Awesome Tips About Is Cost Of Goods Sold Closed To Income Summary

The reason for using temporary accounts is.

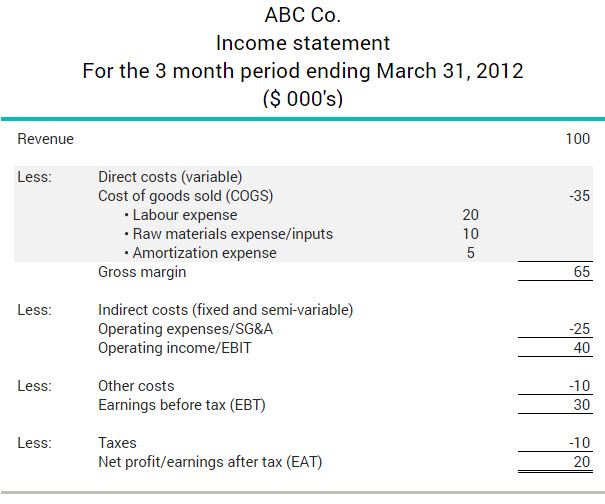

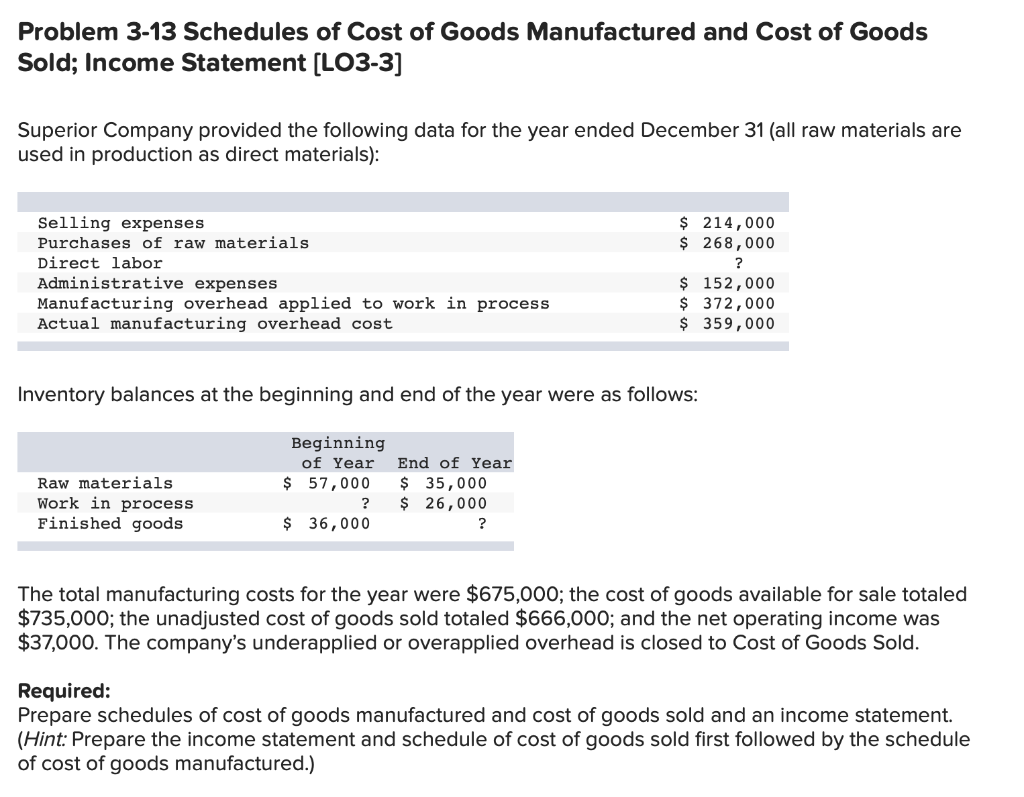

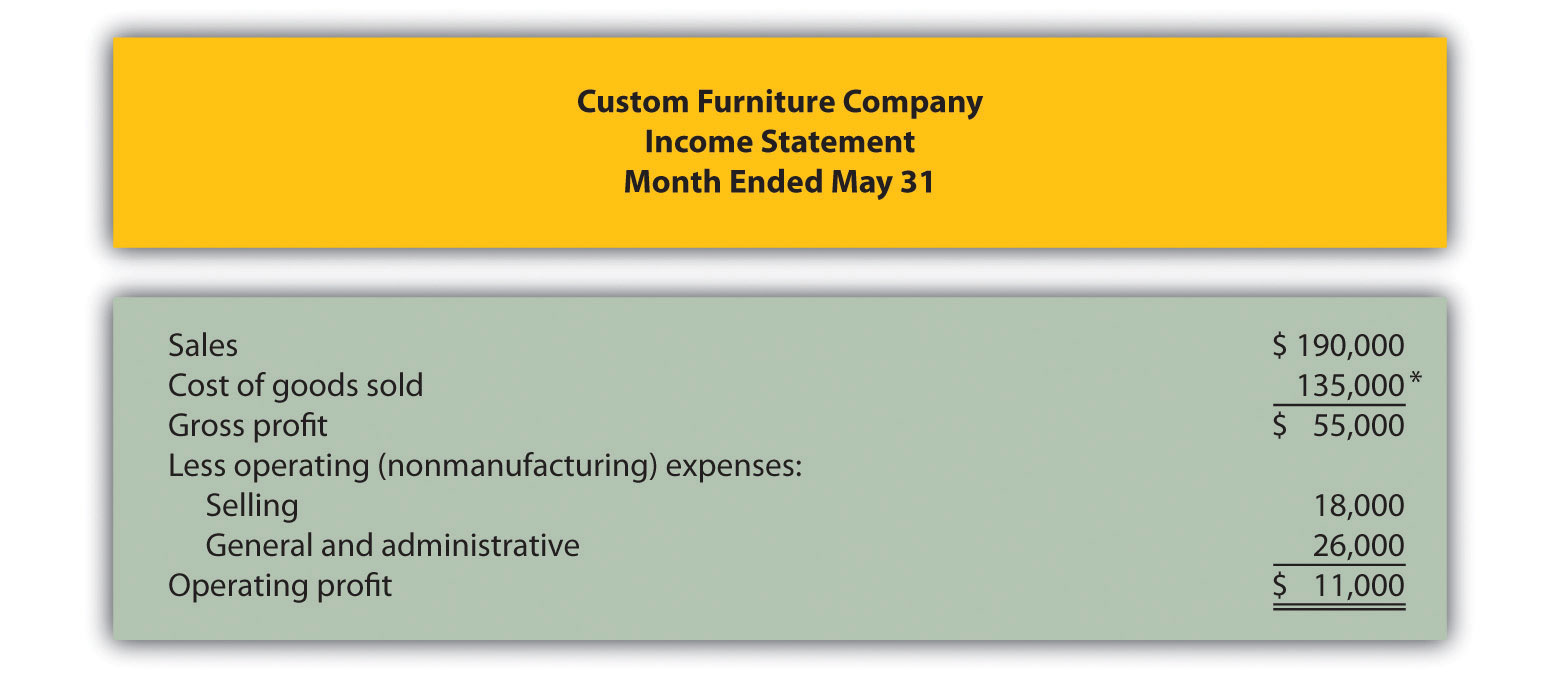

Is cost of goods sold closed to income summary. Sales discounts is closed with the expense accounts. Which accounts are closed at year end? Cost of goods sold (cogs) measures the “direct cost” incurred in the production of any goods or services.

As the first step, the revenue accounts have to be closed, wherein such balances would reflect credit balance at the end of the financial period. Cost of goods sold is closed with. Income summary account is a temporary account used in the closing stage of the accounting cycle to compile all income and expense balances and determine net income or net loss for the period.

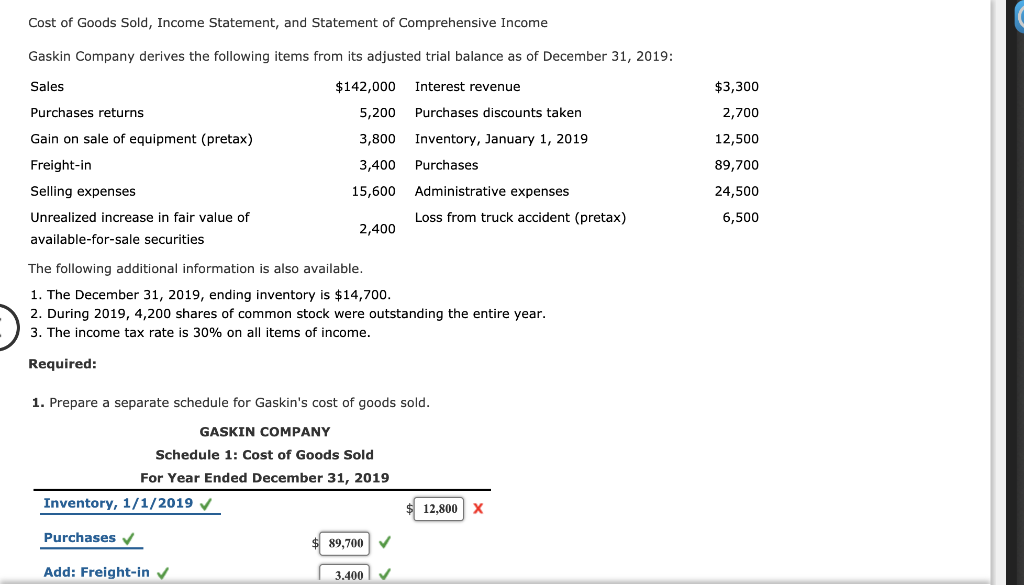

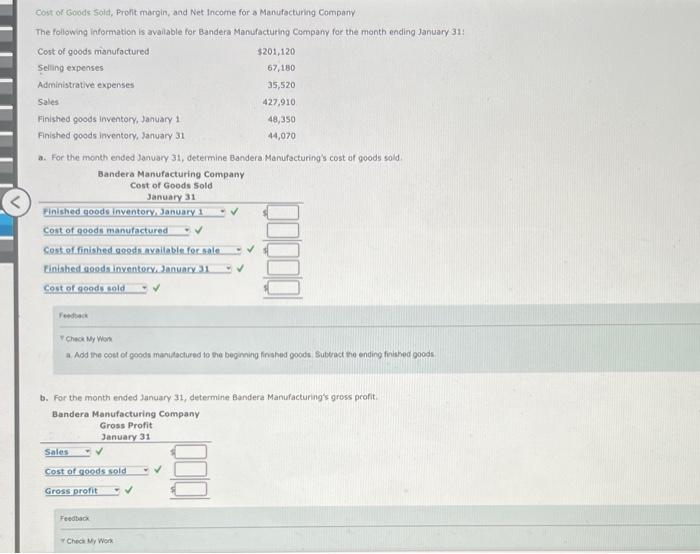

We calculate cost of goods sold as follows: This may include direct and indirect costs like purchase and freight costs. Simply put, the cost of goods sold (cogs) is the total cost incurred by a business to produce and sell its products.

It includes material cost, direct labor cost, and direct factory overheads, and is directly proportional to revenue. The dividends account is closed to retained earnings 5. The dividends account is closed to income summary merchandise inventory is closed with the expense accounts.

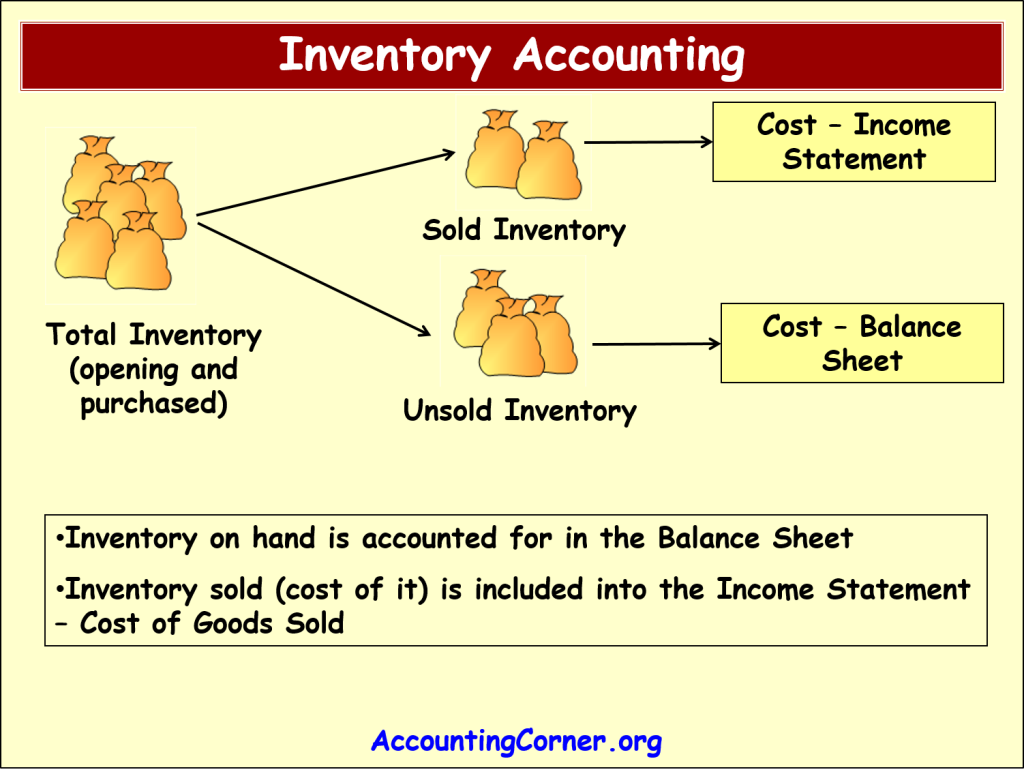

However, before the company sells the goods or products to its customers, this cost is in the balance sheet items. Sales is closed as a revenue account 2. The basic income statement differences between a service business and.

The dividends account is closed to retained earnings. There are three broad steps that are involved in using and preparation of income summary account. View the full answer previous question next question not the question you’re looking for?

Sales discounts, sales returns and allowances, and cost of goods sold will close with the temporary debit balance accounts to income summary. It may belong to the raw materials, works in. (check all that apply.) check all that apply.

Debiting income summary and crediting cost. Note that for a periodic inventory system, the end of the period adjustments require an update to cogs. No, the cost of goods sold is the income statement’s item and is not present in the balance sheet.

Debiting cost of goods sold and crediting retained earnings. To close these debit balance accounts, a credit is required with a corresponding debit to the income summary. Debiting cost of goods sold and crediting income summary.

All accounts listed in the income statement columns are transferred. (check all that apply) cost of goods sold is closed with the revenue accounts cost of goods sold is closed with the expense accounts. The net balance of the income summary account is.

![Cost Of Goods Sold Audit Procedures 80+ Pages Summary [1.5mb] Latest](https://www.wikihow.com/images/thumb/1/10/Account-for-Cost-of-Goods-Sold-Step-16.jpg/aid1565032-v4-1200px-Account-for-Cost-of-Goods-Sold-Step-16.jpg)