Supreme Info About Net Profit In Accounting

Calculating net profit is straightforward.

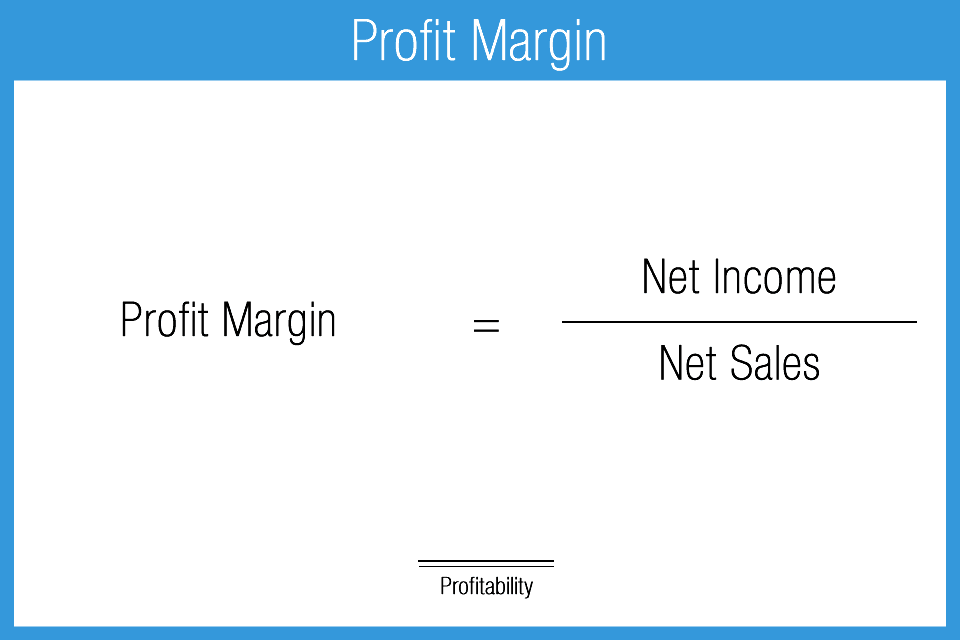

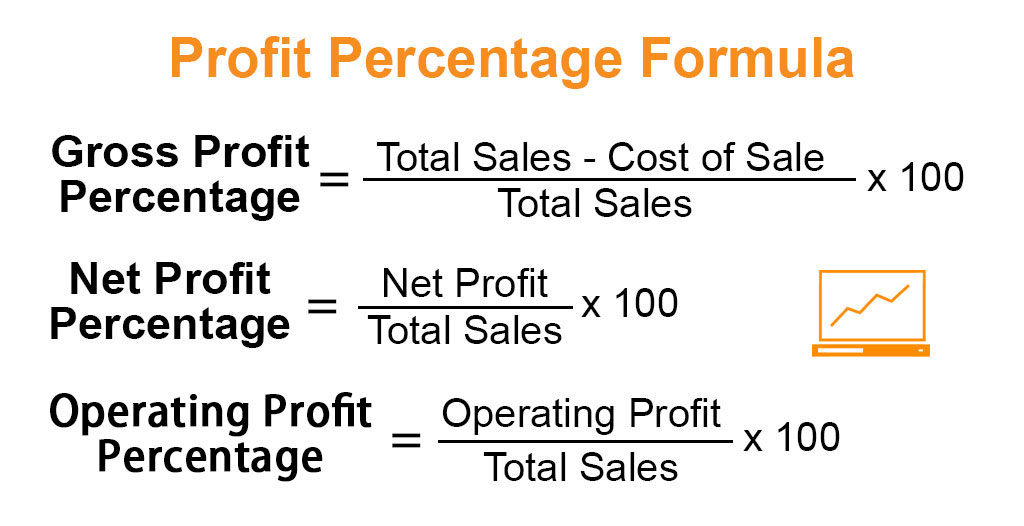

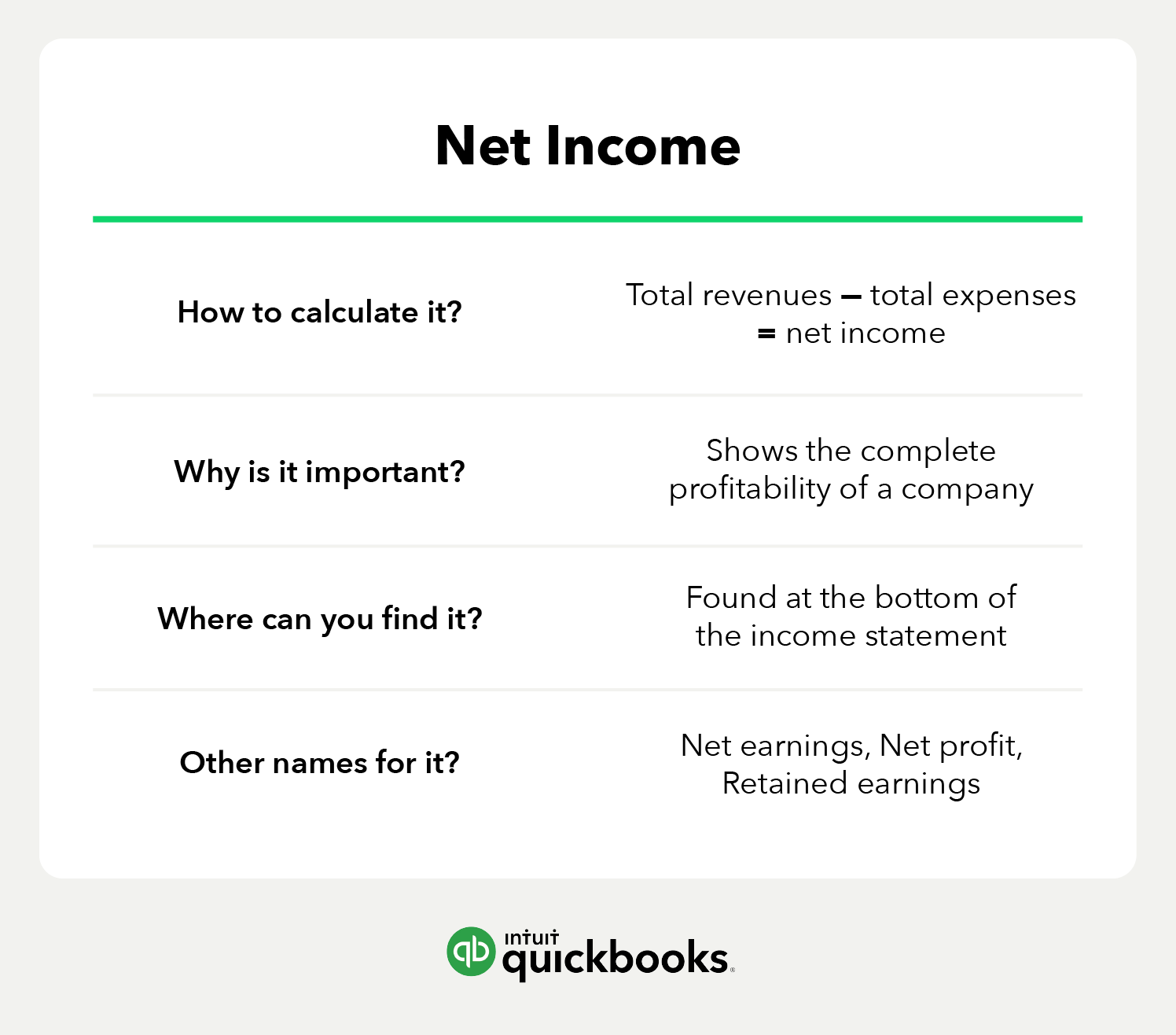

Net profit in accounting. Net profit is the amount of money that a company has after all its expenses are paid. Net profit margin = net profit ⁄ total revenue x 100. Net income, or net profit, is usually the last line item on a company's income statement, detailing the amount of money earned.

The net profit of a company is the amount of money a business earns after deducting interest, operating expenses, and tax over a defined period. You can think of net profit like your paycheck: Three extracts from examples of exam questions requiring adjustment of profits are shown below to demonstrate how different questions should be approached.

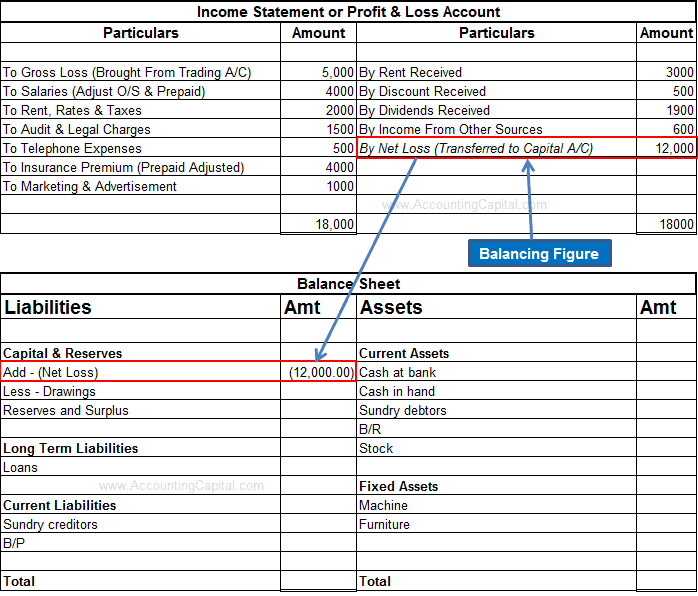

It is the difference between the gross profit or loss and the total indirect income/expenses of a business. The result of the profit margin calculation. The measure could be modified for use by a nonprofit entity, if the change in net assets were to be used in the formula instead of net profit.

