Impressive Info About Supplies Expense On Balance Sheet

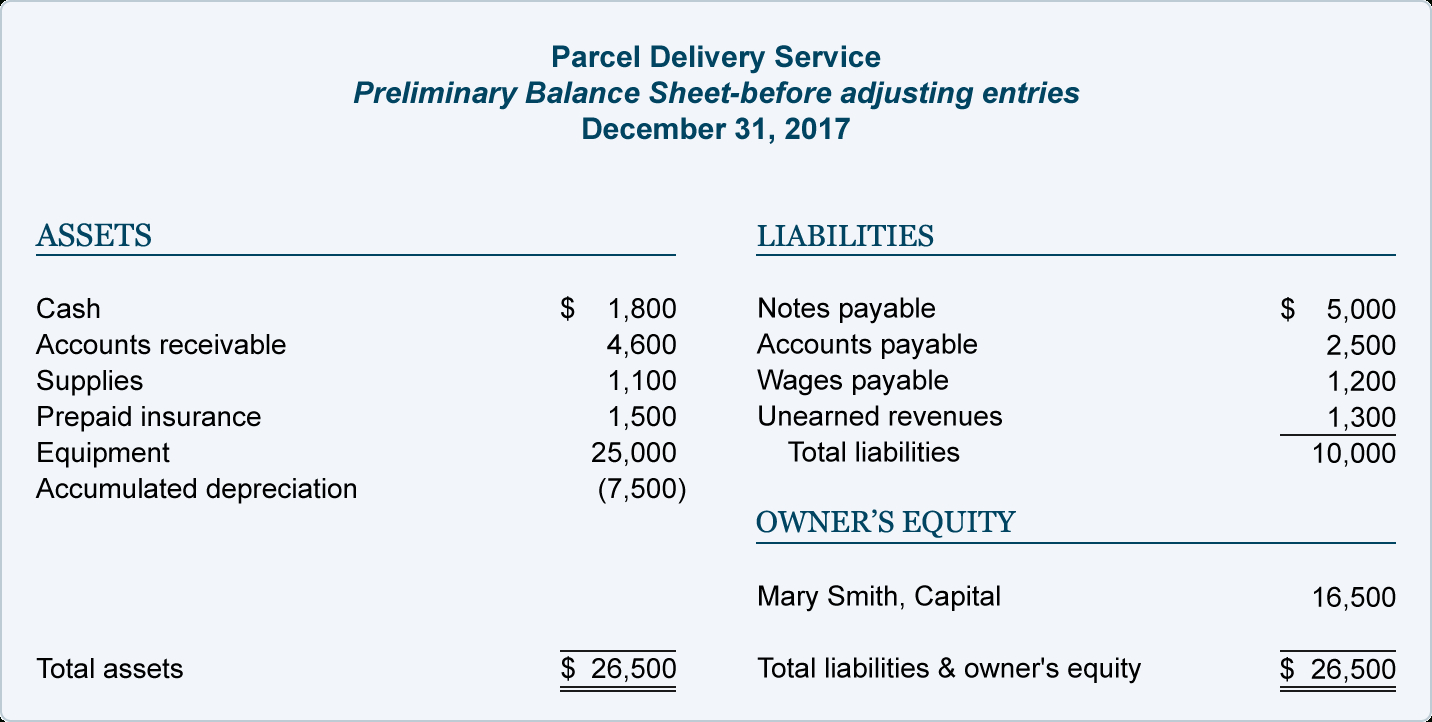

If the cost is significant, small businesses can record the amount of unused supplies on their balance sheet in the asset account under supplies.

