Best Info About Stock Adjustment In Profit And Loss Statement

How does overstated inventory affect income statements?

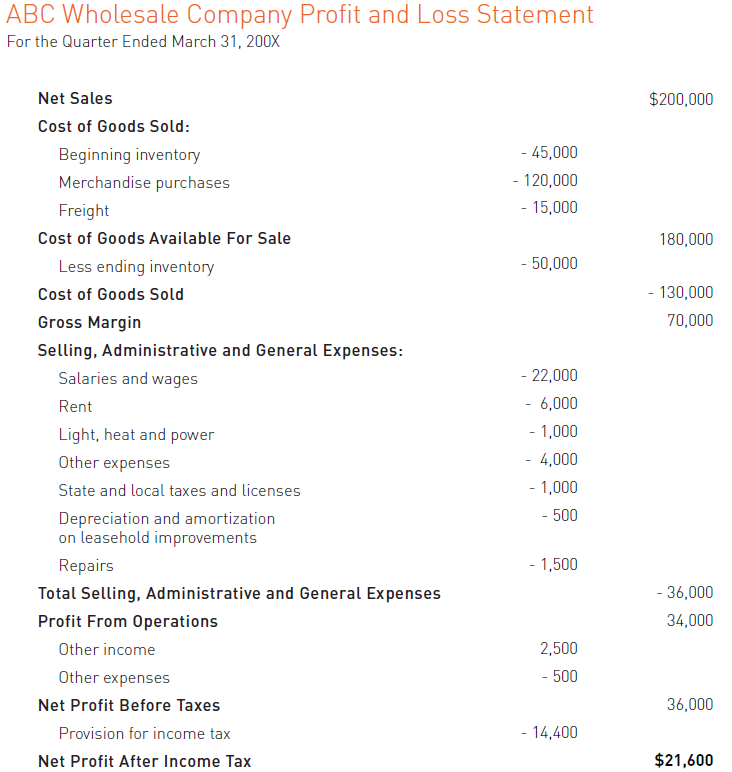

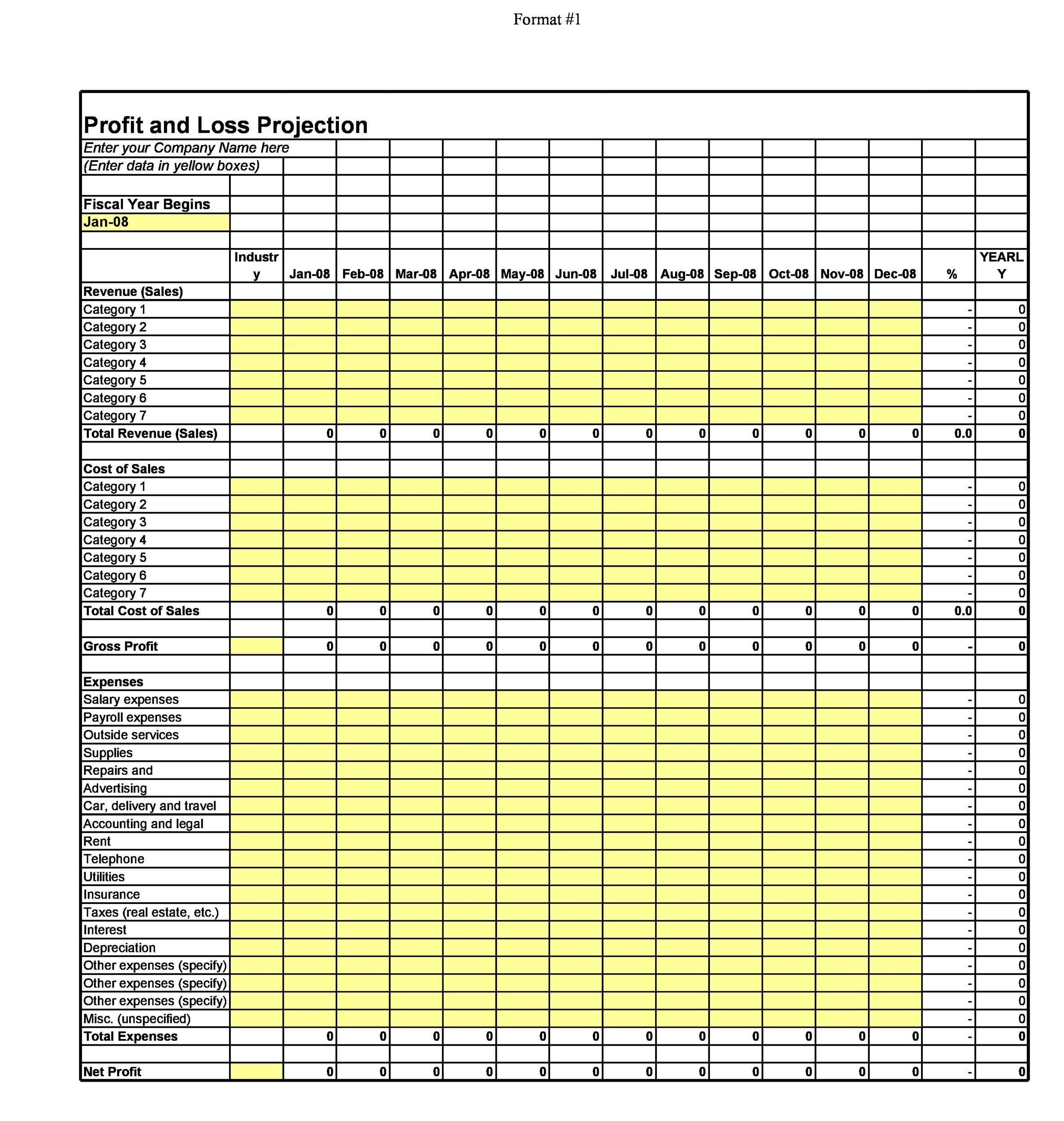

Stock adjustment in profit and loss statement. The closing inventory is therefore a reduction. (b) calculate mooncake ltd's tax adjusted trading loss for the year ended 31 march 2024. What is profit & loss statement?

