Smart Tips About The Accounting Equation For A Corporation Is

Accounting equation for a corporation:

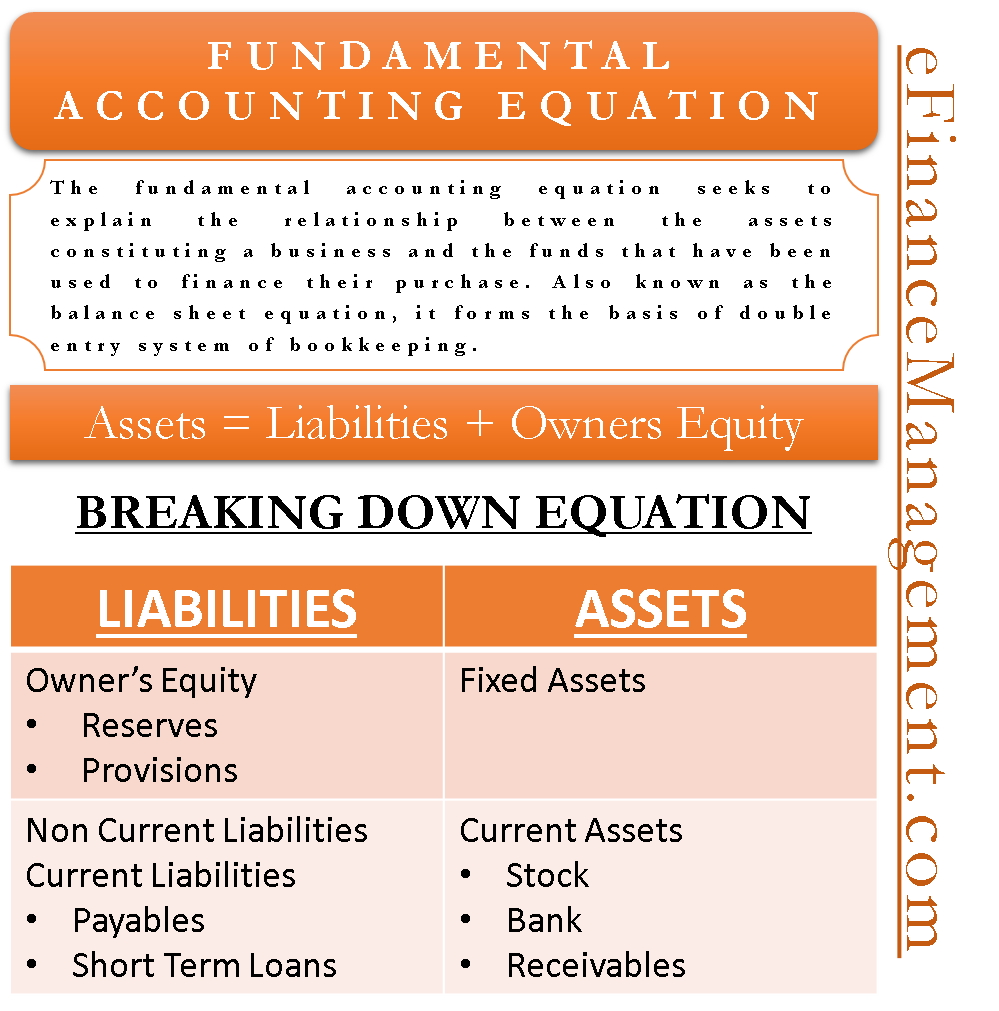

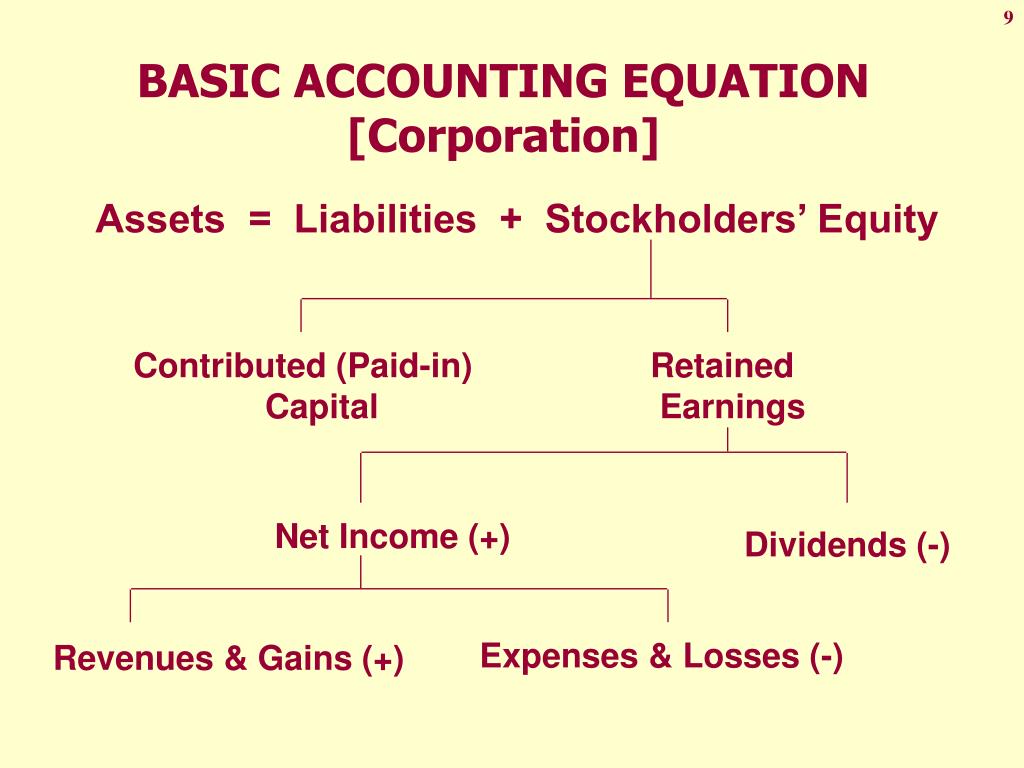

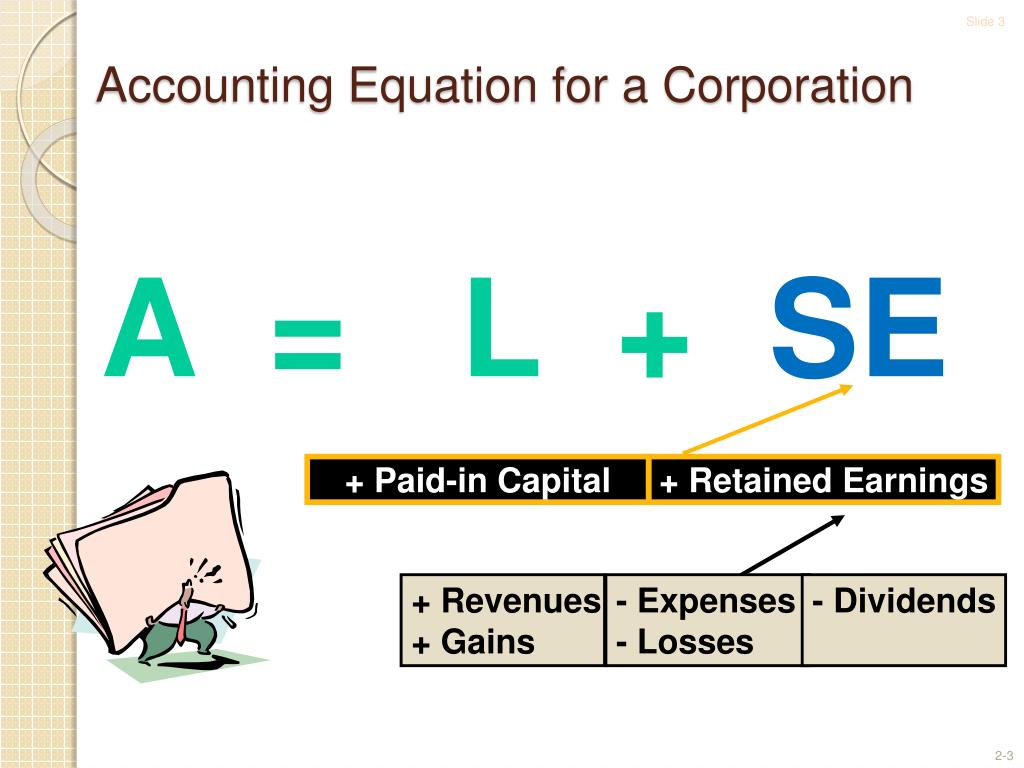

The accounting equation for a corporation is. The expanded