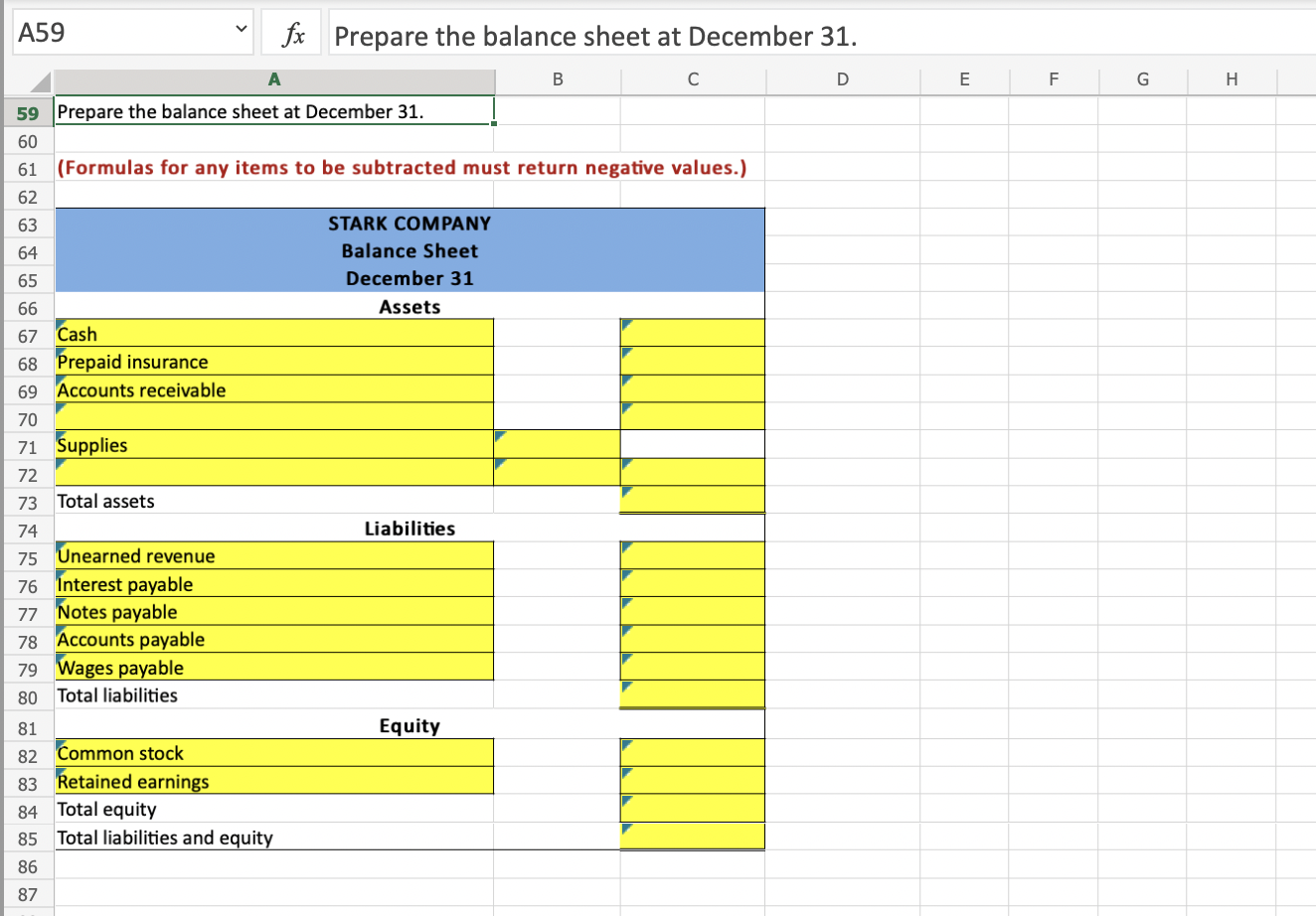

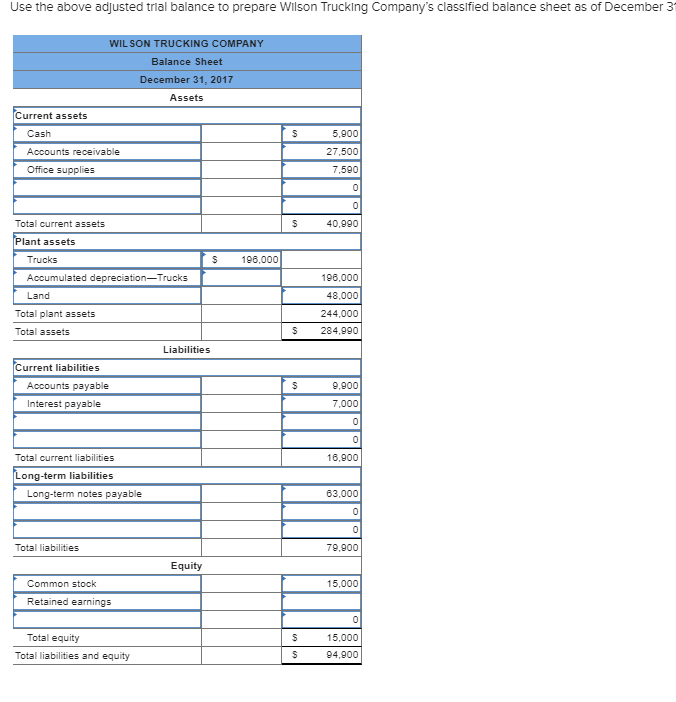

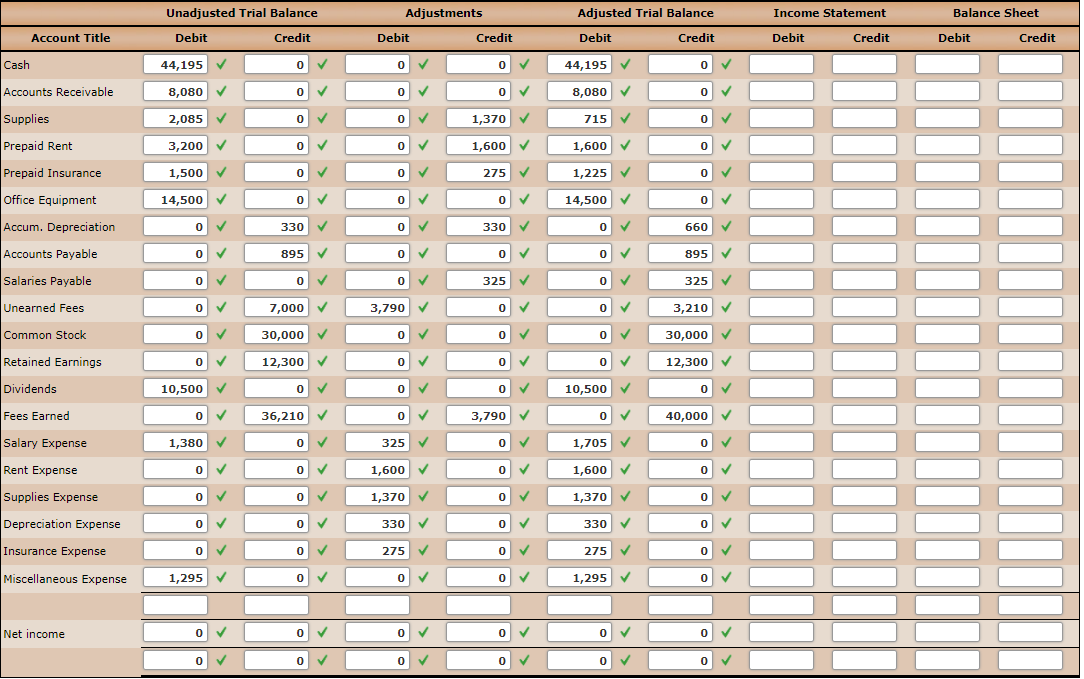

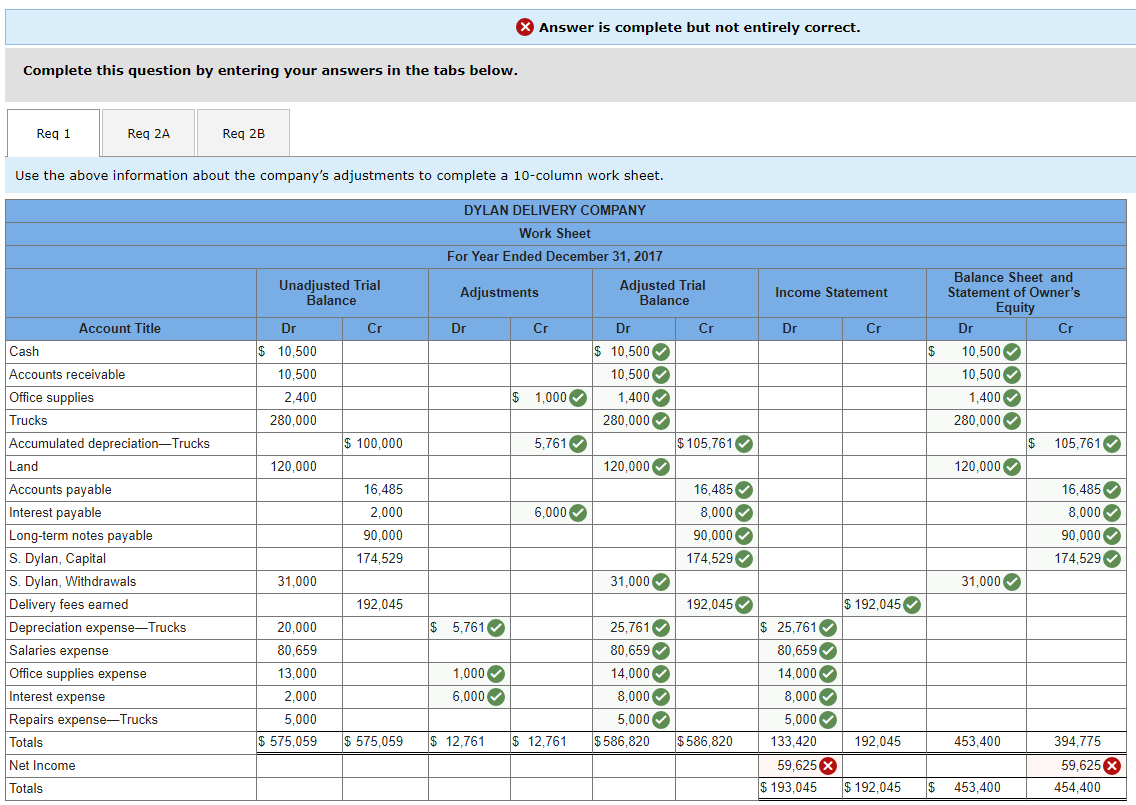

Supplies expense on balance sheet. A decrease in cash, prepaid expenses , supplies on hand, inventory The balance in the asset supplies at the end of the accounting. The income statement shows the financial results of a business for a designated period of time.

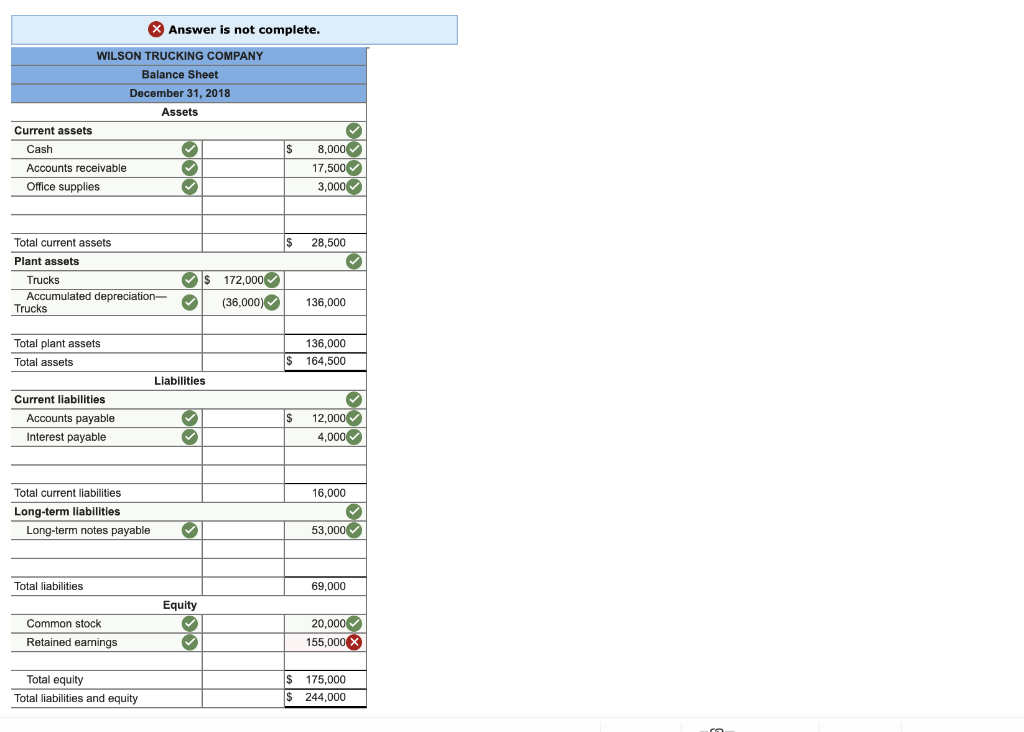

For printing plus, the following is its january 2019 income statement. This satisfies the rule that each adjusting entry will contain an income statement and balance sheet account. Lawn mowing revenue, gas expense, advertising expense, depreciation expense (equipment), supplies expense, and salaries expense.

