Underrated Ideas Of Tips About Tax Form 26as

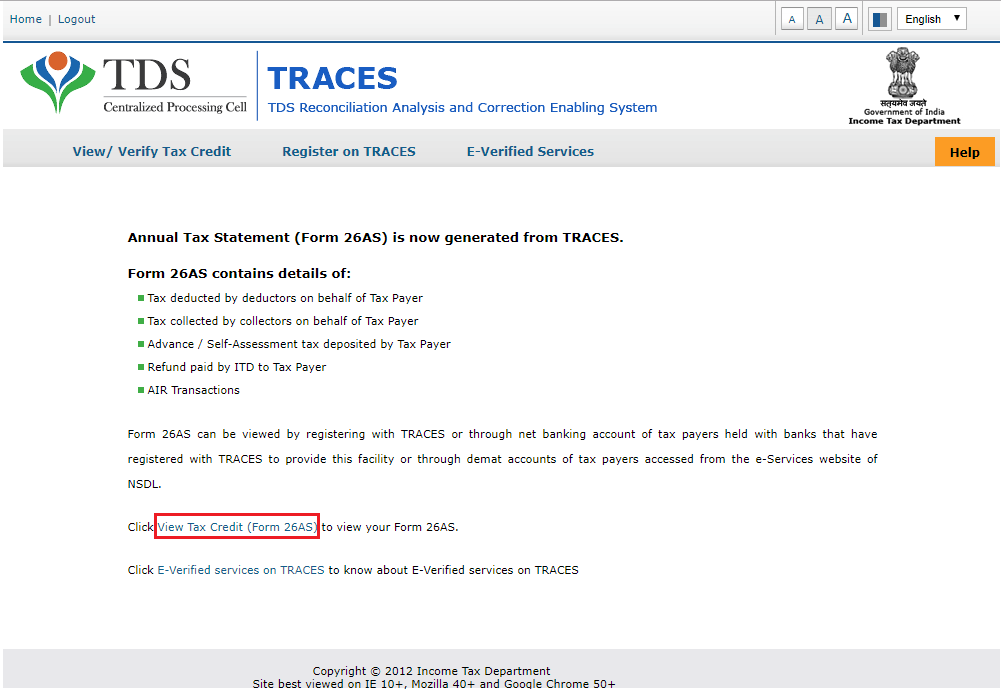

The website provides access to the pan holders to view the details of tax credits in form 26as.