accounting equation for a sole proprietorship is: The three elements of the accounting equation 1. The basic accounting equation is often expanded so that it is a little clearer what makes up each.

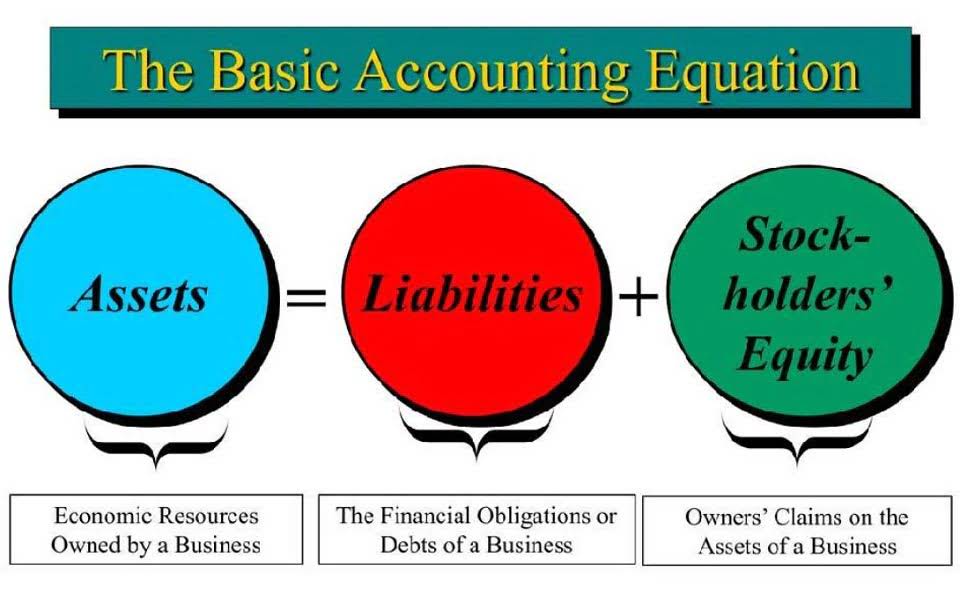

The accounting equation tells us that asi has assets of $10,000 and the source of those assets was the stockholders. Assets = liabilities + equity. Assets = liabilities + owners’ equity assets assets are the economic resources of the entity, and include such items as cash, accounts receivable (amounts owed to a firm by.

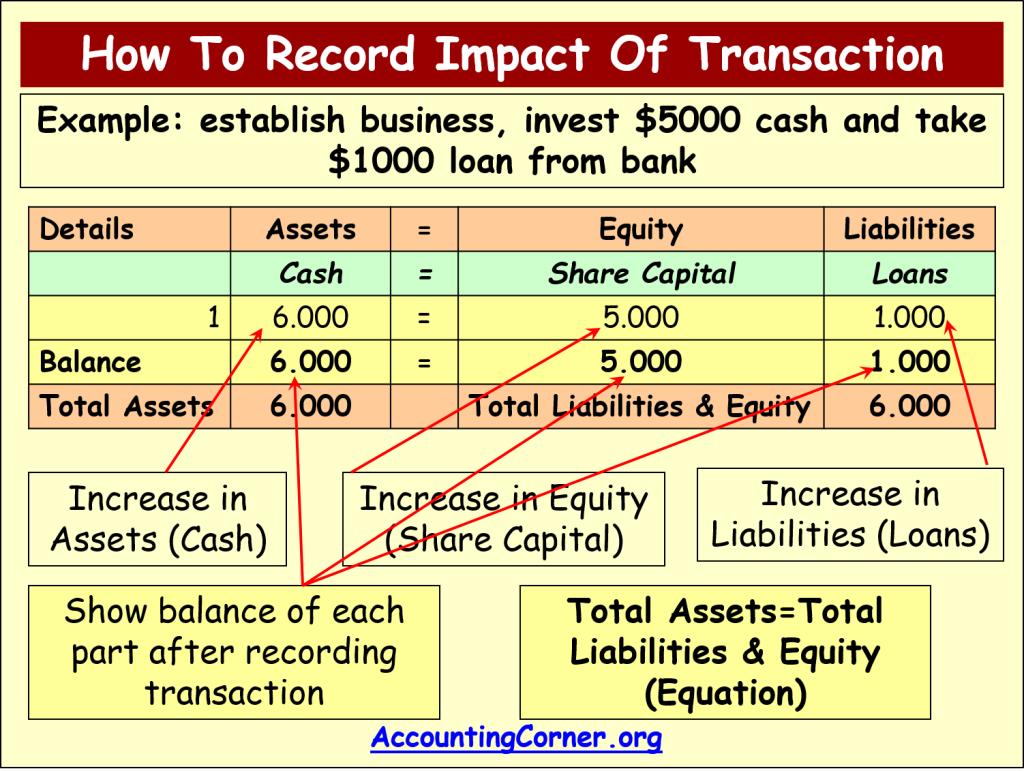

The transaction involves three steps in accounting: What is the accounting equation? The expanded accounting equation for sole proprietors.

80% equity and 20% debt. Social science economics finance far 1: Assets = liabilities + equity key takeaways the basic accounting equation is as follows:

