Unique Tips About Tds Return 24q

Cleartax provides you with a prompt mechanism to comply with all the tds compliance tds return on salary payment.

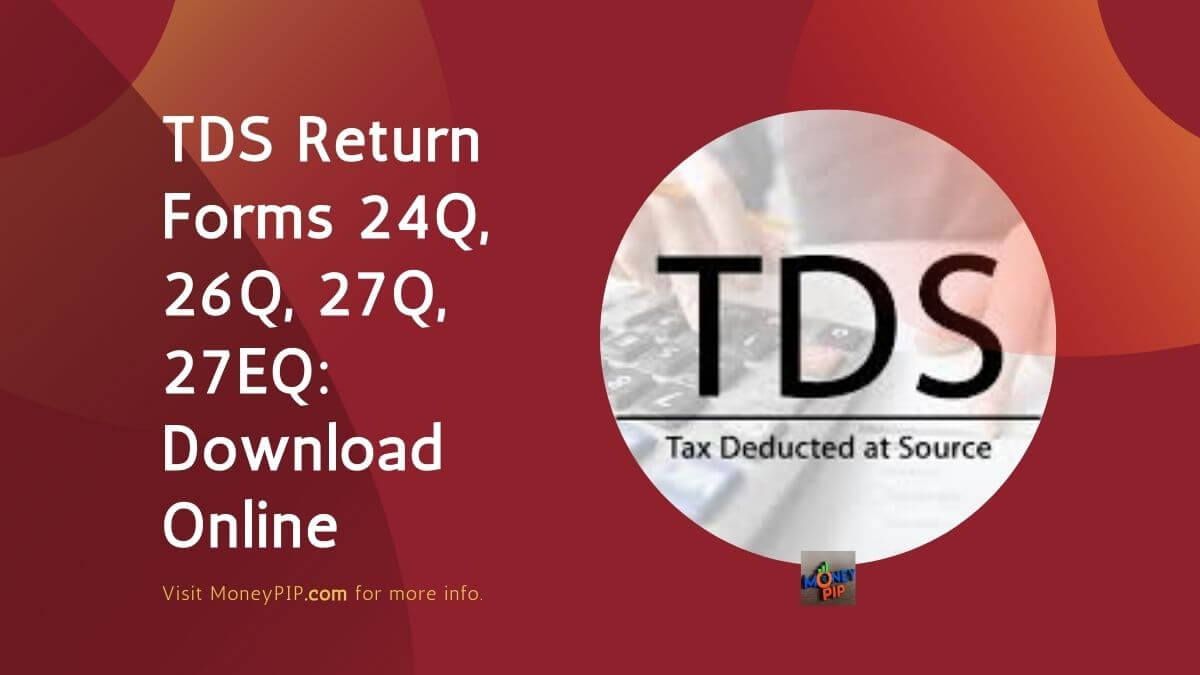

Tds return 24q. Form 24q is specifically meant for tds on salaries. An employer has to file salary tds return in form 24q, which has to be submitted on a quarterly basis. Annexure ii (salary details) are not.

The users are advised to read these guidelines carefully before the. This form can be generated through. Unlike gst, where the return filing and payment of taxes occur simultaneously, here there is a clear separation.

Employers submit it quarterly to the income tax department. Form 24q is a quarterly statement of deduction of tax on salaries. Form 24q is utilized by the taxpayers for the declaration of the tds returns of the citizen.

Form 24q is a tds return/ statement containing details of tds deducted from the salary of employees by the employer. It contains details of tds deducted and. It contains details of tax deducted and deposited with respect to employees’ salaries.

Also know interest and penalty. Annexure i is the regular quarterly data for the. Know about time limit to deposit tds and file tds return.

So, who is responsible for tds and. Form 24q is required to be submitted on. It is a document that employers use to report.

Form 24q is a statement for tds, which is used to report tds deducted details from salaries. The form would have the information on the salary and. Form 24q is a quarterly.

Each form is filed for the respective quarter in which tds on salary has. Once you've calculated and paid your tax to the government, you have to record payment challans and generate form 24q. Details of the salary paid to the employees and the tds.

Form 24q is one type of tds return. Features of rpu 4.9 guidelines for usage of these rpus are provided in the respective utilities. Form 24q is a tds (tax deducted at source) return that is filed by an employer who deducts tds on salaries.

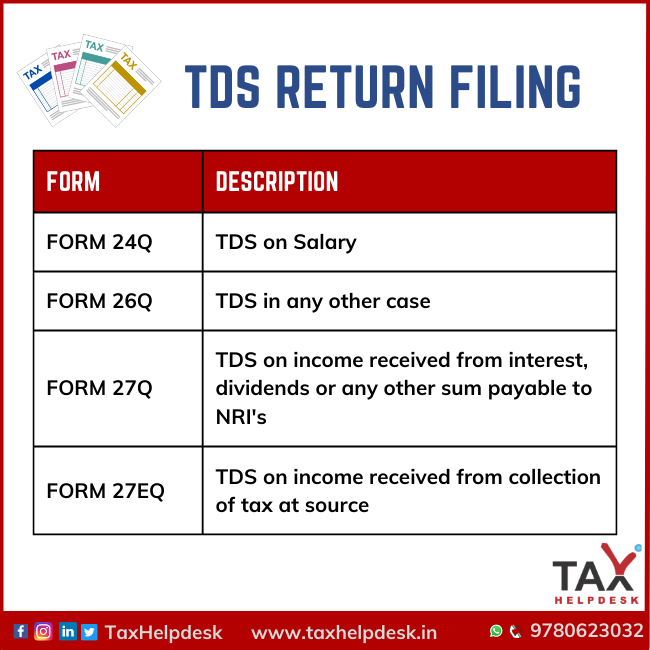

![An overview of TDS return forms [with explanation]](https://www.saraltds.com/wp-content/uploads/2019/03/TDS-return-forms-1024x597.jpg)