Favorite Info About Comprehensive Income And Other

Regarding the number of concepts covered, 35 studies (44.3%) of the intervention covered only one concept,.

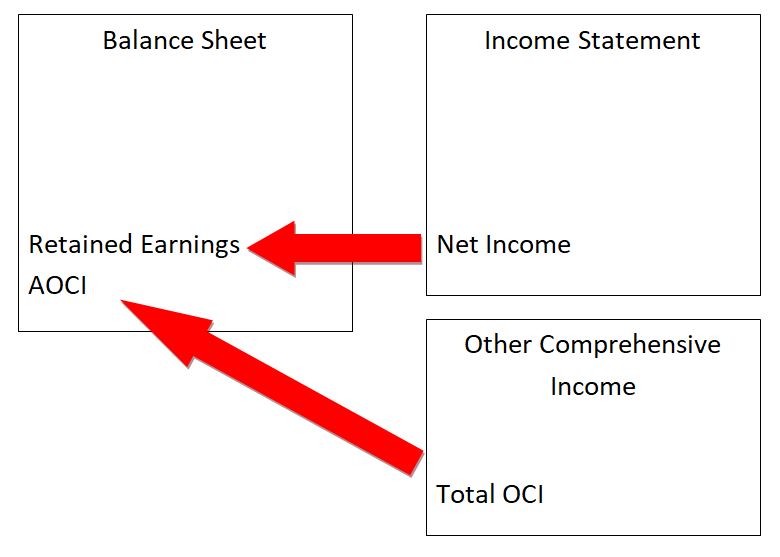

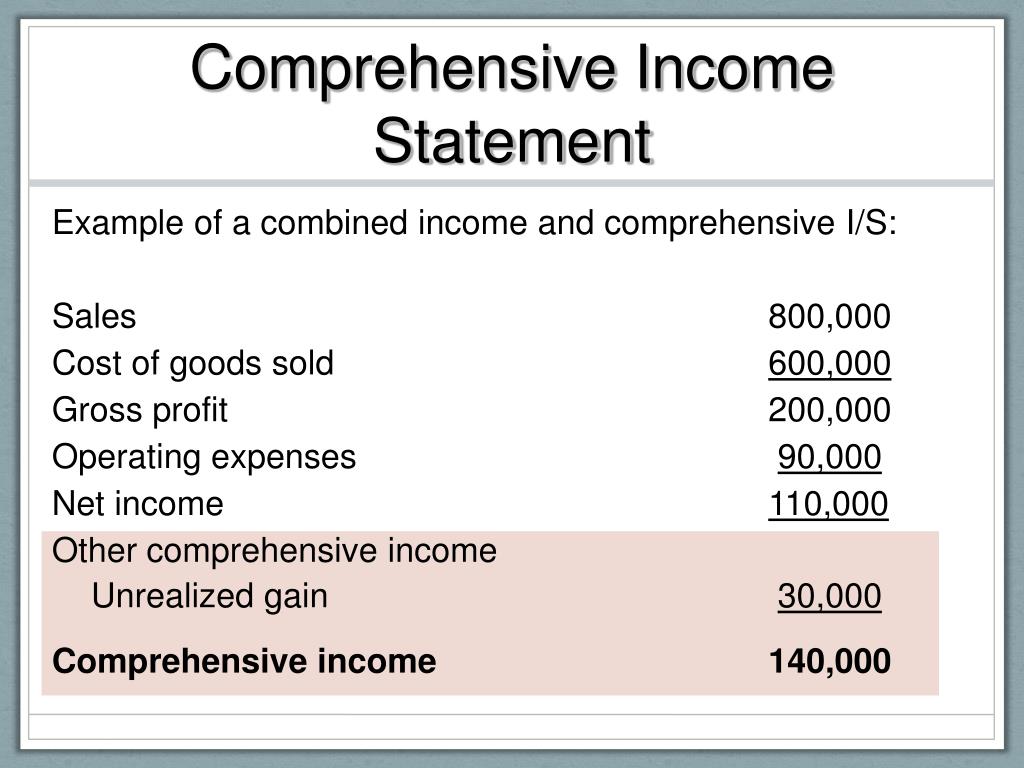

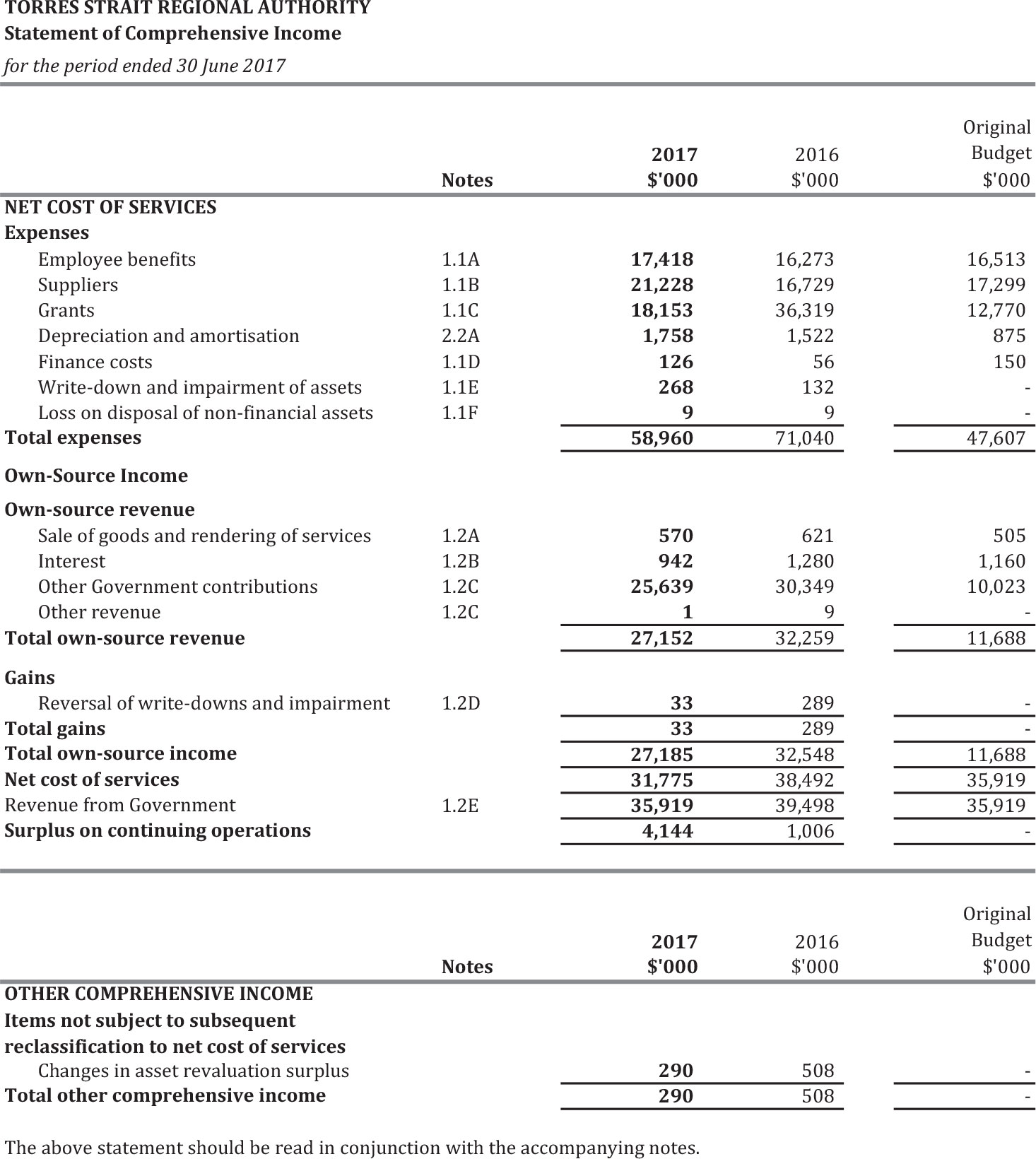

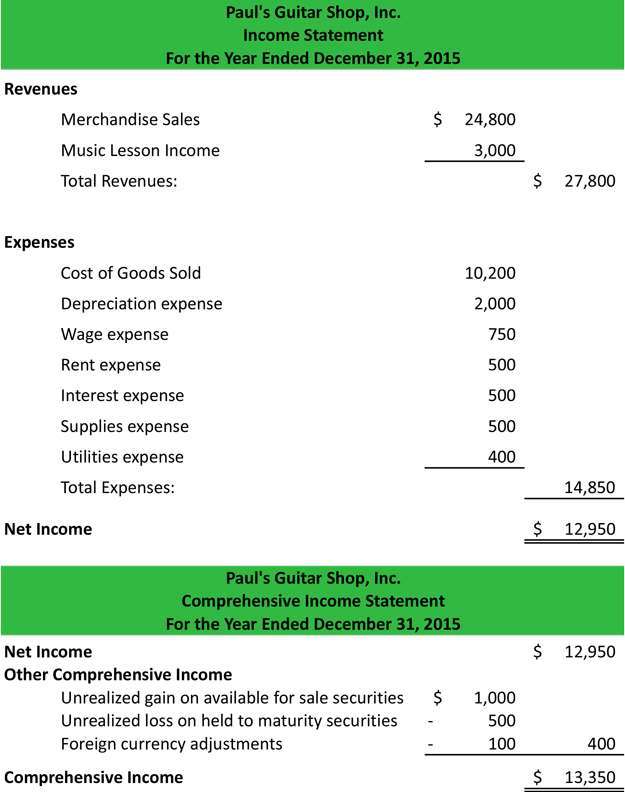

