Spectacular Tips About Balance Sheet Format For Nonprofit Organizations

Become an accounting jedi with springly's free nonprofit excel templates.

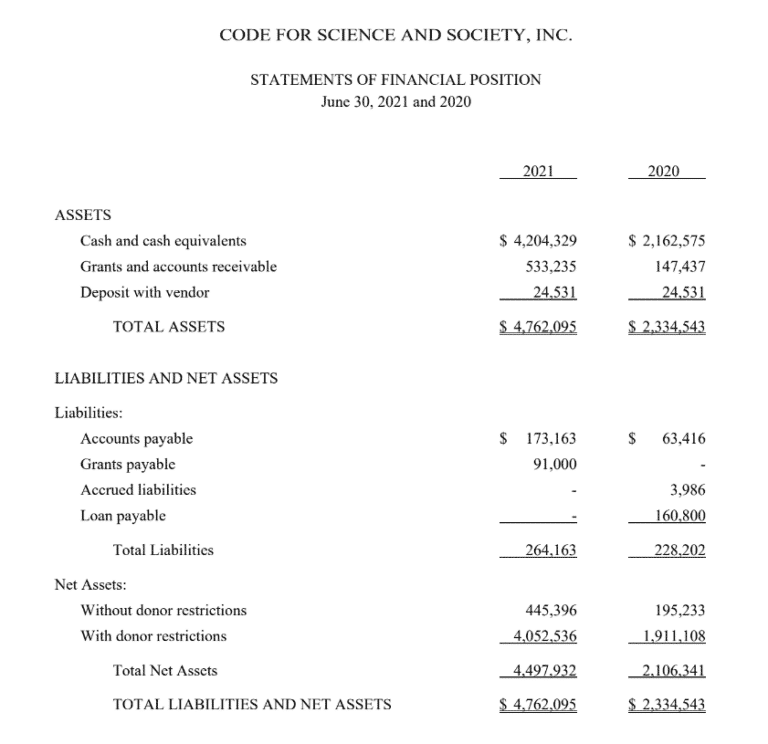

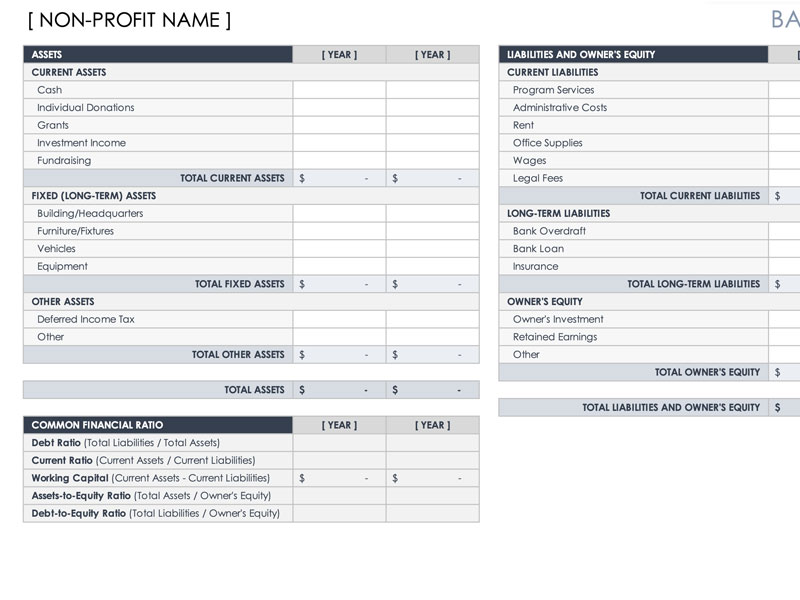

Balance sheet format for nonprofit organizations. More specifically, our template includes the following categories: Statement of financial position, statement of activities, statement of cash flows, and statement of functional expenses. Nonprofits must provide this information when filing form 1023to apply for 501c3 tax exemption with the internal revenue service.

