Wonderful Info About Personal Income And Expense Statement

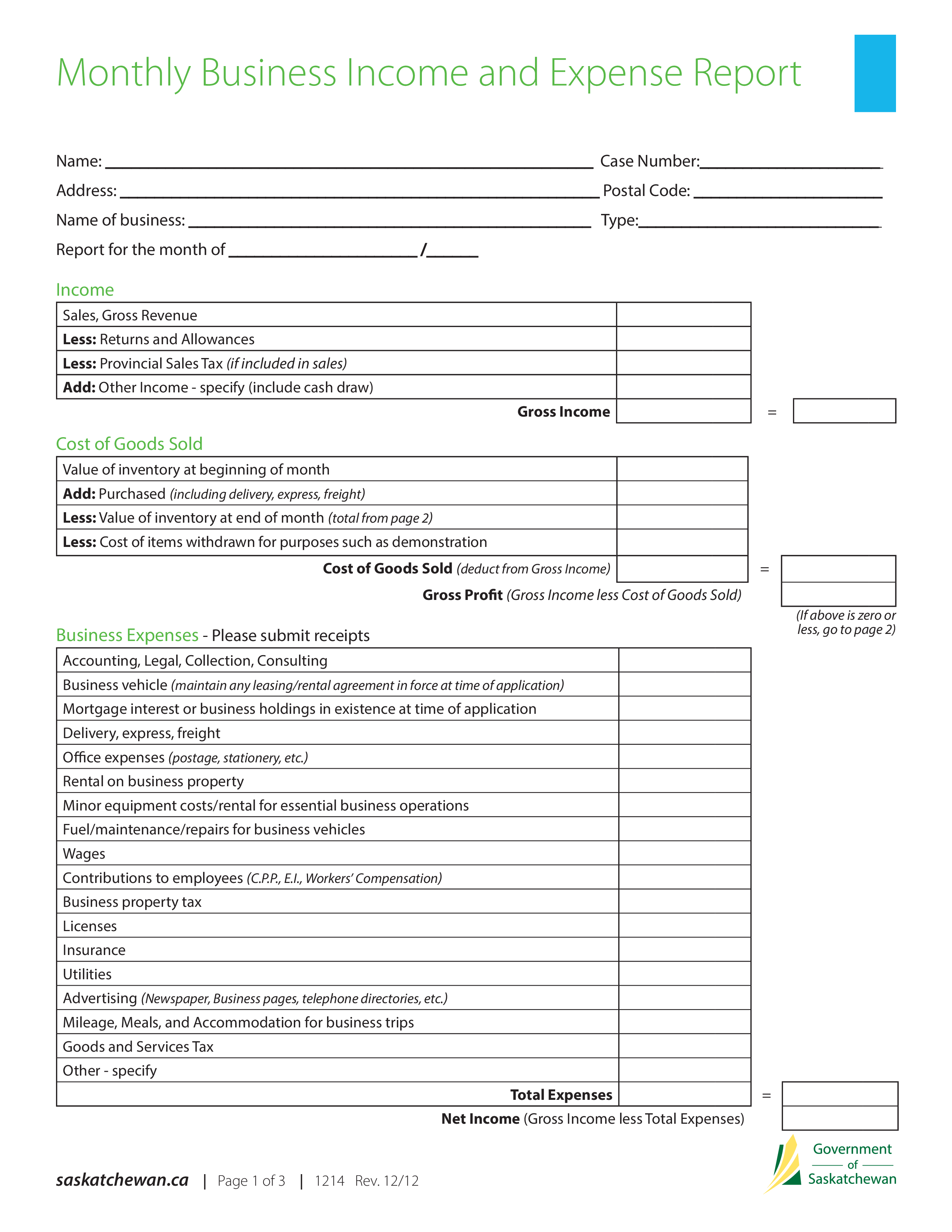