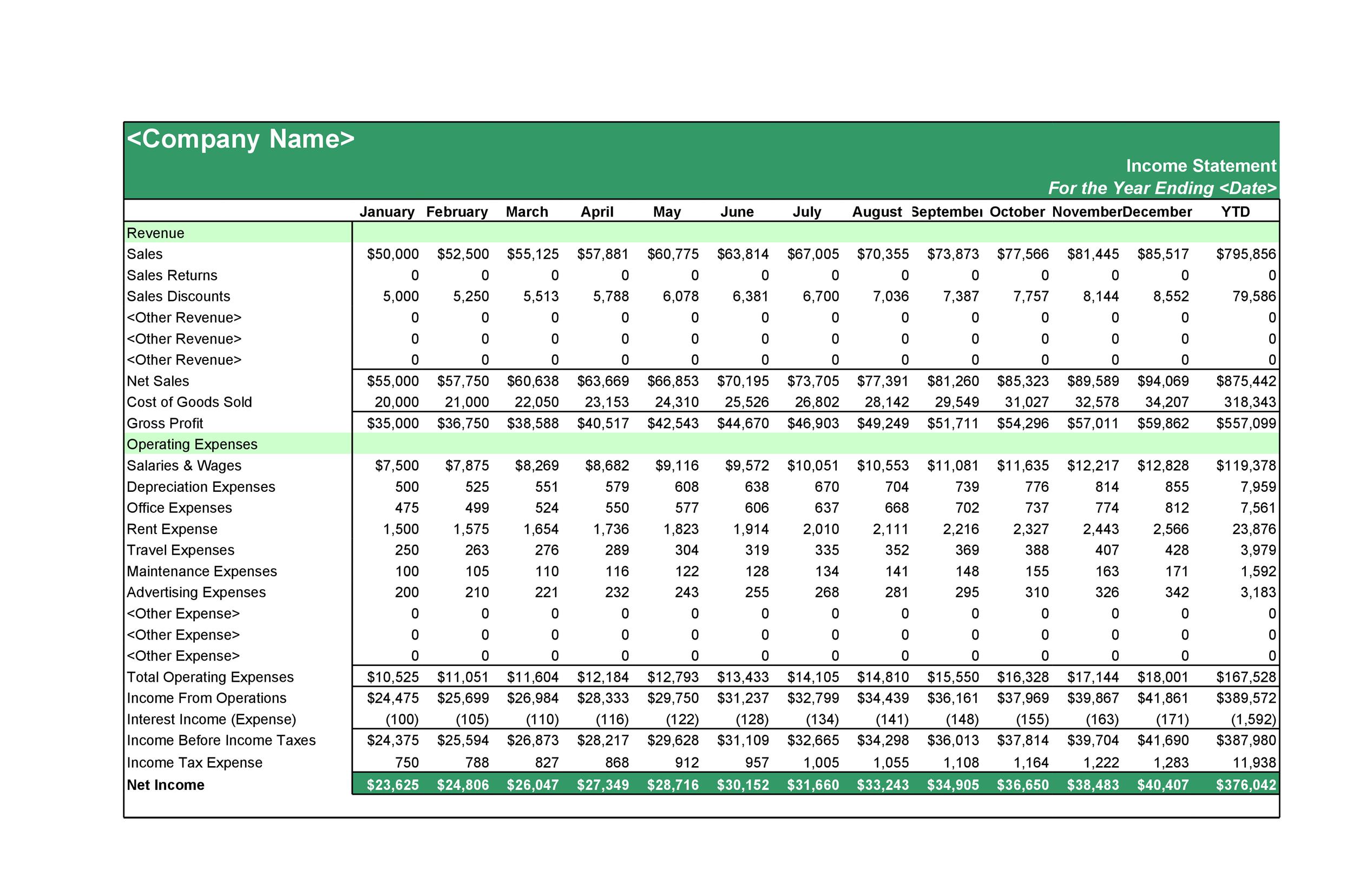

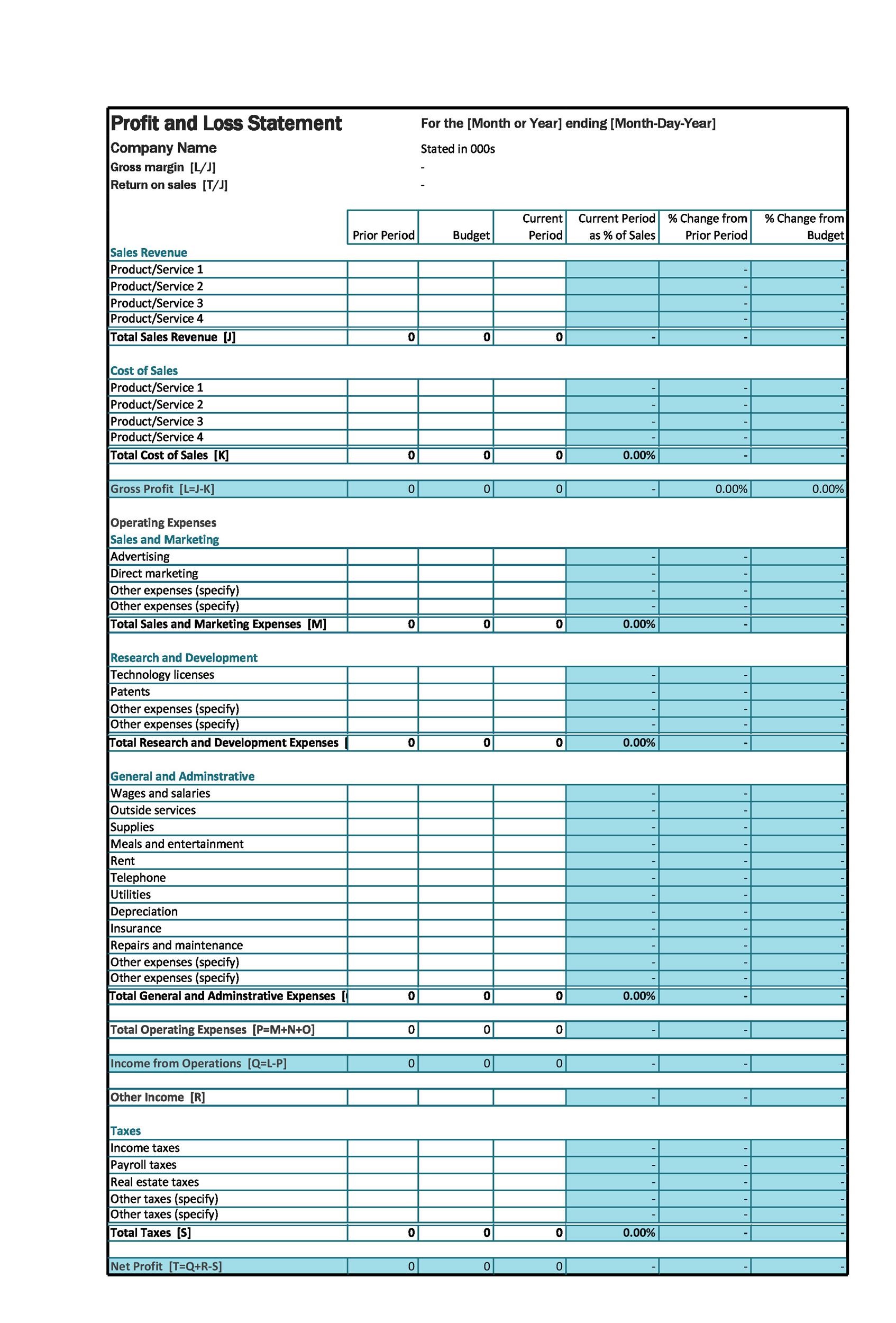

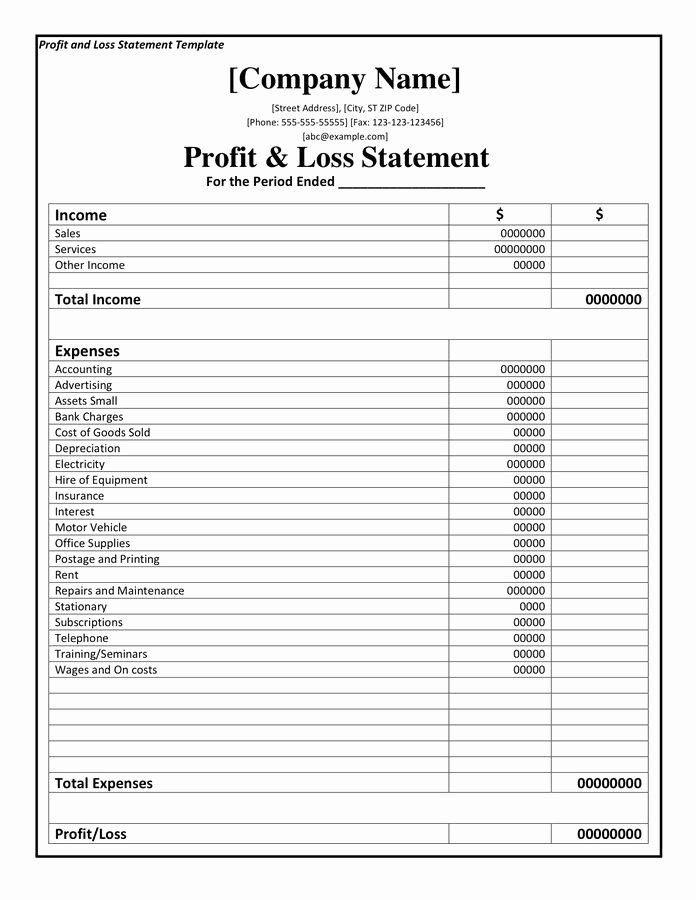

Your p&l statement shows your. This chapter describes profit & loss (p&l) adjustment which is one of the product control that