Casual Tips About Us Gaap Extraordinary Items

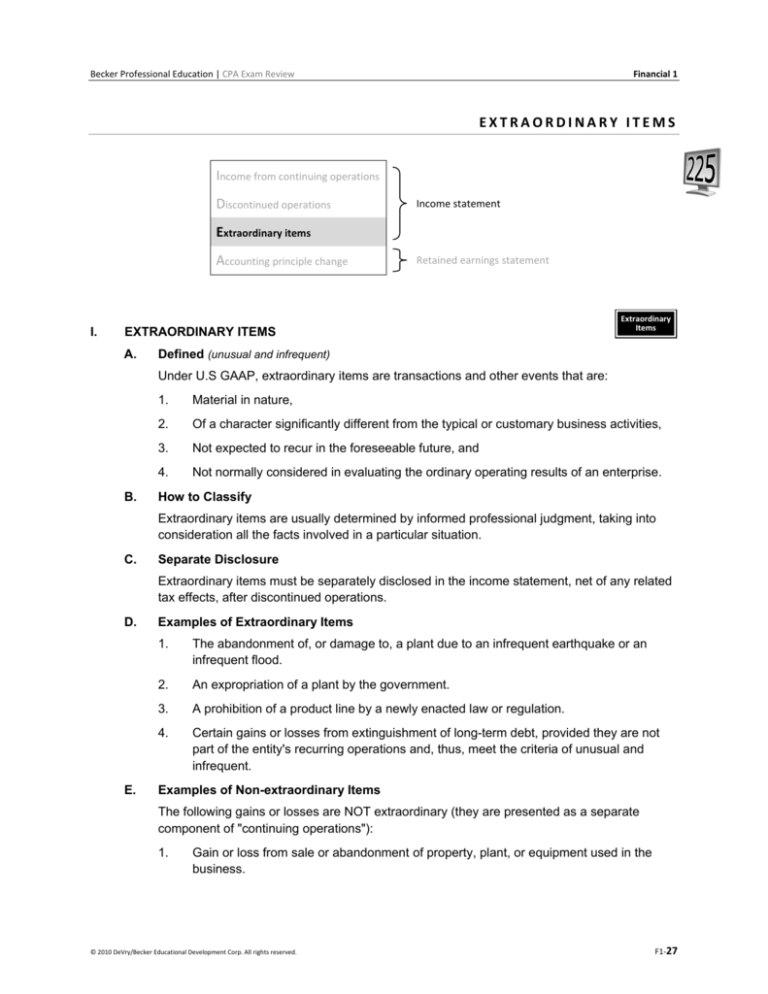

Extraordinary items are no longer a concept in us gaap as of january 2015.

