Can’t-Miss Takeaways Of Tips About Depreciation In Balance Sheet Is Considered As

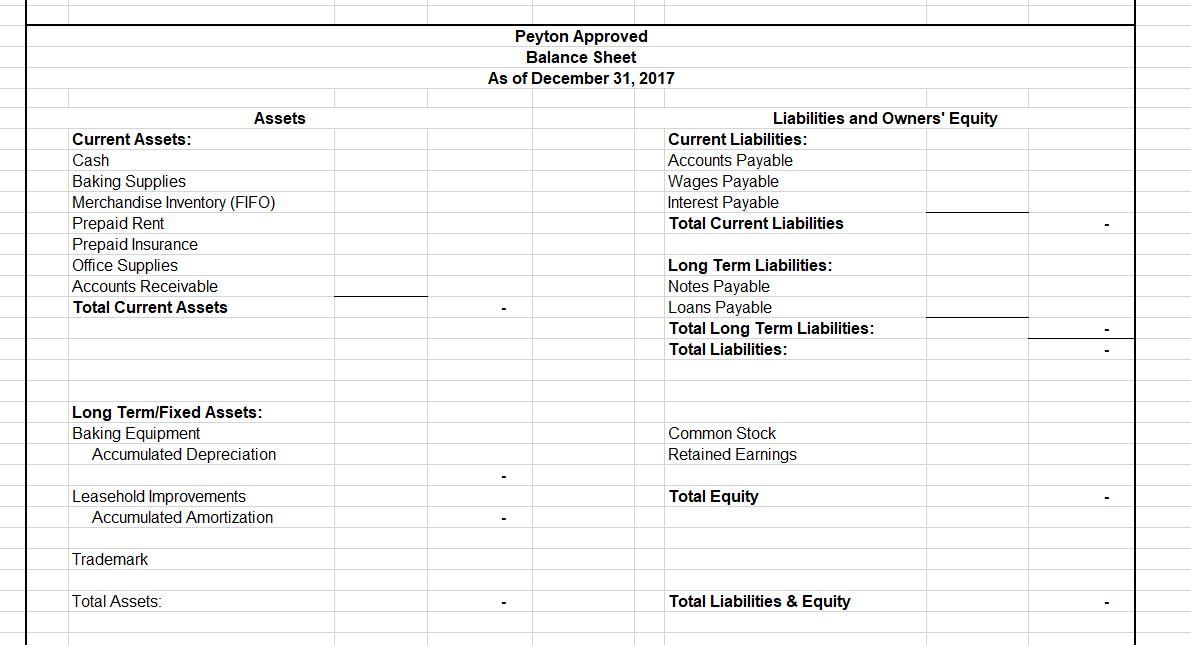

In accountancy, depreciation is a term that refers to two aspects of the same concept:

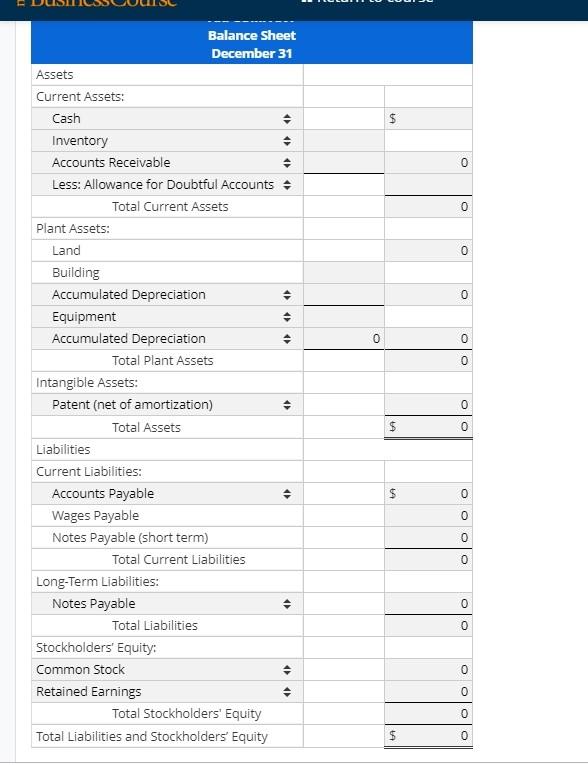

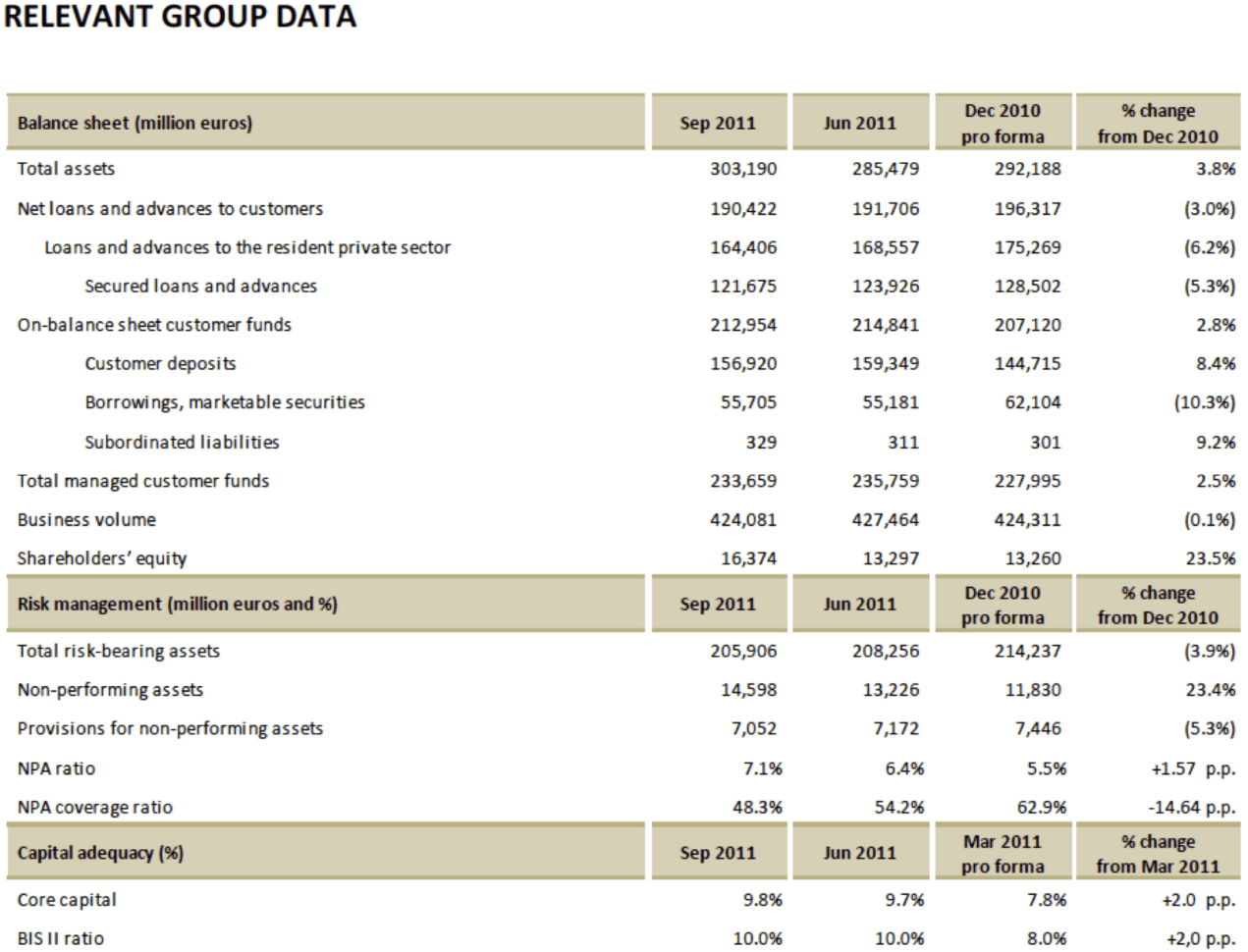

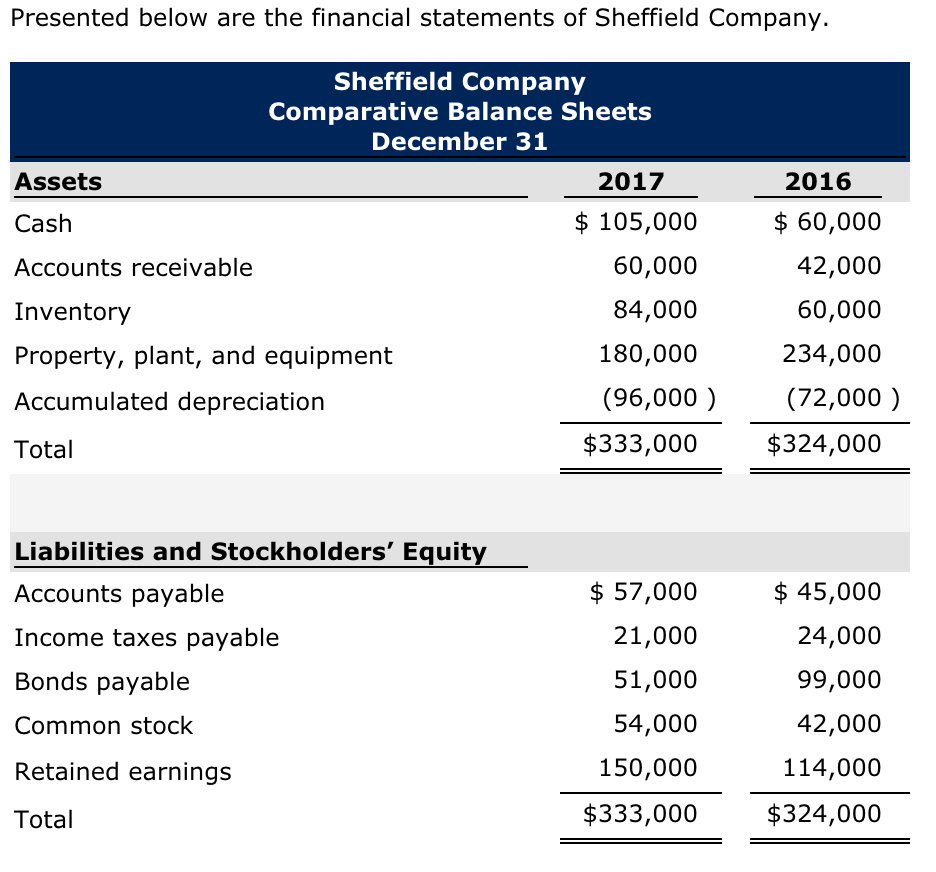

Depreciation in balance sheet is considered as. On the balance sheet, it is listed as accumulated depreciation, and refers to the cumulative amount of depreciation that has been charged against all fixed assets. The net difference or remaining amount that has yet to be depreciated is the asset's net book value. In short, by allowing accumulated depreciation to be recorded as a credit, investors can.

It appears as a reduction from the gross amount of fixed assets. The 0.668 crs has been written off the books of account and is no longer considered as assets, hence. Accumulated depreciation is to be reduced from the asset’s book value to represent the true value of the asset.

The total decrease in the value of an asset on the balance sheet over time is accumulated depreciation. Depreciation is an expense, so it can be difficult to understand how it can affect the balance sheet. If you must make a choice between classifying accumulated depreciation as an asset or liability, it should be considered an asset, simply because that is where the account is reported in the balance sheet.

Showing contra accounts such as accumulated depreciation on the balance sheets gives the users of financial statements more information about the company. Accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. Over time, as the asset is used and wears down, it loses value.

Depreciation is normal wear and tear in the asset’s value as the asset value gets depreciated with the usage and passage of time. As a noncash expense, depreciation writes off the value of assets over time. On an income statement or balance sheet.

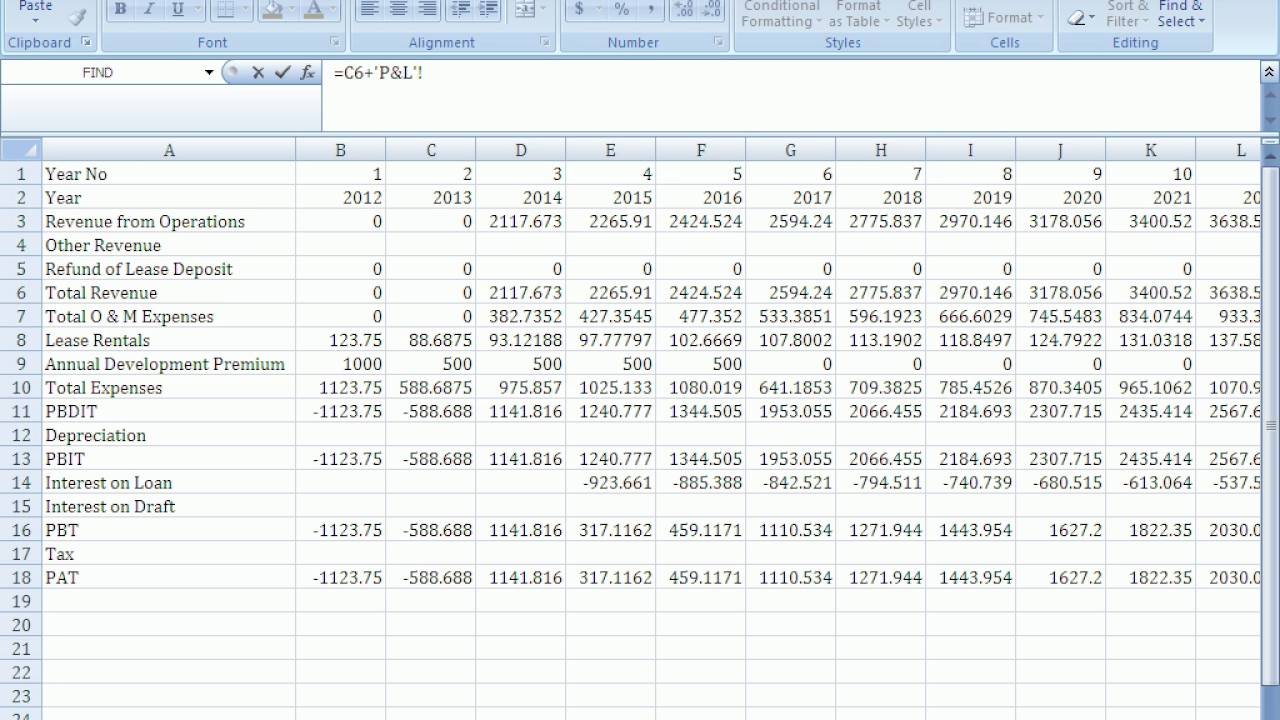

Depreciation is a financial accounting method used to allocate the cost of tangible assets over their useful lives. On the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period. The depreciation expense appears on a profit and loss statement, while the book value and accumulated depreciation accounts appear on a balance sheet.

For income statements, depreciation is listed as an expense. Depreciation expense has a direct impact on the balance sheet through the following components: This decrease in the carrying value of the asset is reflected on the balance sheet, reducing the total.

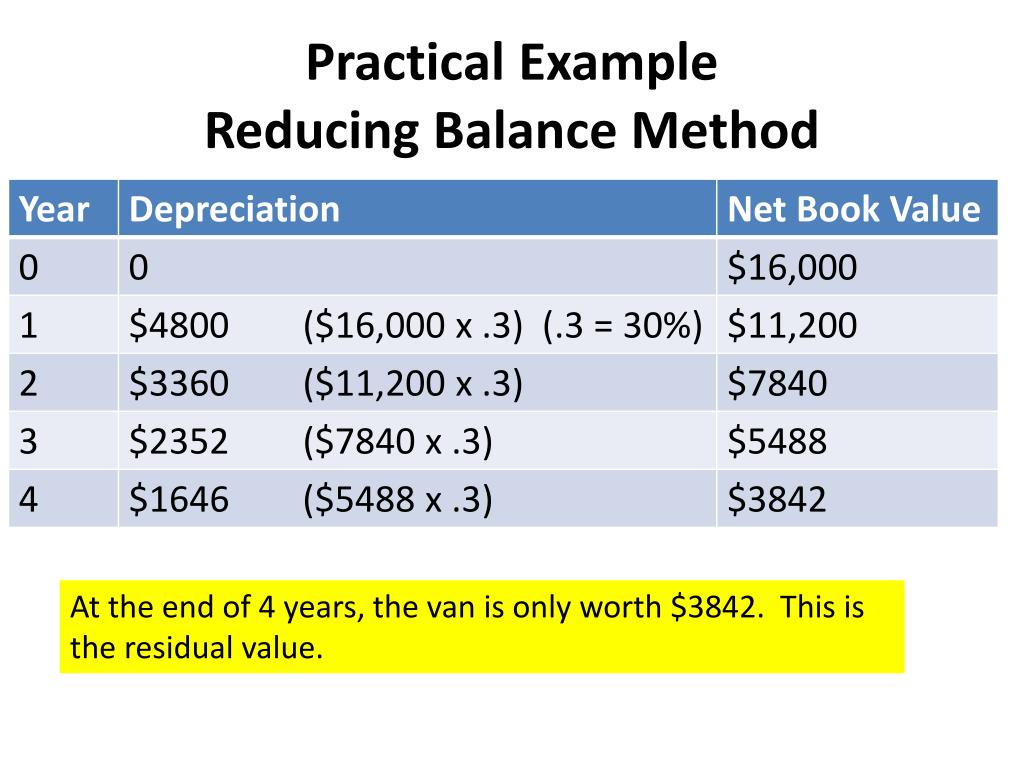

Hence the depreciation in the balance sheet is accumulated year on year. Using the straight line depreciation method, the tractor would depreciate by $5,000 per year for a total accumulated depreciation of $20,000. This loss in value is called depreciation.

Accumulated depreciation is listed on the balance sheet. It accounts for depreciation charged to expense for the income reporting period. The cost for each year you own the asset becomes a business expense for that year.

Depreciation is a financial accounting method used to allocate the cost of tangible assets over t. clearias on instagram: Accumulated depreciation is total wear and tear in the value of assets to date. Please note, depreciation in the balance sheet is referred to as the accumulated depreciation.