Unique Info About Expenses On Income Statement

You can learn about the health of a business—up and down, and across time—by looking at its income statement.

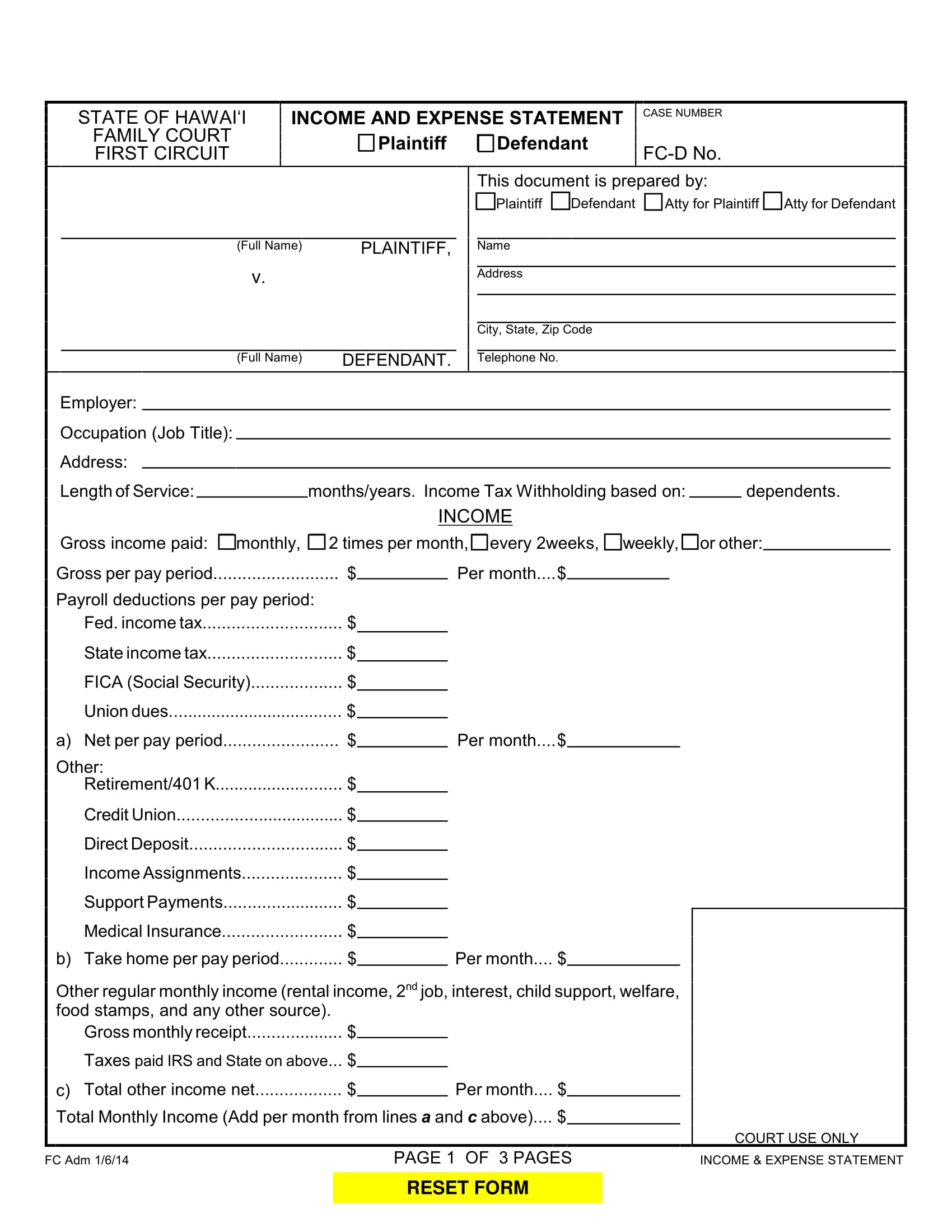

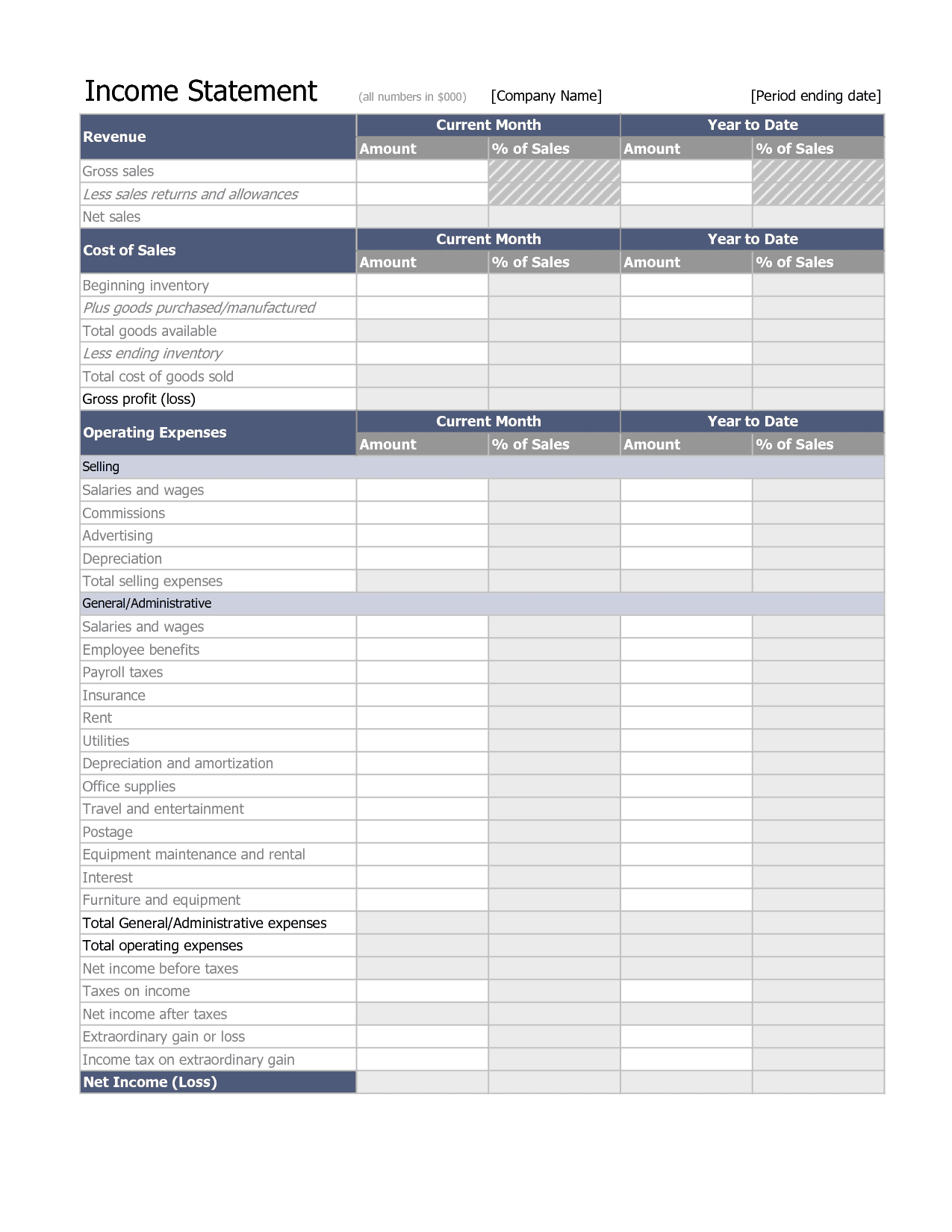

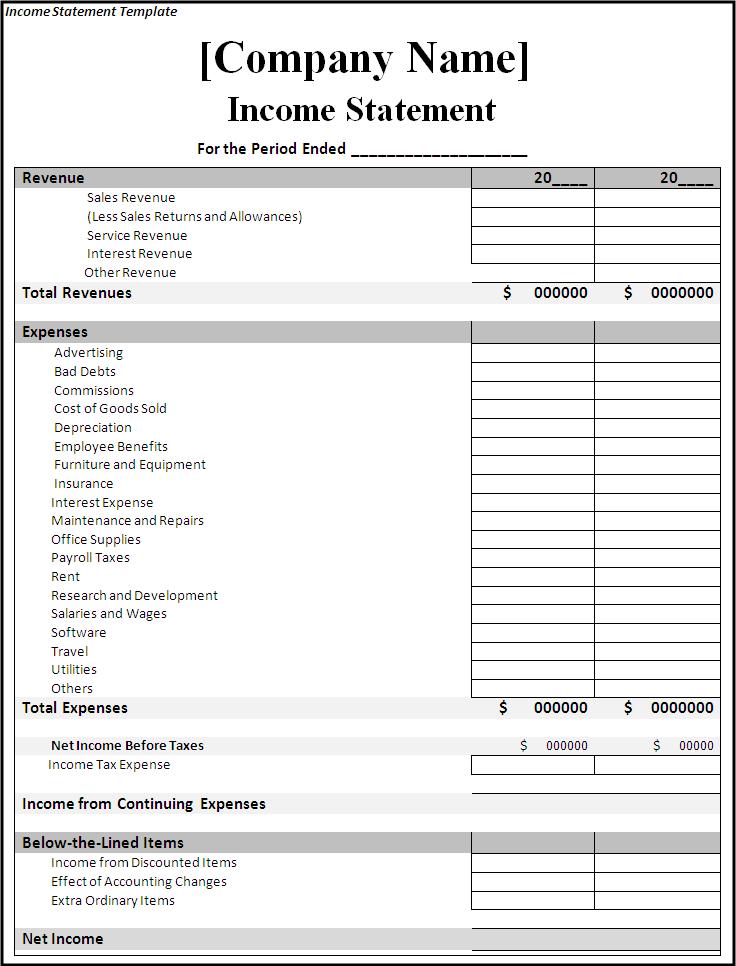

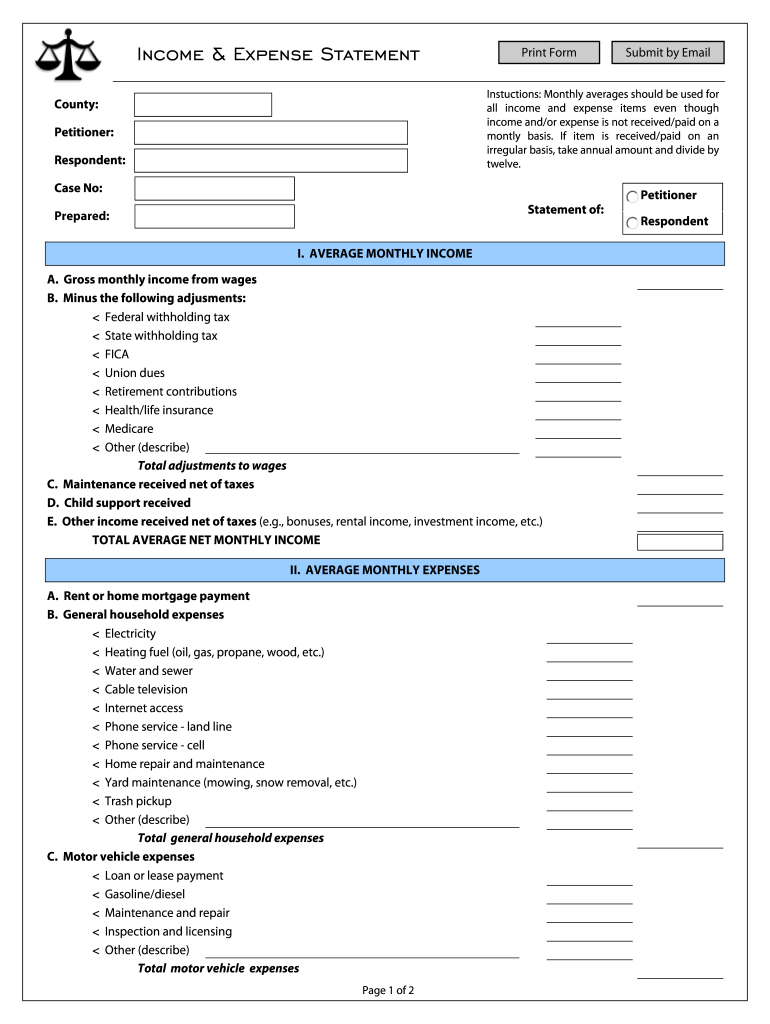

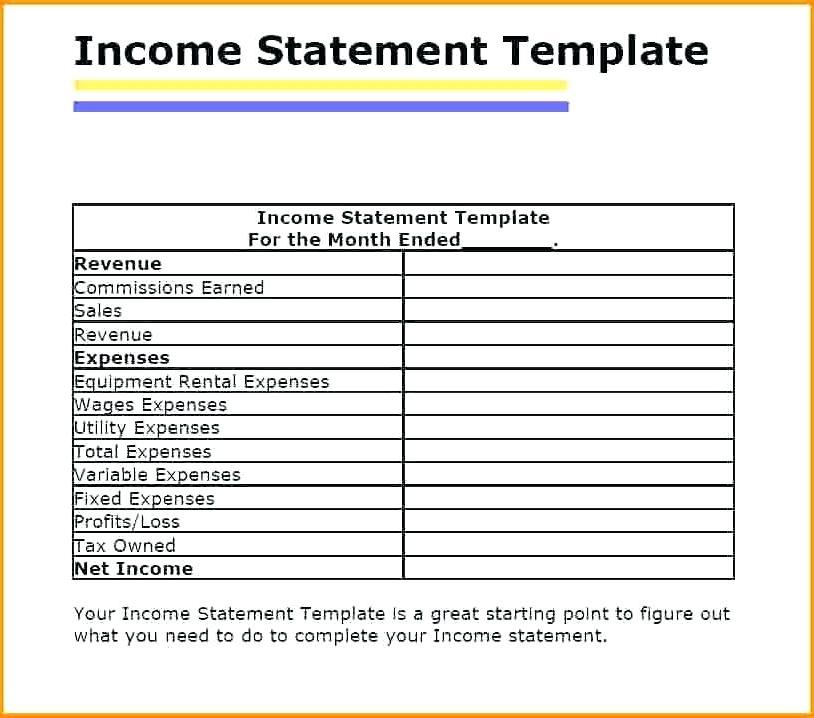

Expenses on income statement. Income from operations of $652 million; The income statement focuses on four key items: Revenue minus expenses equals profit or loss.

Financial statements for businesses usually include income statements , balance sheets , statements of retained earnings and cash flows. Revenue, expenses, gains, and losses. Depreciation and amortization are two common types of expenses that appear on an income statement.

