Heartwarming Tips About Invested Capital In Balance Sheet

Tcbi remains committed to boosting revenues through its strategic initiatives.

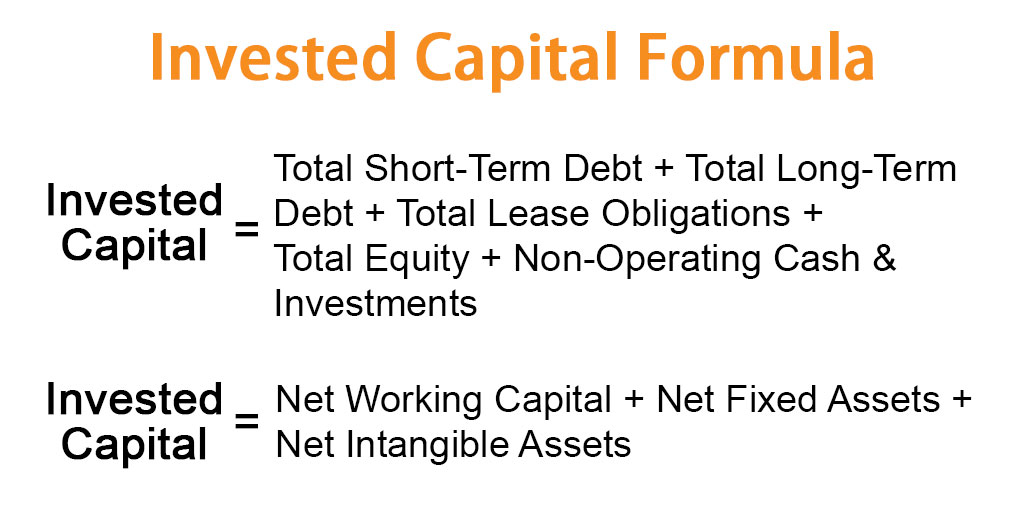

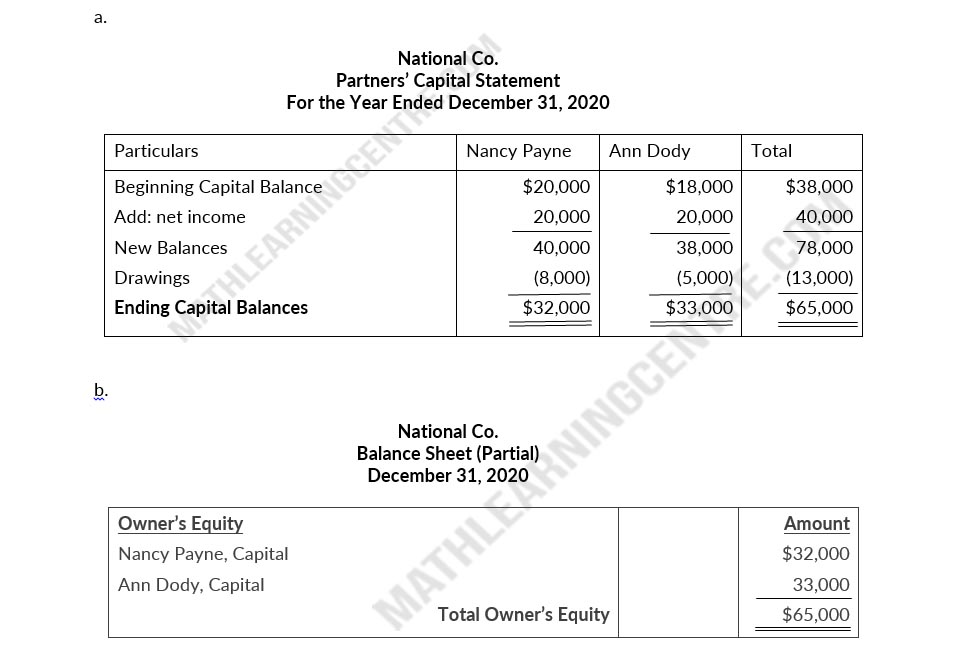

Invested capital in balance sheet. In graham and dodd’s security. Businesses raise capital in order to finance business needs,. Investments might include stock, stock funds, or bonds.

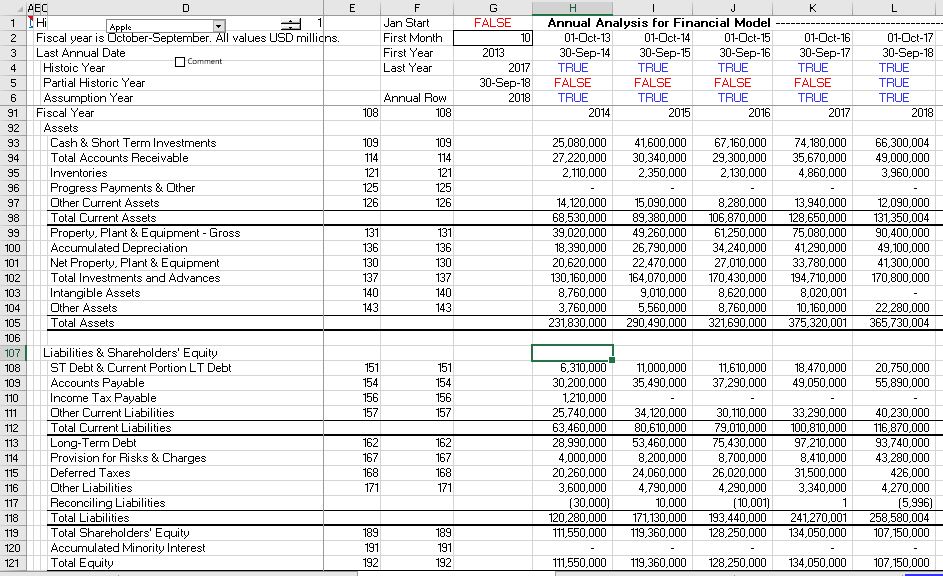

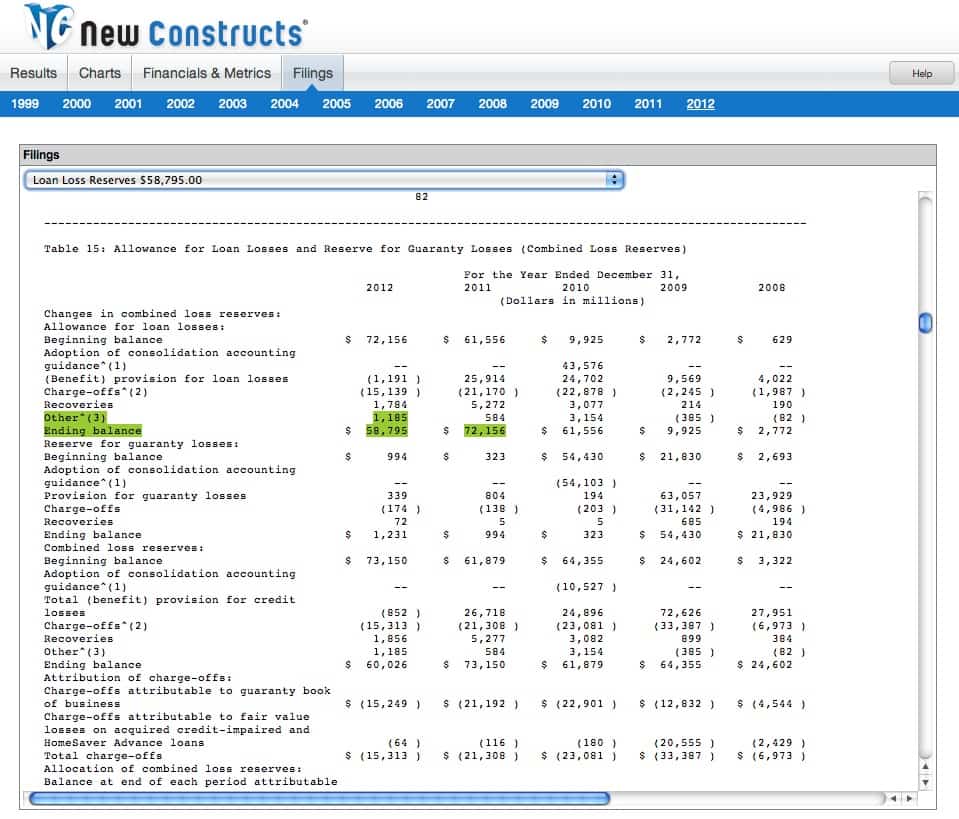

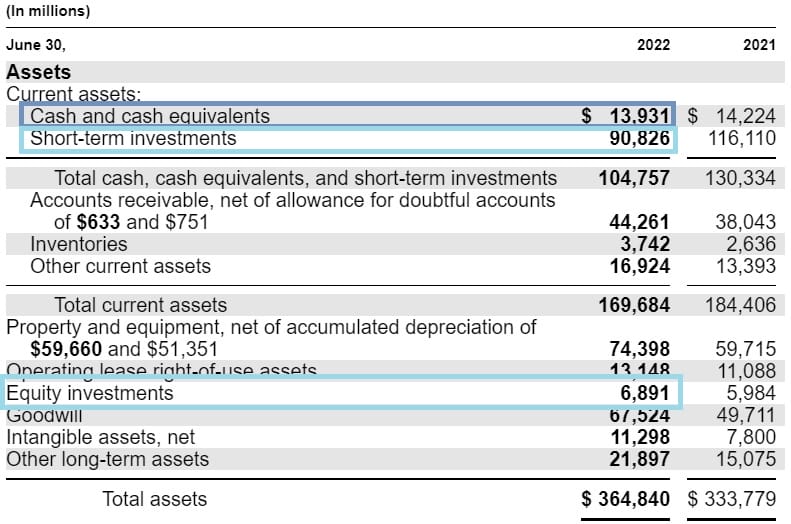

Invested capital equals the sum of all cash that has been invested in a company over its life with no regard to financing form or accounting name. Texas capital bancshares, inc. Instead, it is scattered among several.

Return on assets (roa), return on equity (roe), and return on invested capital (roic) are three ratios that are commonly used to determine. Its strong balance sheet and decent liquidity. Where to find invested capital?

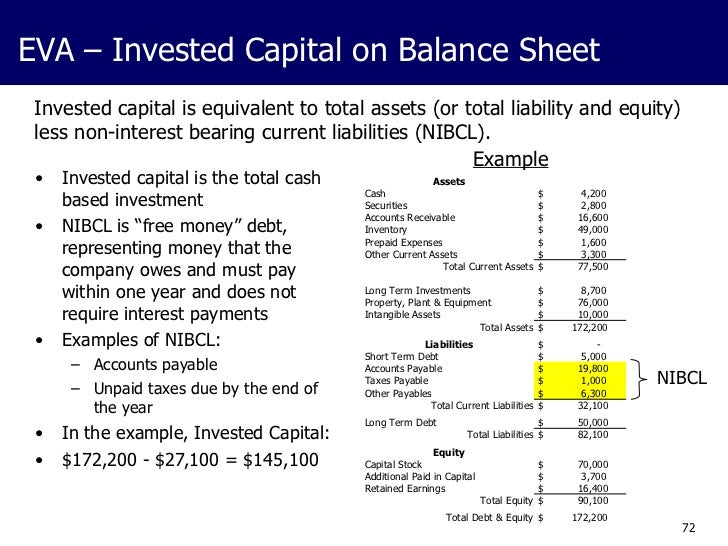

Definition invested capital is the total amount of cash invested in a company since it started operations. In other words, it is capital provided by all investors — both. Instead, the capital invested that is presented must be calculated.

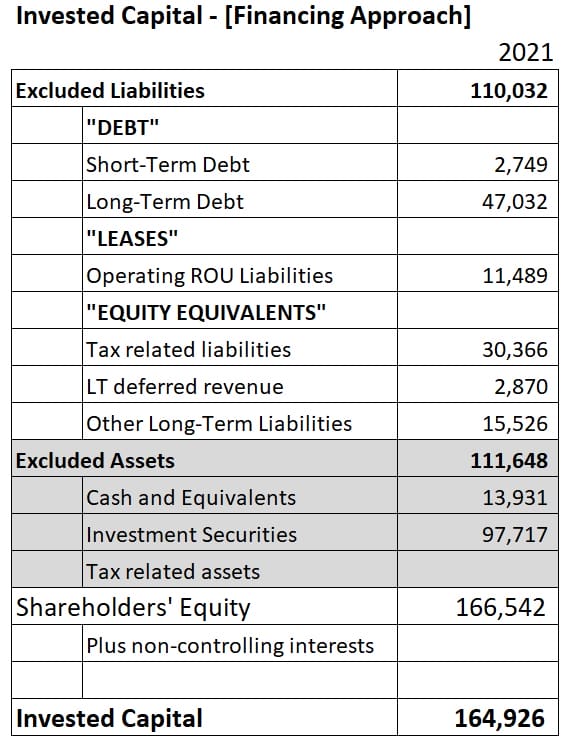

A mix of both equity and debt financing. A robust measure of profitability. The capital invested on a company's balance sheet is not recorded as a separate line item.

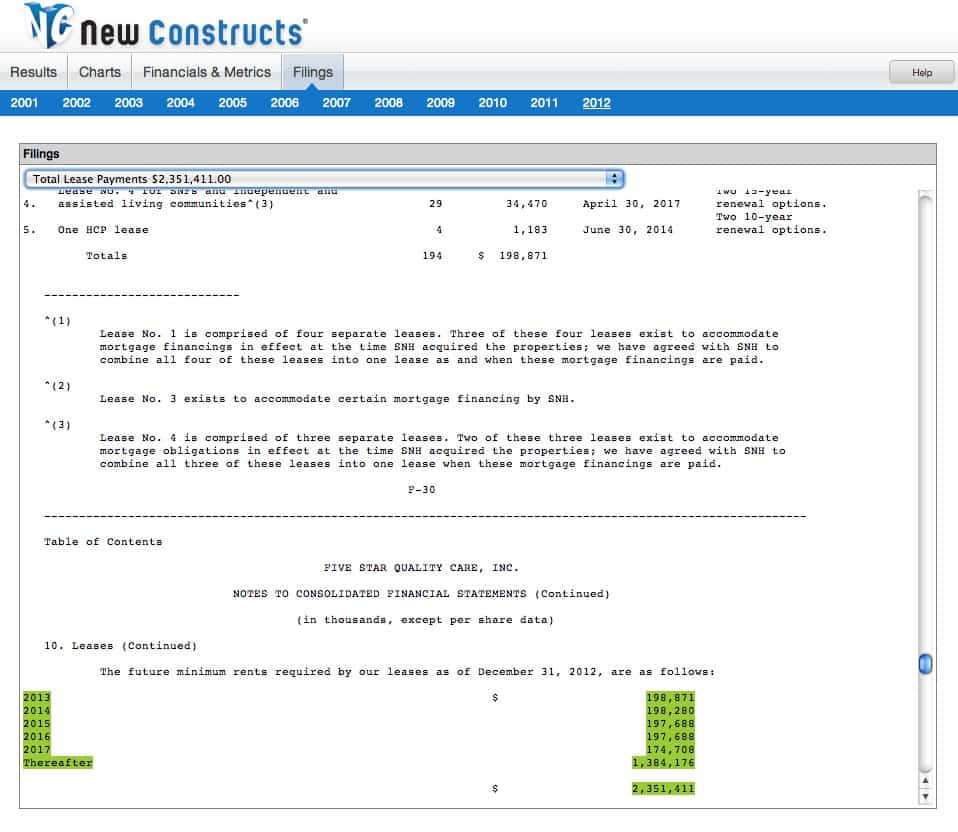

When a company makes an acquisition, the entire purchase price is added to the company’s balance sheet. A company's roic is the ratio of its earnings before any interest expense on debt or taxes to the sum of its debt. However, the income captured is that which occurs.

Roic stands for return on invested capital and is a profitability or performance ratio that aims to measure the percentage return that a company earns on invested capital. Presentation of invested capital. Return on invested capital (roic) is a calculation used to determine how well a company allocates its capital to profitable projects or investments.

