Breathtaking Info About Depreciation In Income Statement

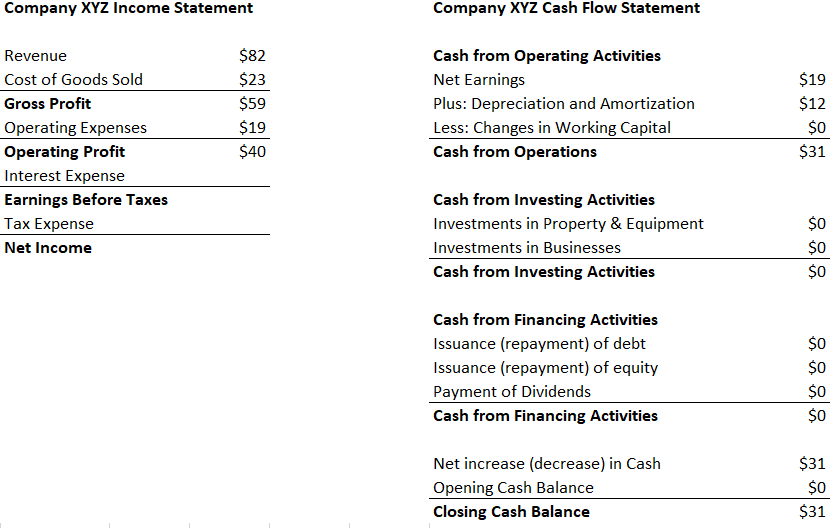

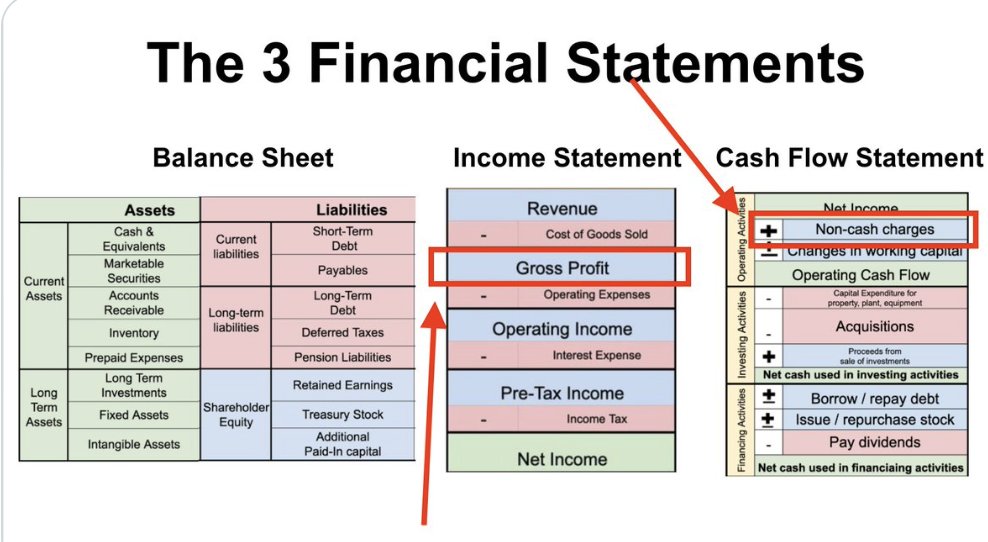

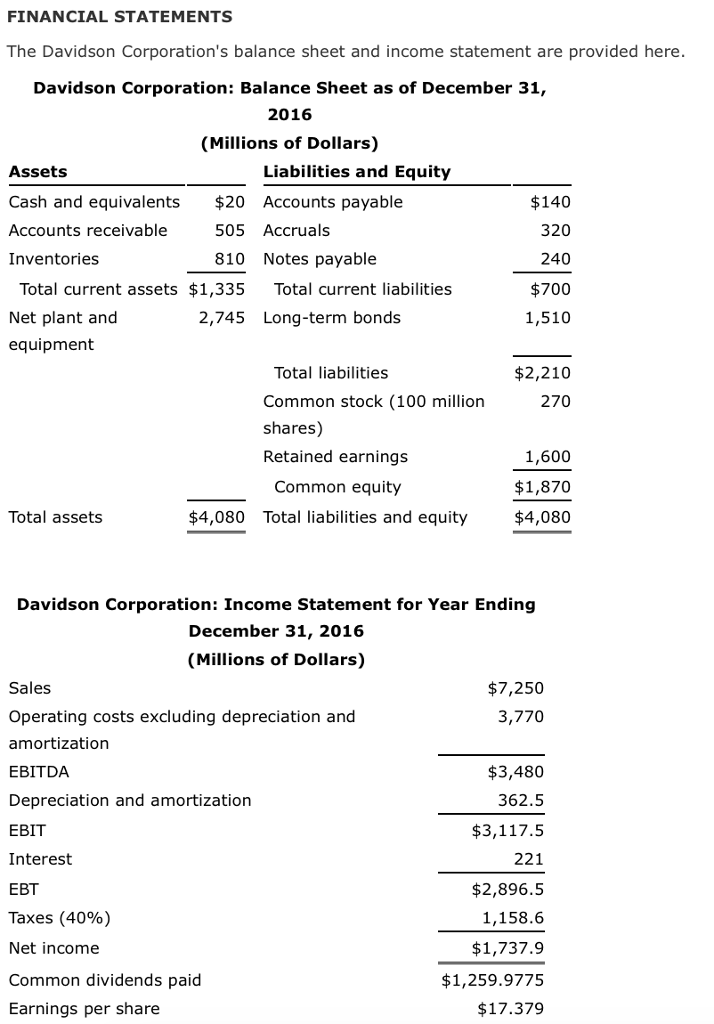

Income statement → if depreciation increases by $10, operating income (ebit) would decrease by $10.

Depreciation in income statement. It is typically included as part of operating expenses. Assuming a 30% tax rate, net income would decline by $7. The income statement is a useful way to see how a company makes money and how it spends it.

This is known as depreciation, and it is the source of depreciation expenses that appear on corporate income statements and balance sheets. Depreciation is the process of. This 100% deduction applies to assets with a recovery period of 20 years or less, including machinery, equipment, and furniture.

Each year, the income statement is hit with a $1,500 depreciation expenses. A depreciation expense reduces net income when the asset's cost is allocated on the income statement. Depreciation represents the cost of capital assets on the balance sheet being used over time, and.

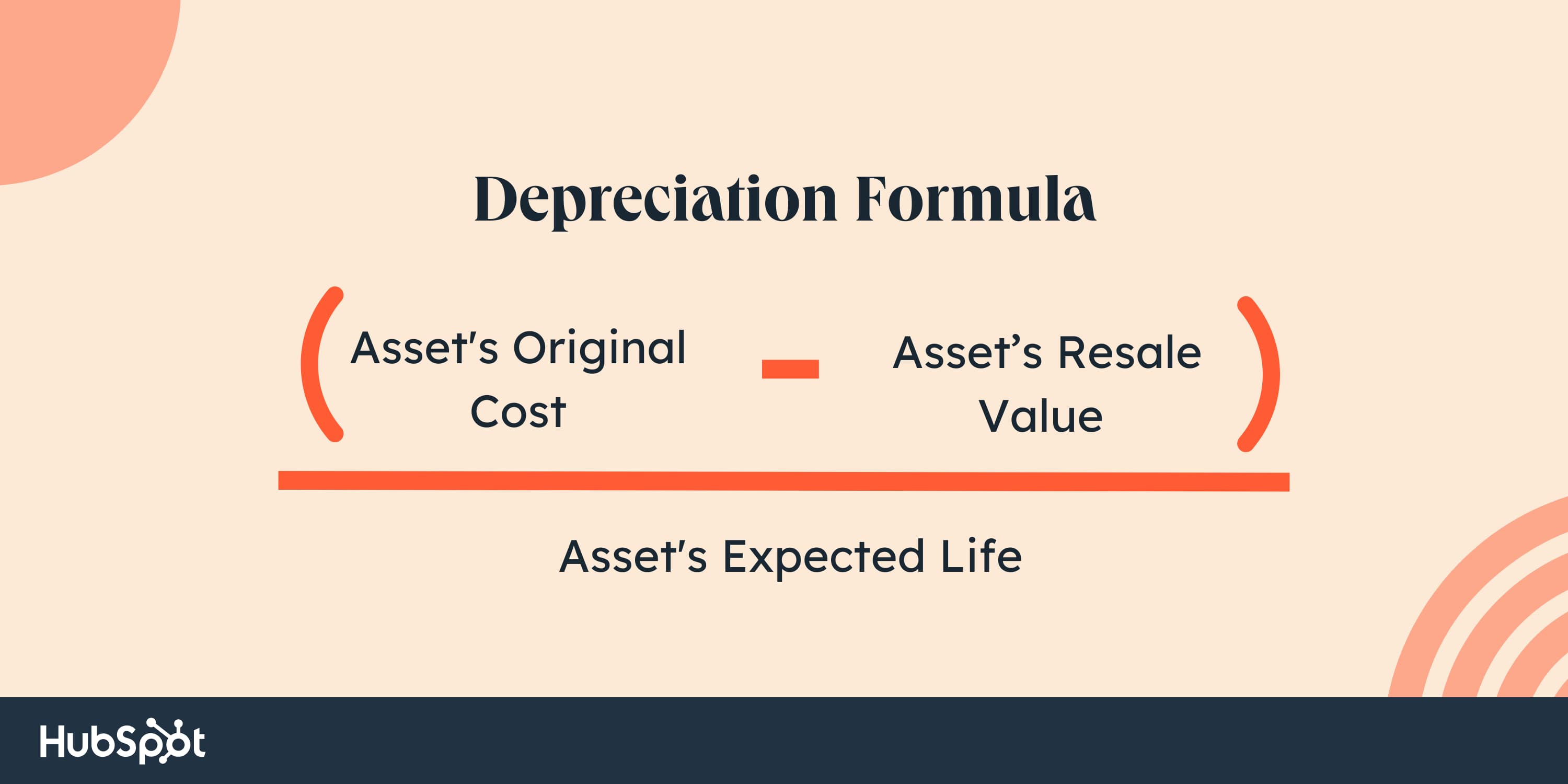

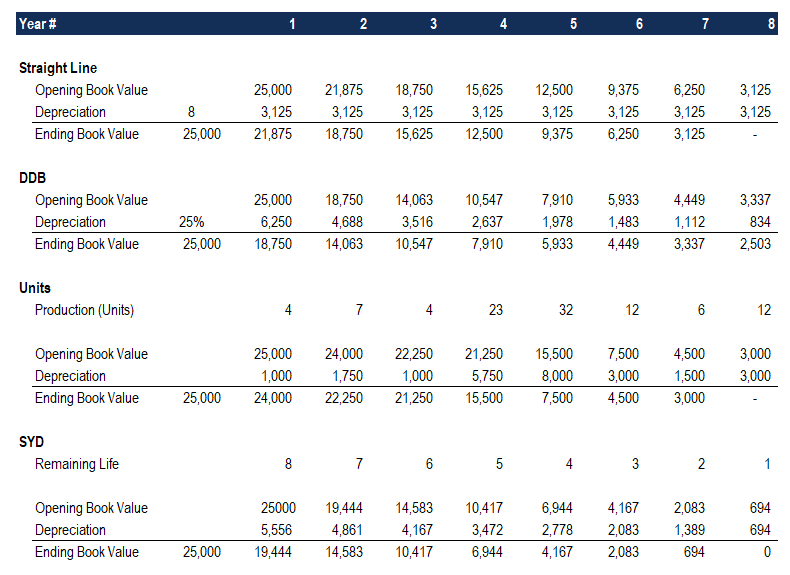

You can look at an income. Depreciation = [(useful life remaining / sum of years digits) × 100] × depreciable bottling machine value. Depreciation is an amount that reflects the loss in value of a company's fixed asset.

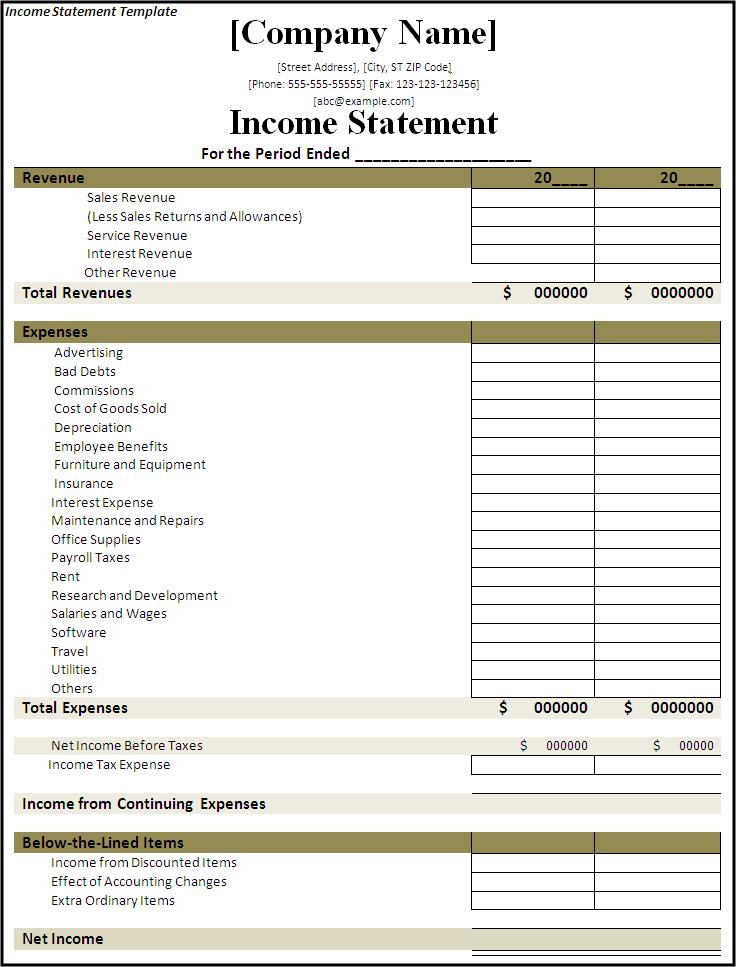

In this guide, we will break down everything you need to know about income statement depreciation and how it plays a crucial role in procurement and accounting practices. Alameda county tax statement for this property, michael's improvement value is $672,000, which is the total amount of depreciation deductions he can claim over 27.5 years as a residential rental. This amount shows the portion of the asset's cost used up during the accounting period.

Using our example, the monthly income statements will report $1,000 of depreciation expense. For accounting purposes, the depreciation expense is. It is an estimated expense that is scheduled rather than an explicit.

Depreciation is used to account for declines in the value of a fixed asset over time. Equipment, vehicles and machines lose value with time, and companies record it incrementally through depreciation. Written by masterclass last updated:

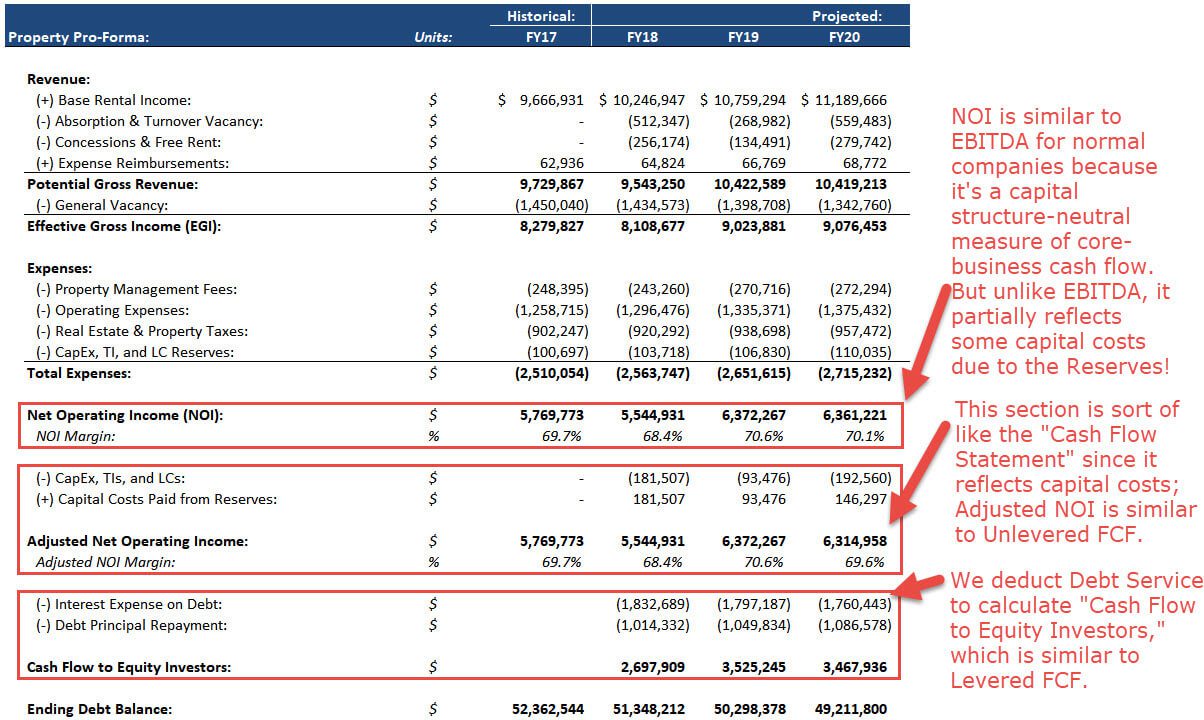

As no entry is made in the fixed asset account, it continues to show the historical cost of the asset. The depreciation term is found on both the income statement and the balance sheet. Depreciation expense for the past decade, sherry’s cotton candy company earned an.

Revenue minus expenses equals profit or loss. Using this new, longer time frame, depreciation will now be $5,250 per year, instead of the original $9,000. When depreciation expenses appear on an income statement, rather than reducing cash on the balance sheet, they are added to the accumulated depreciation account.

As opposed to recording the entire cost of an asset as soon as it’s bought, businesses record depreciation as a periodic expense on the income statement. Keeping a separate provision for depreciation account for each fixed asset offers the following advantages: Depreciable bottling machine value = $100,000

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)