Expenditures denote the amount of money that a business uses to purchase a fixed asset or for increasing fixed asset value. It shows whether a company has made a profit or loss during that period. Some of the common expenses recorded in the income statement include equipment depreciation, employee wages, and supplier payments.

The income statement presents the financial results of a business for a stated period of time. Explanation of the income statement formula example of income statement formula (with excel template) relevance and use of income statement formula At the most basic level, it.

By filing your tax return on time, you’ll avoid delays to any refund, benefit. The statement quantifies the amount of revenue generated and expenses incurred by an organization during a reporting period, as well as any resulting net profit or net loss. An income statement lists a company’s income, expenses, and resulting profits over a specific time frame, usually a quarter or fiscal year.

An income statement typically includes the following information: For example, if you itemize, your agi is $100,000 and your. Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi).

Ratio analysis utilises ratios like gross, operating, and net profit to. You can look at an income. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain,.

The income statement is a useful way to see how a company makes money and how it spends it. Types of expenses as the diagram above illustrates, there are several types of expenses. Expenses are used to calculate net income.

The total costs associated with component parts of whatever product. Record adjusted ebitda margin fourth. The income statement shows a company or individual’s money.

They appear on the income statement under five major headings, as listed below: The income statement calculates the company’s net income or net profit by taking into account its earnings, gains, expenses, and losses over a period. An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)