Wonderful Info About Understanding Bank Financial Statements

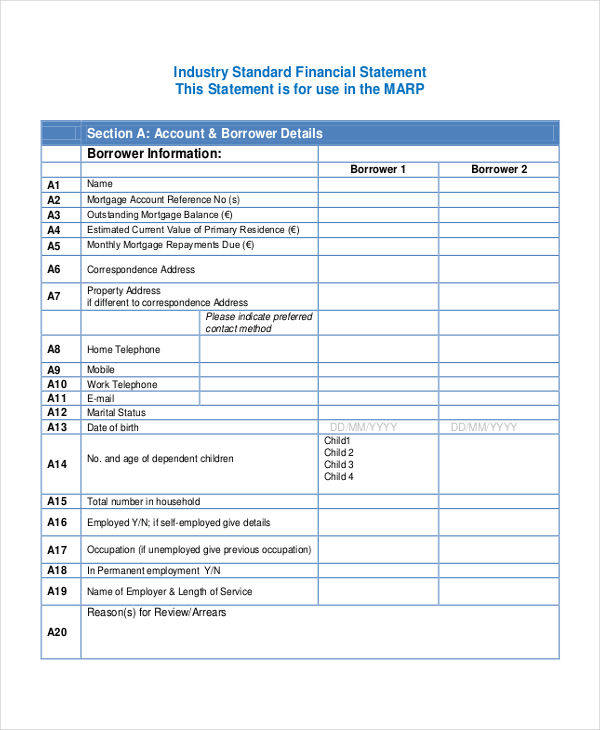

The statement also displays the total amount of deposits and withdrawals.

Understanding bank financial statements. The financial statements of banks differ from most companies when analyzing revenue. To understand a company’s financial position—both on its own and within its industry—you need to review and analyze several financial statements: As a result, analysis of a bank's financial statements requires a distinct approach that recognizes a bank's somewhat unique risks.

These statements provide a comprehensive view of the bank’s financial position, performance, and cash flow, which are crucial for investors, analysts, and regulators alike. Audit financial accounting what is a bank financial statement? A bank statement can be a useful tool for catching accounting errors or fraud and tracking your.

The financial statements of banks can prove to be a black hole. Over 15 years of experience in the financial services industry. Here is an overview of the main elements:

