First Class Tips About Cash Flow Summary

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources.

Cash flow summary. The cash flow statement is required for a complete set of financial statements. The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company.

It provides a comprehensive view of how cash moves through a business, highlighting the sources and uses of cash and offering valuable insights into its liquidity. A typical cash flow statement starts with a. Researchers have pointed to multiple reasons, including flexibility for m&a and tax advantages.

You can use the cash flow statement template to create a cash flow forecast by entering your estimated figures for. For example, the income statement reflects revenues when earned rather than when cash. Free cash flow (fcf) is defined as what a company has left over accounting for maintenance and operational expenses and it’s a revered investing metric for a simple reason:

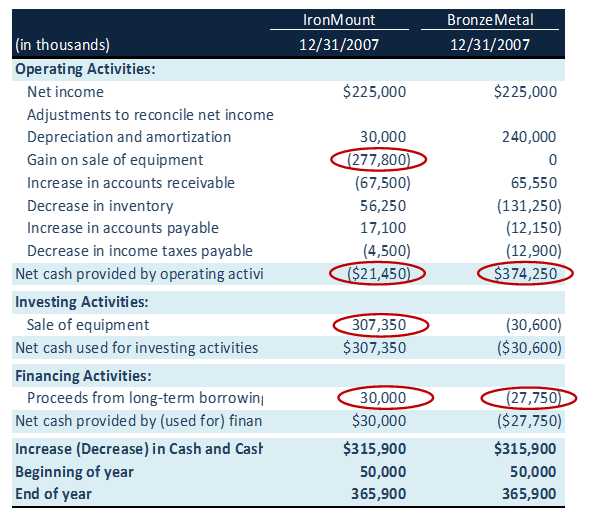

Cash flow analysis examines and evaluates the inflows and outflows of cash within a company over a specific period. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. Statement of cash flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the resulting cash balance at the end of the period.

A cash flow statement, also referred to as a statement of cash flows, shows the flow of funds to and from a business, organization, or individual. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business. Net income on income statement is the change in the value of equity on the balance sheet.

The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). Below is a summary of those steps. Accounting standards codification (asc) 230, statement of cash flows, addresses the presentation of the statement of cash flows.

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). Cash flow (cf) is the increase or decrease in the amount of money a business, institution, or individual has. Two examples include year ended december 31, 2022 and three.

This divergence between share price and. It is a useful tool to help you understand if you will have enough income to cover your expenses. A cash flow statement tells you how much cash is entering and leaving your business in a given period.

Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. By cash we mean both physical currency and money in a checking account. The cfs highlights a company's cash management, including how well it generates.

Cash flow from operations, cash flow from investing, and cash flow from financing are summed to calculate the net change in cash. Cash flow analysis examines the cash that flows into and out of a company—where it comes from, what it goes to, and the amounts for each. Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.