Matchless Tips About Cost Of Goods Sold In Cash Flow Statement

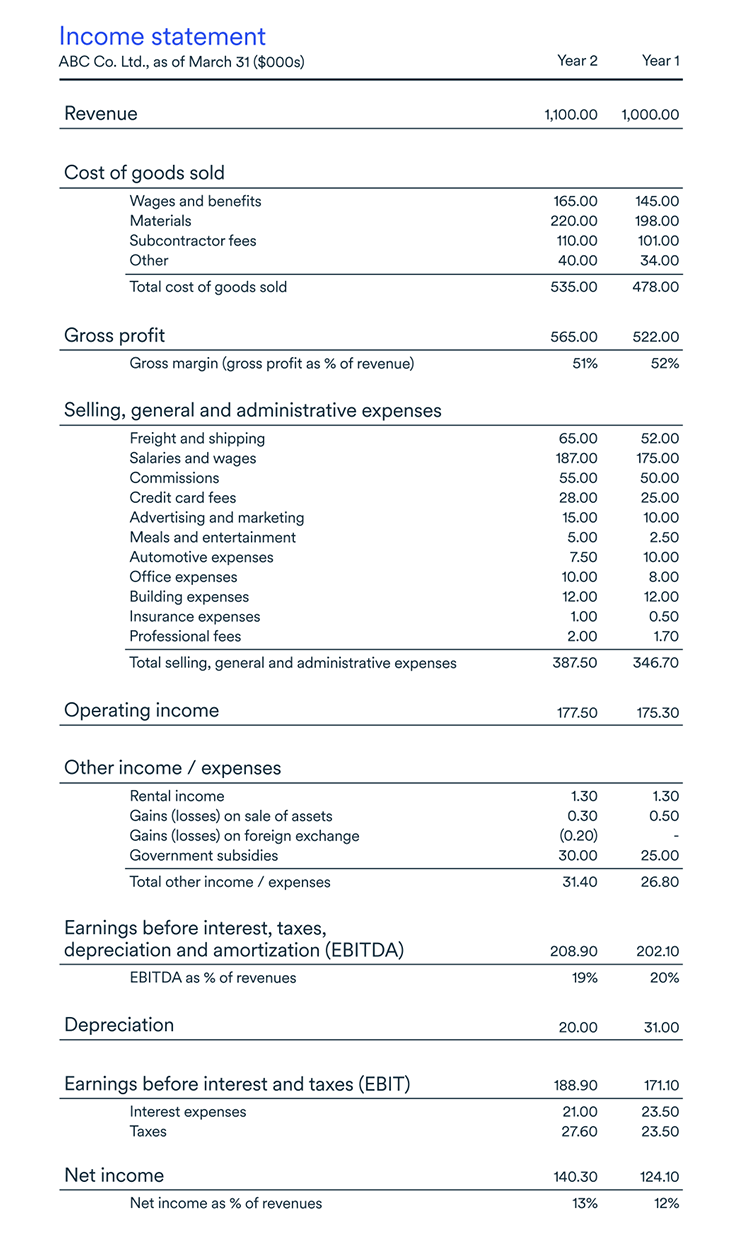

Cost of goods sold (cogs) represents the cost of supplying goods and services to customers.

