Brilliant Info About Treatment Of General Reserve In Balance Sheet

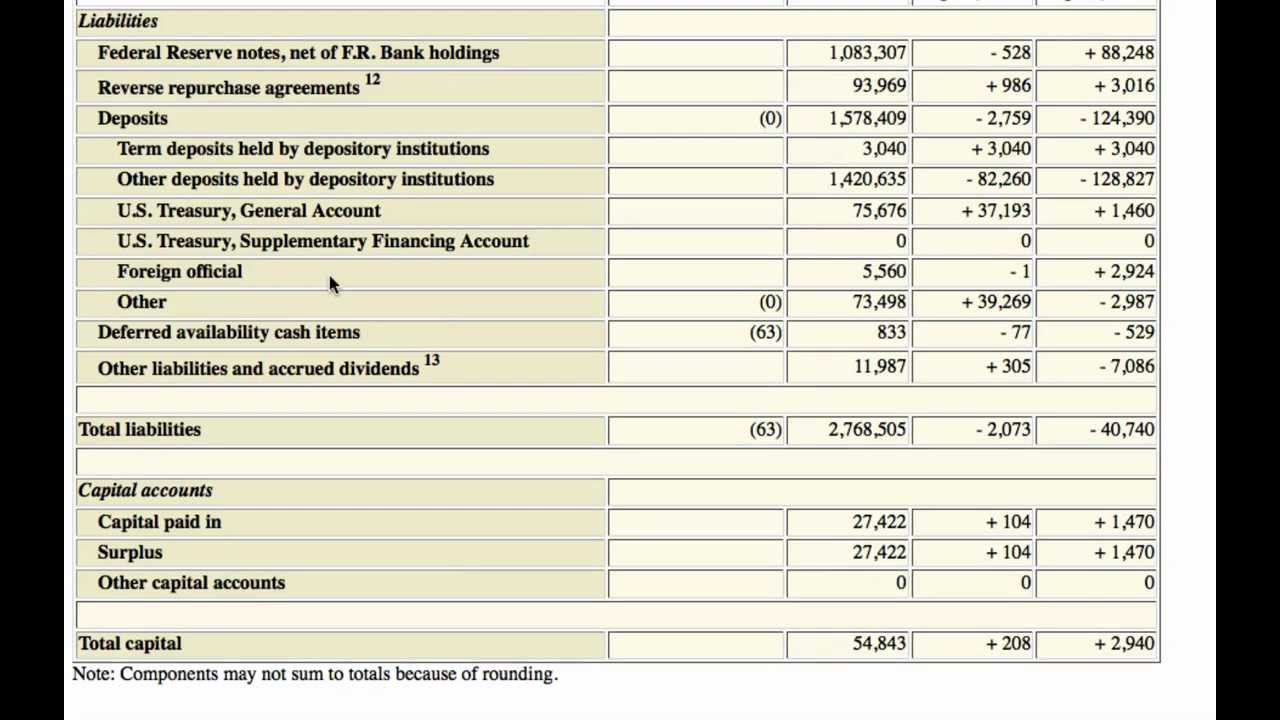

You can learn about the reserves, are a line item of shareholders’ equity (owner's equity) line items in the statement of financial position (balance sheet) and also within the line.

Treatment of general reserve in balance sheet. General reserve is referred to as the reserve fund that is created by keeping aside a part of profit earned by the business during the course of an accounting period for fulfilling. Treatment of reserves reserves are the amount of profits, which is set aside until there is a need for money for some purpose. Arbl has an rs.31.18 crs under this reserve;

It has been observed that many large industrial concerns replace a number of specific reserves by one bulk account and call it. The funds in this reserve are used to fulfil future contingencies, paying dividends to their shareholders, and offset specific future losses. But, specific reserve funds are formed for specific purpose like dividend.

Creating a general reserve in the balance sheet is not a requirement for a corporation. These are the accounting entries that are carried out in order to set aside. It is a part of stockholders’ equity that is unmarked.

The general reserve is established by allocations from the realized profit for the year, which comprises net profit for the year in accordance with ifrs excluding net foreign. A trial balance is a statement prepared to check the arithmetical accuracy of the. However, suppose a firm's articles of association contain a provision.

A surplus is a difference between the total par value of a company's. The revaluation reserve is an accounting term used when a company has to enter a line item on its balance sheet due to a revaluation. General reserve is the amount of profit that the company keeps away without a specific purpose.

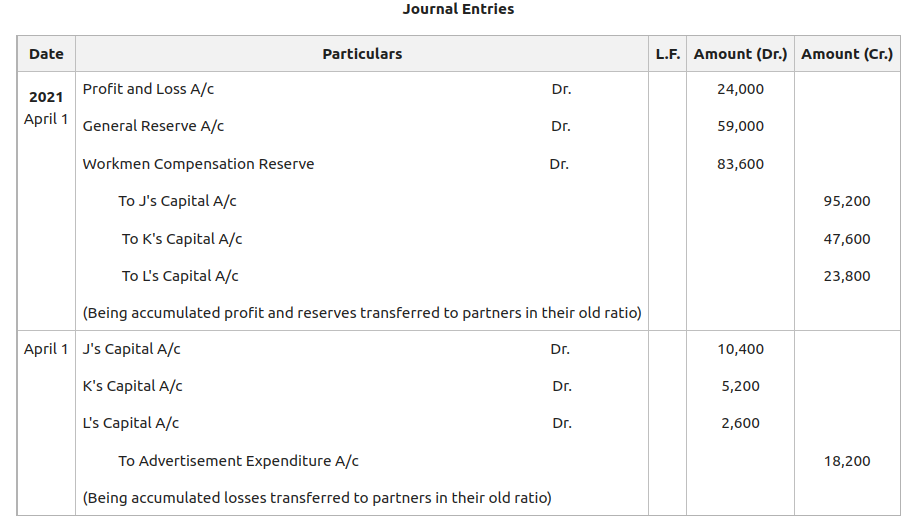

Journal entry for general reserve. Types of equity reserves and their accounting treatment equity reserves form part of the equity section of the balance sheet. To understand capital surplus on the balance sheet, you must first grasp the concept of surplus.

In trial balance, the treatment of the general reserve is that it is presented on the credit side. By nature , a general reserve is a capital or a equity account. General reserve = ₹10,000 + 47,000.

These reserves, as suggested by their name, are not kept aside for any particular or destined purpose, they are for the general financial. Iii) for surplus at the end of the year 2021, net profits = ₹2,35,000. Profit is the amount that company.

Balance sheet reserves are also referred to as claims reserves. It is the reserve created by the company without any specific purpose. The above discussed were specific reserves.

As per the indirect method, since there is no actual flow of cash, any addition to reserves is added back to net profit for calculation of. Treatment of general reserve. General reserve is a specific percentage of money set aside by a company from their profits.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)