Favorite Tips About Cash Balance Financial Statement

However, your cash flow statement will show that your account is overdrawn.

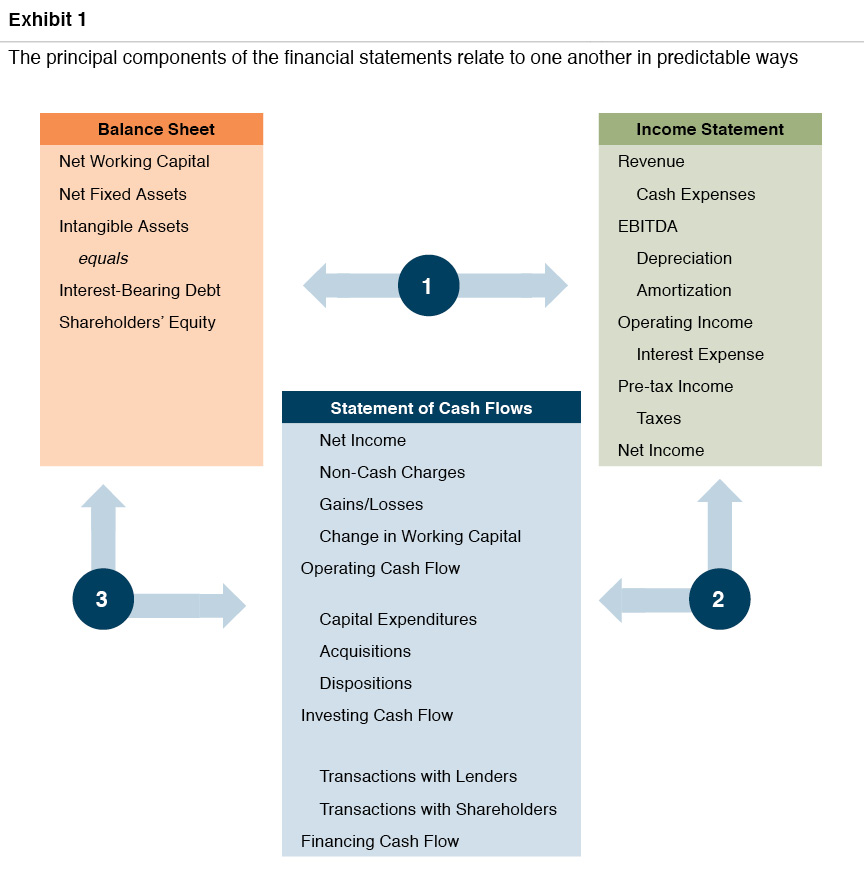

Cash balance financial statement. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. A cash flow statement tells you how much cash is entering and leaving your business in a given period. Each of the financial statements provides important financial information for both internal and external stakeholders of a company.

