Amazing Info About Difference Between Balance Sheet Income Statement And Cash Flow

Unless you went to business school—or at least took an accounting or finance course—you’ve probably never given much thought to financial statements such as balance sheets, income statements, or statements of cash flow, right?but now you’ve got some money to invest, you’re looking at a few companies and trying to figure out.

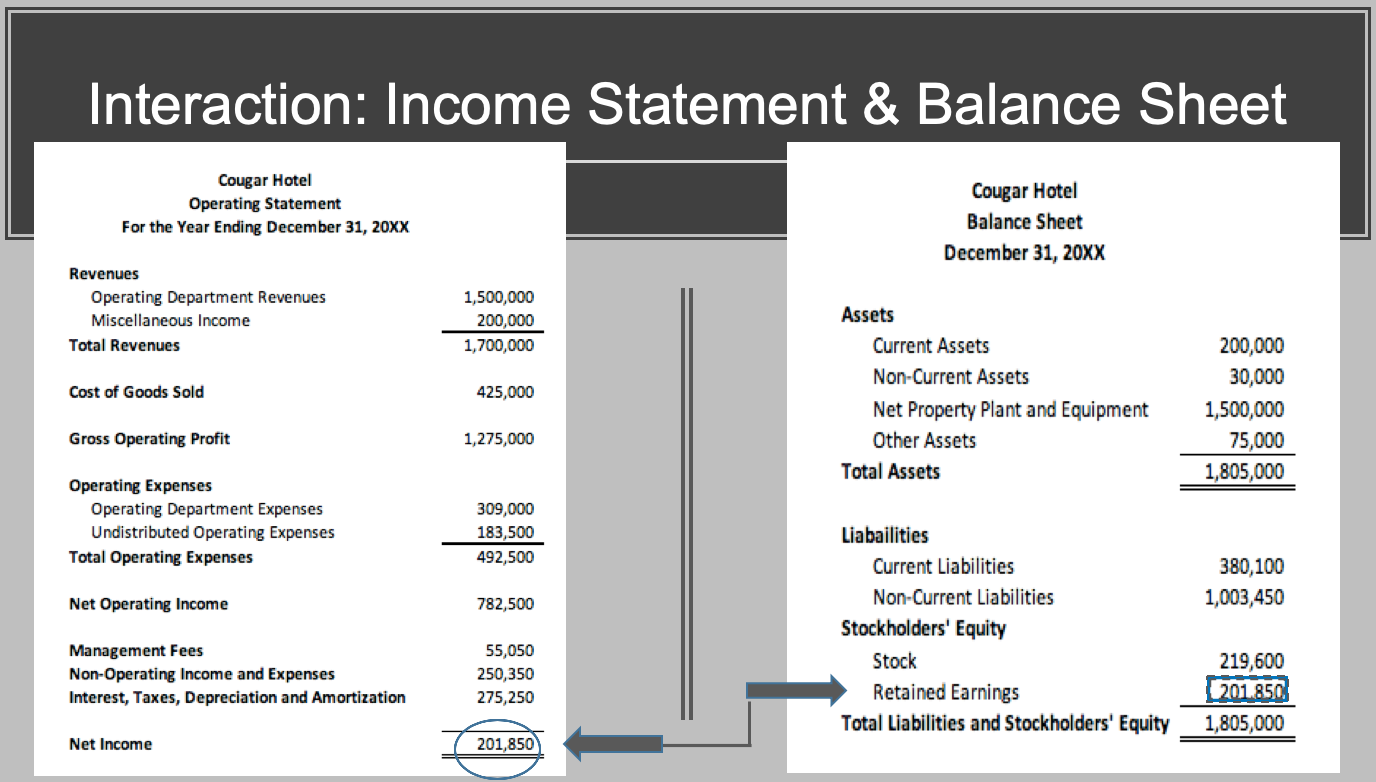

Difference between balance sheet income statement and cash flow. In financial accounting, the balance sheet and income statement are the two most important types of financial statements (others being cash flow statement, and the statement of retained earnings). A balance sheet gives companies a snapshot of what they own and what they owe, represented by assets, liabilities, and shareholder’s equity. Income statements show whether a company is profitable during a specific period.

