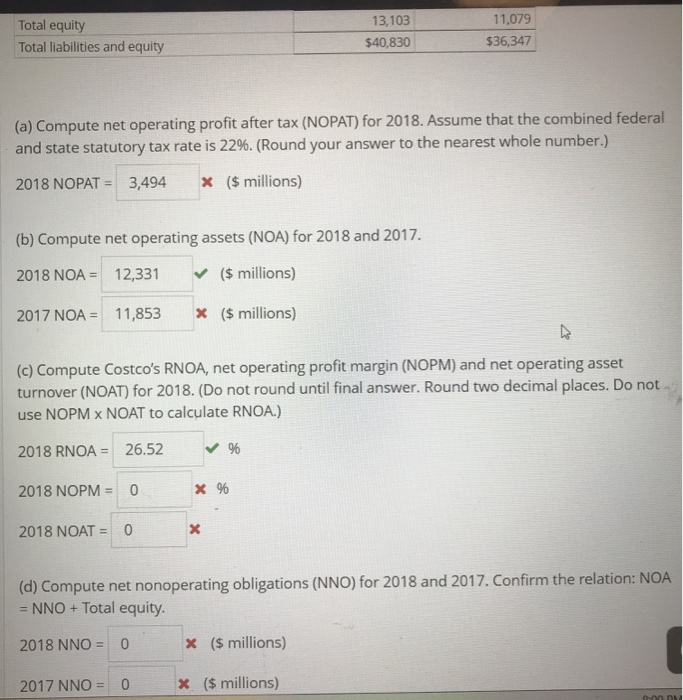

Simple Info About Total Equity And Liabilities

Shareholder’s equity represents 67.6% of their assets while liabilities represent 32.4% of their assets.

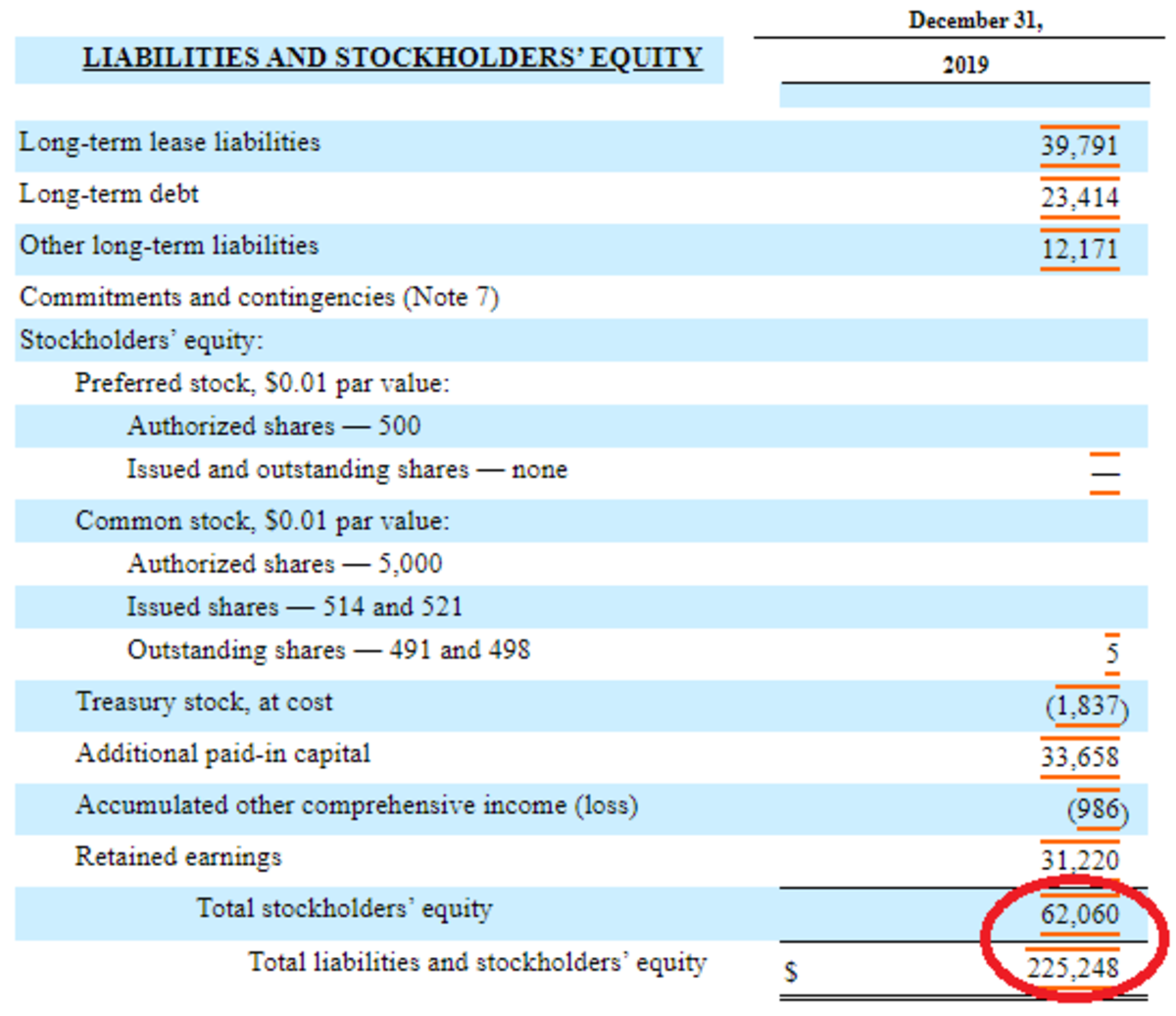

Total equity and liabilities. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Some common asset types include:

Investing experts view the balance sheet as a snapshot of a company's health at a certain point in time. The calculation of equity is a company's total assets minus its total liabilities, and it's used in several key financial ratios such as roe. Current liabilities, meaning amounts due in a year or less, are listed first.