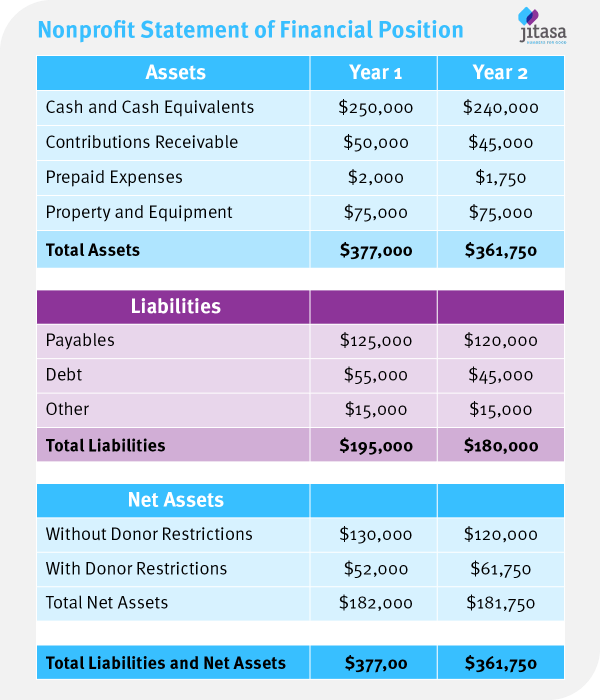

A nonprofit balance sheet, also known as a statement of financial position, is an essential tool for understanding an organization's current financial standing by. In this document, you will find the following templates: Finance unlocked for nonprofits (fun) 2 balance sheet ü liquidity can also be measured by calculating the current ratio:

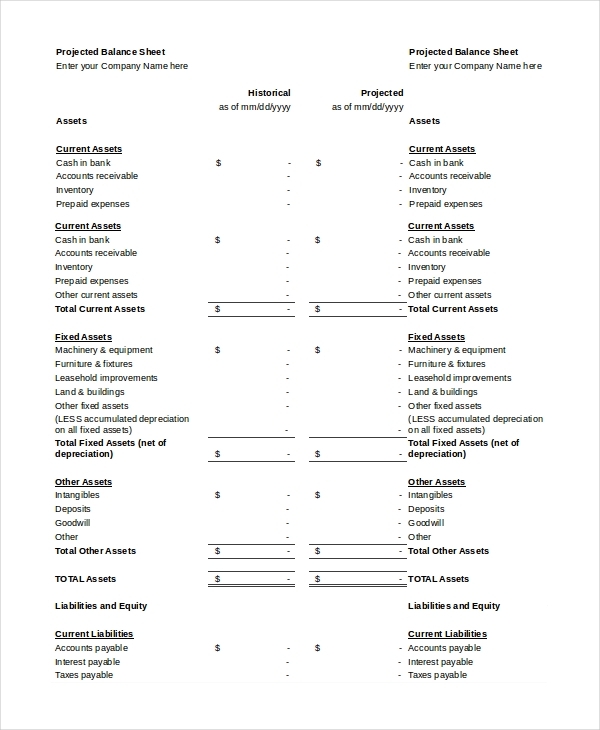

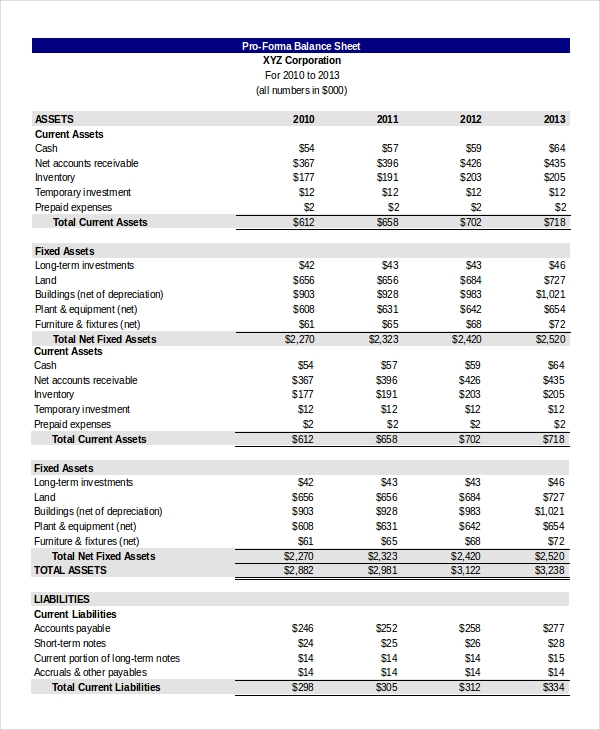

Here’s how you can format your nonprofit’s balance sheet: A balance sheet provides a snapshot of your nonprofit’s financial position at. What’s included in a nonprofit’s balance sheet (statement of financial position)?

