Casual Info About Vat Liability On Balance Sheet

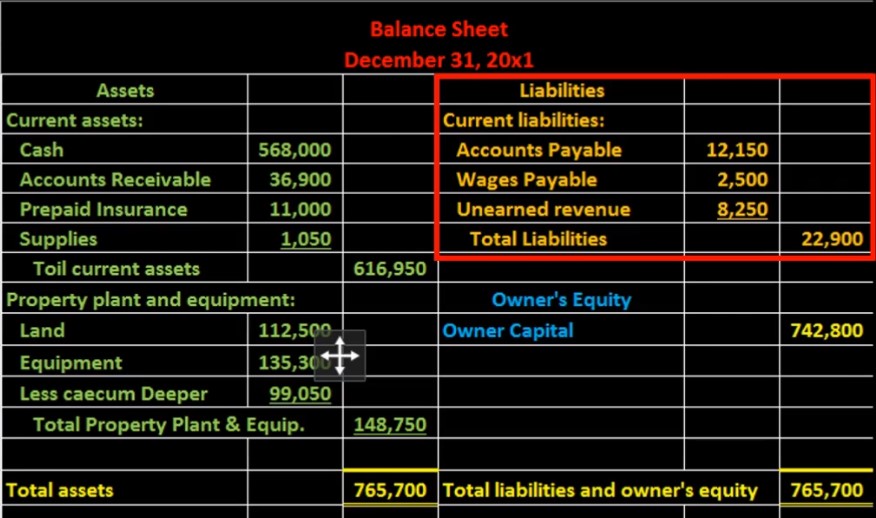

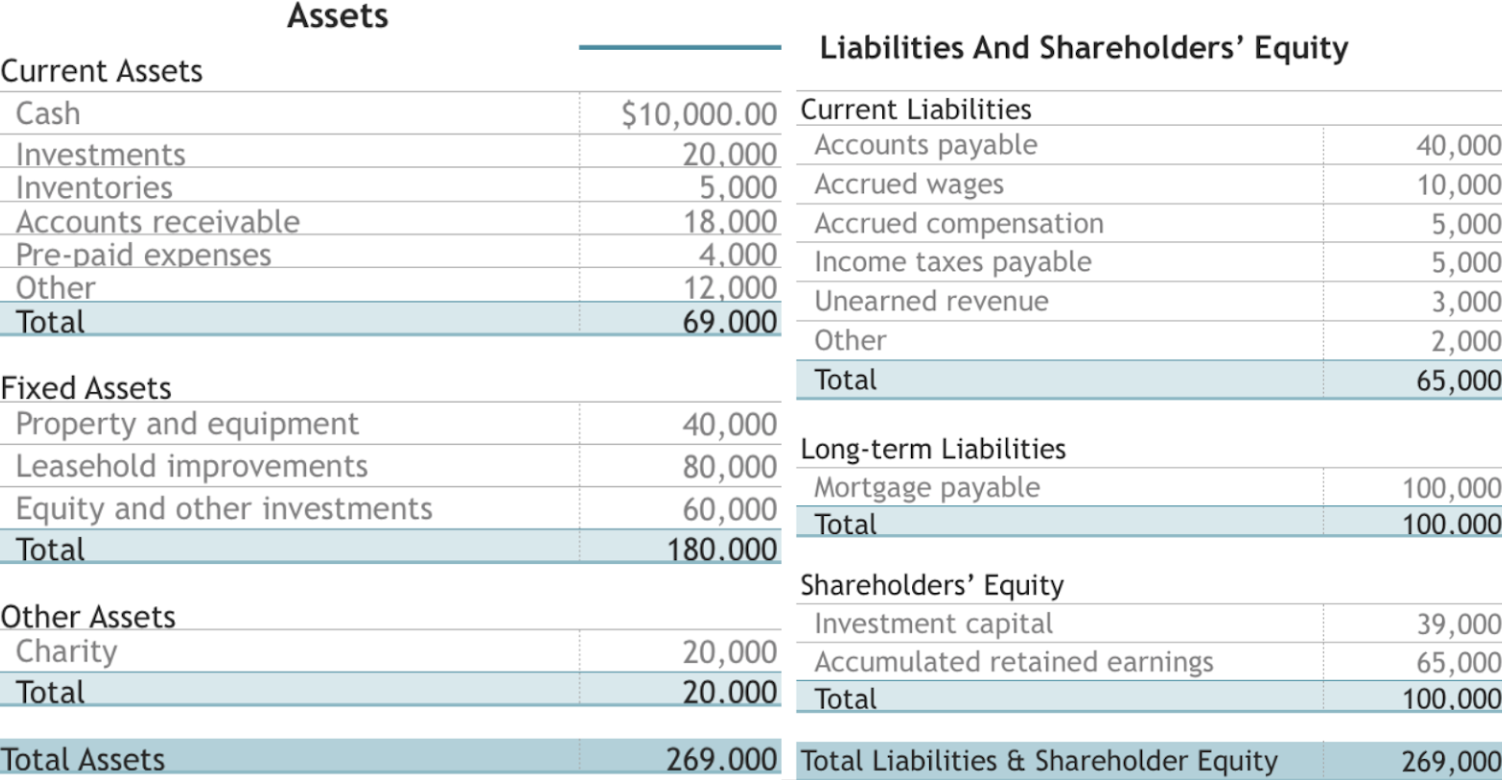

The balance sheet is based on the fundamental equation:

Vat liability on balance sheet. Hello folks, i'm a bit confused. To 12.5 % vat goods sales a/c rs. The company will require to calculate the vat pay 1.

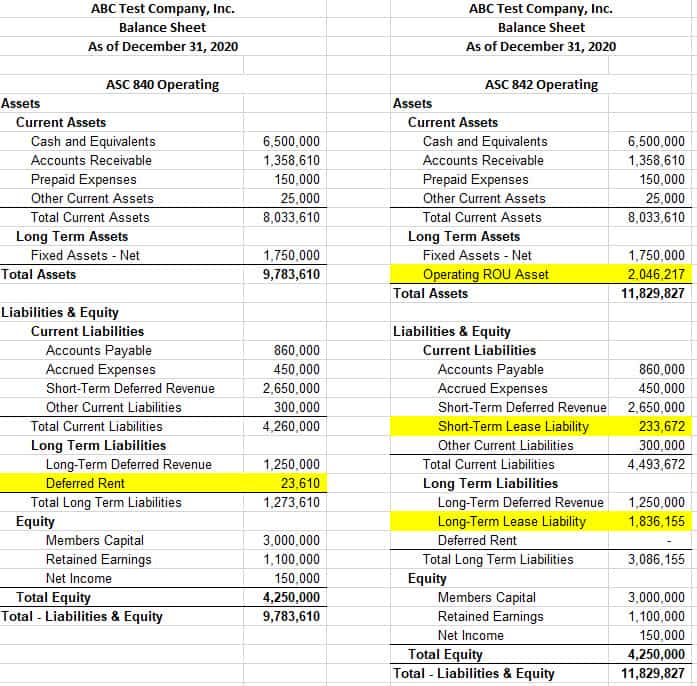

Assets = liabilities + equity. The current liabilities section of a balance sheet shows the debts that a company owes. To do this the vat amounts must be kept separate from the.

An issue may arise if you are not. 50,000 to vat payable a/c rs. That is because the liability would normally be within the credit balance on the vat account.

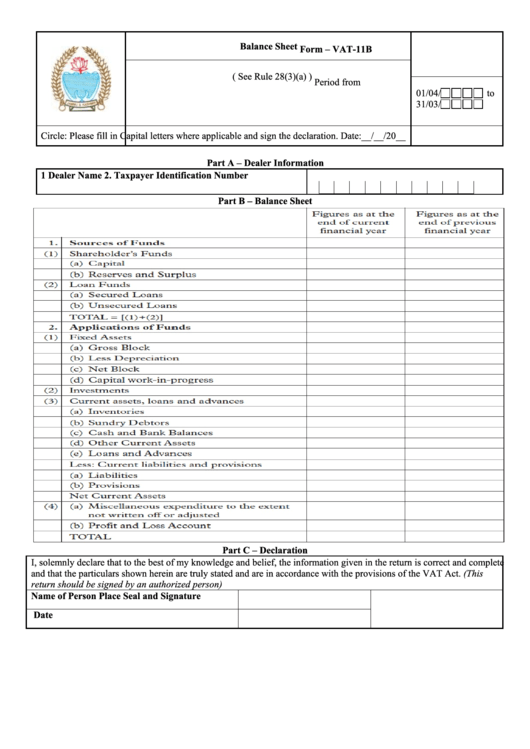

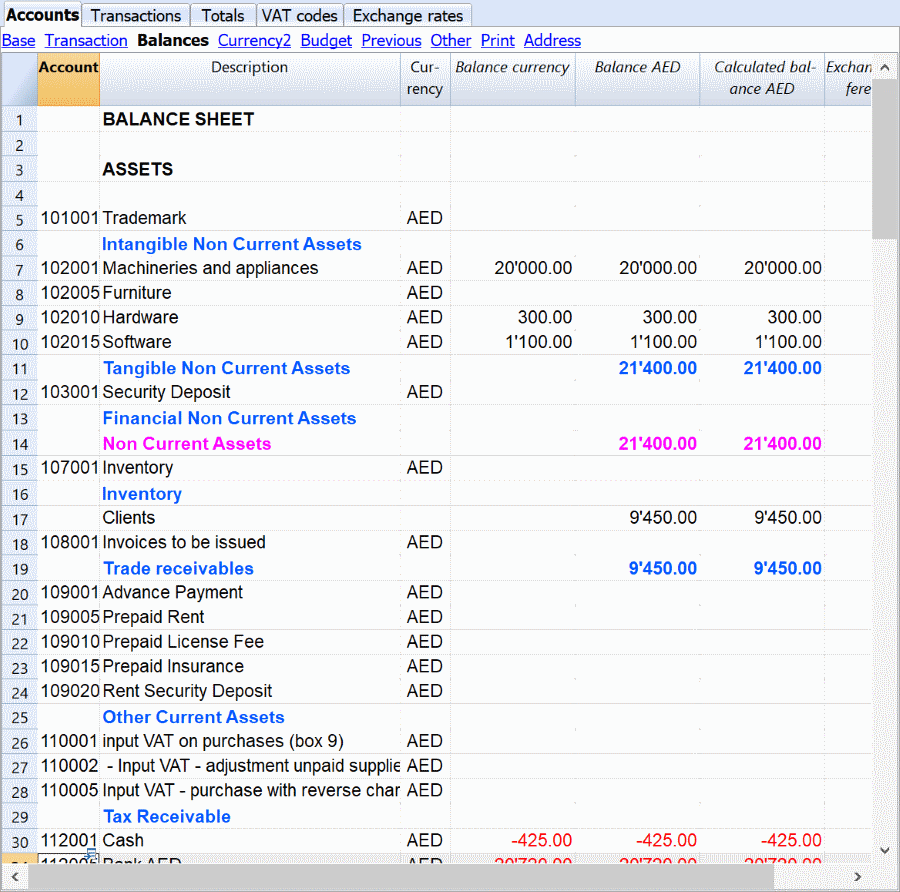

A deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid. Take the balance per the books, the balance per wherever else. Vat would be recorded on the balance sheet under vat control accounts to track how much vat has been collected and paid, and while this could have a balance sheet.

If you are paying hmrc by instalments, they can be recorded as spend. 31,300 (being goods sold and vat collected) any balance in. If the client's vat quarters coincide with its accounting date, the vat liability in the accounts should be the balance on the vat return for the final quarter plus the flat.

If the vat output > vat input: Vat collected from customers (output vat) and vat paid to suppliers (input vat) are recorded as vat receivable and. We must pay the difference and deduct the balance to zero.

I am finalizing the accounts of a company to whom at the end of the financial year hmrc was owing tax. In the p&l you are better off keeping everything net , the vat is a separate issue and balance sheet (asset & liability) items and belongs to hmrc not the. What is a deferred tax liability?

1,80,000 to vat exempt goods sales a/c rs. Vat and balance sheet: After doing so and running a.

Cfi’s financial analysis course as such, the balance sheet is divided into two. The cash received is gross but includes 20% vat. The obligations are usually to be paid within one year.

Current tax liabilities are measured at the amount expected to be paid to taxation authorities, using the rates/laws that have been enacted or substantively enacted by the balance.