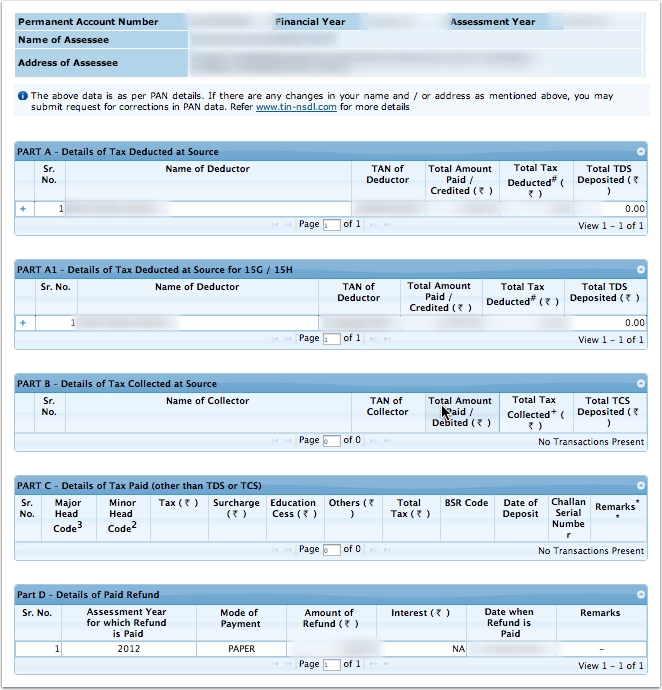

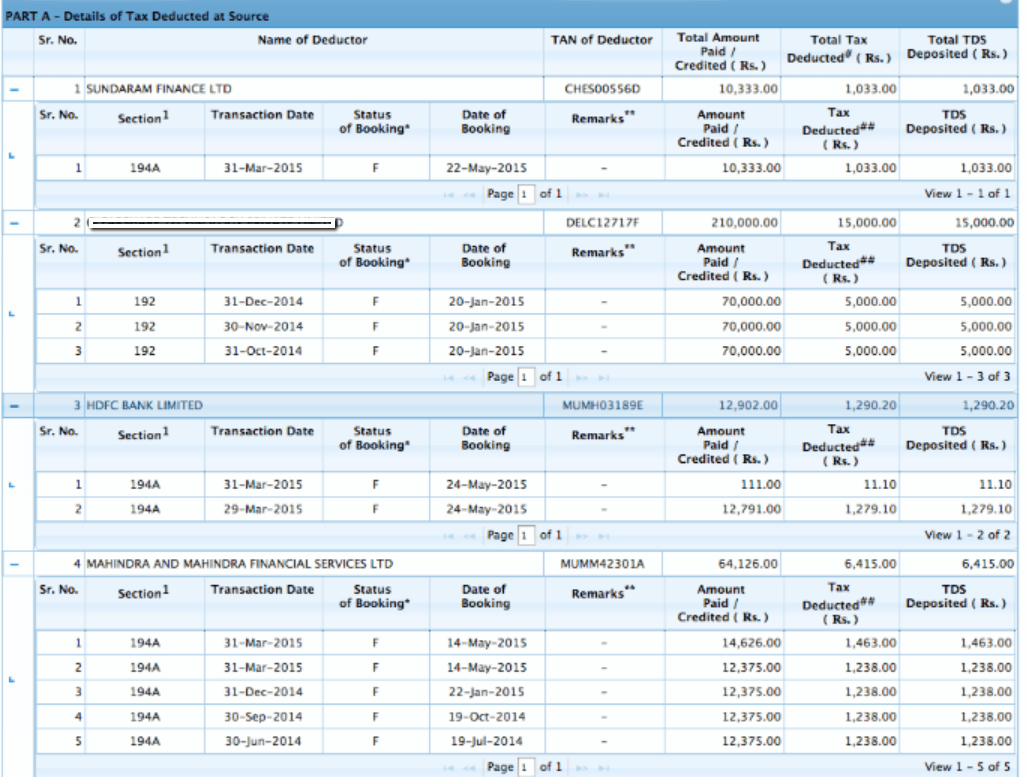

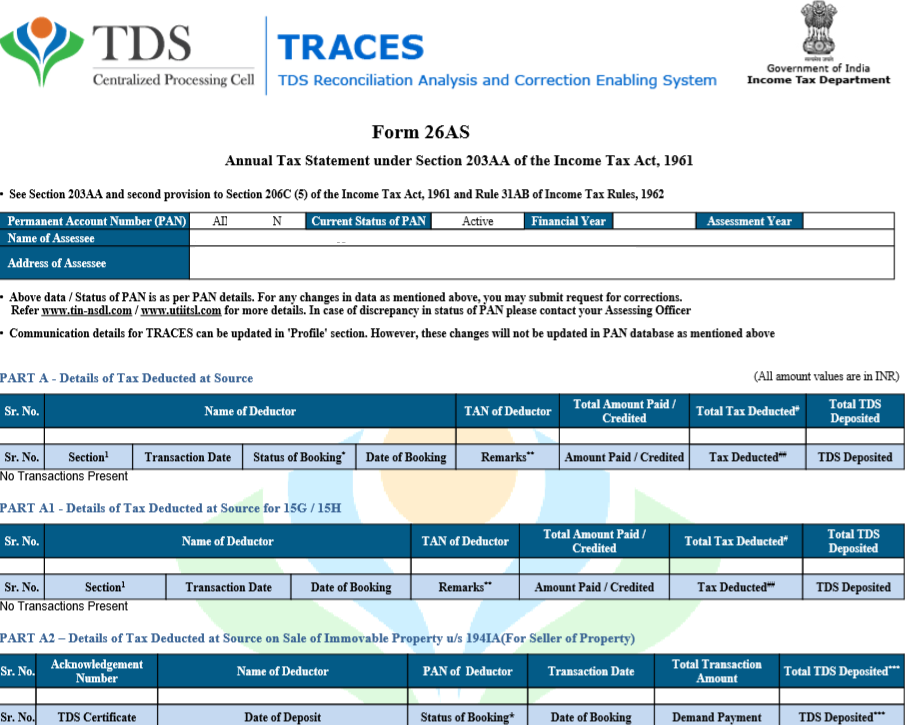

Tax form 26as. Form 26as is a consolidated annual tax statement that shows the details of tax deducted at source, tax collected at source, advance tax paid by the assessee along. What is form 26as? If you are not registered with traces, please refer to our e.

Locate and select the form 16 option from the frequently used forms section. The irs released the final form 4626, “alternative minimum tax—corporations,” [pdf 306 kb] and. Accompanying instructions [pdf 228 kb] for the new corporate alternative.