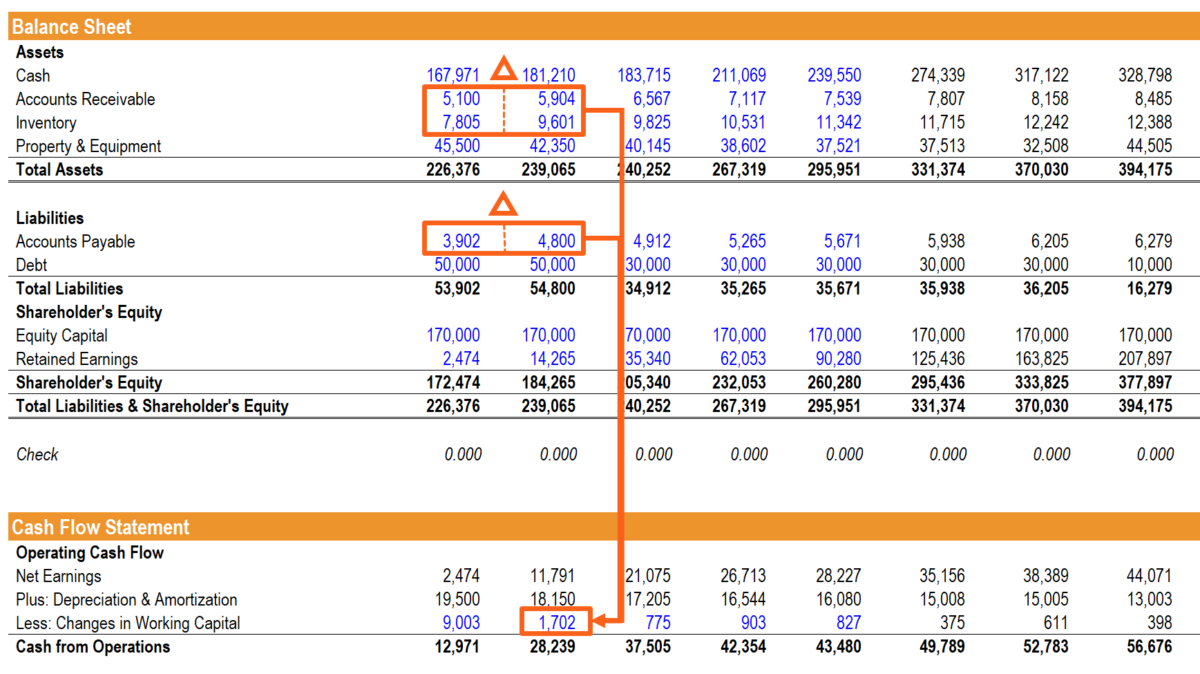

Total net cash flow added to the beginning cash balance equals the ending cash balance. Balance sheet (compared) for a comprehensive assessment of a business’s financials, you need to understand how to analyze each of the main financial statements and how they are interconnected. Assuming the statement was prepared correctly, the sum should equal the ending cash balance on the balance sheet.

Unless you went to business school—or at least took an accounting or finance course—you’ve probably never given much thought to financial statements such as balance sheets, income statements, or statements of cash flow, right?but now you’ve got some money to invest, you’re looking at a few companies and trying to figure out. Cash flow statement vs. The value of these documents lies in the story they tell when reviewed.