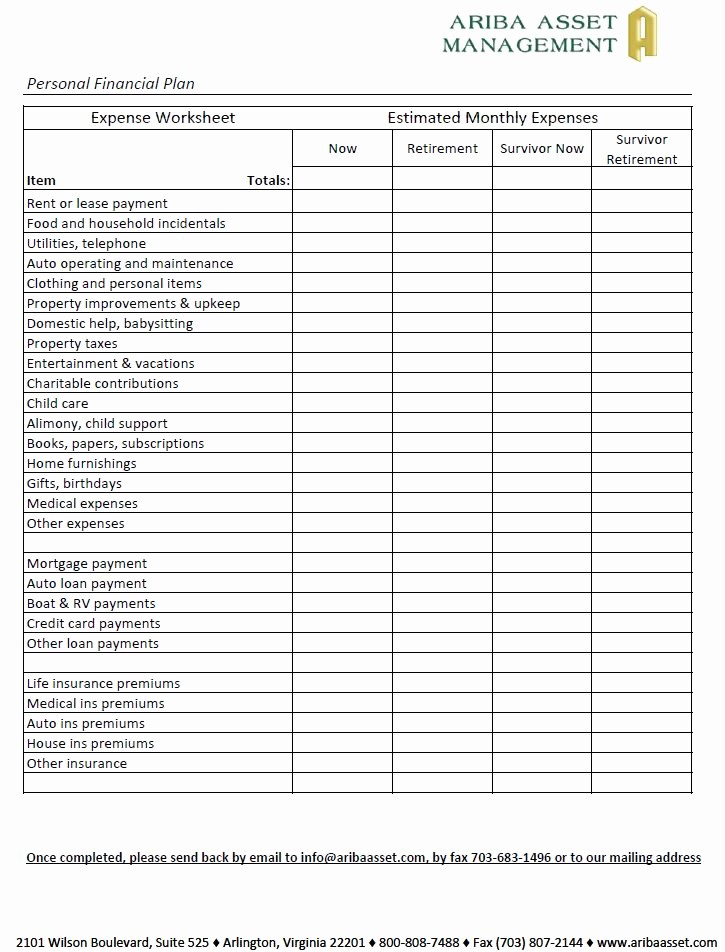

Input your costs and income, and any difference is calculated automatically so you can.