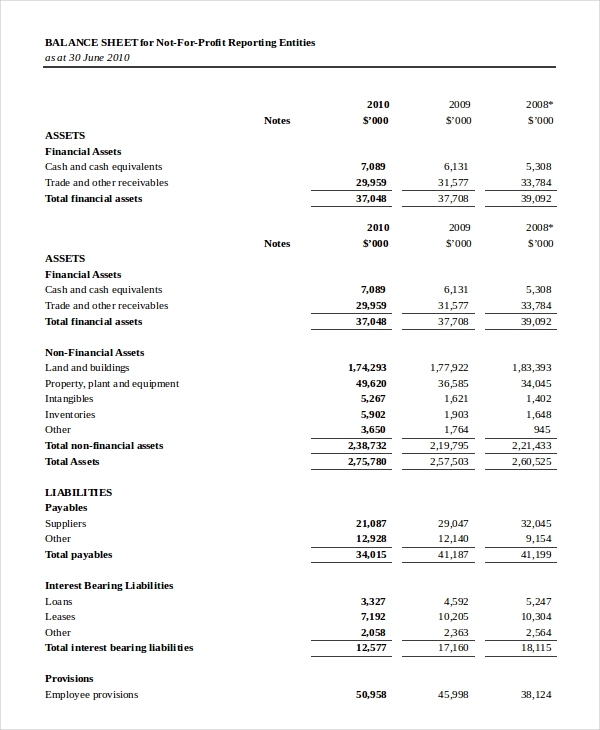

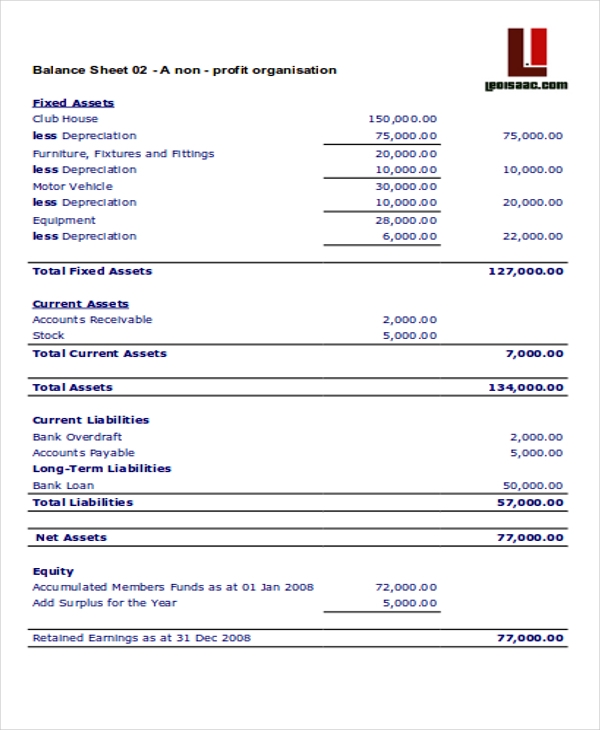

Start with a clear title at the top, such as “statement of financial position” followed by the name of. A balance sheet for a non profit should include assets, liabilities and net assets. The four required financial statements are:

The statement of financial position (sofp) is the correct nonprofit term for the balance sheet. The concept and the equation are essentially the same as any business balance. General balance sheet of nonprofit a balance sheet shows the financial health of any.

The statement of financial position (sofp) is the correct nonprofit term for the balance sheet. The organization’s assets (such as cash, investments, property and equipment), liabilities (such as payroll, loans and other expenses) and net. Nonprofit balance sheet standard template 3.

Nonprofit balance sheets list your organization’s assets, liabilities, and net assets. It outlines three primary areas: