What Everybody Ought To Know About Indirect Cash Flow Formula

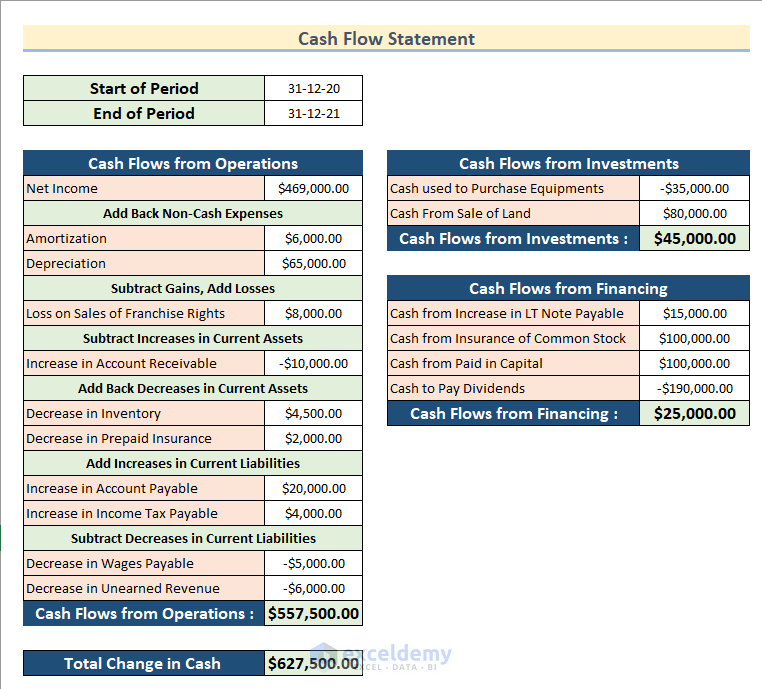

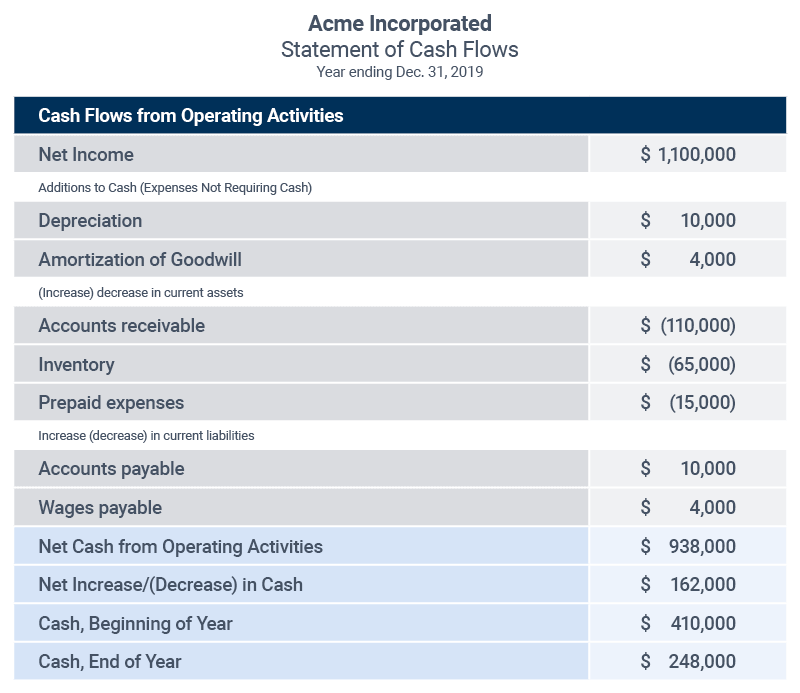

Cash flow from operations is the first of the three parts of the cash flow statement that shows the cash inflows and outflows from core operating the business in an accounting year;

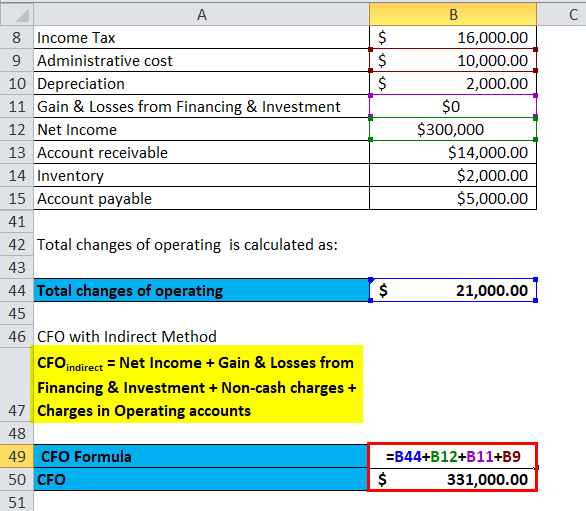

Indirect cash flow formula. This means that it uses increases and decreases in balance sheet accounts. (think of inputs as the raw materials being used to create the final product). The indirect method, as the name implies, looks at cash flow indirectly.

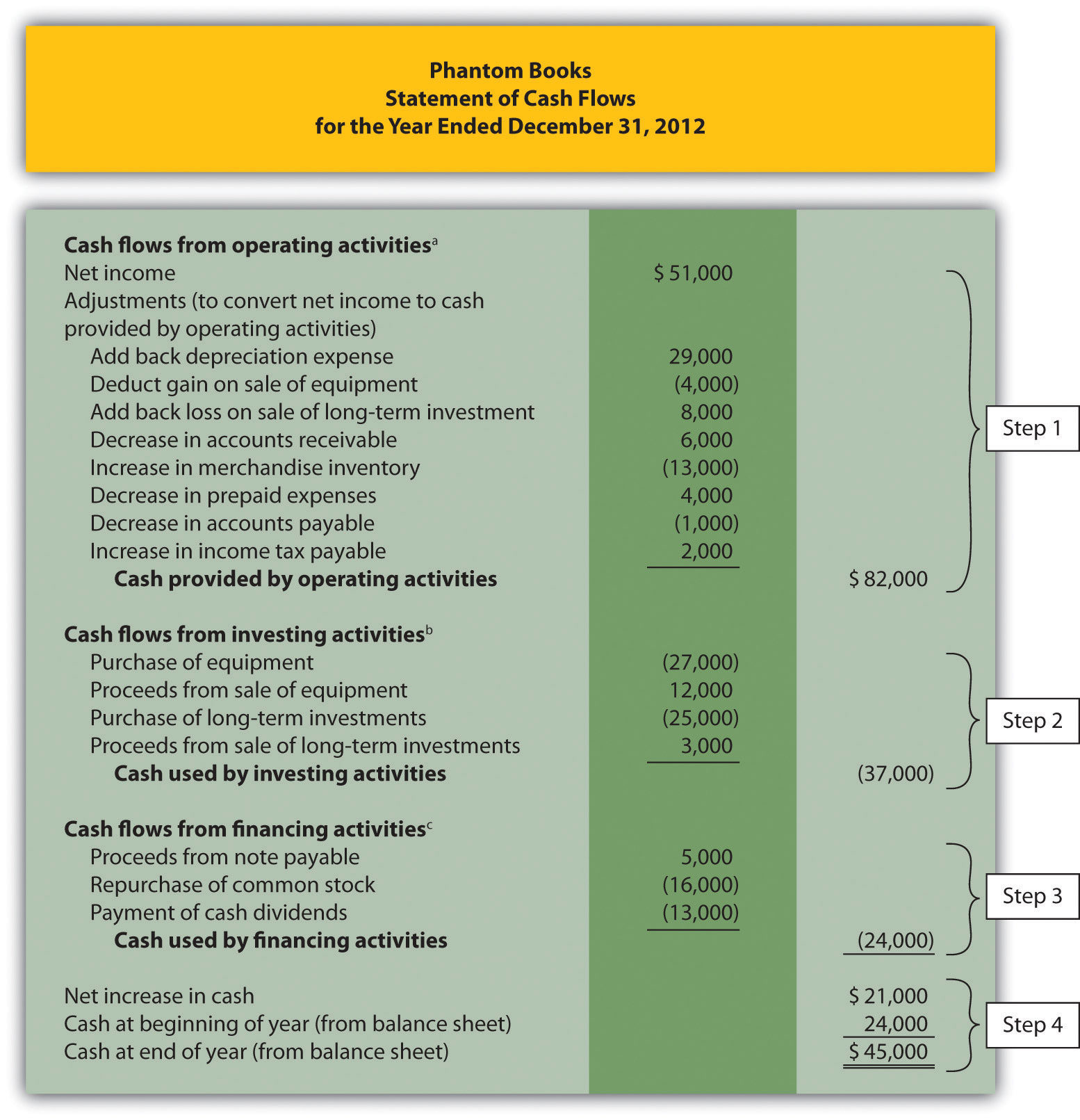

The cash flow from the operations section of the cash flow statement can be prepared using either the direct method or the indirect method. What is the cash flow statement indirect method? Let's take a closer look at the formulas from the above section with an example.

The indirect method is one of the two treatments for creating cash flow statements. To understand how to calculate the cash flow from operations using the indirect method, you need to first be aware of all the inputs used to calculate it. In theory, cash flow isn’t too complicated—it’s a reflection of how money moves into and out of your business.

What is the indirect method? The balance sheet shows all of the companies assets, liabilities, and equity accounts. A cash flow statement, one of the most important tools to manage your company’s finances, can be calculated in one of two ways:

Here we will study the indirect method to calculate cash flows from operating activities. Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: The indirect method uses increases and decreases in balance.

With the indirect method, the individual cash flows are not compared with each other as with the direct method. What is the indirect method to create a cash flow statement? The cash flow statement indirect method is one way to present a company’s total cash flow.

The indirect cash flow method calculates cash flow by adjusting net income with differences from noncash transactions. In this method, you begin with the net income and adjust it to calculate the company’s operating cash flow. Cash flow from operating activities.

The two methods of calculating cash flow are the direct method and the indirect method. Direct and indirect cash flow reporting. Net change in cash = cash from operations + cash from investing + cash from financing

What is the statement of cash flows indirect method? The indirect method is one of two accounting treatments used to generate a cash flow statement. The indirect method for a cash flow statement is a way to present data that shows how much money a company spent or made during a certain period and from what sources.

Operating activities include cash received from sales, cash expenses paid for direct costs as well as payment is done for funding working capital. To construct the cash flow statement using the indirect method, we need to combine information from the p&l with the balance sheet (b/s). Add back noncash expenses, such as depreciation, amortization, and depletion.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)