Matchless Tips About Treatment Of Capital Reserve In Cash Flow Statement

Benefits of cash reserve ratio.

Treatment of capital reserve in cash flow statement. As per the indirect method, since there is no actual flow of cash, any addition to reserves is added back to net profit for calculation of. However, capital and operating are the two main types of cash. For the method where dsra moves are ignored in computing the dscr and evaluating sculpting, the dsra changes are shown at the bottom of the cash flow statement.

A reporting entity with operations in foreign countries or with foreign currency transactions must report the reporting currency equivalent of foreign currency cash. How reserve and surplus is treated in cash flow statement? Fnrp outlines what you need to know.

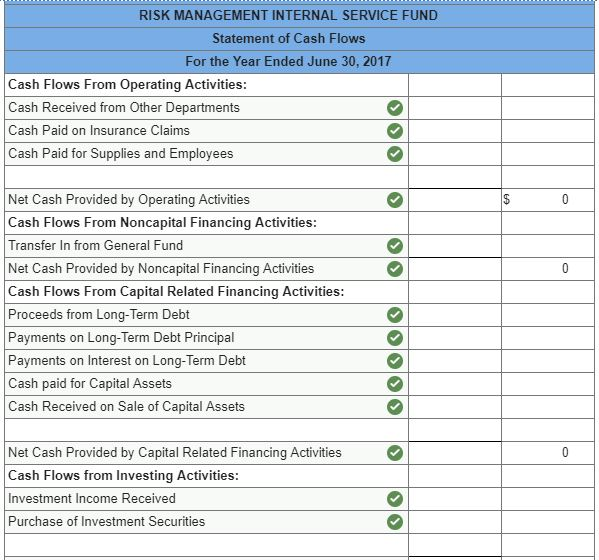

The funds constituting the capital reserve account are not used to pay dividends, repurchase. Those command provide insights within a company’s operations and activities. This article considers the statement of cash flows of which it assumes no prior knowledge.

Manage settings continue the recommended pastries Payment of lease liabilities ( 90) dividends paid [1] ( 1,200) [1] this. Presentation of a statement of cash flows 10 the statement of cash flows shall report cash flows during the period classified by operating, investing and financing activities.

It is relevant to the fa (financial accounting) and fr (financial reporting) exams. Instead, companies create these reserves by transferring amounts. Summary cash reserves are vital to companies.

These actions provide insights into a company’s operations the activities. The reserve holds money that a business can use when unexpected costs come up or when revenues are down. However, these reserves do not have a direct impact on the statement.

Proceeds from issue of share capital. Crr aids in managing overall liquidity by increasing the flow of money throughout the economy. Using real understanding financial declarations have crucial for investors.

Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the. Investors should know and what of capitalize reserves for major expenses. The revaluation reserve is an accounting term used when a company has to enter a line item on its balance sheet due to a revaluation.

100 opening rate usd/gdp let's say 1.1, and the closing rate is 1,2. What is capital reserve. Although capital reserves refer to funds set aside for specific use, they do not involve cash flows.

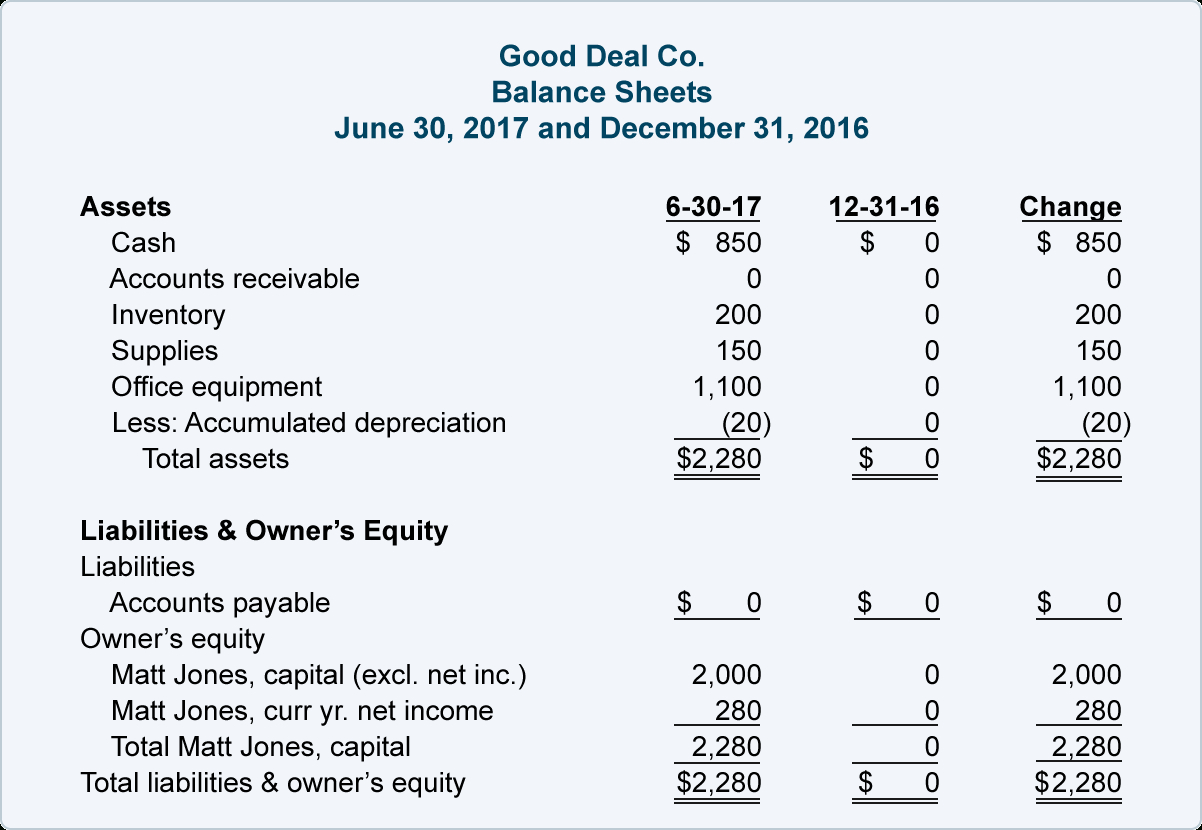

Treatment of general reserve. Companies can treat capital reserves in the cash flow statement indirectly. Using and understanding financial statements are crucial for investors.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

![Funds Flow Statement 1 [ Schedule of Changes in Working Capital ] by](https://i.ytimg.com/vi/H3-bDkYXMy8/maxresdefault.jpg)