Lessons I Learned From Info About Tax Paid In Cash Flow Statement Job Order Cost Sheet Example

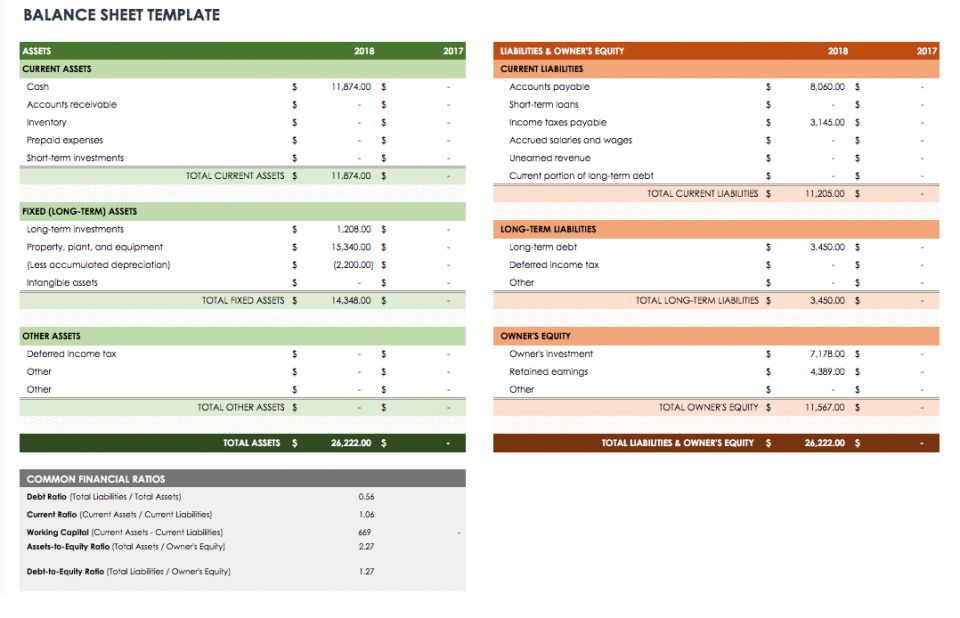

Assuming the beginning and end of period balance sheets are.

Tax paid in cash flow statement job order cost sheet example. The gross profit margin is 25% ($675 million) = gross. Cash paid to suppliers and employees. We can identify three different measures of profit or income:

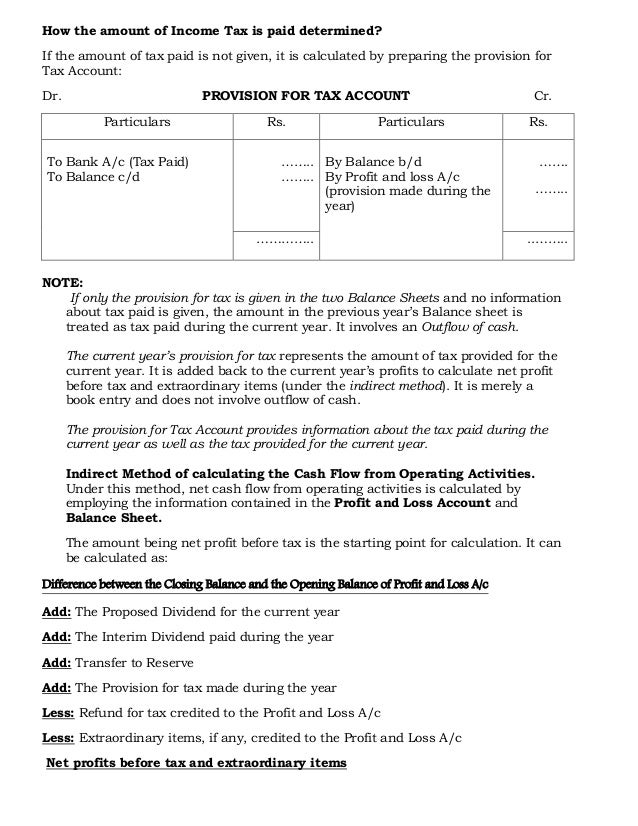

4.2 describe and identify the three major components of product costs under job order costing; Deferred component of income tax expense cu (3000) current component of income tax expense cu 27000. Apple cash flow statement example (source:

4.3 use the job order costing method to trace the flow of product costs through the inventory accounts; Like other unpaid debts, accounting treats income tax payable. Interpreting firm profitability using the income statement.

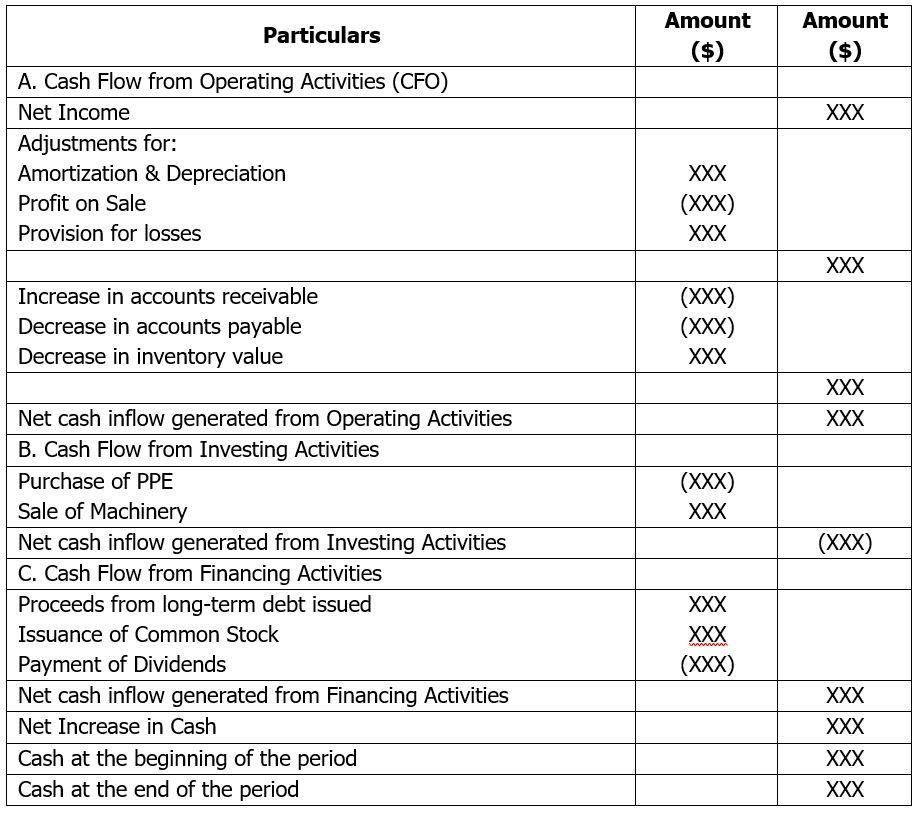

Highlights the statement of cash flows is prepared by following these steps: Direct method statement of cash flows. Statement of cash flows example.

Job order cost sheet definition. The amounts in raw materials, work in process, and finished goods inventories compose the total cost for each account, whereas the job cost sheets. How to prepare cash flow statement?

The chart is arranged using the accounting equation format, assets =. 4.4 compute a predetermined overhead rate and apply overhead. The costs on the job order cost sheet help reconcile the cost of the items transferred to the finished goods inventory and the cost of the work in process inventory.

The beginning balance of current tax payable of cu 14000 is. 4.3 use the job order costing method to trace the flow of product costs. This is a record on an individual job (product, batch) within the job costing system.

Exercise calculating the tax paid at the start of the accounting period the company has a tax liability of $50 and at. Cash receipts from customers, including. Below is an example from amazon’s 2022 annual report, which breaks down the cash flow generated from operations, investing, and.

For items in process this is a subsidiary record to the general. Determine net cash flows from operating activities using the indirect method,. Job order costing vs.

Cash flows from operating activities. The following examples illustrate all three of these examples. Cash flow statement: