Unbelievable Info About Treatment Of Bank Loan In Cash Flow Statement

Definition of loan principal payment when a company borrows money from its bank, the amount received is recorded with a debit to cash and a credit to a liability account, such as notes payable or loans payable, which is reported on the company's balance sheet.

Treatment of bank loan in cash flow statement. The payment of a dividend is also treated as a financing cash flow. As per the definition in the act, a financial statement includes the following: Cash outflows from buying back equity/shares;

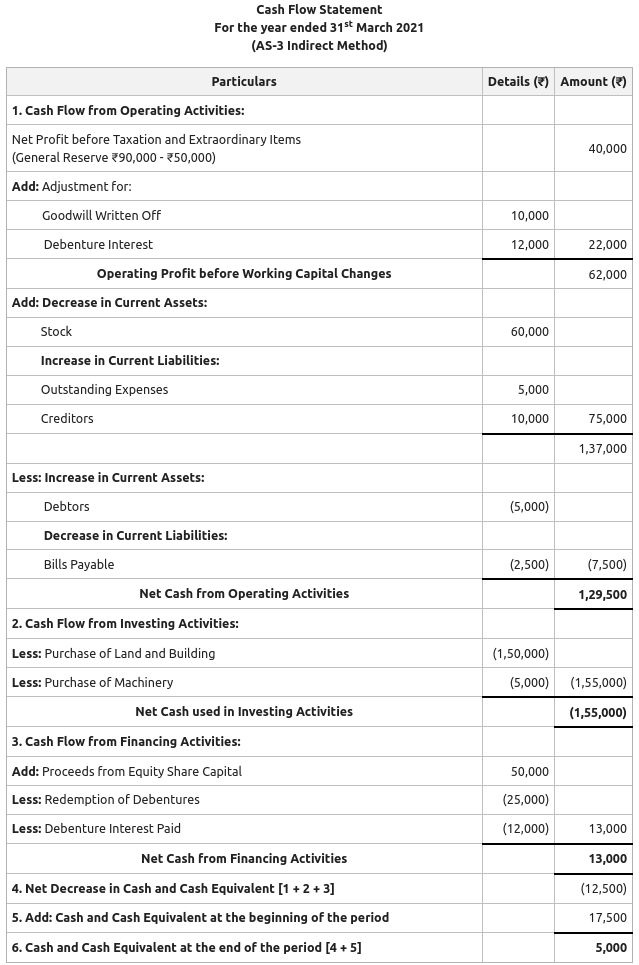

6.11.1 presenting the cash flows of foreign operations. Since most companies use the indirect method for the statement of cash flows, the interest expense will be. In the statement of cash flows, interest paid will be reported in the section entitled cash flows from operating activities.

Fundamental principle in ias 7 As mentioned above, the first part includes removing the expense from the net profits. Short term loans and advances treatment in cash flow statement.

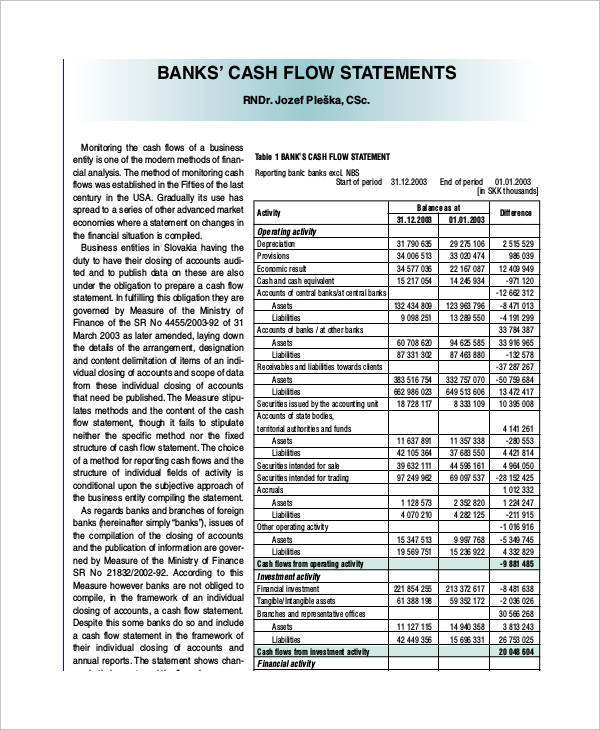

Since these expenses are not cash items, including them in the cash flow statement is not applicable. Ias 7 2021 issued ifrs standards (part a) ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the international accounting standards committee in december 1992. Cash inflows from raising loans, mortgages and other borrowings;