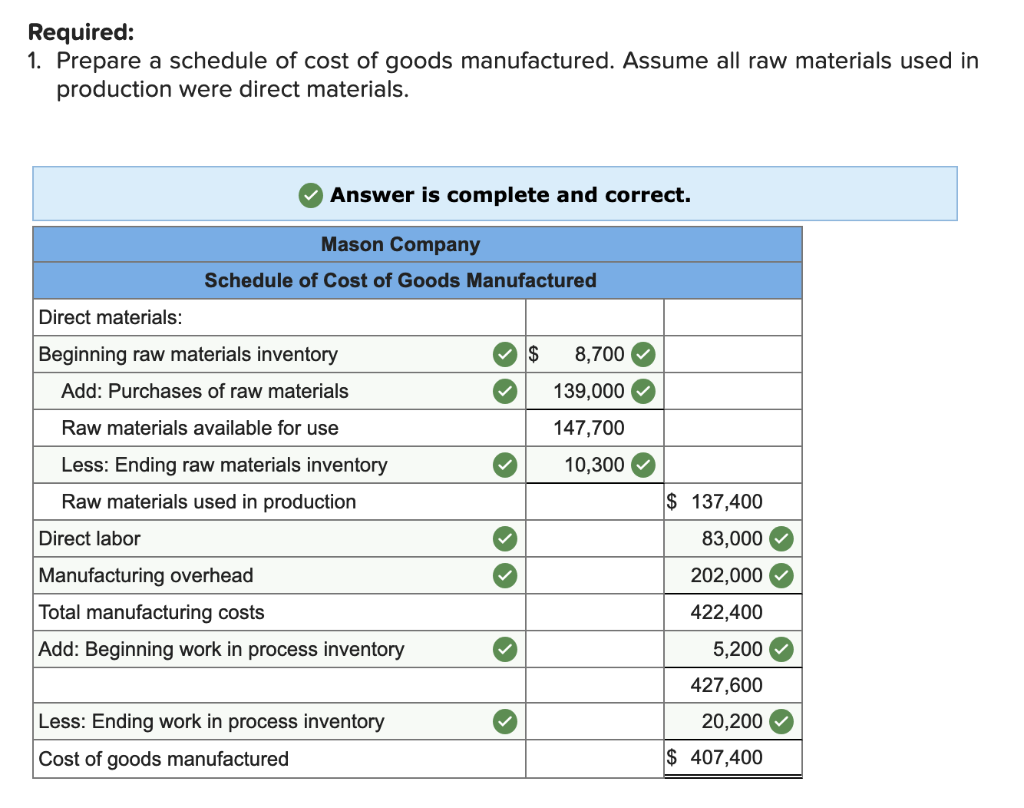

Cost of goods sold in cash flow statement. Openai has completed a deal that values the san francisco artificial intelligence company at $80 billion or more, nearly tripling its valuation in less. A merchandising company uses the same 4 financial statements we learned before: It includes material cost, direct labor cost, and direct factory.

Cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods or services. The total cost to good deal for all 14 calculators was $700. The cash flow statement is the least important financial statement but is also the most transparent.