It's a summary of how much a. Any payments that your clients and customers owe. The balance sheet shows current and total.

Here total assets refer to assets present at. The equity formula states that the total value of the company’s equity is equal to the sum of the total assets minus the total liabilities. The accounting equation states that a company's total assets are equal to the sum of its liabilities and its shareholders' equity.

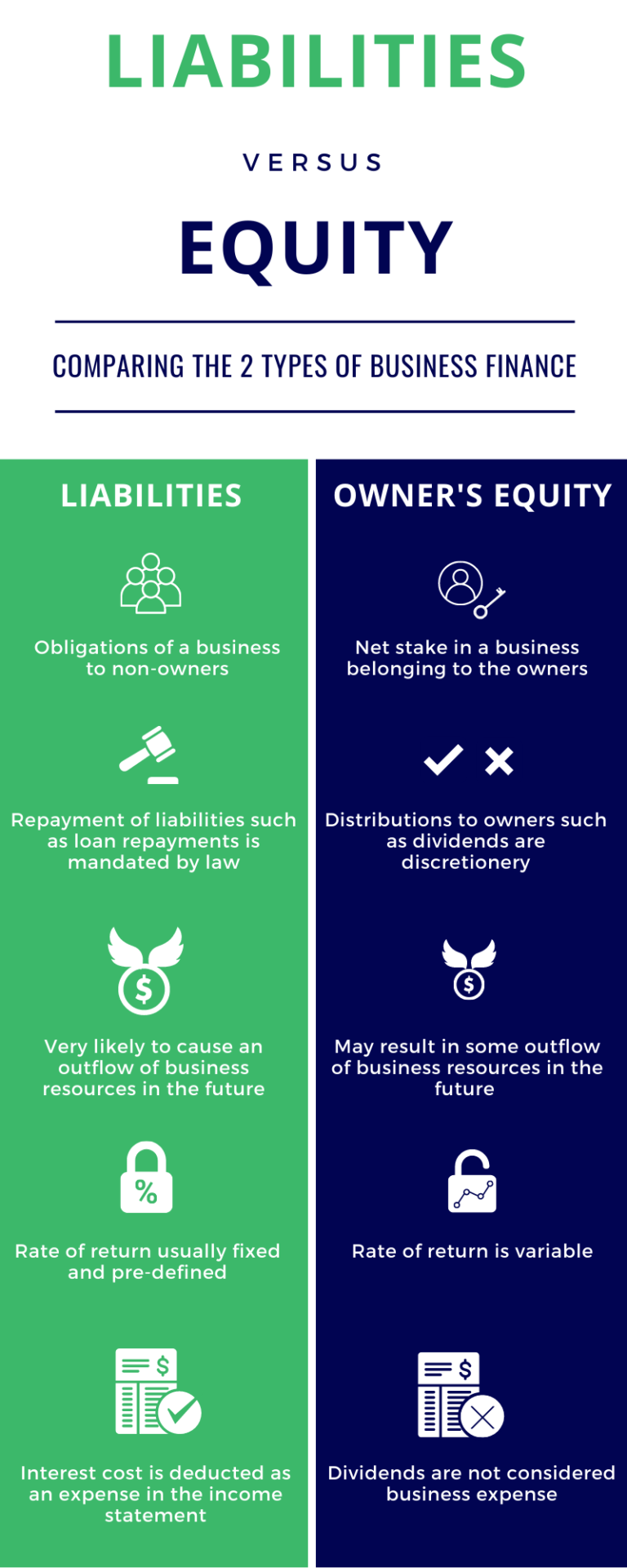

Learn the difference between liabilities and equity, two key accounting concepts that affect the financial health of a business. The balance sheet is based on the fundamental equation: The balance between assets, liability , and equity.

Shareholder equity is the value left to investors after all liabilities are covered and represents the business's intrinsic value. Liabilities on a balance sheet refers to money owed to creditors. This is one sign of a generally healthy business.

How much do i have? if it has value, and you own it, it’s an asset. For the balance sheet to balance, total assets should equal the total of liabilities and shareholders' equity. Assets = liabilities + equity.

They are recorded on the balance sheet as a. What is a balance sheet? By subtracting the total liabilities from the total assets, you arrive at the total equity, which represents the residual value after deducting debts from assets.

This is a list of what the company owes. It can also be referred to as a statement of net worth or a statement of financial position. Liabilities are the financial obligations of a.

Business ratios guidebook the interpretation of financial statements example of total equity the balance sheet of abc international contains total assets of. Equity is the residual value left for its owners after paying all.

![[Solved] Required a. For the balance sheet, identify how](https://media.cheggcdn.com/media/1fa/1fa88419-d3af-4dc0-ae82-cc7695ce9b66/phpfl6iz4)

:max_bytes(150000):strip_icc()/latex_ee299ef83f267e92b7d1a82e14f82c14-5c73ffaf46e0fb0001f87d26.jpg)