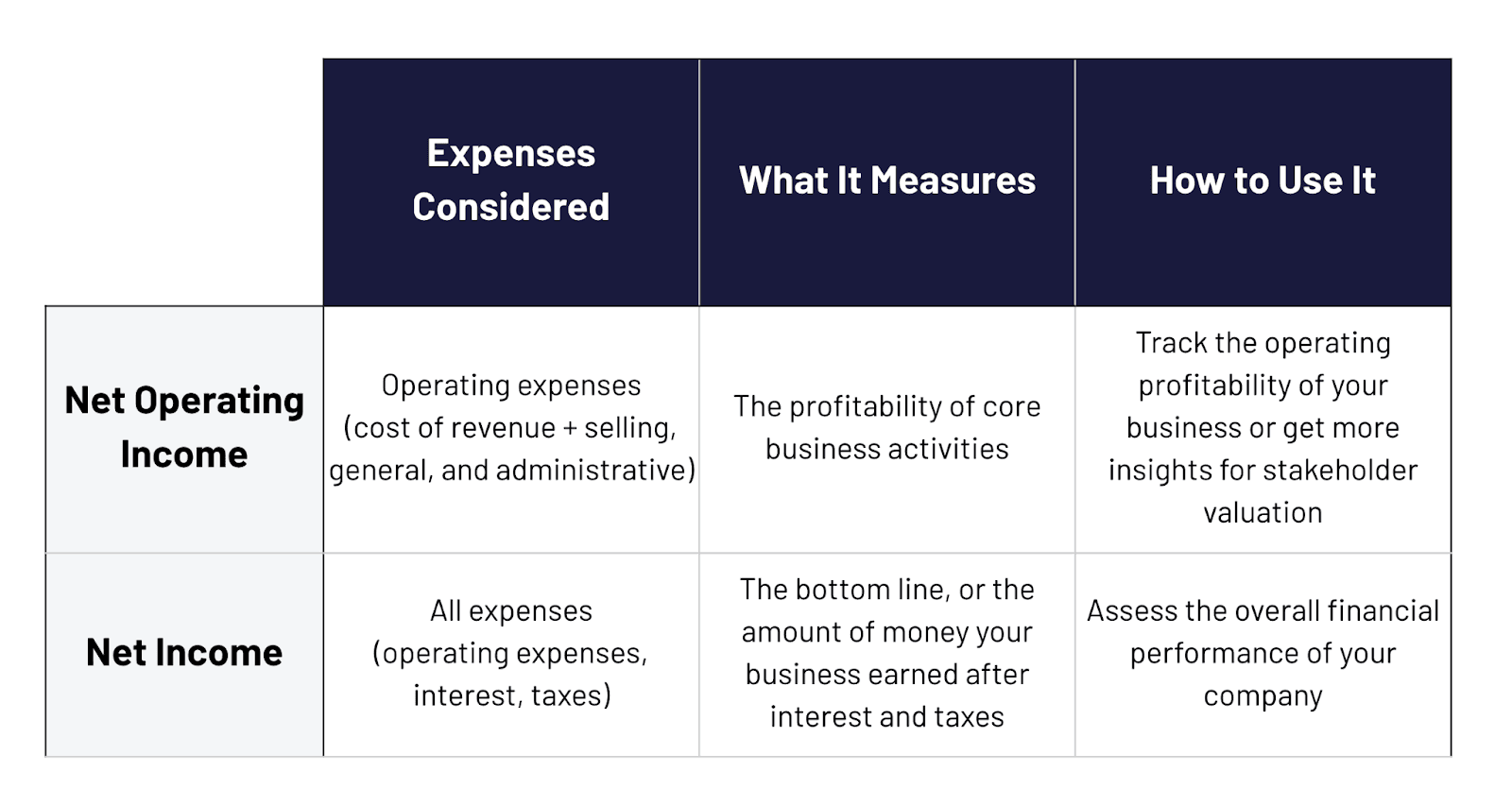

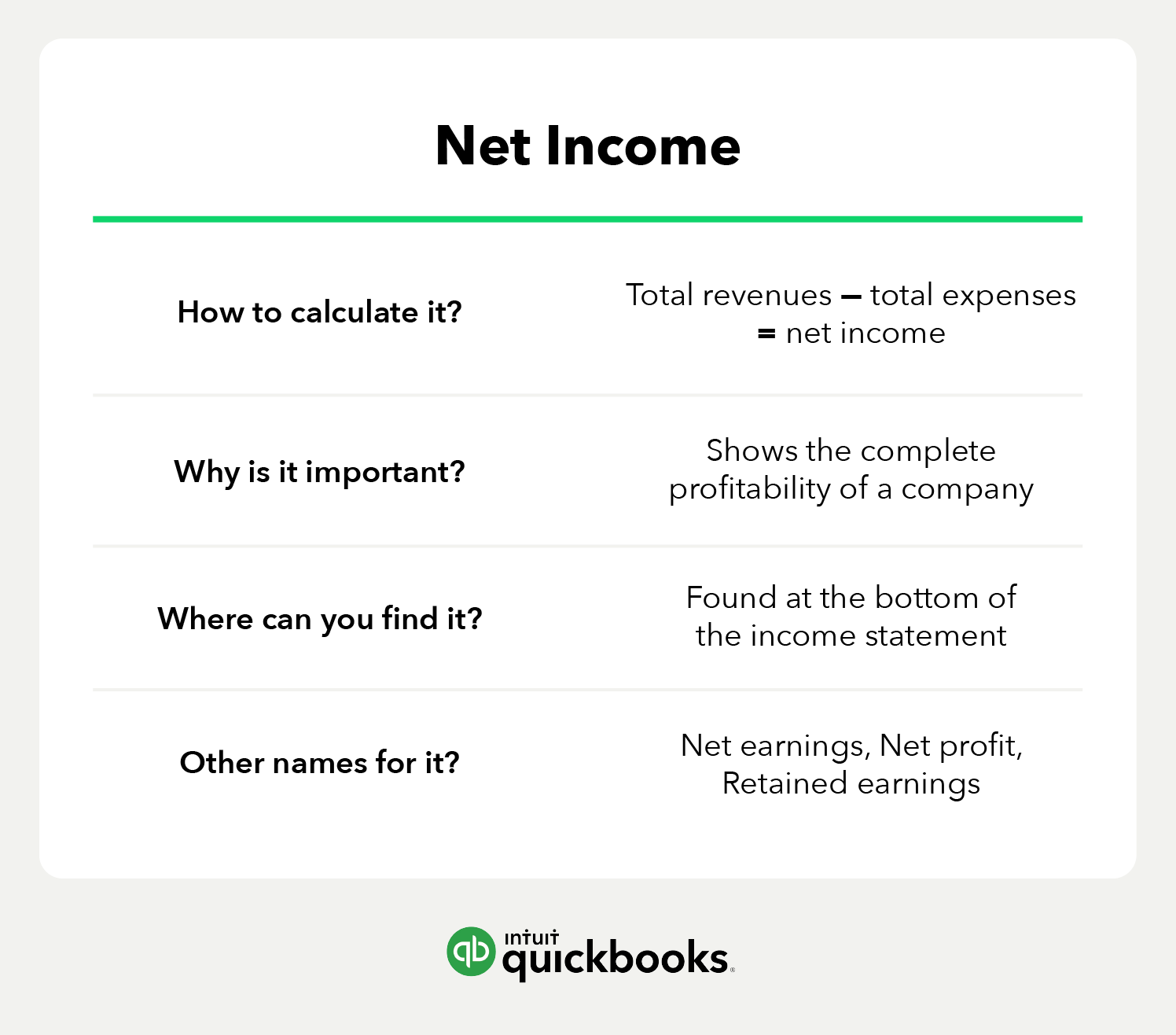

The net operating income formula is shown below: These items directly relate to daily decisions that managers. The other two formulas you can use to calculate operating income expand the above formula and use more values from the company.

Operating income is important because it is an indirect measure of efficiency. Noi is calculated by taking the total revenue of a property and subtracting all reasonably necessary operating expenses. Formula for operating income there are three formulas to calculate income from operations:

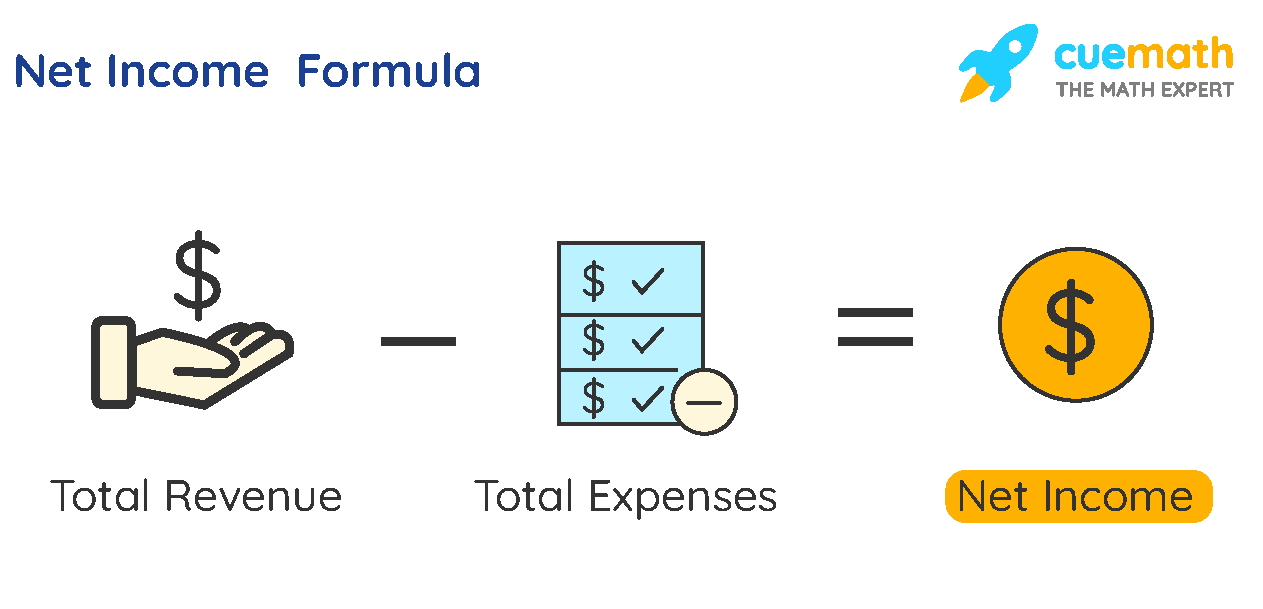

Imagine our company owes $80,000 to suppliers and has other payables of $20,000. Noi determines the revenue and profitability of real estate property after subtracting necessary operating expenses. Operating income tells investors and company owners how much revenue will eventually become profit for a company.

Buyorsellcallhertell on october 20, 2023: Define noi in simple terms. Here are the most common examples of revenue sources:

Net operating income, or noi for short, is a formula people use to quickly calculate the profitability of a particular real estate investment. Calculate gross operating income first, you can calculate all the income a piece of real estate generates. Record adjusted ebitda margin fourth.

Operating revenue = rental income + vending machine + parking fees. Revenue rose 24% to $2.1 billion during the period, beating the $2.08 billion average estimate of analysts surveyed by bloomberg. This is despite having a.

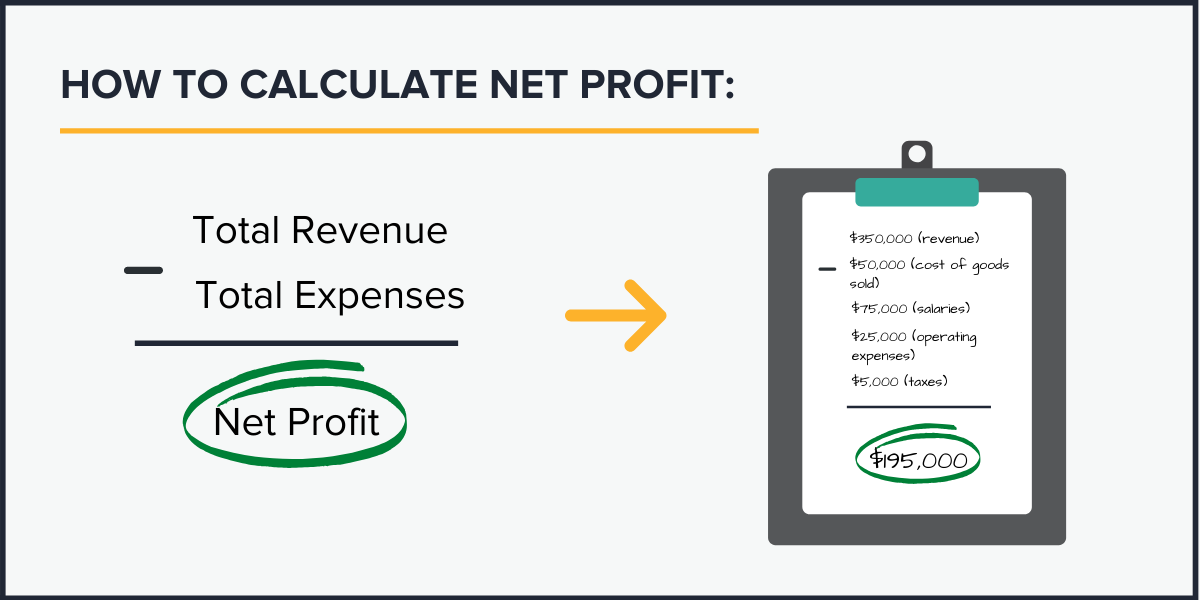

Profit =sales−variable expenses−fixed expenses profit = sales − variable expenses − fixed expenses net operating income is defined as sales less all ordinary expenses of a business, before interest and taxes. After accounting for debt and tax provision, your bottom line is a net loss of $25,000 for the quarter. The net operating income of the bank of england reached a record high in 2023.

As i mentioned earlier, revenues include more than just rental income. Or, put another way, you can calculate operating net income as: Operating margin (%) = $119,437 million ÷ $394,328 million = 30.3%;

:max_bytes(150000):strip_icc()/NetProfitMargin2-edf5ae45cbe048208913caa9d3b03110.png)

:max_bytes(150000):strip_icc()/Term-Definitions_noi-4eae808a643c4ca9b130f12fed343370.jpg)