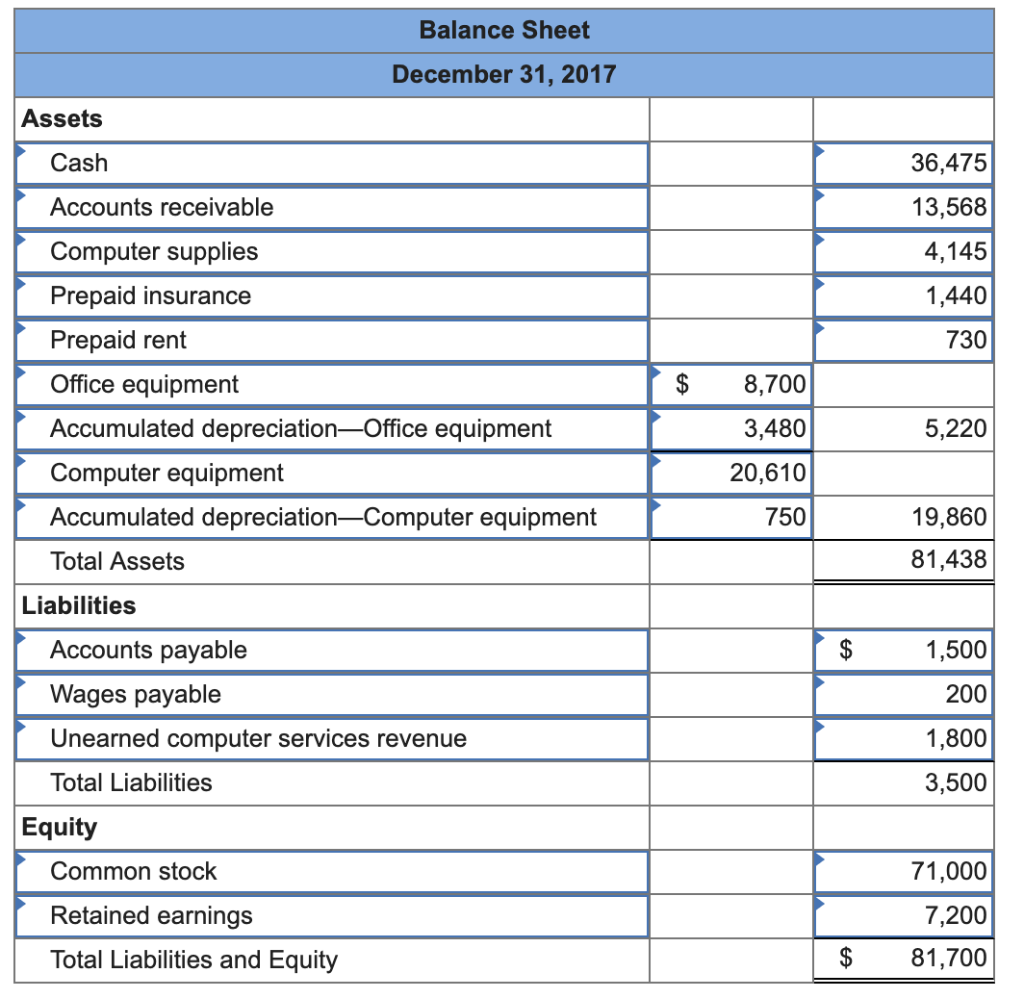

At the end of an accounting period, the consumable supplies on hand are counted and amount used is recorded as an expense in the income statement using an. Its accounting team can add $1,500 to the assets column of the company's balance sheet. Generally, supplies are recorded as current assets on a company’s balance sheet until they are used.

Bookkeeping guidebook if the cost of the supplies that you have purchased and not yet consumed is significant, then you can instead record them as an asset, using the following entry: Supplies expense would increase (debit) for the $100 of supplies used during january. In addition to affecting retained earnings or the owner's capital account, an expense will also cause one or more of the following changes to the balance sheet:

Revenue and expense information is taken from the adjusted trial balance as follows: Supplies expense refers to the cost of consumables used during a reporting period. Depending on the type of business, this can be one of the larger corporate expenses.

When cost of supplies used is recorded as supplies expense. Office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file folders, and markers. The cost of the office supplies used up during the accounting period should be recorded in the income statement account supplies expense.

Impact on the financial statements: An expense appears more indirectly in the balance sheet, where the retained earnings line item within the equity section of the balance sheet will always decline by the same amount as the expense. Once supplies are used, they are converted to an expense.

Cfi’s financial analysis course as such, the balance sheet is divided into two sides (or sections). Supplies expense will start the next accounting year with a zero balance. The balance in supplies expense will increase during the year as the account is debited.

All of these items are 100% consumable, meaning that. Total expenses are subtracted from total revenues to get a net income of $4,665. Supplies expense would increase (debit) for the $100 of supplies used during january.

This financial statement is used both internally and externally to determine the so. Supplies expense definition under the accrual basis of accounting the account supplies expense reports the amount of supplies that were used during the time interval indicated in the heading of the income statement. Impact on the financial statements:

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)