required to ensure the bank's financials report accurately. Adjustment, an alternative performance measure, is a term used by the company which includes material charges or profits caused by movements.

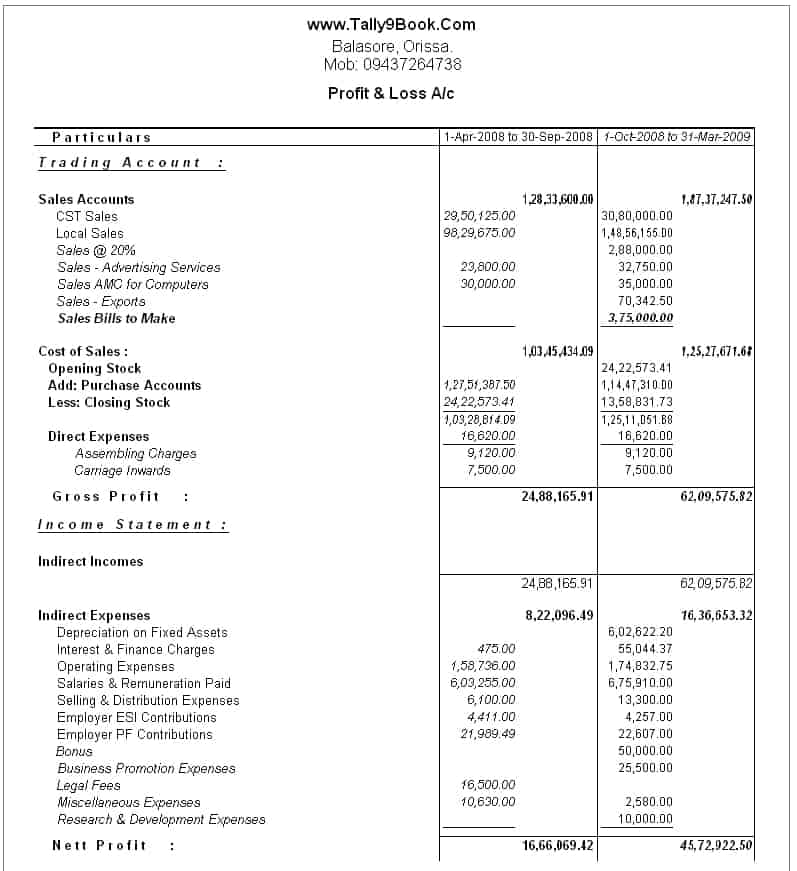

There are a few common stock adjustment outcomes. Adjustment of closing stock in the final accounts the closing stock implies inventory held at the end of the year. When i check the profit and loss statement the stock adjustments value causing negative profit.