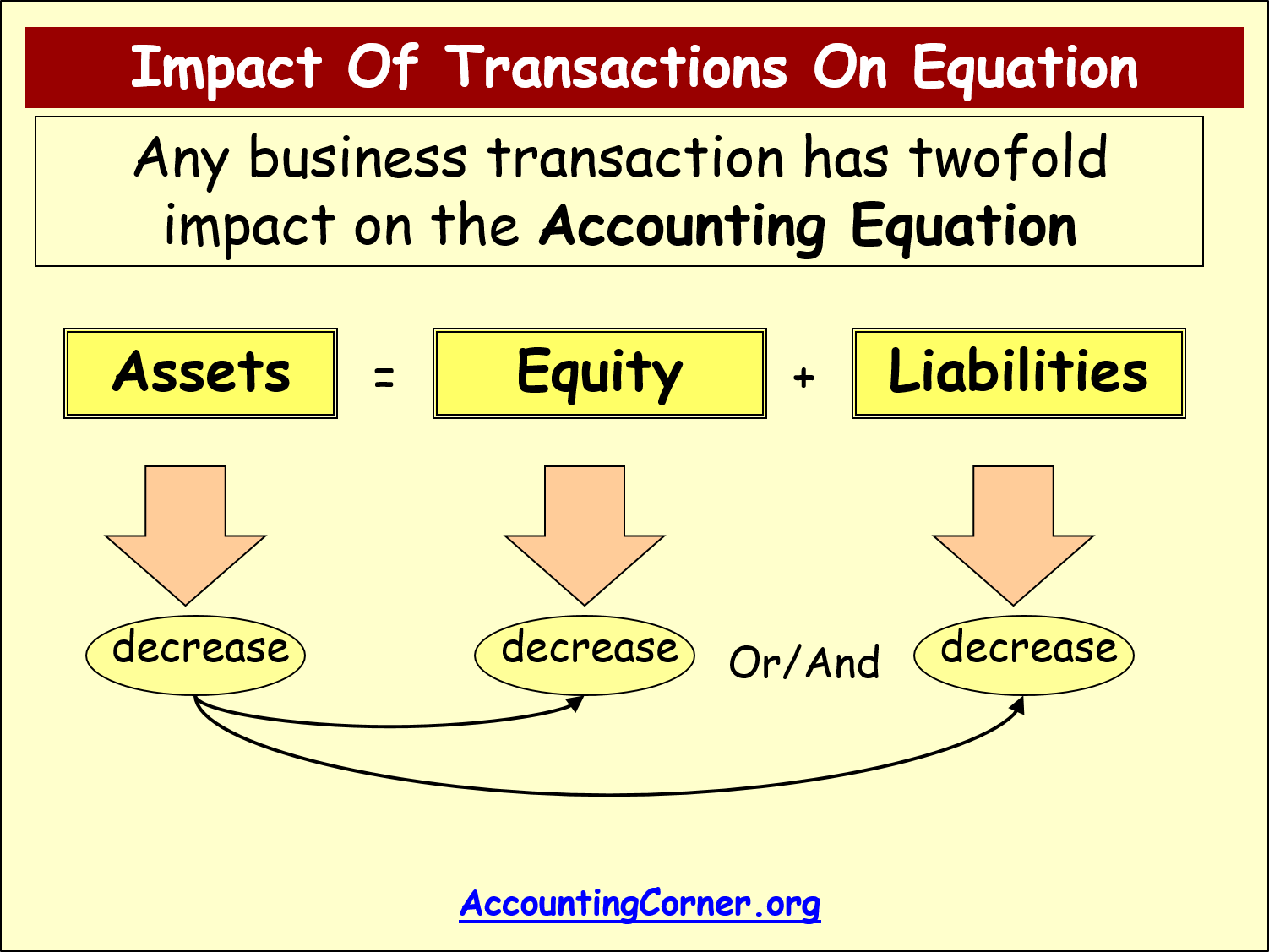

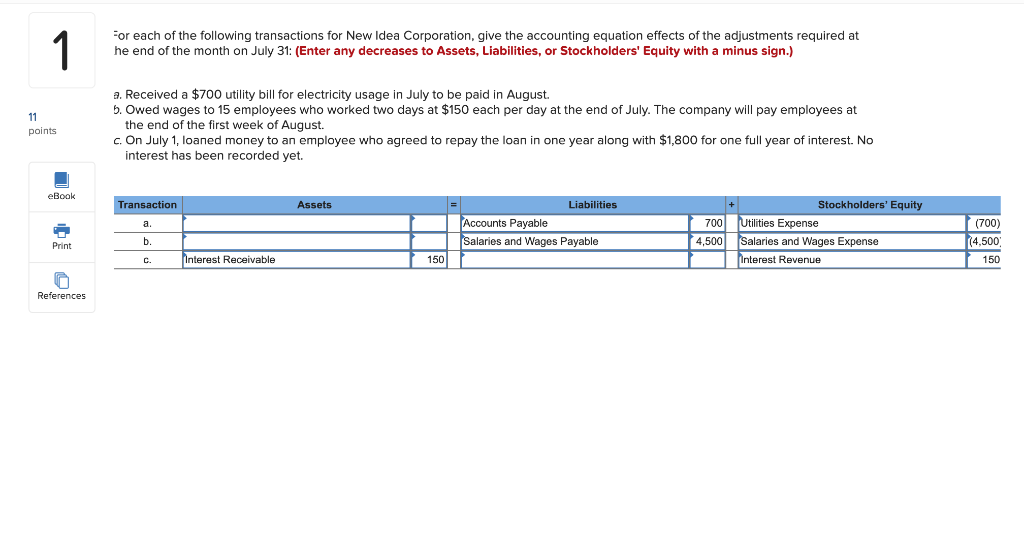

Chpt 2 problems 5.0 (1 review) analyze each transaction and show the effect of each on the accounting equation for a. Remember that the accounting equation must remain balanced, and assets need to equal liabilities plus equity. These are the building blocks of the basic accounting equation.

We show formulas for how to calculate it as a basic accounting equation and an expanded accounting equation. Alternatively, the accounting equation tells us that the corporation has assets of $10,000 and the only claim to the assets is from the. On the asset side of the equation, we show an increase of.

Assets = liabilities + shareholders’ equity a business's assets are resources, and. This equation is the foundation.

/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)