Brilliant Strategies Of Info About Profit And Loss Ledger

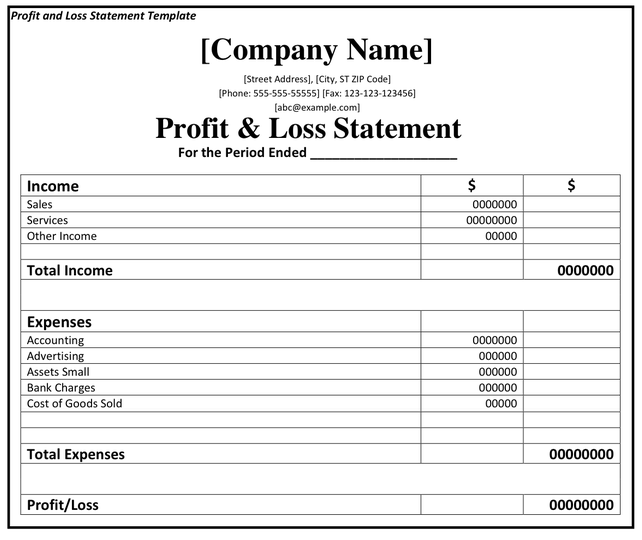

Use this simple general ledger template to gain insight into your business’s financial data and debit and credit accounting.

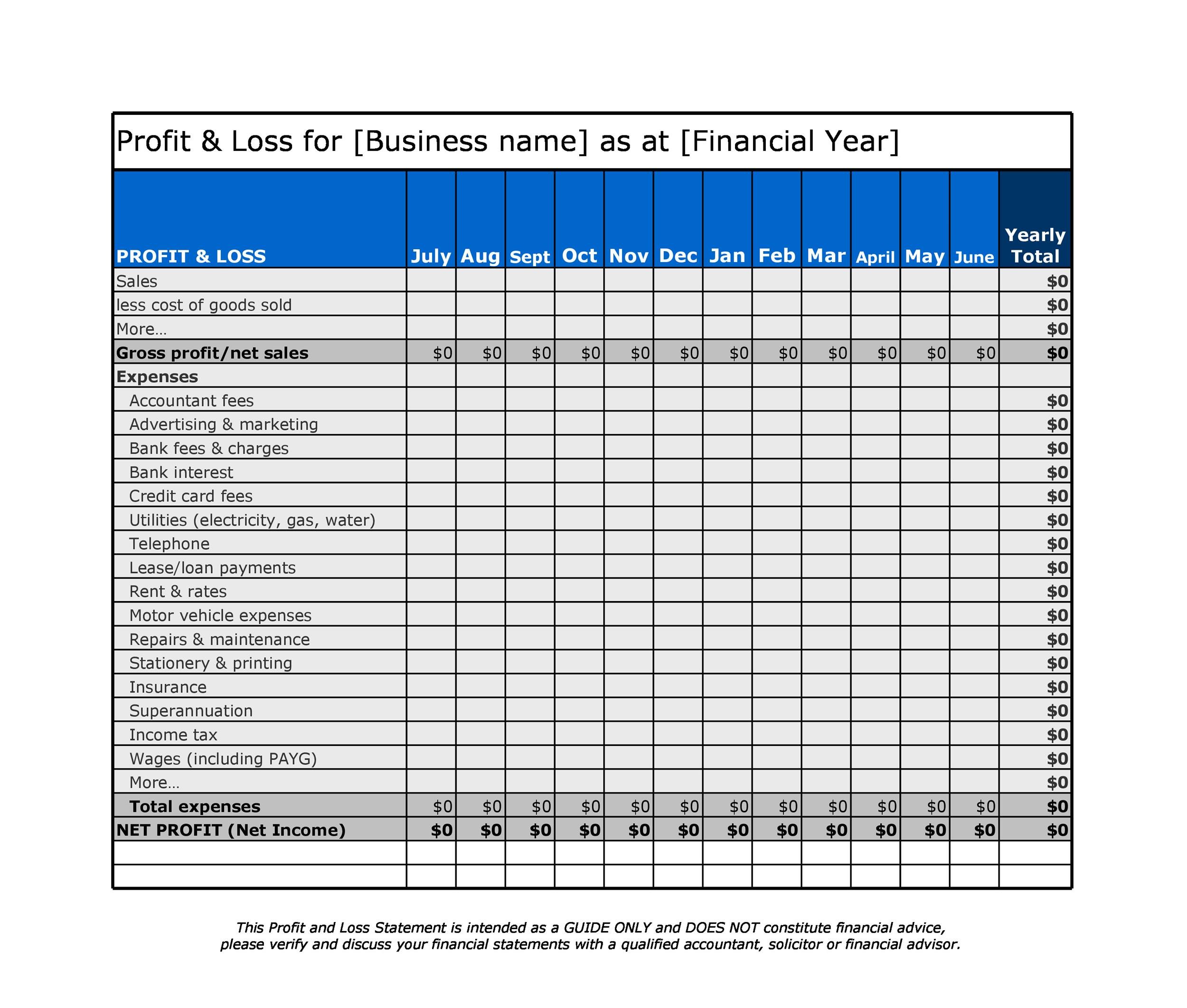

Profit and loss ledger. Leave it to the new york jets to find a way to sit behind the new england patriots even when they supposedly win. Donald trump ’s comments over the weekend that he once told a european leader he’d abandon nato members to a. Calculate revenue the first step in creating a profit and loss statement is to calculate all the revenue your business has received.

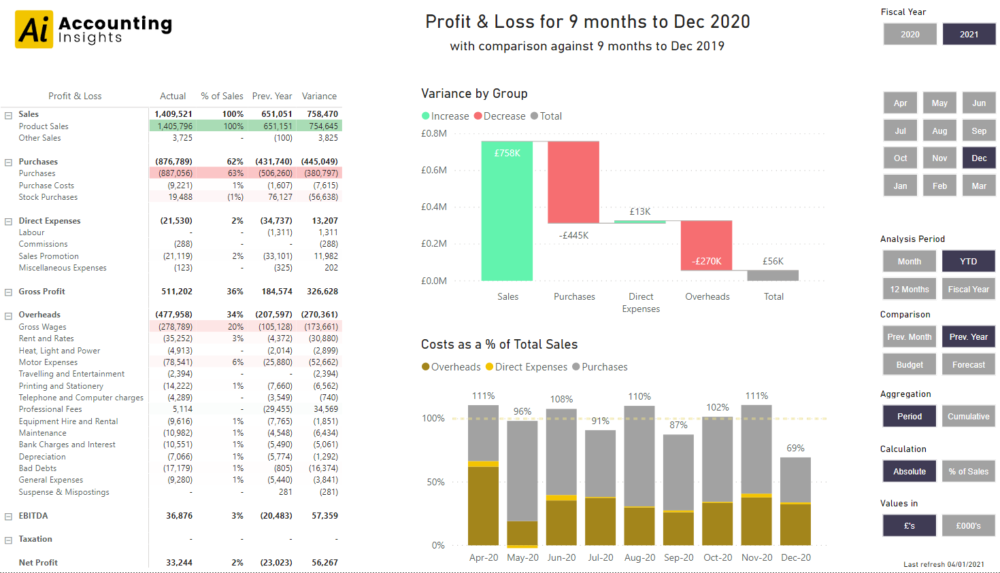

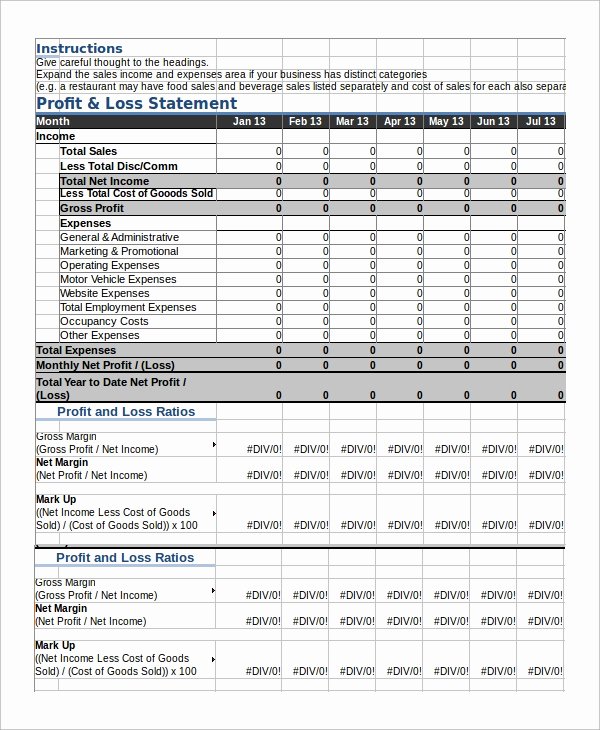

31, from a profit of c$117 million or c$0.17 per share, a year. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. A p&l statement provides information.