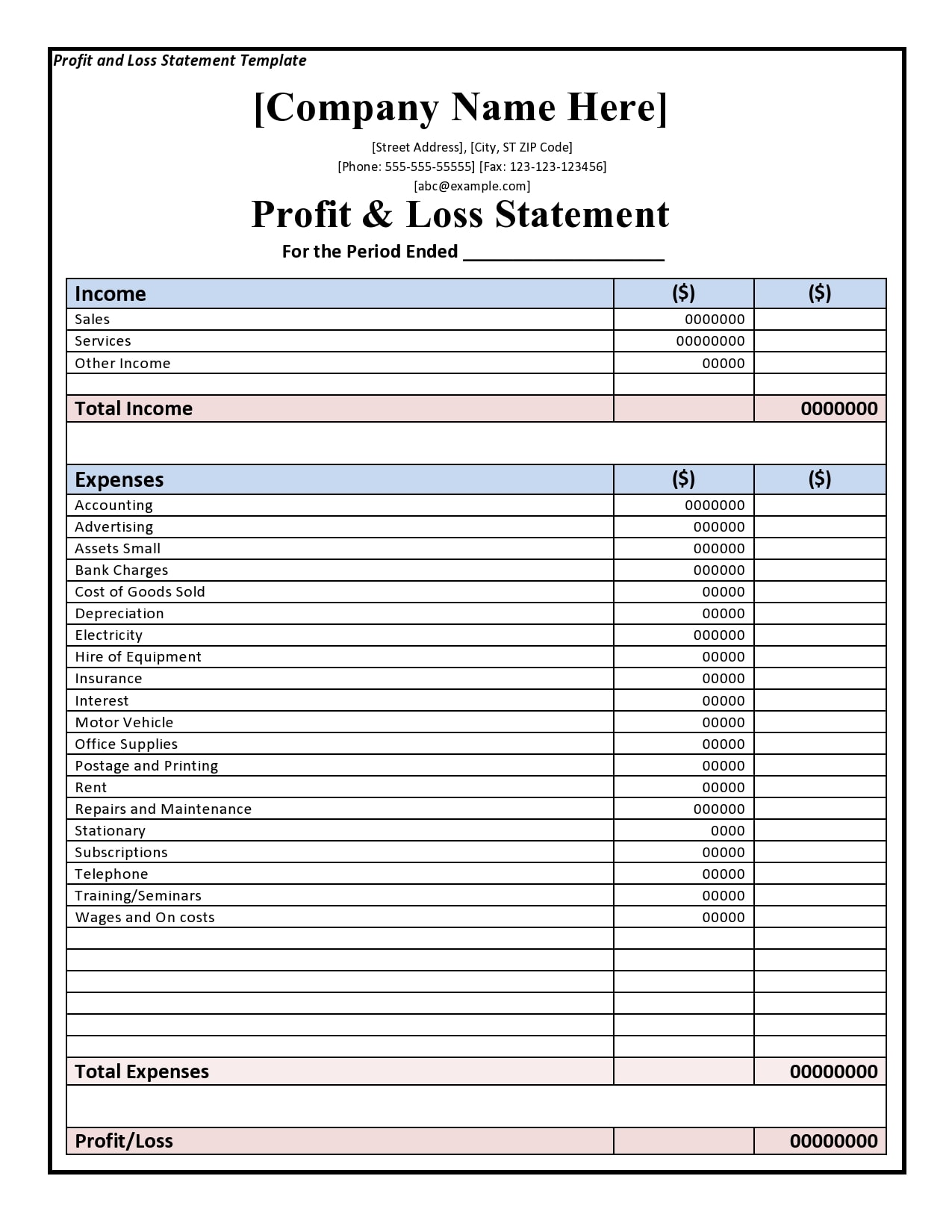

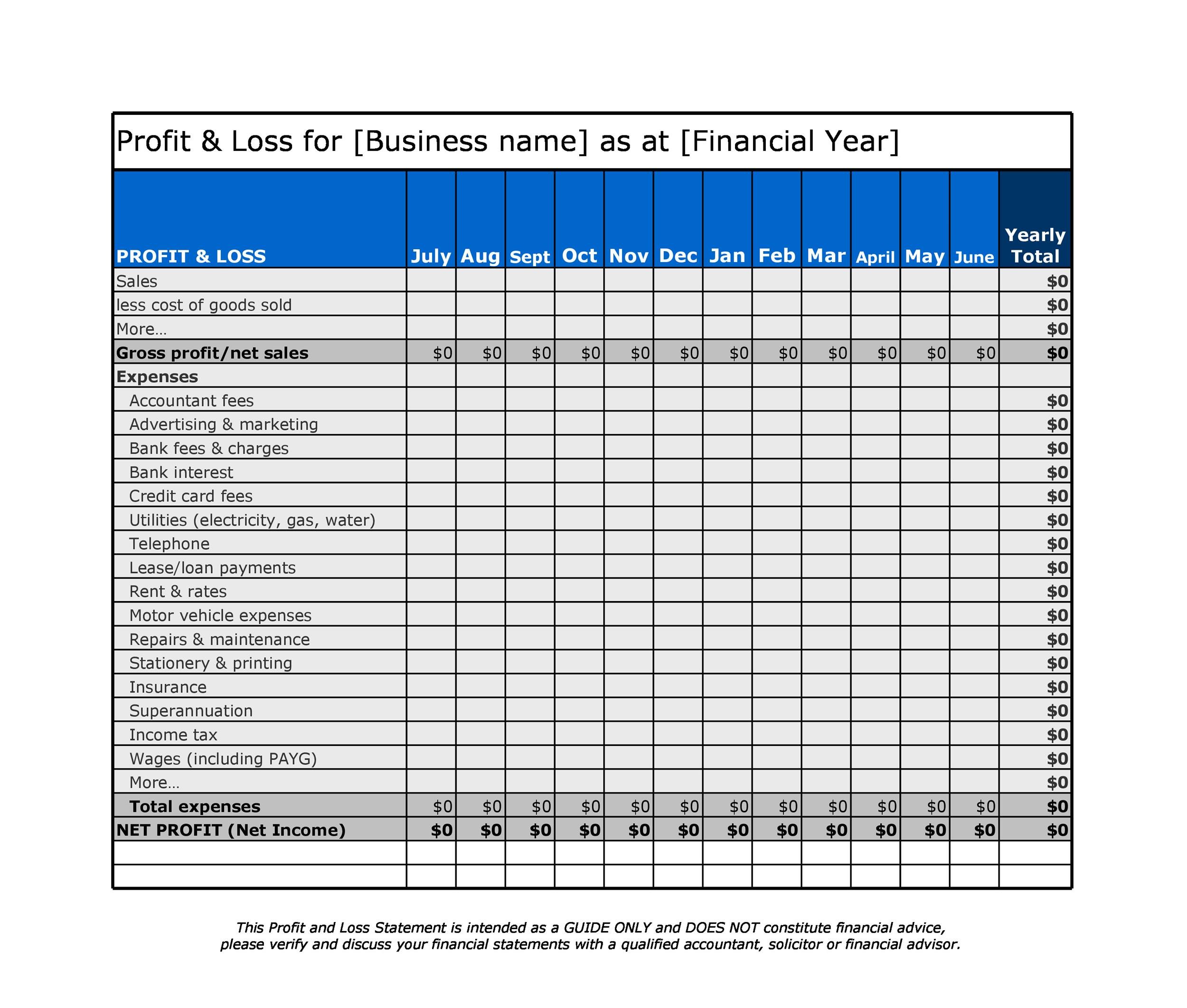

The profit & loss statement is a crucial financial statement summarising the costs, revenues and expenses incurred by a. Realized profits and loss. Ias 27 defines consolidated financial statements as ‘the financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and.