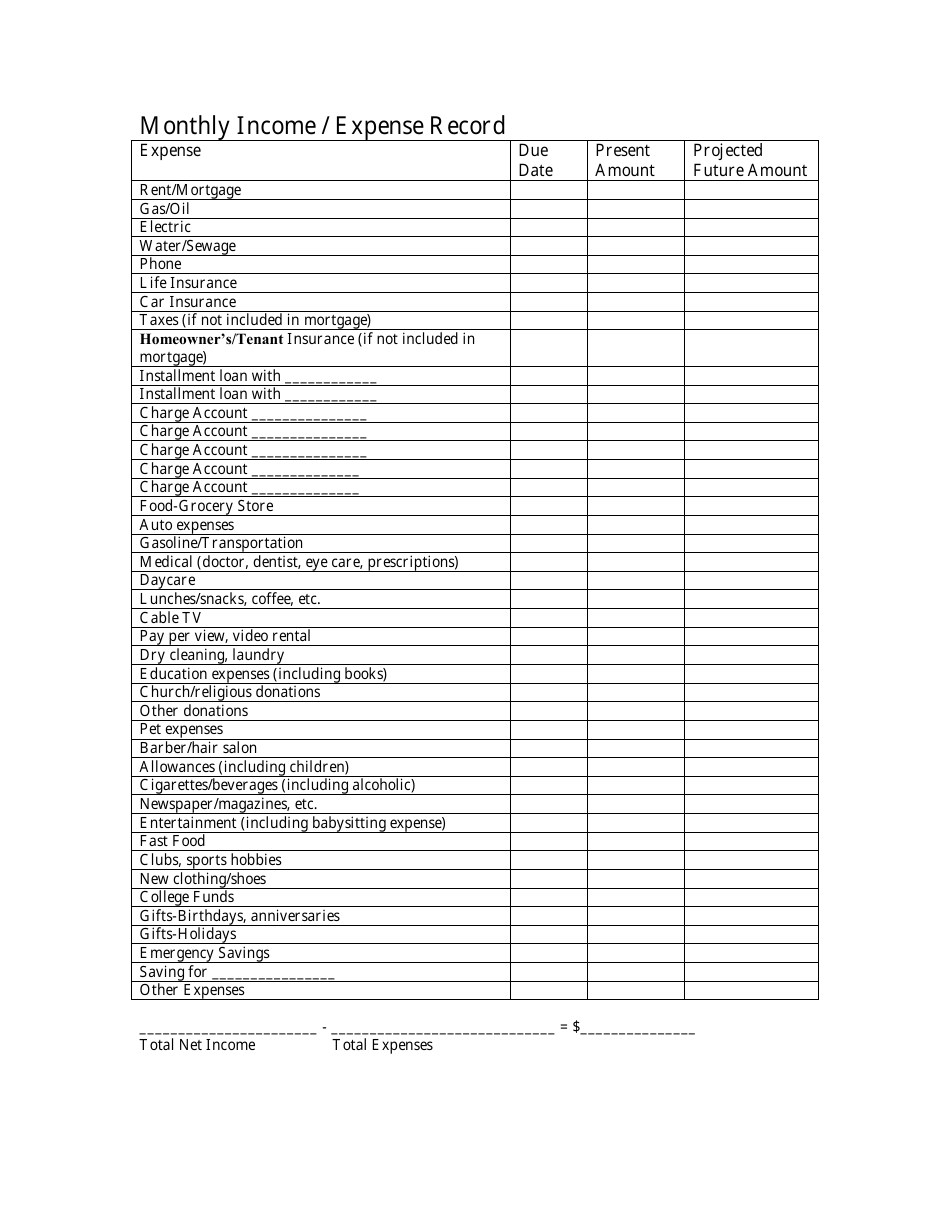

Personal income and expense statement. Personal financial statements template. If you want to use an income. Personal income and expenses you have to keep a close eye on your income when you create a personal budget.

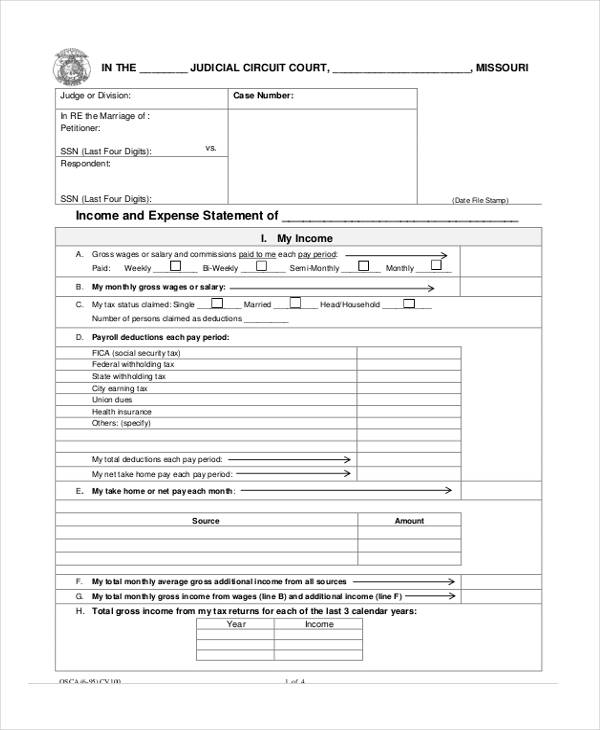

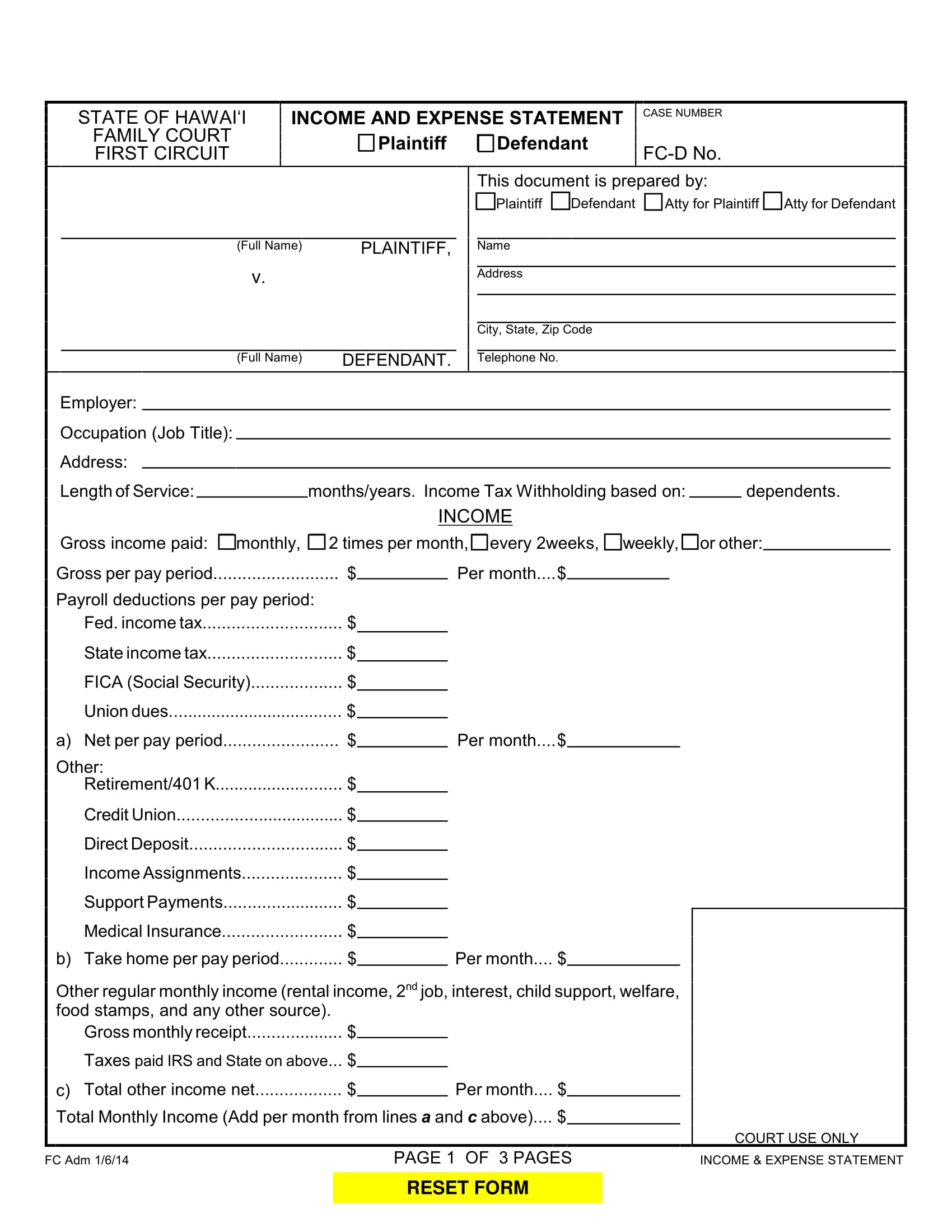

Monthly budgeting (emg5h) to produce a budget you need to estimate what your income and expenses should be for a given month. For example, if you itemize, your agi is $100,000. An income and expenditure statement is also known as a profit and loss account.

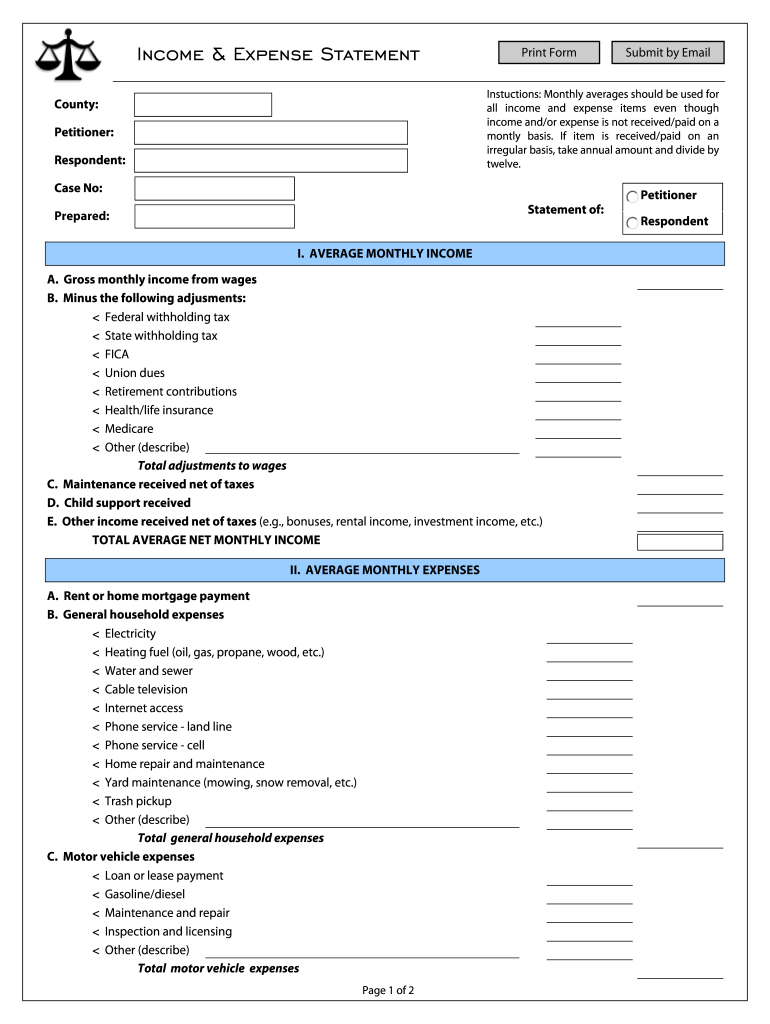

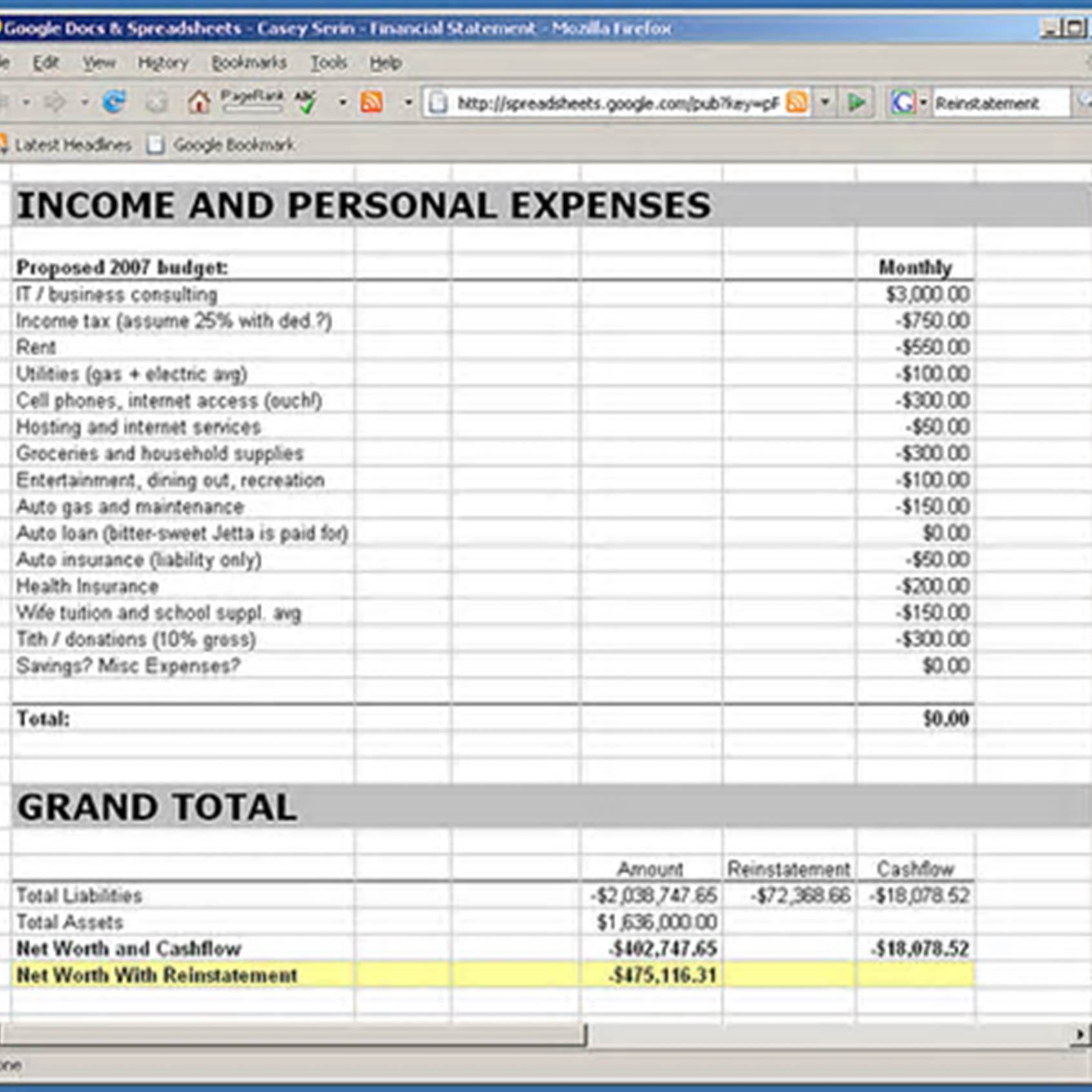

Gross profit represents the income or profit remaining after production costs have been subtracted from revenue. 'financial statements' or 'income and expenditure' (i&e) forms help creditors understand your situation. A personal financial statement is an overview of a person or household's finances.

A personal financial statement is a document that details an individual's assets and liabilities. Add up all your gains then deduct your losses. Income and expenditure form and financial statement.