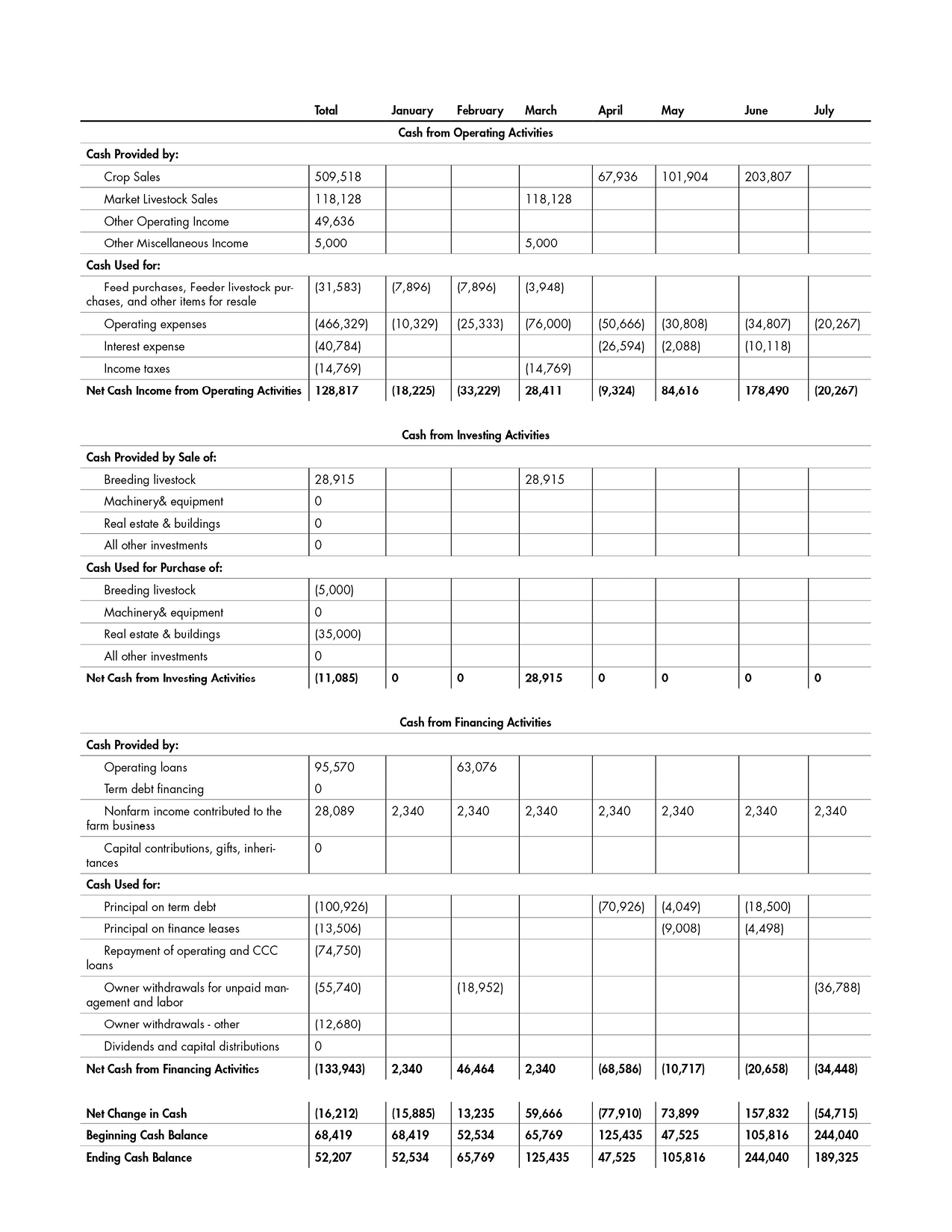

All revenues, cost of goods sold (cogs), operating expenses, and income taxes are shown on a statement of cash flow. To calculate the actual cash paid for purchases of inventory and raw materials, the cost of goods sold, we. The cash paid to suppliers for purchases relating to inventory is calculated by adjusting cost of goods sold (cogs) from the income statement for movements in.

Cogs is then subtracted from. Reporting cost of goods sold; Because of the choice to apply perpetual inventory updating, a second entry made at the same time would record the cost of the item based on the actual cost of the items,.

Cost of goods sold is the cost of inventory. It describes all the expenses. A new parcel of land was purchased for $20,000, in exchange for a note payable.

To convert the accrual based cost of goods sold figure from the. Cost of goods sold: Matt prepared the income statement and balance sheet for.

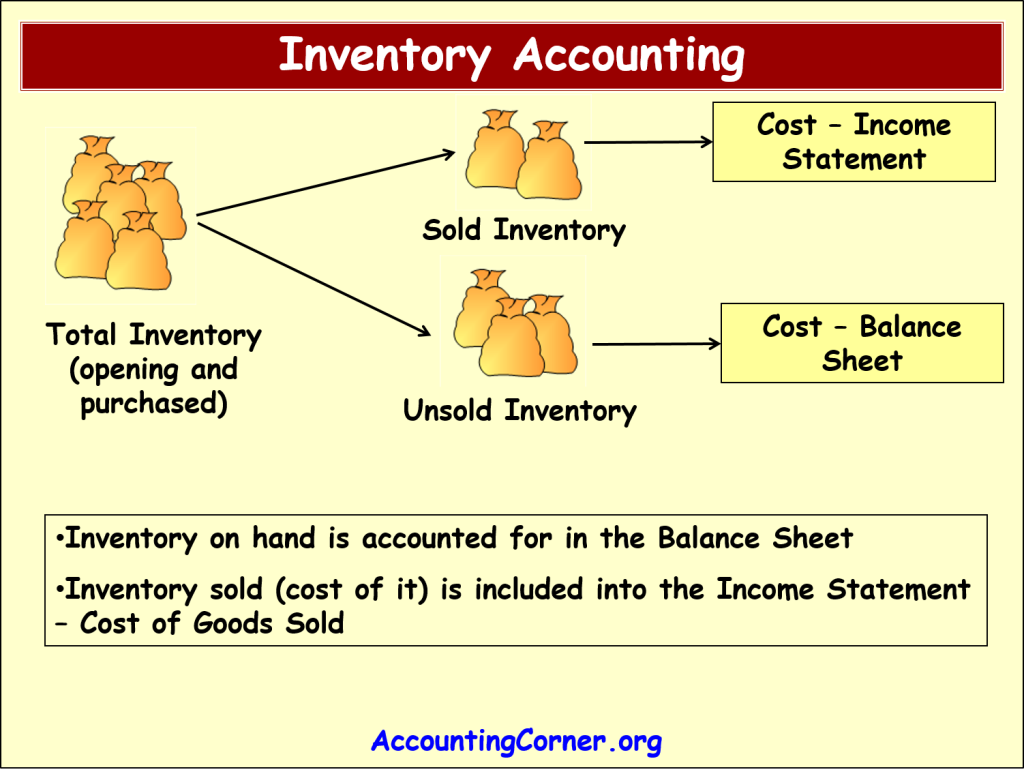

The inventory that is sold within the accounting period will be classified as “cost of goods sold” in the income statement. Take the cost of goods sold figure from the. To calculate cogs, business owners need to.

Cost of goods sold (cogs) is the cost associated with producing products in a business during a specific time period. Impact of inventory on cash flow statement inventory. Cost of goods sold (cogs) is a critical business measure that helps drive profitability in your company, product or department.

Both manufacturers and retailers list cost of good sold on the income statement as an expense directly after the total revenues for the period. A reduction in inventory will result. Cost of goods sold is a general ledger account under the.

We expense cogs and reduce inventory when recording cost of goods sold. Propensity company sold land with an original cost of $10,000, for $14,800 cash. Net income refers to the total sales minus the cost of.