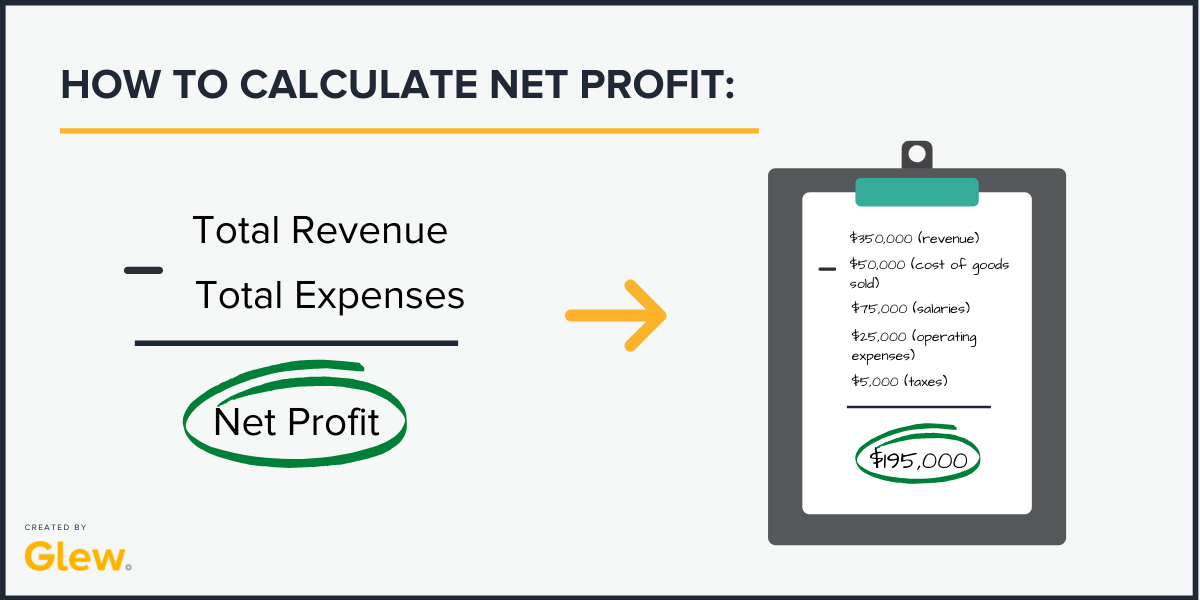

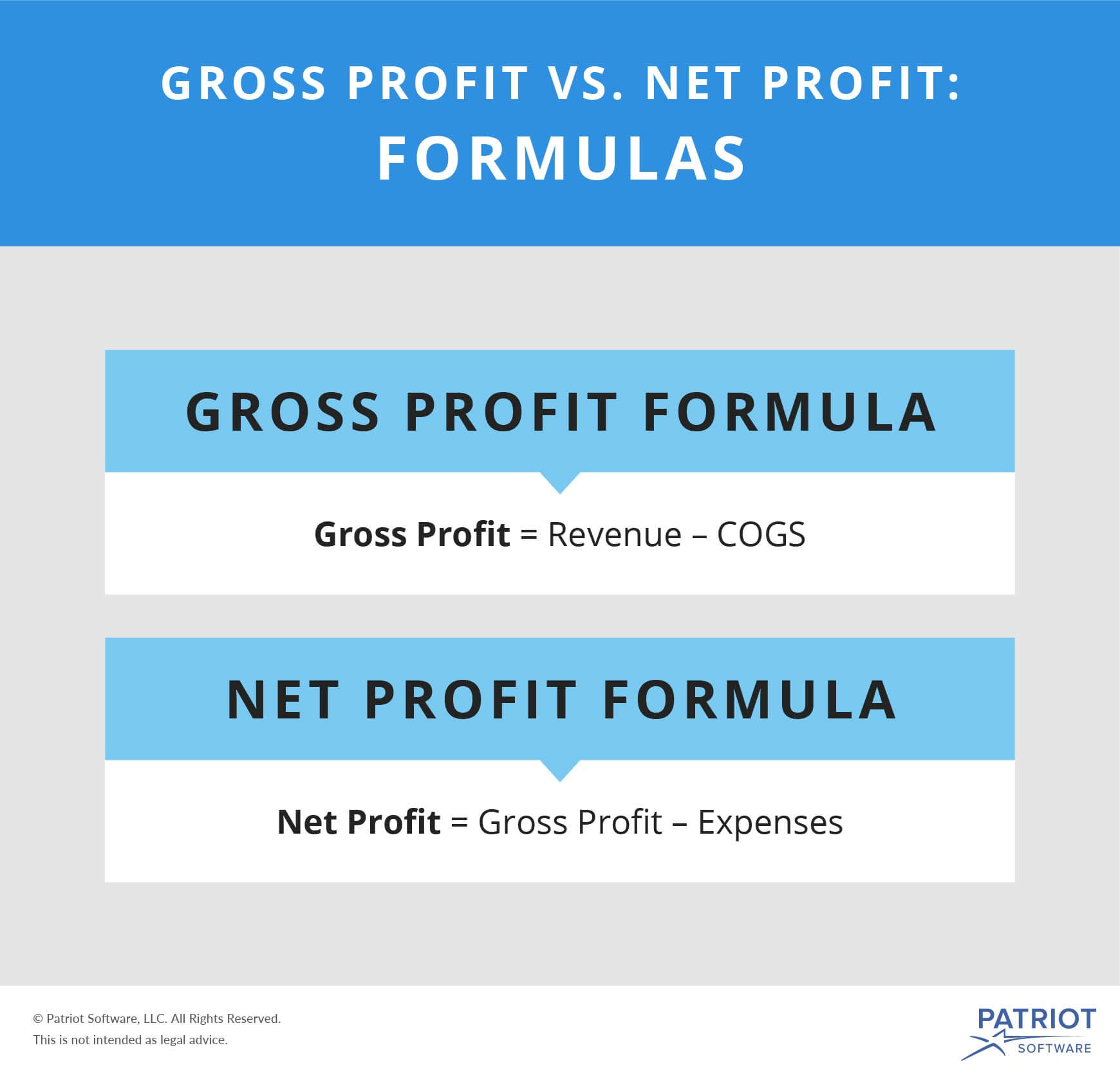

Net profit, also known as net income, is a company's total earning after accounting for expenses. A company’s net profit is also known as its net income, net earnings or bottom line. To calculate net profit, subtract the cost of goods sold, operating expenses, financing costs, and tax costs from net revenues.