Comprehensive income and other comprehensive income. They are reported in a separate part of the financial statement known as statement of comprehensive income. An income statement also shows comprehensive income. These items, such as a company’s unrealized gains on its investments, are not recognized on the income statement and do not impact net income.

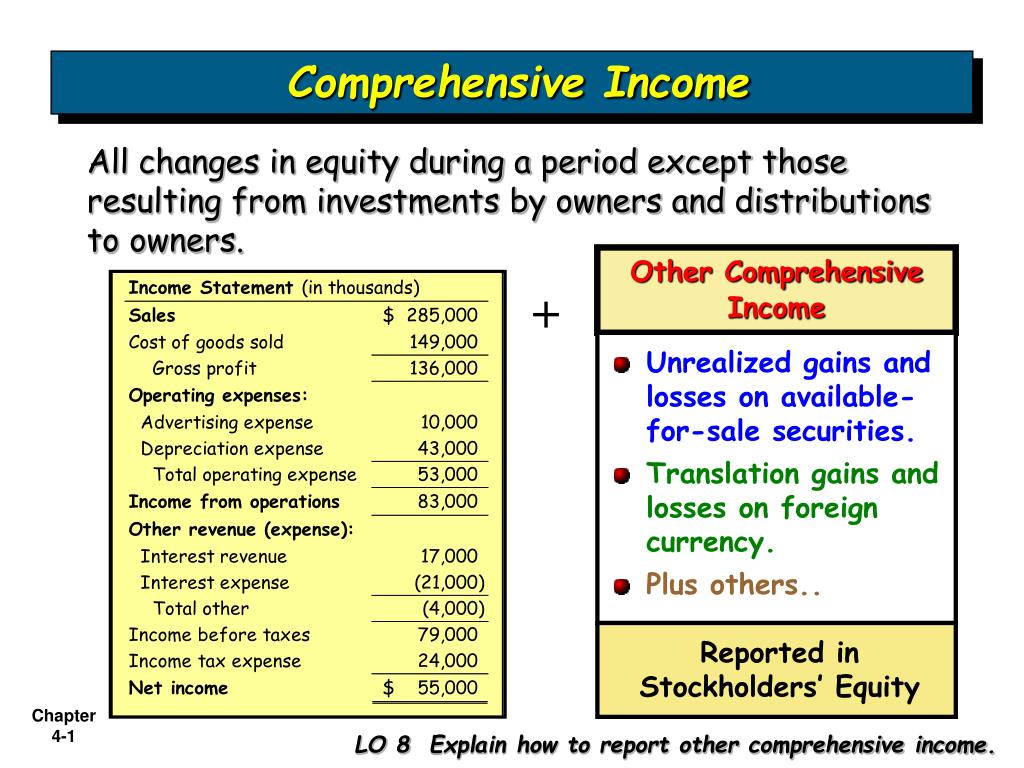

Comprehensive income includes net income and oci. Tuesdays and thursdays 6:00pm to 8:30pm est. Other comprehensive income (oci) is an accounting item for firms that includes revenues, expenses, gains, and losses that have yet to be realized.