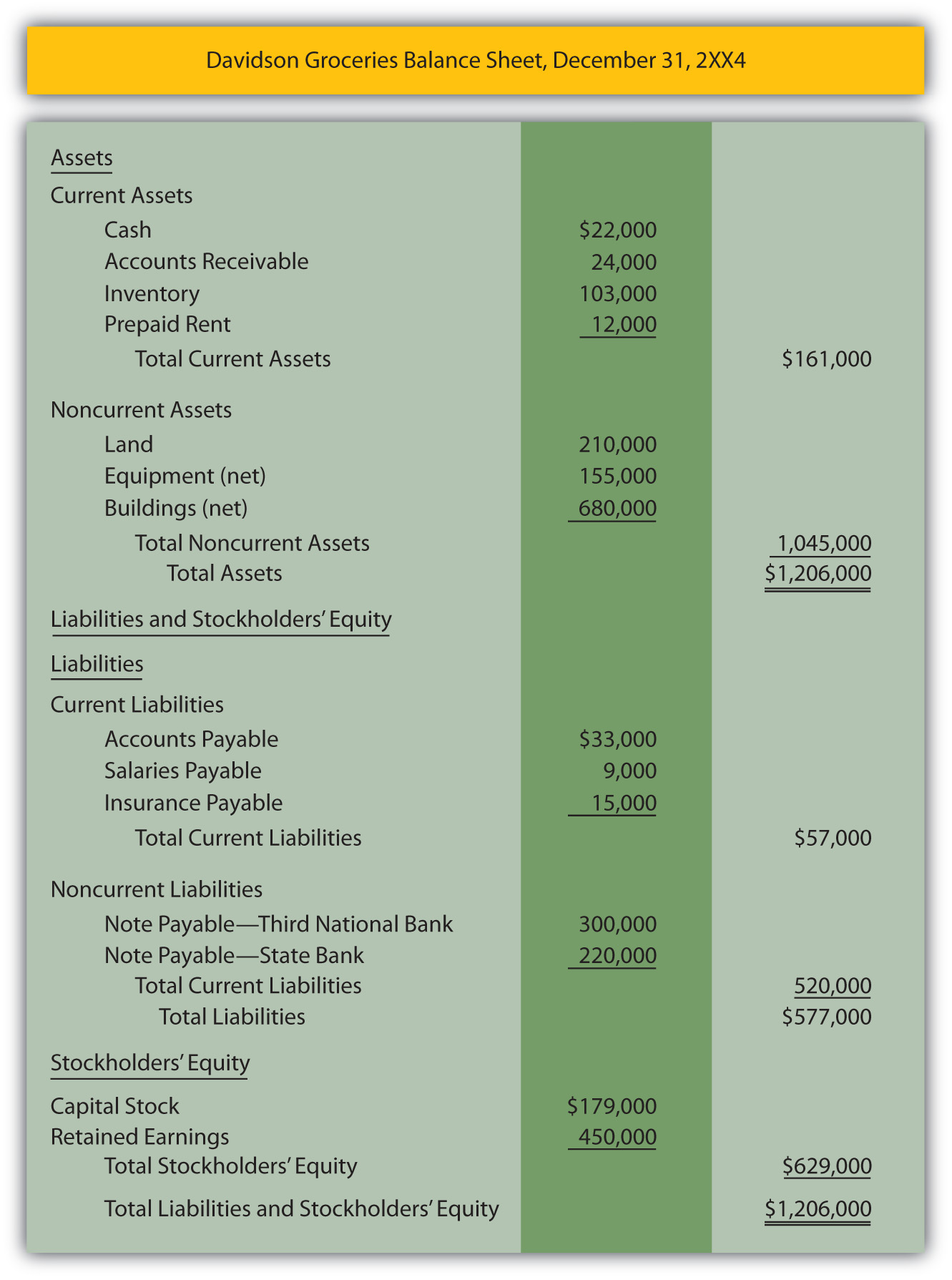

Balance sheets provide the basis for. The balance sheet is based on the fundamental equation: The balance sheet also referred to as the statement of financial.

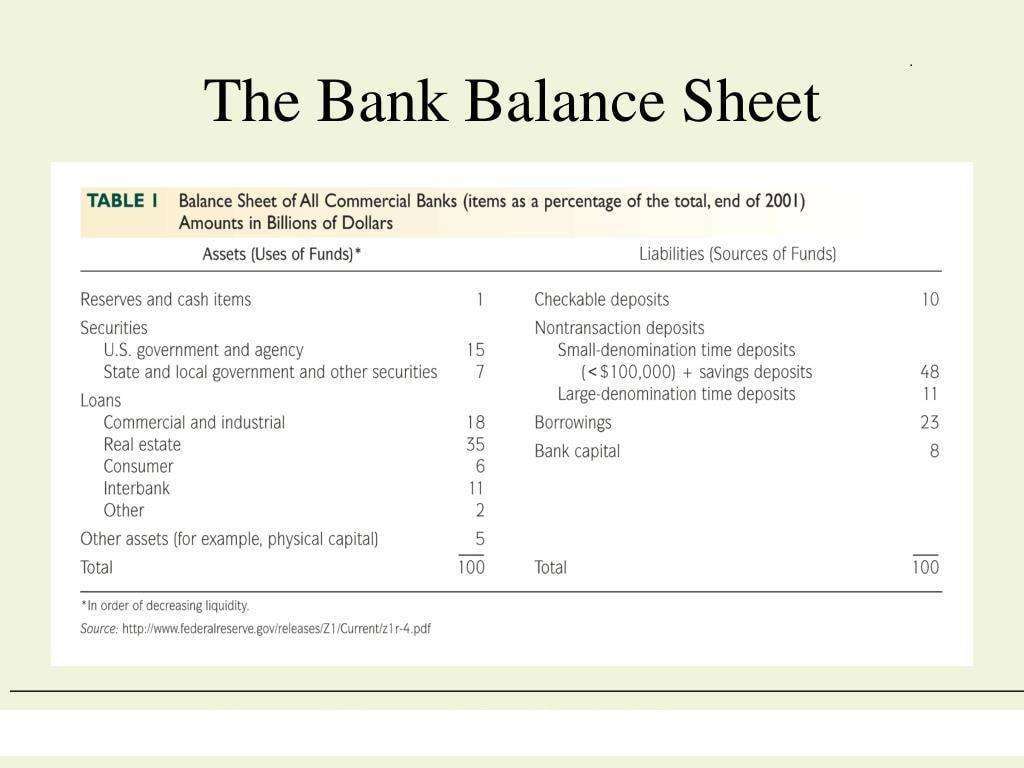

Today, the bank is announcing that rg auctions will commence on february. The income statement, balance sheet, and statement of cash flows are required financial statements. Along with income statements and balance sheets, cash flow statements provide crucial financial.

Understanding financial statements. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. The cash flow statement provides a view of a company’s overall liquidity by showing cash transaction activities.

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). The beginning cash balance was $90,000, making the ending cash balance $110,000 (see figure 5.19). Balance sheets, income statements, cash flow statements, and annual reports.

Cash balance this is the final step in linking the 3 financial statements. This cash flow statement shows company a started the year with approximately $10.75 billion in cash and. The three financial statements are:

To understand a company’s financial position—both on its own and within its industry—you need to review and analyze several financial statements: The beginning and ending balance of cash, cash equivalents, restricted cash, and restricted cash equivalents and any other segregated cash and cash equivalents shown on the statement of cash flows should agree to. The balance sheet, income statement, and cash flow statement:

This article will provide a quick overview of the. This guide is designed to be useful for both beginners and advanced finance professionals, with the main topics covering: These offer an inside look at a company.