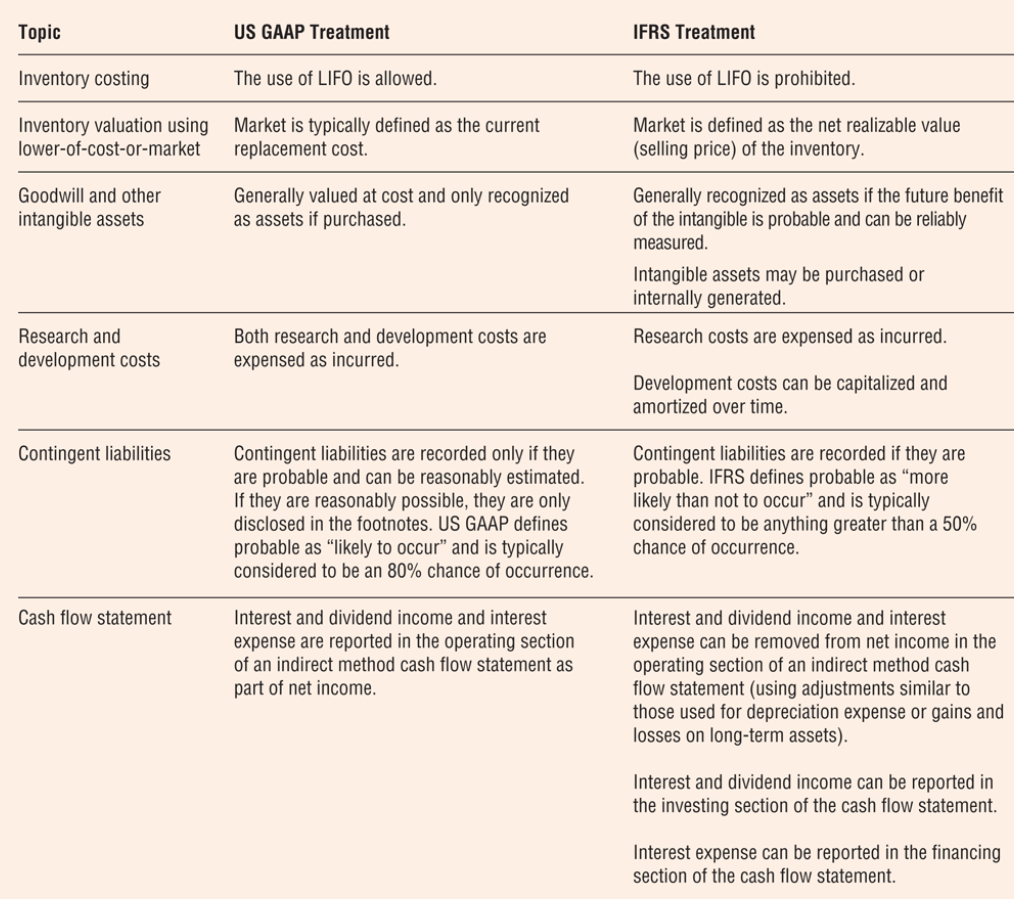

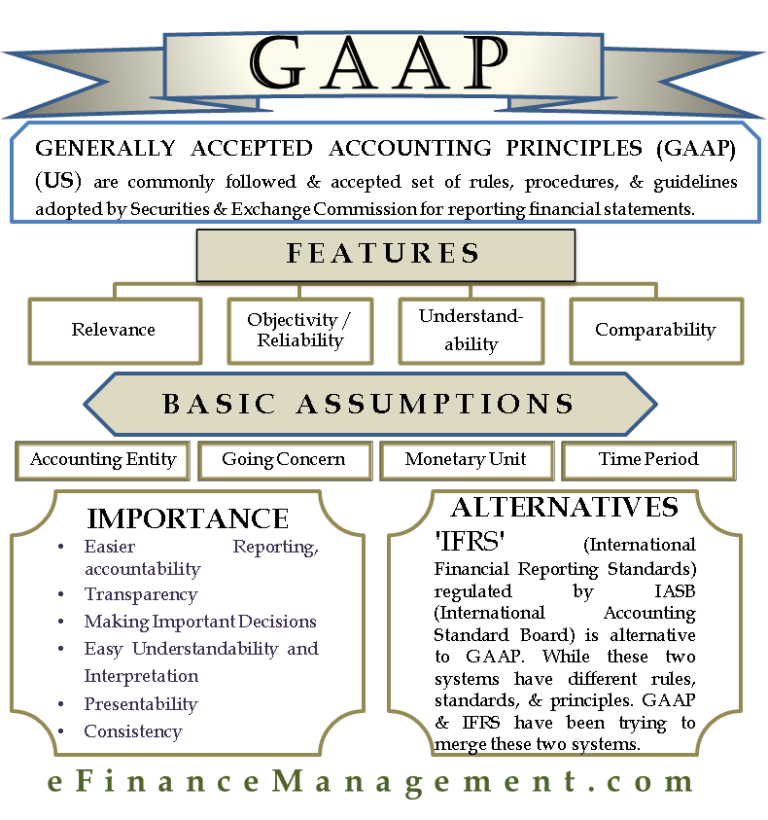

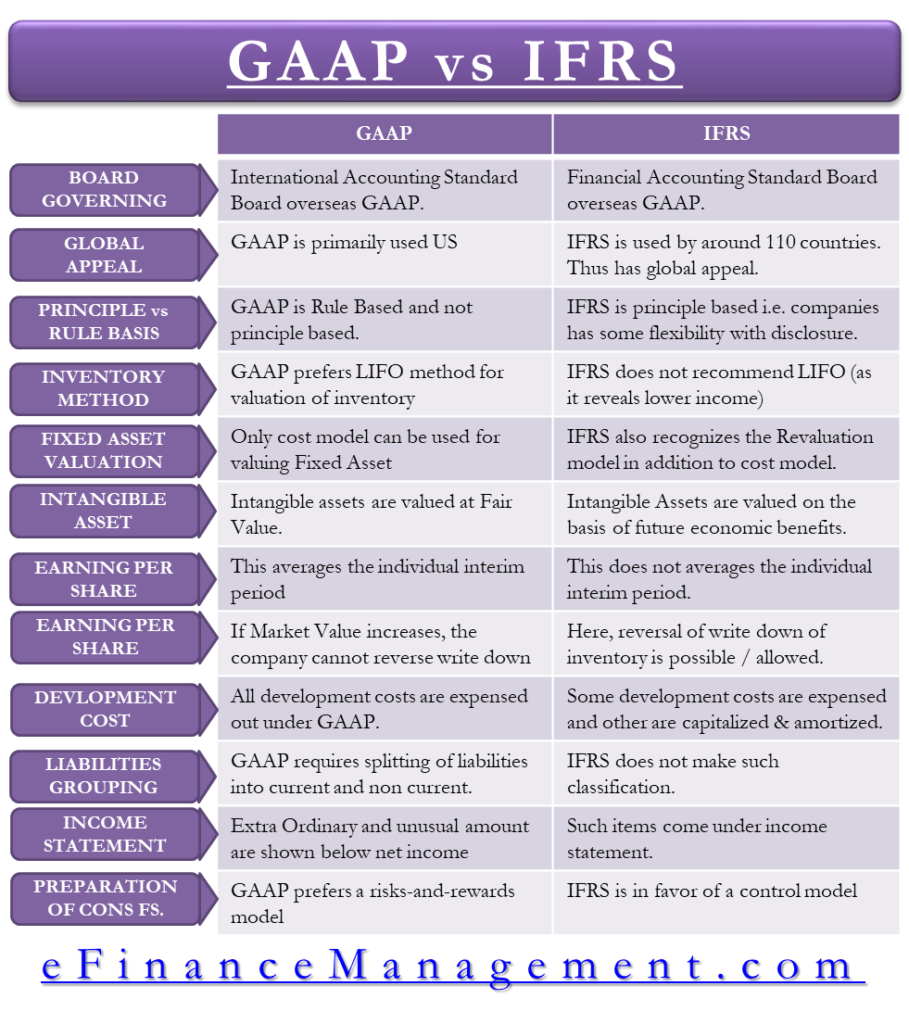

Us gaap extraordinary items. Us gaap according to ifrs, nothing is extraordinary. Extraordinary items are gains or losses in a company's financial statements that are infrequent and unusual. Ifrs does not describe events or items of income or expense as ‘unusual’ or ‘exceptional’.