It represents the financial standing of a company after all its expenses have been paid off. It includes all revenues and expenses calculated using gaap. Accounting profit is the profit or net income of the business reported in the financial statements.

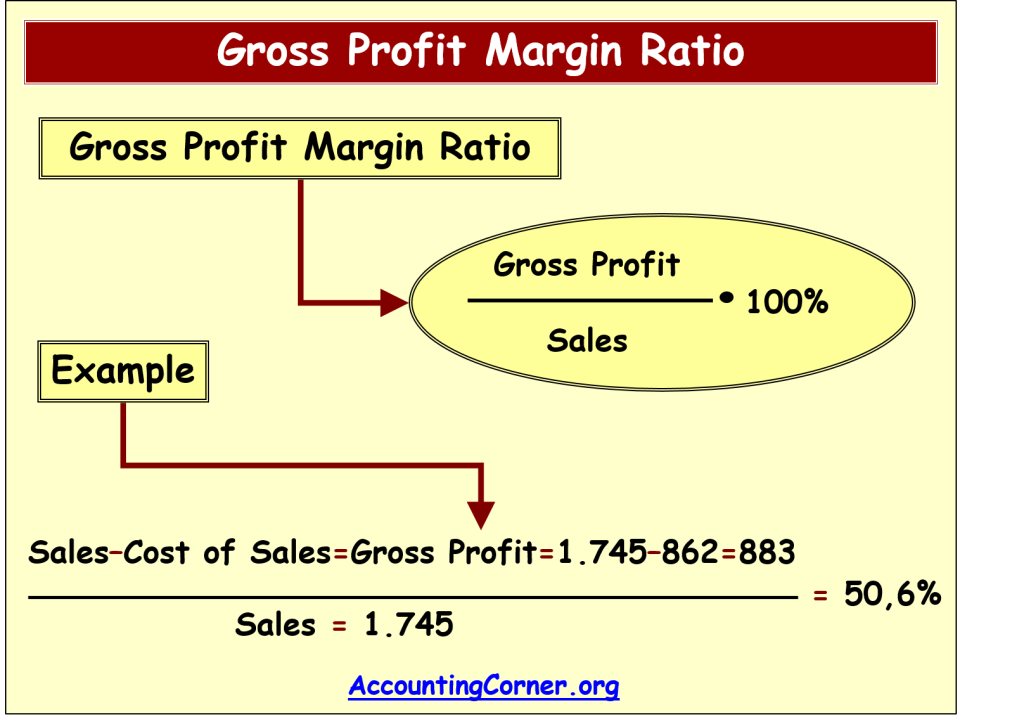

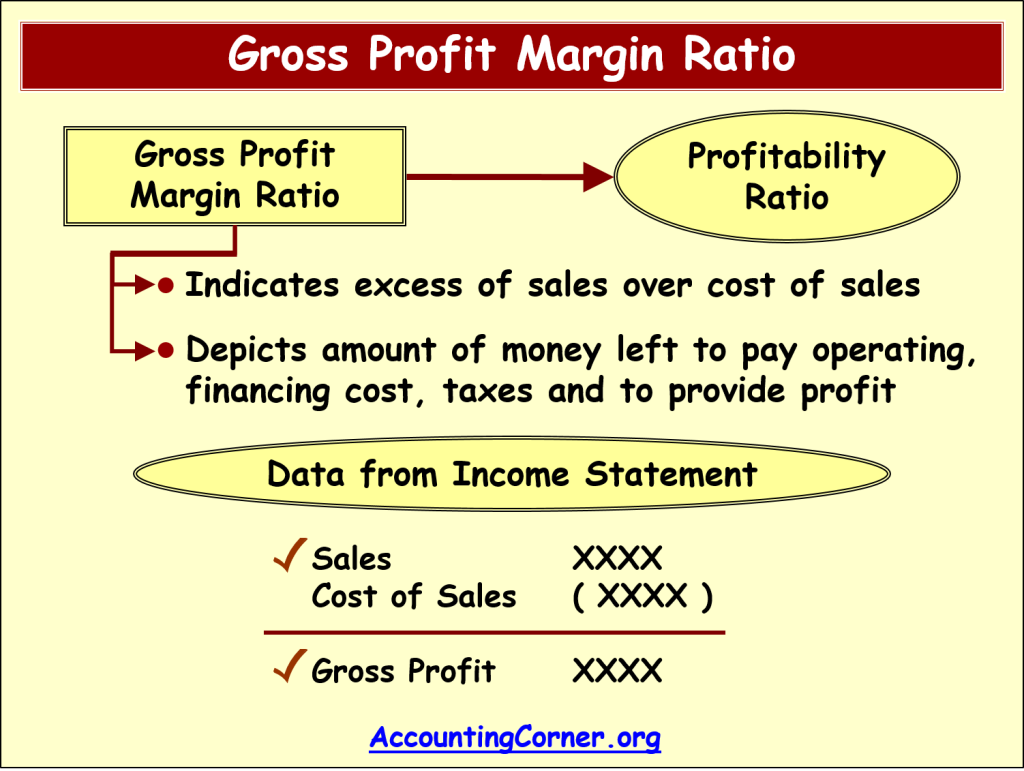

When people talk about income in business, they usually mean net income. The gross profit percentage is gross profit divided by sales and measures how effectively a company generates gross profit from sales or controls cost of merchandise sold. Detroit (ap) — ford motor co.

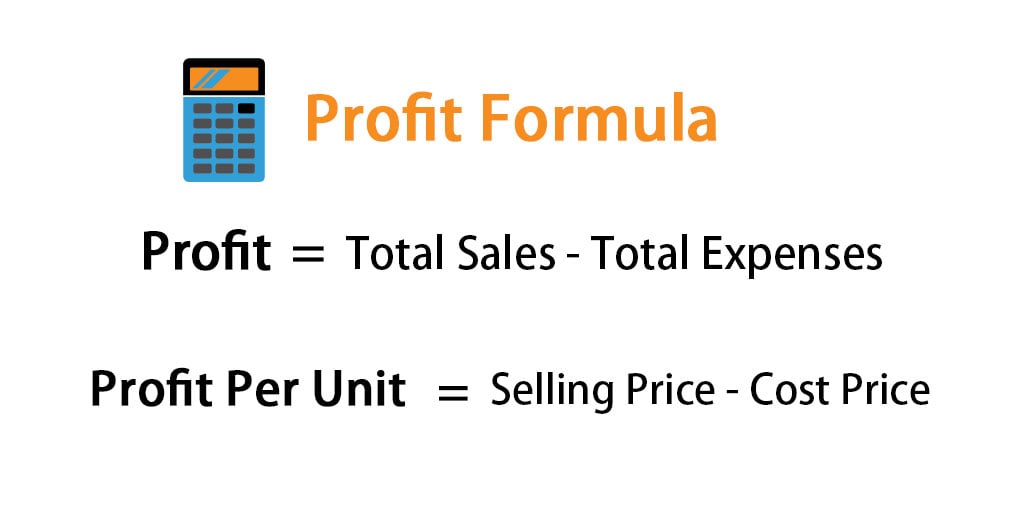

The most obvious difference between net income and net profit is that net income is the “bottom line” of the firm’s income statement from which all expenses have. How to calculate net profit. If the difference is a positive value, it’s net profit, and if.

Revenue recognition methods in accounting 1. Net profitability is an important indicator. Net income is the profit that remains after all expenses and costs, such as taxes, have been subtracted from revenue.

Net profit / loss. Revenue is the amount of income generated. It’s also commonly referred to as net income.

Net profit (also called net income or net earnings) is the value that remains after all expenses, including interest and taxes, have been deducted from revenue. Gathering all the figures you'll need may be complex, but keeping proper records will make it easier. It’s the money left after all taxes and benefits are subtracted.

:max_bytes(150000):strip_icc()/NetProfitMargin2-edf5ae45cbe048208913caa9d3b03110.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)