Amazing Info About Cash Flow Statement Exemption

Income statement and free cash flow.

Cash flow statement exemption. Ceo statement “in 2023, we delivered another strong and resilient performance. The increasing attention on companies’ cash generation and liquidity position has led to greater focus on the statement of cash flows by financial statement users, regulators and other commentators. As 3 cash flow statements states that cash flows should exclude the movements between items which forms part of cash or cash equivalents as these are part of an enterprise’s cash management rather than its operating, financing and investing activities.

Resolution select edit | data screen | cash flow statement | cash flow required or exemption if the frsse is being claimed then a cash flow is not required so. Structure of the cash flow statement frs 102, section 7 presents the cash flow statement using three cash flow classifications: [ias 7.1] the statement of cash flows analyses changes in cash and cash equivalents during a period.

Frc, december 2018. The following companies are given exemption from filing cash flow statement: If the subsidiary (or ultimate parent) meets the definition of a qualifying entity, it can claim the exemption from preparing a cash flow statement in frs 102, para 1.12 (b) and para 3.17 (d).

Section 7 provides an exemption from presenting cash flow statements if the entity is a qualifying entity. Even though our net income listed at the top of the cash flow statement (and taken from our income statement) was $60,000, we only received $42,500. The statement classifies cash flows during a period into cash flows from operating, investing and financing activities:

Free cash flow eur 423 million; Frs 1 applies to financial statements intended to give a true and fair view, but there are exemptions such as small companies (based on the small companies exemption in companies’ legislation) and some subsidiaries which are not required to. Cash management consists of the investment of excess cash in the cash.

Introduction under ‘old’ irish gaap many reporting entities were given exemption from preparing cash flow statements but under frs 102 a complete set of financial statements must now include a cash flow statement for accounting periods. Section 7 deals with the information that is to be presented in a statement of cash flow and identifies which entities may qualify for exemption from preparing cash flow statements. Investing and financing transactions that do not require the use of cash or cash equivalents are excluded from a statement of cash flows but separately disclosed.

Ceo statement “in 2023, we delivered another strong and resilient performance. An investment company subject to the registration and regulatory requirements of the 1940 act, or. However, asc 230 is not a comprehensive source of authoritative guidance.

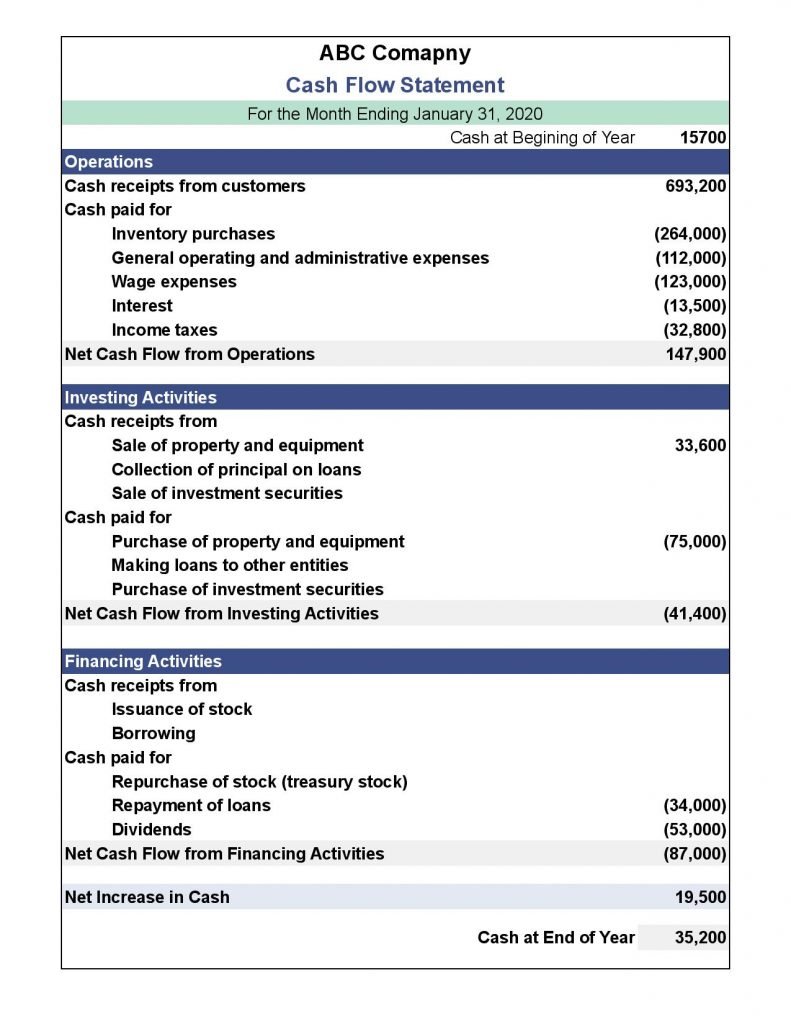

At the bottom of our cash flow statement, we see our total cash flow for the month: A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. Cash flow statements as per the definition of ‘financial statements’ under the companies act, 2013, financial statements include cash flow statement.

It looks at exemptions from presenting a cash flow statement, reporting cash flows from operating activities, and disclosures. Innovation rate increased to 20%; Innovation rate increased to 20%;

Section 7 provides an exemption from presenting cash flow statements if the entity is a qualifying entity. The following list contains additional sources for guidance governing the. Fundamental principle in ias 7 all entities that prepare financial statements in conformity with ifrss are required to present a statement of cash flows.