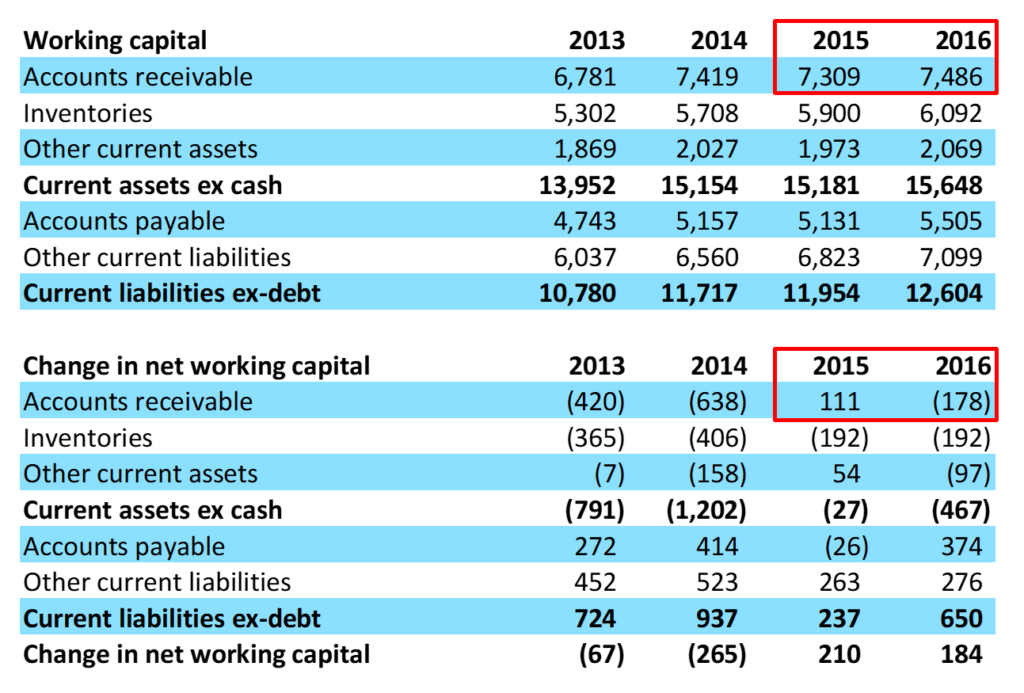

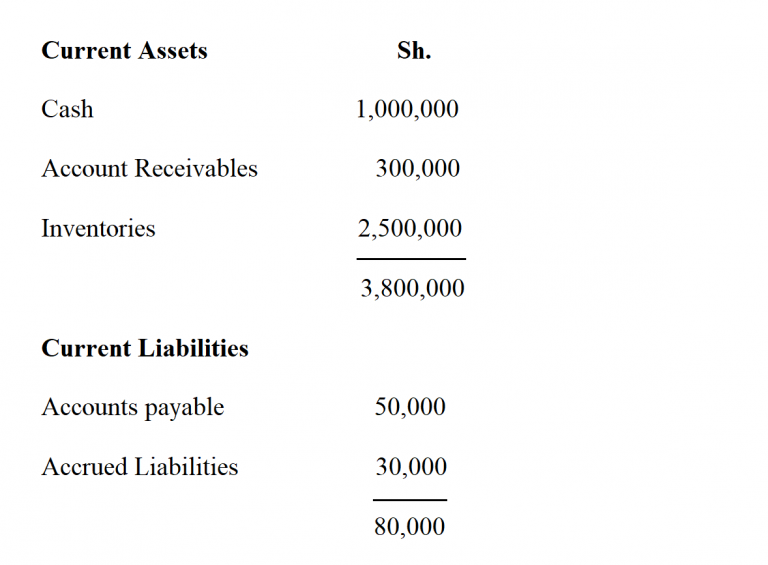

The sum of our company’s net working capital (nwc) and net pp&e is its invested capital for each year, which amounts to $152 million and then $168 million the. This is not limited to cash—rather, it includes cash equivalents as well, such as stocks. In the balance sheet, one must choose ‘separation of operations and finance’ as the layout.

Invested capital is capital invested in a company by debtholders and shareholders; Fixed assets are shown net of accumulated depreciation on the balance sheet. For companies, invested capital is used to expand operations and further develop the.

The total amount of invested capital is not listed in one place on a company’s balance sheet. It’s the total investment in the. Invested capital turns are an important consideration in the analysis of return on invested capital (roic).

:max_bytes(150000):strip_icc()/ScreenShot2021-09-26at9.44.14AM-6cee97e1408448c18d726884f472cad5.png)