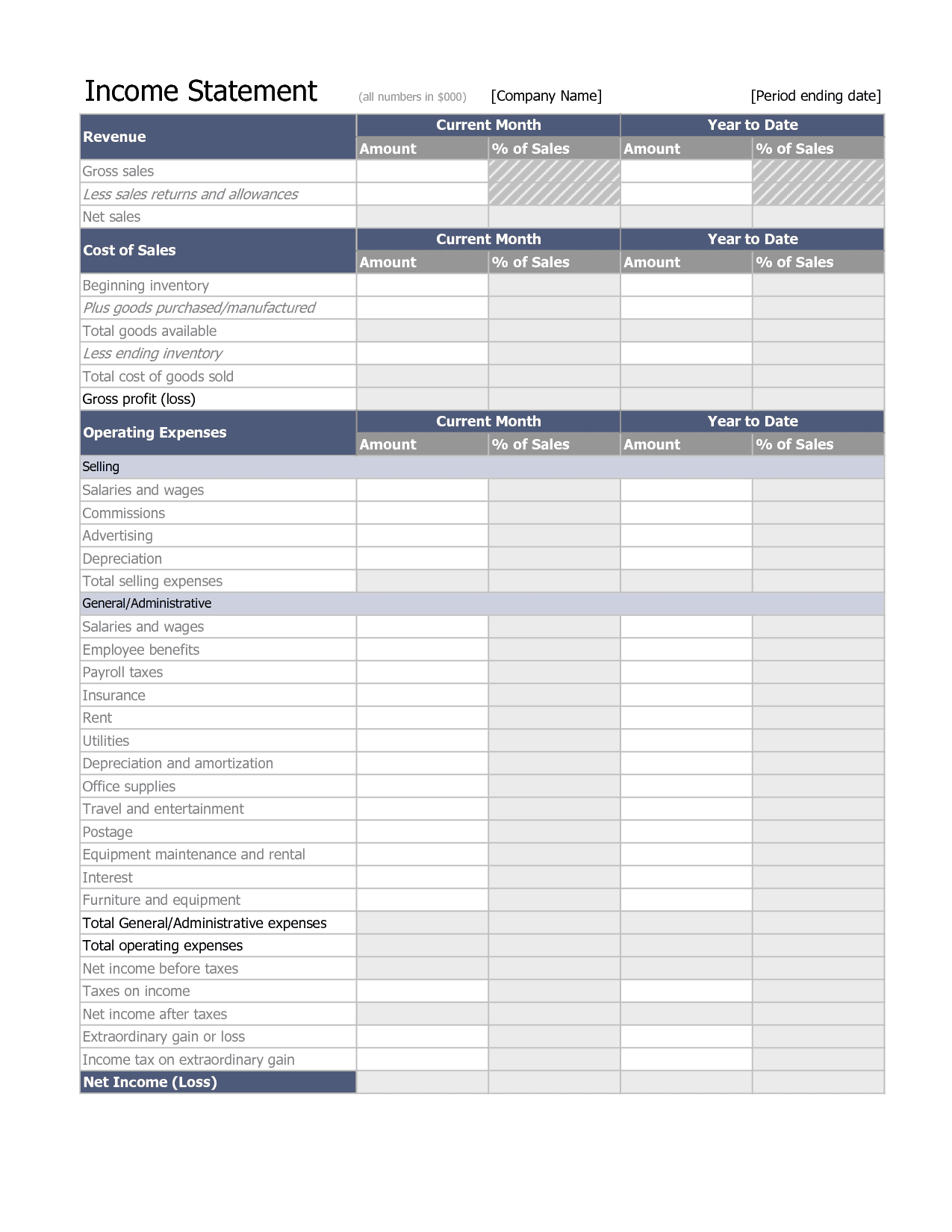

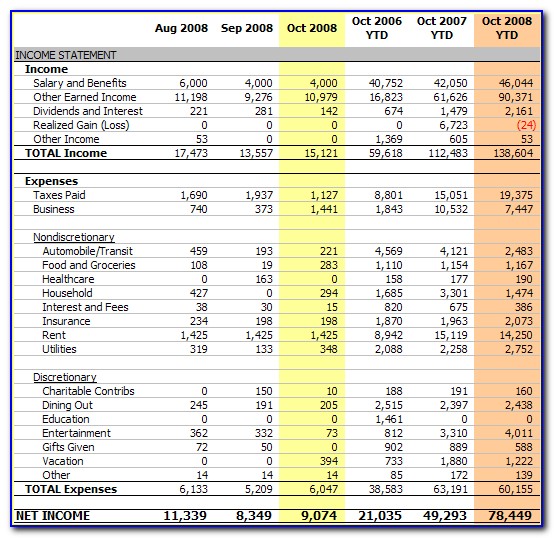

By radhey sharma budgeting being a financial planner, i am shit scared about not meeting my goals. The income statement gives you a straightforward overview of the monthly, quarterly or annual income and expenses. You might already know exactly how much.

Net income is the profit that remains after all. An income statement compares revenue to expenses to determine profit or loss. Expenditure can include living expenses (e.g.

Three commonly used financial statements are the income statement, the cash flow statement, and the balance sheet. Essentially, it summarises all your business income and expenses. Stay on track for your personal.

It's often used by lenders to learn a loan. Expenditure (emg5f) personal expenditure is money that you spend. Create from scratch show all budget your personal and business finances using these templates manage your finances using excel templates.

Identify your goals, assess your income, assets, liabilities, &. Food, clothing, entertainment), accounts (e.g. Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi).

You can learn about the health of a business—up and down, and across time—by. Anchiy / getty images. This excel template can help you track your monthly budget by income and expenses.