The corporate tax rate in the uae is 9% on taxable income exceeding aed 375,000, effective from the start of the financial year commencing on or after 1st june 2023. (a) a single statement of comprehensive income; 37 this paper is based on the literature review and hypothesis development sections of my dissertation, ‘essays on other comprehensive income’.

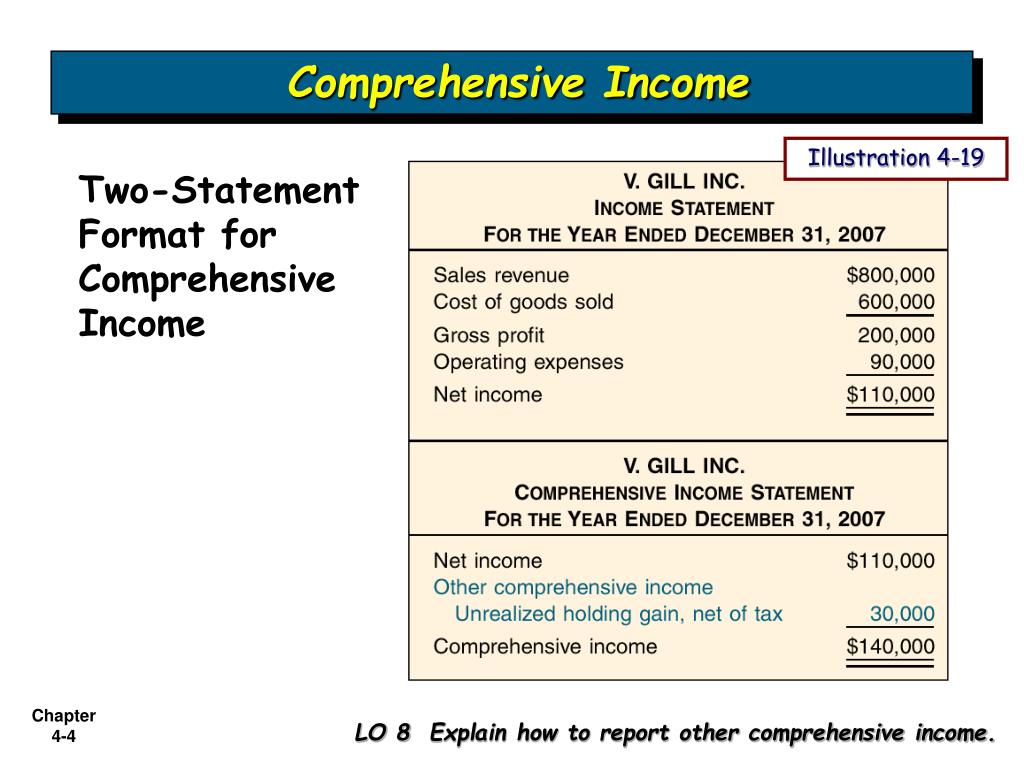

This means that they are instead listed after net income on the income statement. This paper examines how analysts incorporate elements of other comprehensive income (oci) into their earnings forecasts for nonfinancial firms. Net income is the profit that remains after all expenses and costs, such as taxes.