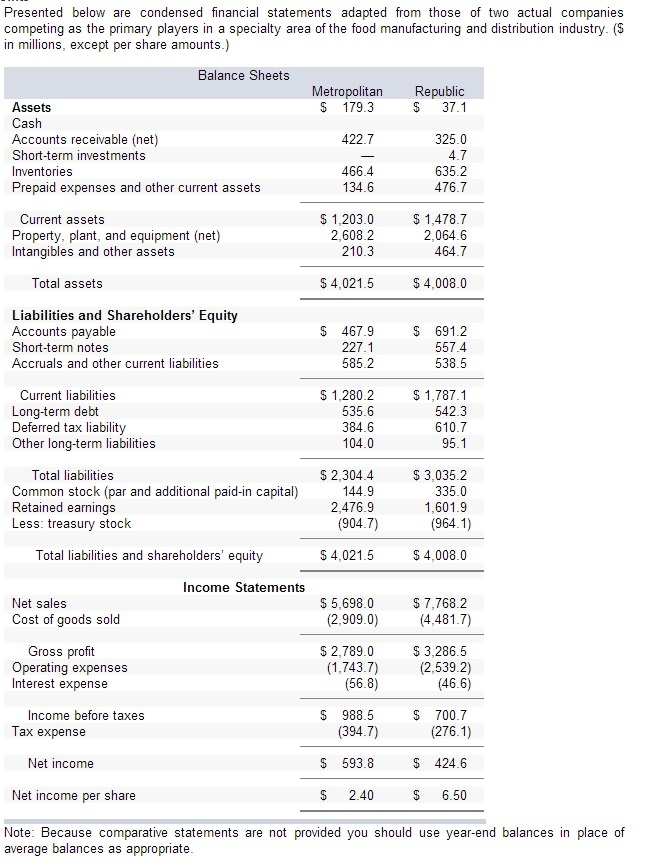

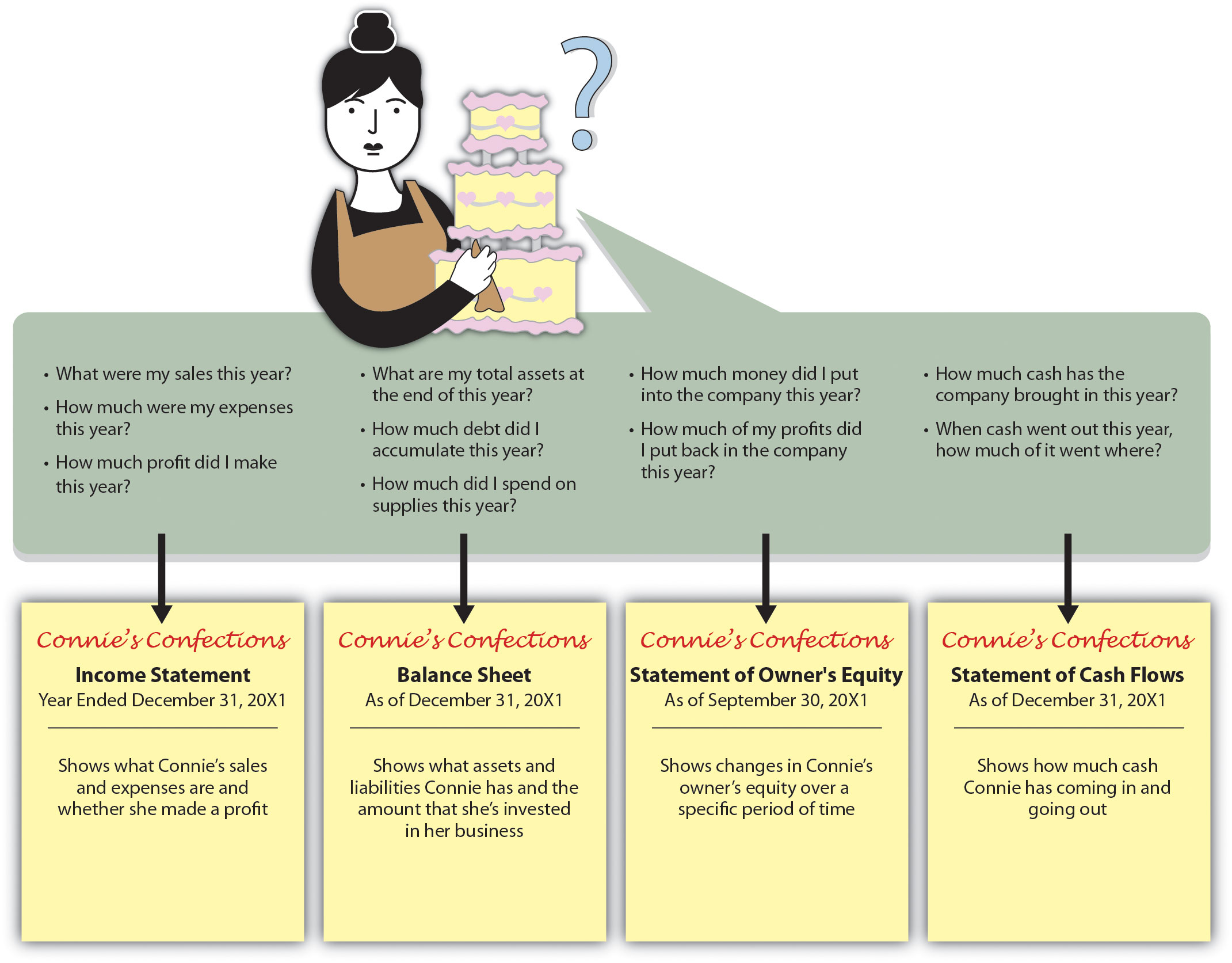

Balance sheets show what a company owns and what it owes at a fixed point in time. Financial statement = scorecard there are millions of individual investors worldwide, and while a large percentage of these investors have chosen mutual funds as the vehicle of choice for. To learn more, launch our finance courses online!

Balance sheet a bank’s balance sheet has certain unique items. The value of these documents lies in the story they tell when reviewed together. Statements include every transaction—deposits, withdrawals and other charges made during the month.

Financial statements are often audited by government agencies and accountants to ensure. Understanding your bank statement involves identifying several key components. Income statements show how much money a company made and spent over a period of.

Provisioning, asset valuation, securitisation etc.) on the financial statements In this article, you'll get an overview of how to analyze a bank's financial statements and the key areas of focus for investors who are looking to invest in bank stocks. Assets such as bank balances, stocks, accounts receivable, investments liabilities (accounts payable and debt) shareholders' equity on the exact date the fiscal year ends (assets minus liabilities)

Renowned community banking podcaster byron earnheart will demystify financial institution statements. Balance sheets, income statements, cash flow statements, and annual reports. Loans to customers and deposits from customers the main operations and source of revenue for banks are their loan and deposit operations.

Corporate finance financial statements how do you analyze a bank's financial statements? Banks use bank statements to record an account holder’s transactions each month. The statement period dates indicate the time frame covered.

The concept and functions of banks is quite simple. Banks have no accounts receivables or inventory to gauge whether sales are rising or falling. We visit each unique line item in the subsections below.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)