Income & expenses tracker, profit & loss log book for small businesses, 160 pages 8.5x11, bookkeeping ledger, budget tracker crystal wambeke 5.0 out of 5. A profit and loss account is a general ledger account that constitutes part of your profit and loss statement. February 11, 2024 at 1:17 pm pst.

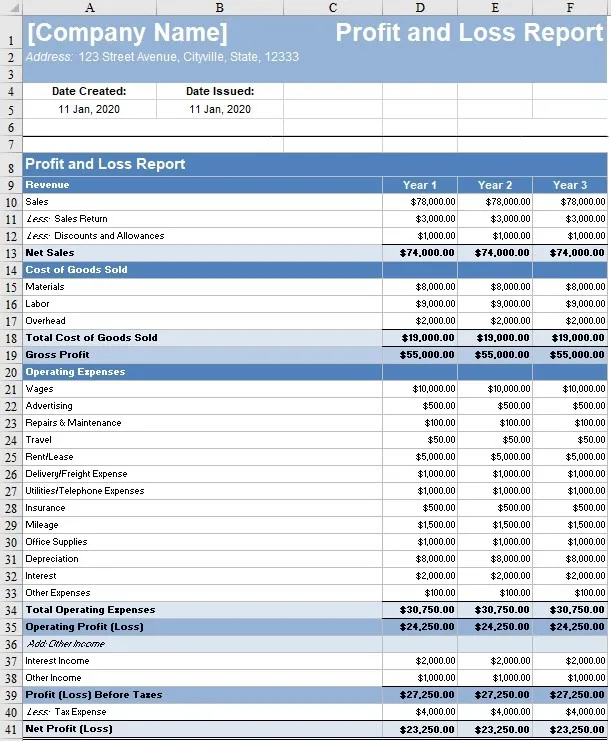

The company reported a net loss of c$1.45 bln or c$2.09 per share, for the quarter ended dec. A profit and loss statement is a type of financial statement that defines and lists all the expenses borne by an organization as well as the revenue earned during the. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