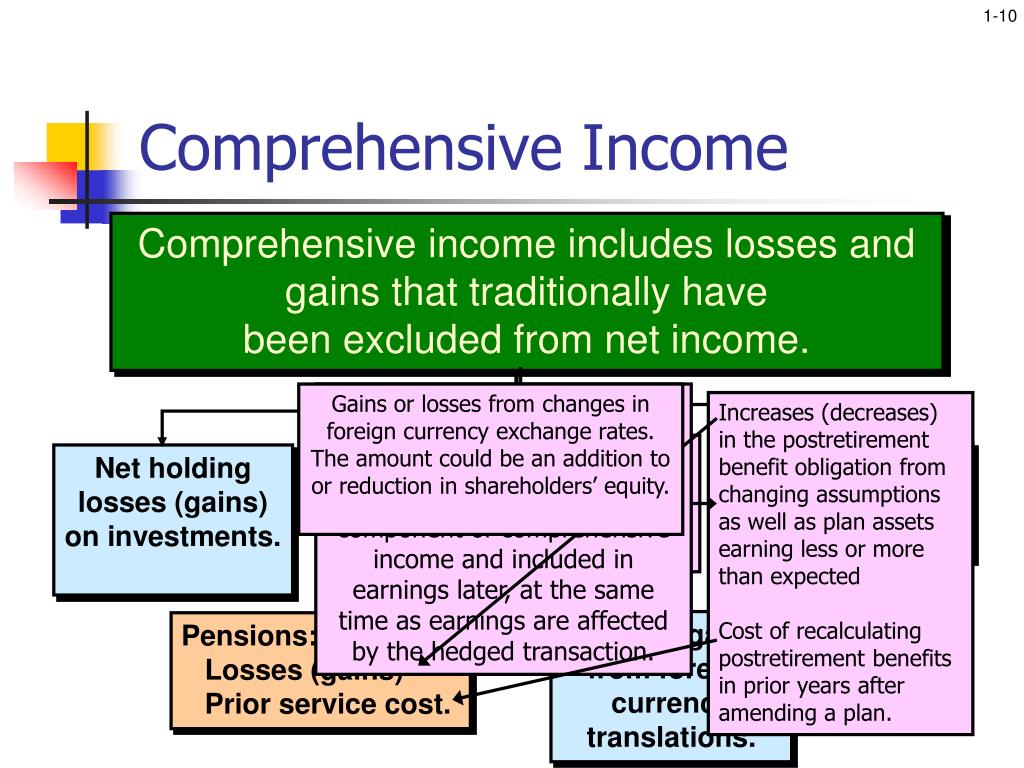

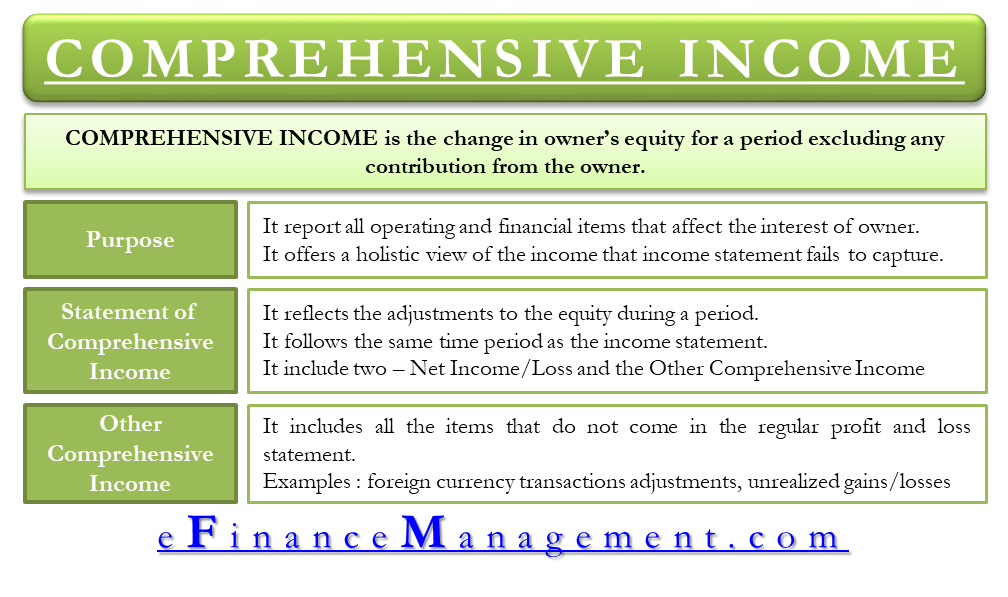

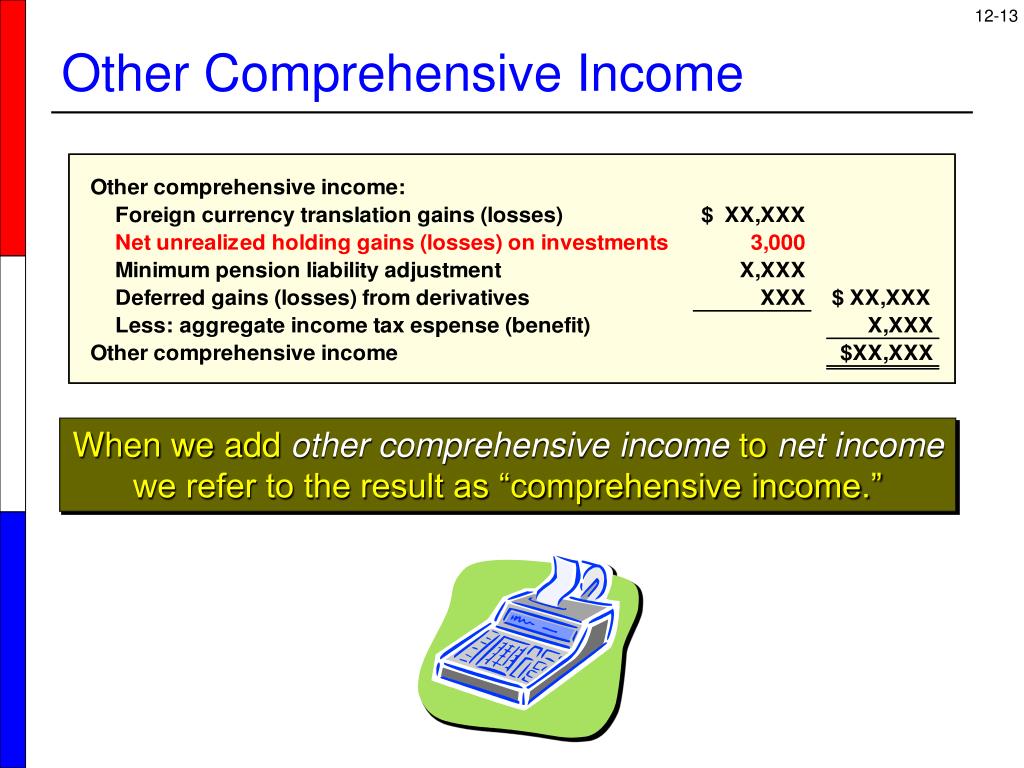

In business accounting, other comprehensive income (oci) includes revenues, expenses, gains, and losses that have yet to be realized and are excluded from net income on an income statement. The change in equity (net assets) of a business entity during a period from transactions and other events and circumstances from nonowner sources. The comprehensive income total is calculated by adding net income and oci to arrive at the entire sum of comprehensive income.

Other comprehensive income explained. Let’s take a stock investment for example. Gross profit represents the income or profit remaining after production costs have been subtracted from revenue.

Oci consists of revenues, expenses, gains, and losses to be included in comprehensive income but excluded from net income. The other comprehensive income statement is the profit or loss that the business entity generates but are not shown in the profit and loss statement. A statement displaying components of profit or loss (an income statement), and a second statement beginning with profit or loss and displaying the

These can be from things like foreign currency changes or investments. Reporting entities should present each of the components of other comprehensive income separately, based on their nature, in the statement of. There are two elements to the statement of comprehensive income:

Comprehensive taxation (personal t1 and corporate t2) certification. Ias ® 1, presentation of financial statements, defines profit or loss as ‘the total of income less expenses, excluding the components of other comprehensive income’.other comprehensive income (oci) is defined as comprising. Other comprehensive income (oci) refers to any revenues, expenses, and gains / (losses) that not have yet been realized.

Comprehensive taxation (personal t1 and corporate t2 income) includes both 5. Entities currently have a choice and can present profit or loss and other comprehensive income in either: The net income is the result obtained by preparing an income statement.

![[PDF] The Usefulness of Comprehensive and Other Comprehensive](https://d3i71xaburhd42.cloudfront.net/78ce08472de069aeec47aa58838228ff2bee7d9d/11-Figure1-1.png)