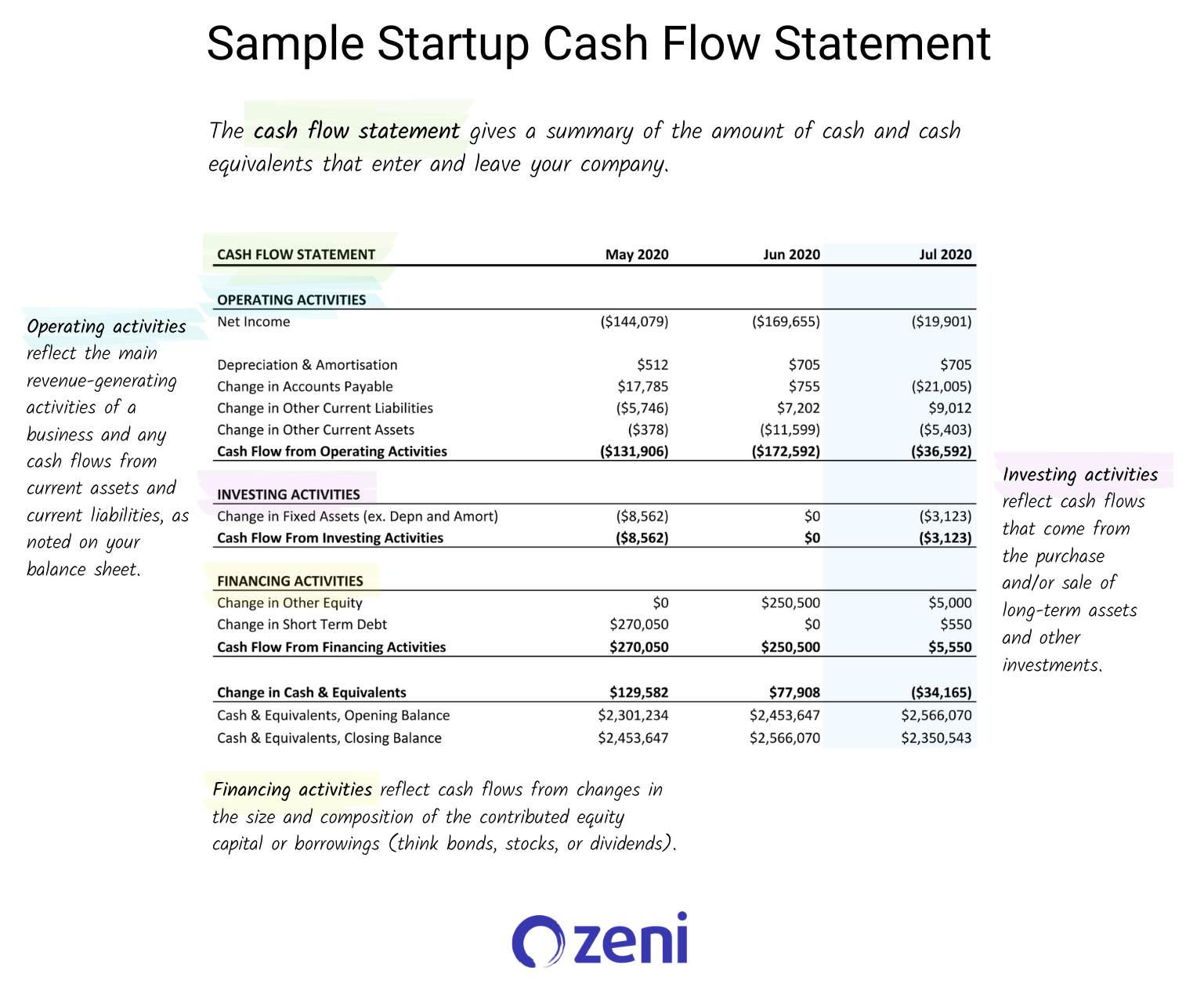

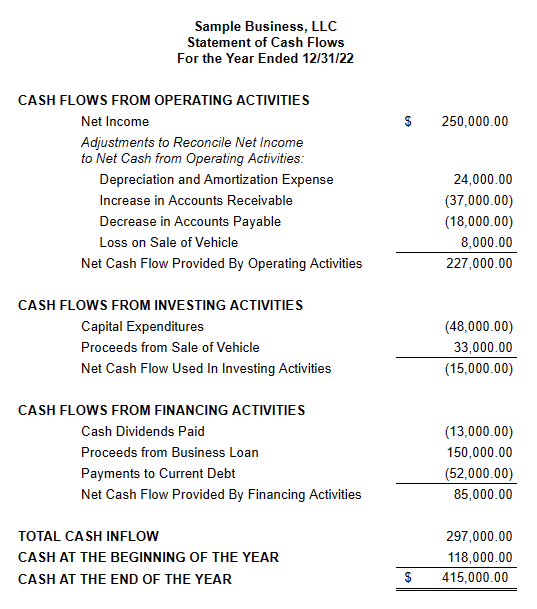

The cash received from the bank loan. Examples of cash flows from financing activities include: A cash flow statement tells you how much cash is entering and leaving your business in a given period.

Cash flows are classify and screened into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with and latter two categories generally presented on a gross basic. The treatment of provision in the cash flow statement occurs through cash flows from operating activities. Cash flow from financing (cff) activities is a category in a company’s cash flow statement that accounts for external activities that allow a firm to raise.

The indirect method reports cash flows from operating activities into categories such as: Provide the committee with a summary of the matter; The applicability of cash flow statement has been defined under the companies act, 2013.

Cash flow from financing activities: Cash inflows from sale of equity/shares; Whichever method be used, the end result under all three activities i.e.

The article will explain how to calculate cash flows and where those cash flows are presented in the statement of cash flows. How a loan repayment is disclosed in statement of cash flows? The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of cash flows, which classifies cash flows during the period according to operating, investing, and financing activities.

The statement of cash flows for each distinct and separable operation should be prepared on a standalone basis in its respective. Cash flow from financing activities is the net amount of funding a company generates in a given time period. Cash outflows to pay dividends

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)