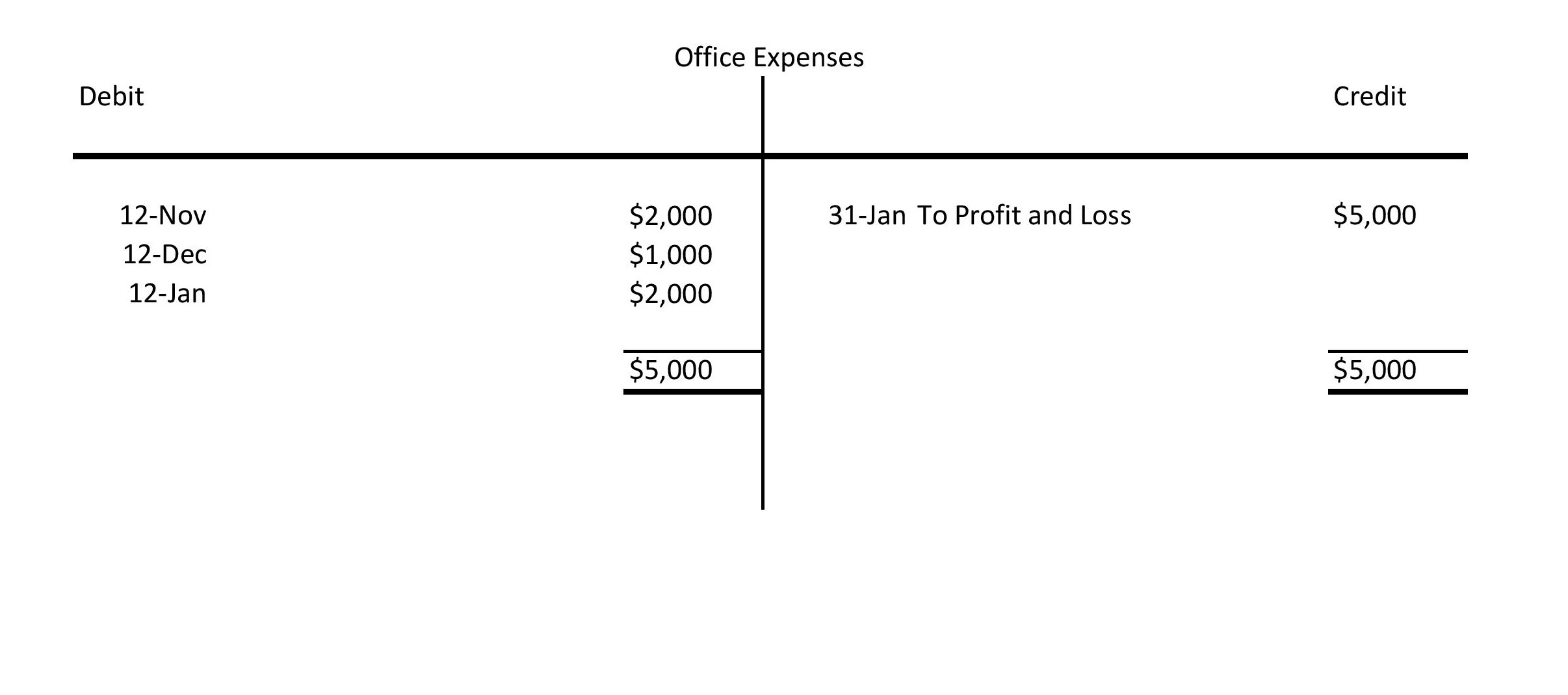

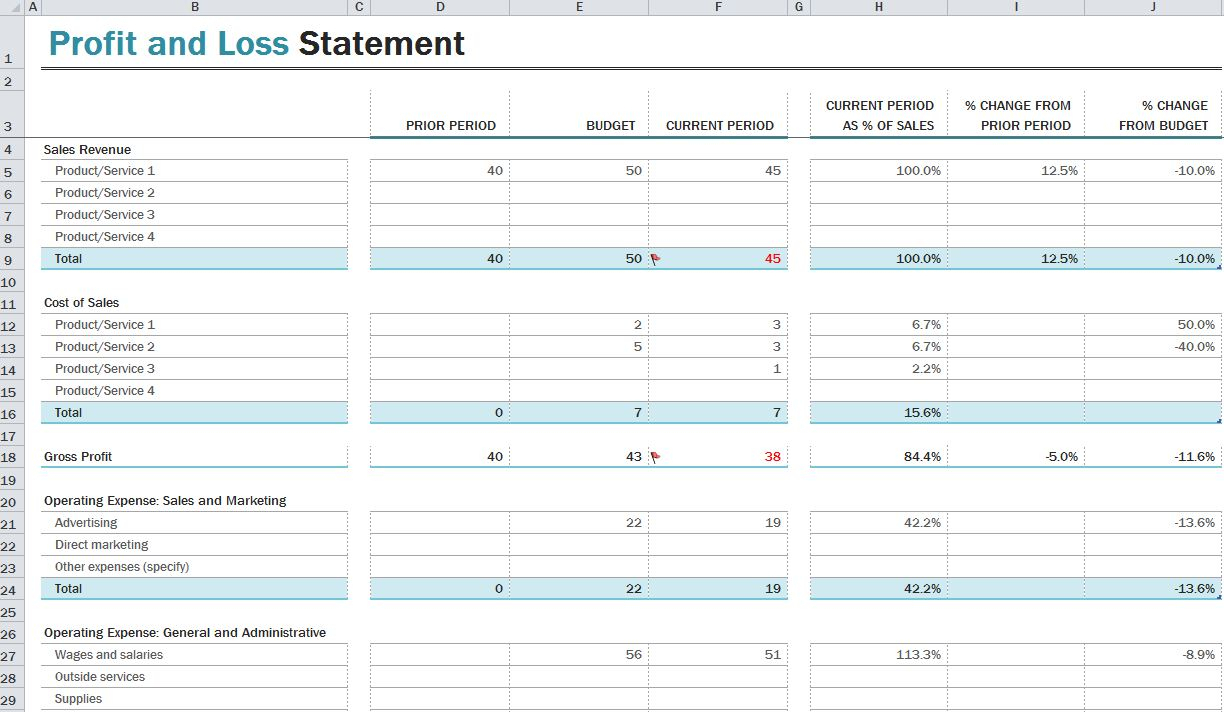

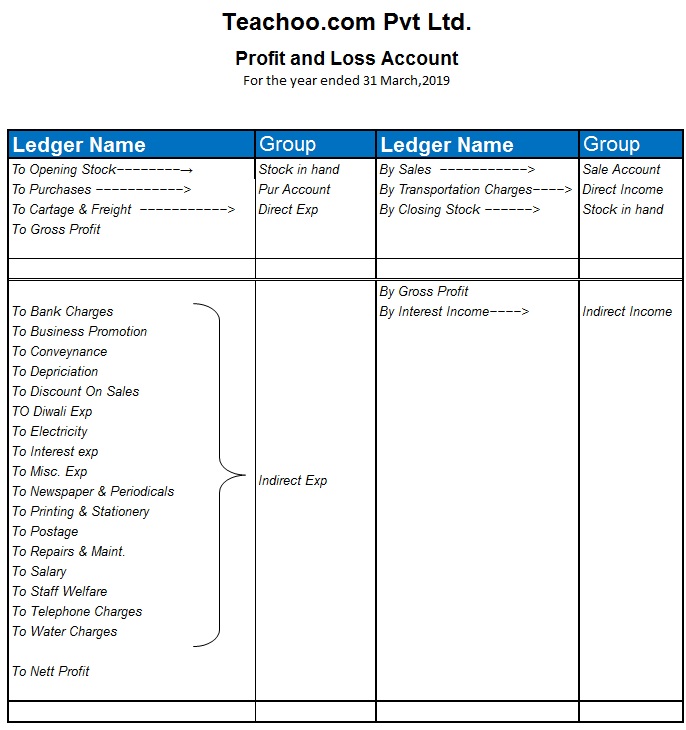

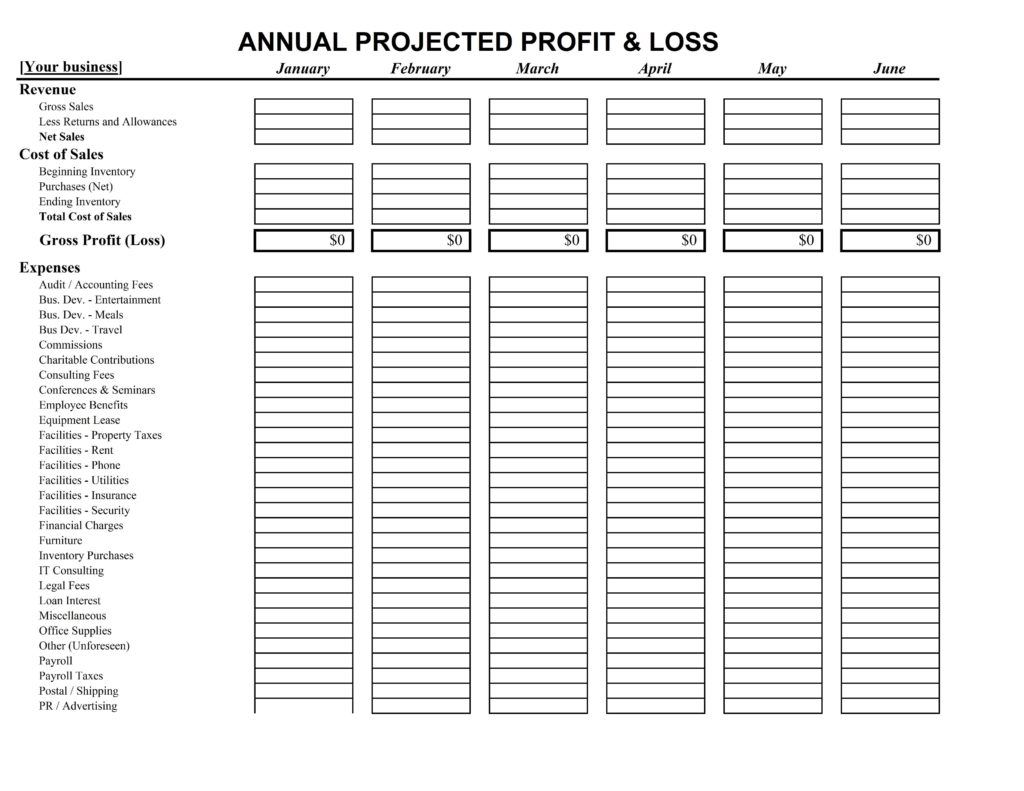

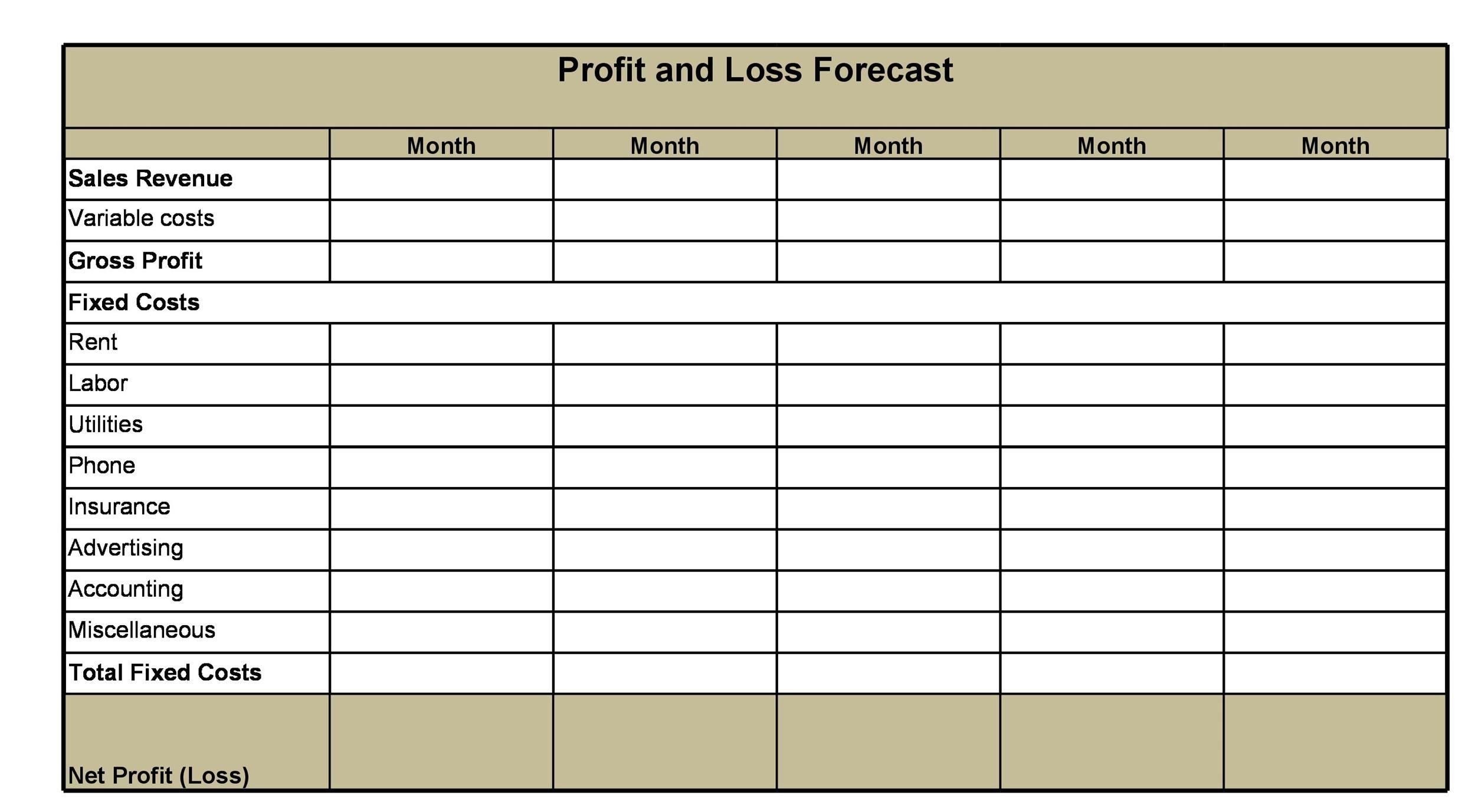

The trading profit and loss account is made up of two separate accounts within the general ledger. Simple general ledger template. Below is the process to prepare the profit & loss statement:

The general ledger and the profit & loss report are both critical tools in the accounting process, serving distinct purposes. The jets were one of the nfl's. An account statement must be prepared for each ledger from the journal book.

What does a profit and loss statement tell you? A profit and loss b account will have a general ledger category of. Using the above p&l example, we can make the following calculations:

The profit and loss statement helps you to assess the financial position of a business by providing the details of incomes and expenses incurred by a business during a particular. The trading account the profit and loss account the purpose. The ledger provides a complete record of financial.

A profit and loss statement is a company’s financial report summarizing the costs, revenues and expenses a. A p&l statement compares company revenue against expenses to. The single step profit and loss statement formula is:

The p&l statement shows a company’s ability to generate sales, manage expenses, and create. It summarises the revenues, costs, and expenses for a. A general ledger is a company's set of numbered accounts for its accounting records.