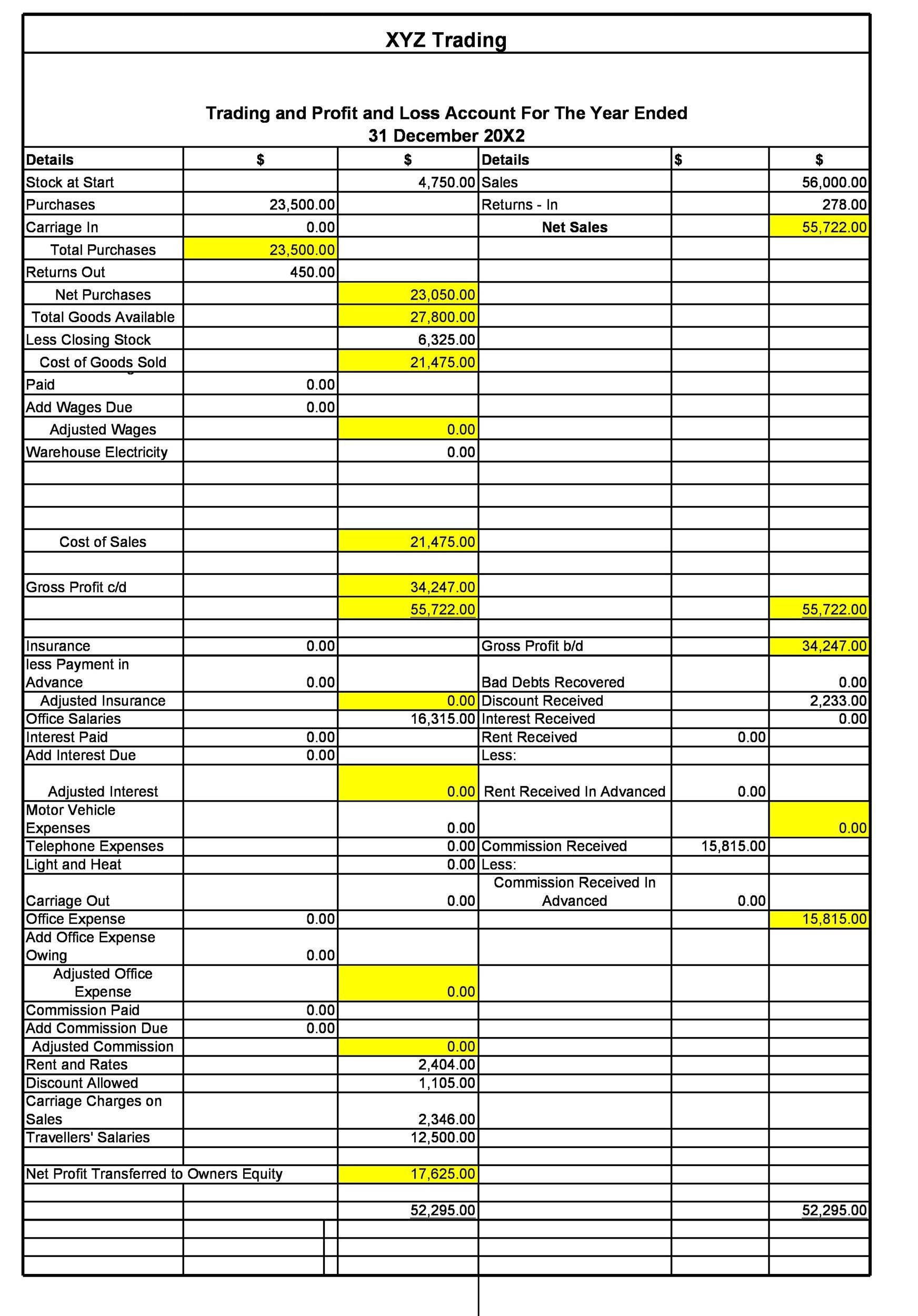

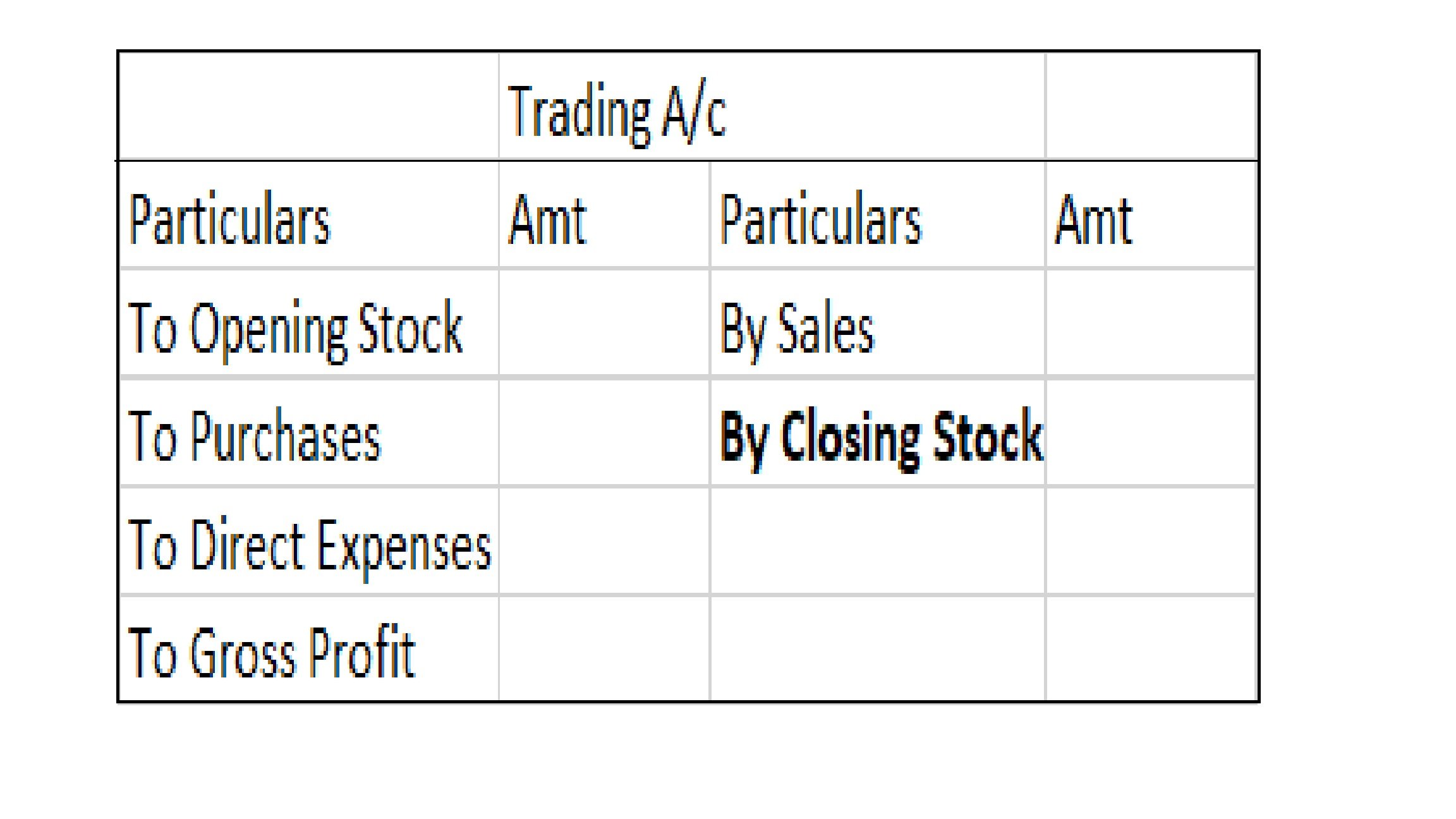

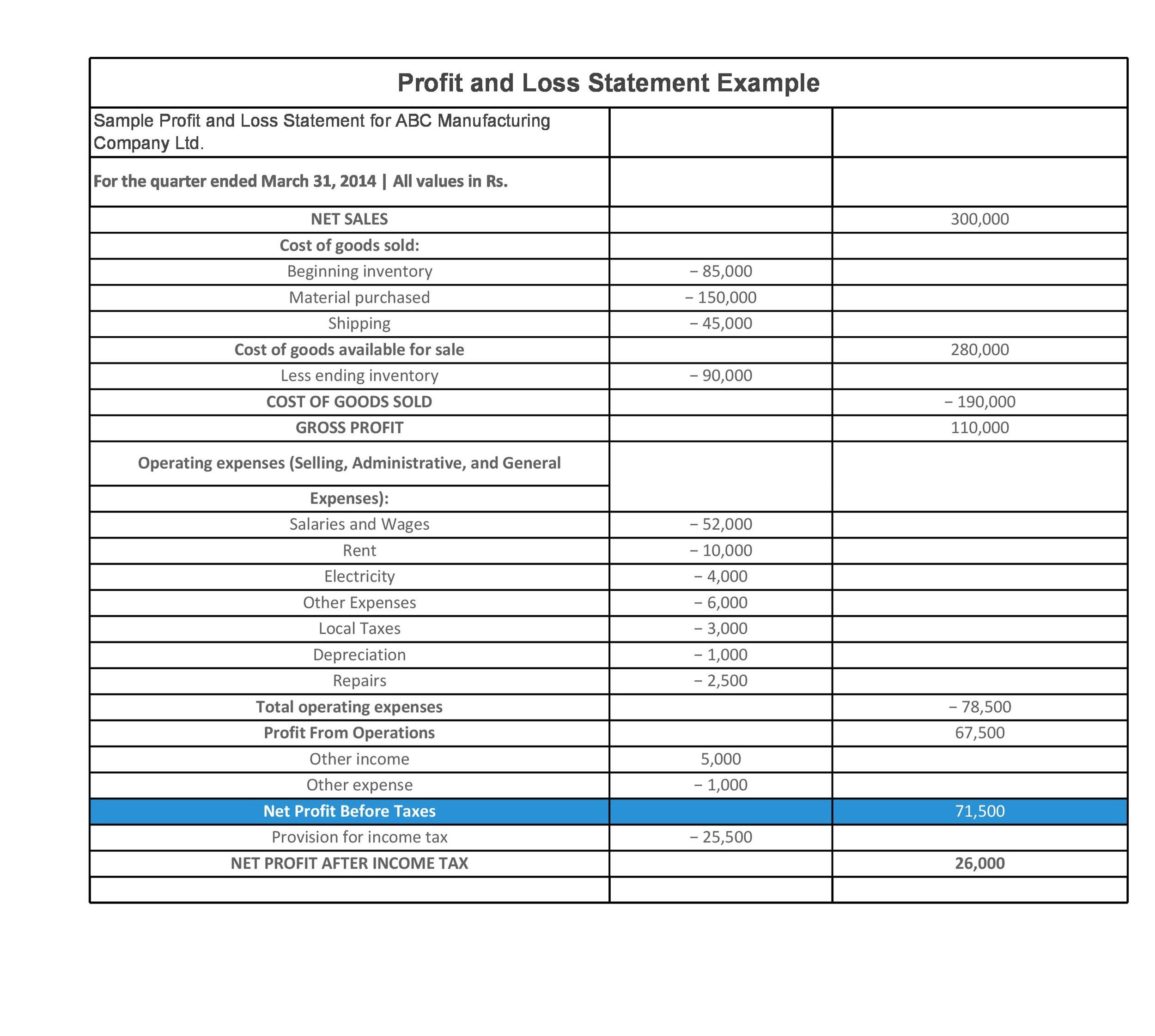

The cost of sales consists of opening inventory plus purchases, minus closing inventory. The first step in creating a profit and loss statement is to calculate all the revenue your business has received. Managers often use this real and important adjustment in production costs to boost profits, however temporarily.

An overstated inventory lowers the. You sell stock and transfer it to the cost of sales on the profit and loss account, also known as the income statement. On this company until now we didn’t entered any expenses.

Using the above p&l example, we can make the following calculations: The first step will be to adjust the operating figure to establish the tax adjusted trading profit. This is a very common adjustment.

Thus, to derive information relating to closing stock we maintain a. A large positive change in finished goods inventory should be viewed as problematic (operational or sales deficiency) and. The following adjustments are therefore required:

Adjustment entry for adjustment of closing stock is as follows: Your computation should commence with the operating loss figure of £93,820,.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Yearly-Profit-Loss-Statement-Template-TemplateLab-790x1101.jpg)