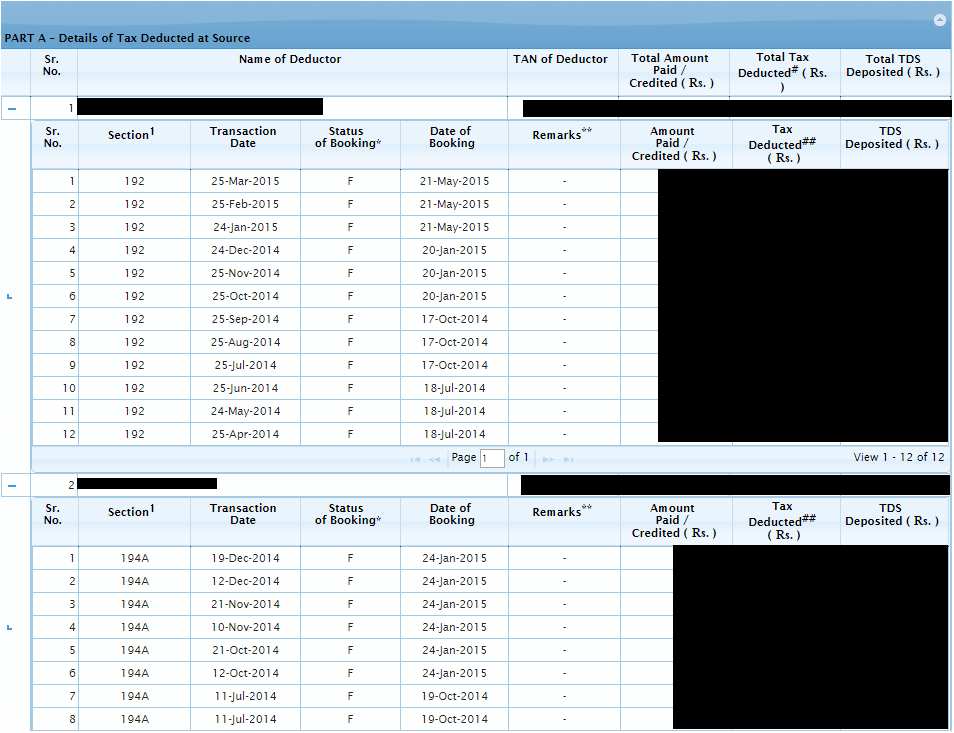

Income tax form 26as is a consolidated statement showing details related to tds and tcs from different sources. Transparency in taxation | hdfc bank know everything about income tax form 26as form 26as is a consolidated statement from the income tax. Form 26as means a tax credit statement and is an important document for taxpayers.

Form 26as includes the information on all the deducted tax on the income of deducted. Form 26as provides the taxpayer with the relevant tax related information such as details of tds and tcs, details of taxes paid in the form of advance tax and. How to view form 26as?

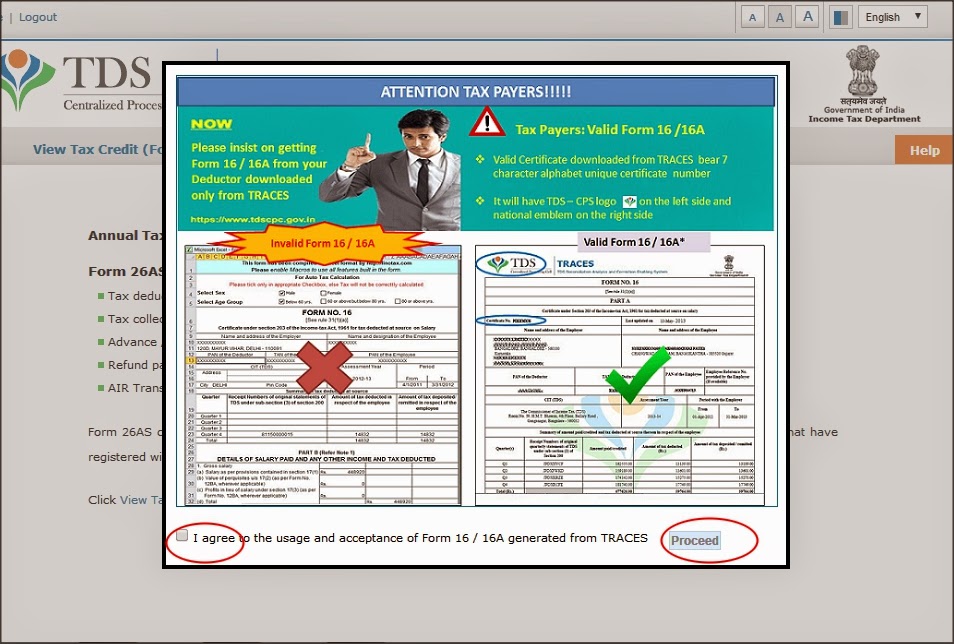

Read the disclaimer, click 'confirm' and the user. As a taxpayer you can view form 26as in two modes: As discussed, form 26as is a crucial record of tax credits in the form of a report or statement, also known as an annual statement.

A lot of information related to your. All the details of collected tax by the person who is collecting. Form 26as can be downloaded:

For those who don't know, form 26as is an annual declaration that enables a user to check the amount of tax levied against them. Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer. Form 26as is a consolidated tax statement issued.

What is form 26as? 26as full form is annual information statement (ais). Click on the income tax forms tab.

Form 26as, introduced on june 1 2020, is a vital document that encapsulates a comprehensive overview of your financial transactions related to taxation. Form26as is an important tax document in india, that every tax payer need to refer at the time of income tax filing, broadly contains the taxes that are paid on your. Form 26as is an annual consolidated tax statement that you can acquire on the it website with your permanent account number (pan).