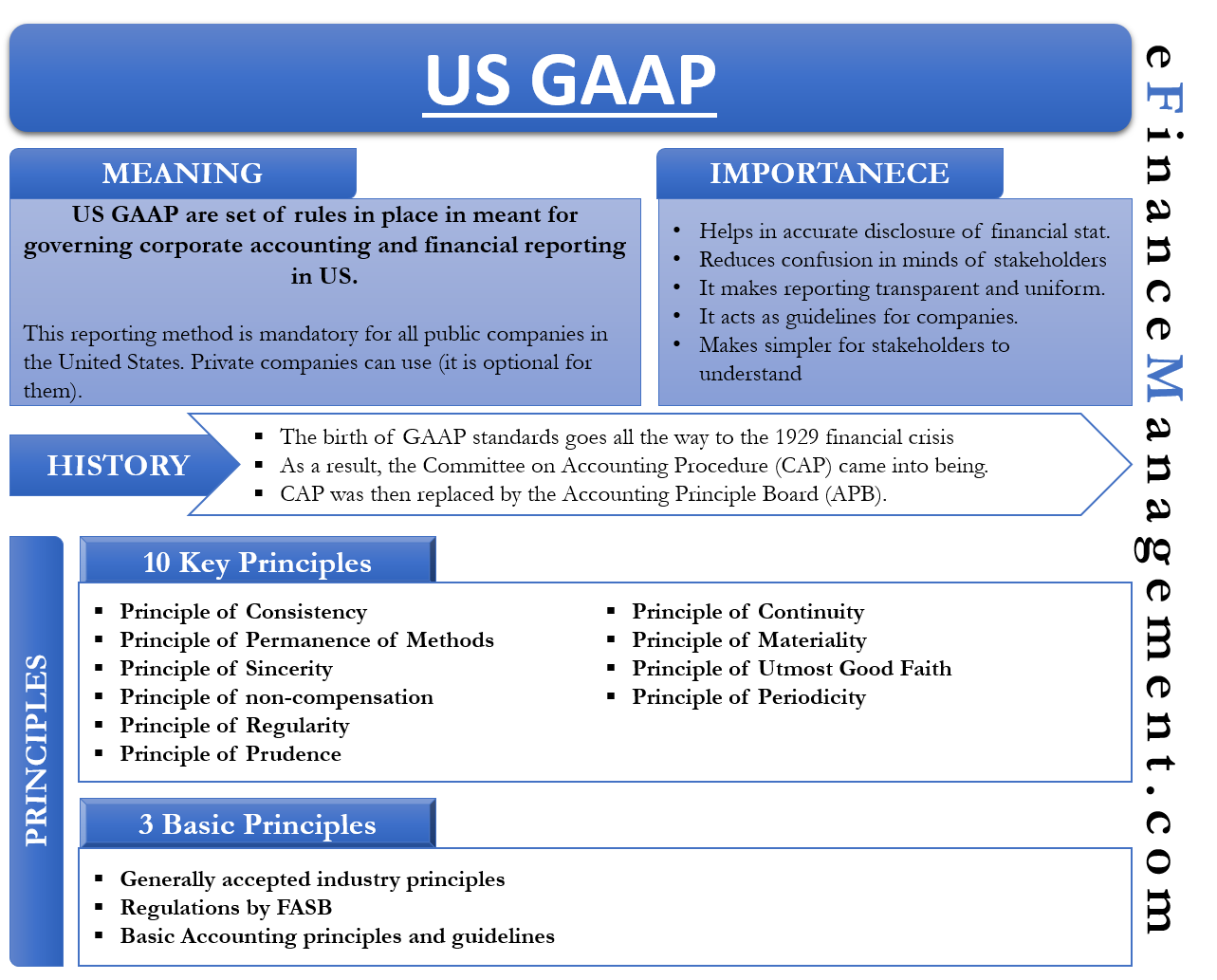

To qualify as an extraordinary item, both of the following criteria must exist: The financial accounting standards board (fasb) eliminated the category to. This update eliminates from gaap the concept of extraordinary items.

Unusual or infrequent items: An extraordinary item in accounting is an event or transaction that is considered abnormal, not related to ordinary company activities, and unlikely to recur in. Disclosure of immaterial items can obscure material information.

No items may be presented in the income statement as extraordinary items under ifrs regulations, but are permissible under us gaap. A fasb initiative designed to simplify gaap has yielded a standard that eliminates the concept of extraordinary items from gaap. An item is unusual if both of the following criteria are met:

Previously, us gaap allowed classification of certain items as ‘extraordinary items’. There used to be a classification of extraordinary items in income.

Today, gaap (generally accepted accounting principles) and ifrs (international financial reporting standards) do not recognize the formal use of extraordinary items; Extraordinary items extraordinary items 23.1€applicable authoritative pronouncements. Ifrs 9 allows a layer of a group to be designated as the hedged item.

The ifrs income statement follows sure formatting specifications and options different from us gaap. No items may be presented in the income statement as extraordinary items under ifrs regulations or (as of asu no. Financial statements should fairly present the company’s performance;

A layer component can be specified from a defined, but open, population or from a defined nominal amount. An item is deemed extraordinary if it is not. It must be unusual in nature (the underlying event or transaction must be abnormal and unrelated,.

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

:max_bytes(150000):strip_icc()/extraordinaryitem.asp_final-d0270152e7de486dac7351818079547b.png)