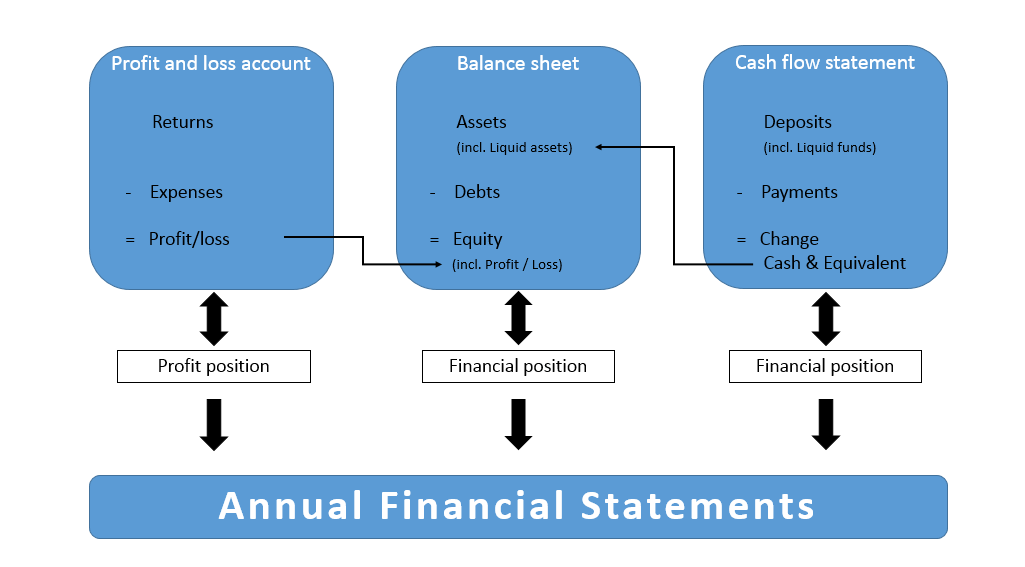

The components of a balance sheet are: In this article, we'll examine the balance sheet and income statement and. An understanding of the linkages among the cash flow statement, income statement, and balance sheet is helpful in understanding a company’s financial health.

The cfs highlights a company's cash management, including how well it generates. Difference between income statement vs. (1) the income statement, (2) the balance sheet, and (3) the cash flow statement.

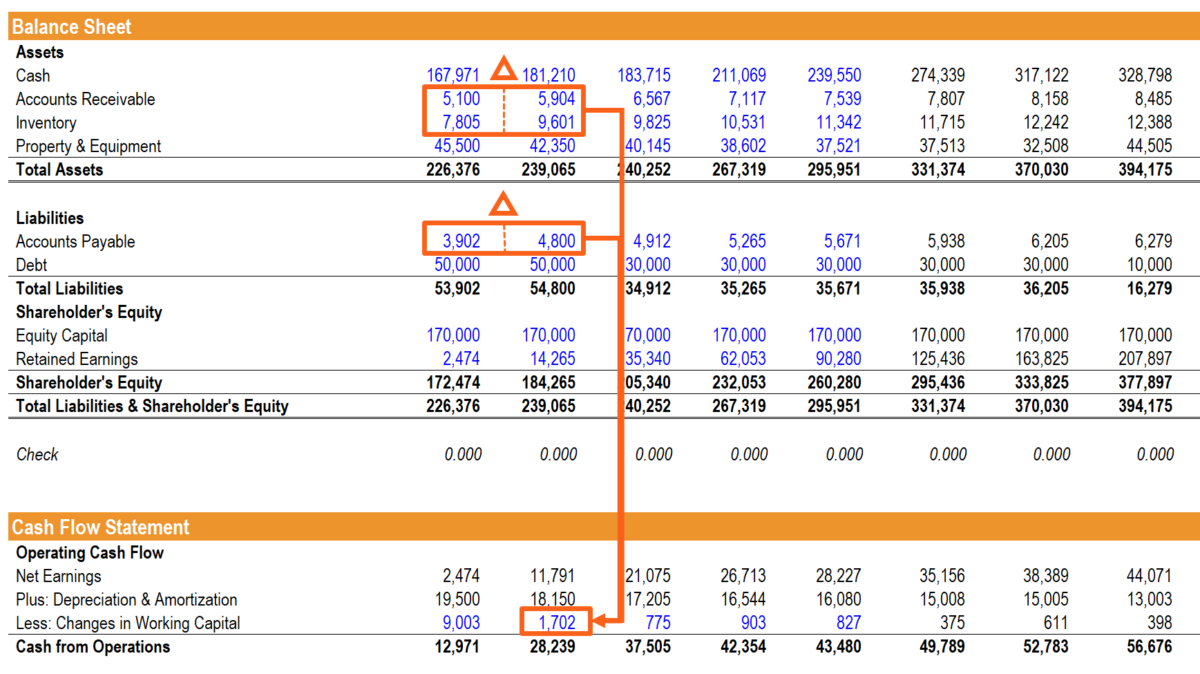

The basic formula for the balance sheet is as follows: Financing events such as issuing debt affect all three statements in the following way: Income statements focus on revenue and expenses.

What are the differences between a balance sheet and income statement? The cash flow statement tells you the amount of cash inflows and outflows of a business during a financial year. A balance sheet lists assets and liabilities of the organization as of a specific moment in time, i.e.

In other words, the balance sheet shows the assets and liabilities that result, in part, from the. As of a certain date. The cash flow statement shows the cash inflows and outflows for a company during a period.

The balance sheet provides the information about the company’s financial position. Here's what you need to know about them. The balance sheet also referred to as the statement of financial.

31 july 2023 | metrics & reporting cash flow statement vs. Income statements are used to track. Cash flow by editorial team updated by beverly bird reviewed by ashley donohoe updated november 10, 2022 ••• financial statements are essential documents that detail how a company earns and spends its income.

The income statement illustrates the profitability of a company under accrual accounting rules. The cash flow statement shows how well a company manages cash to fund operations and any expansion efforts. The cash flow statement is prepared on the basis of both the income statement and the balance sheet of a company.

It is instrumental in the detection of any accounting. A balance sheet is a precise representation of the assets, liabilities, and equity of the entity, whereas, a cash flow statement presents total data concerning complete cash inflows a business gains from its continuing progress and external financing sources. Why do shareholders need financial statements?

.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)