Fabulous Info About Tax Basis Financial Statements

On friday, the law enabled ms.

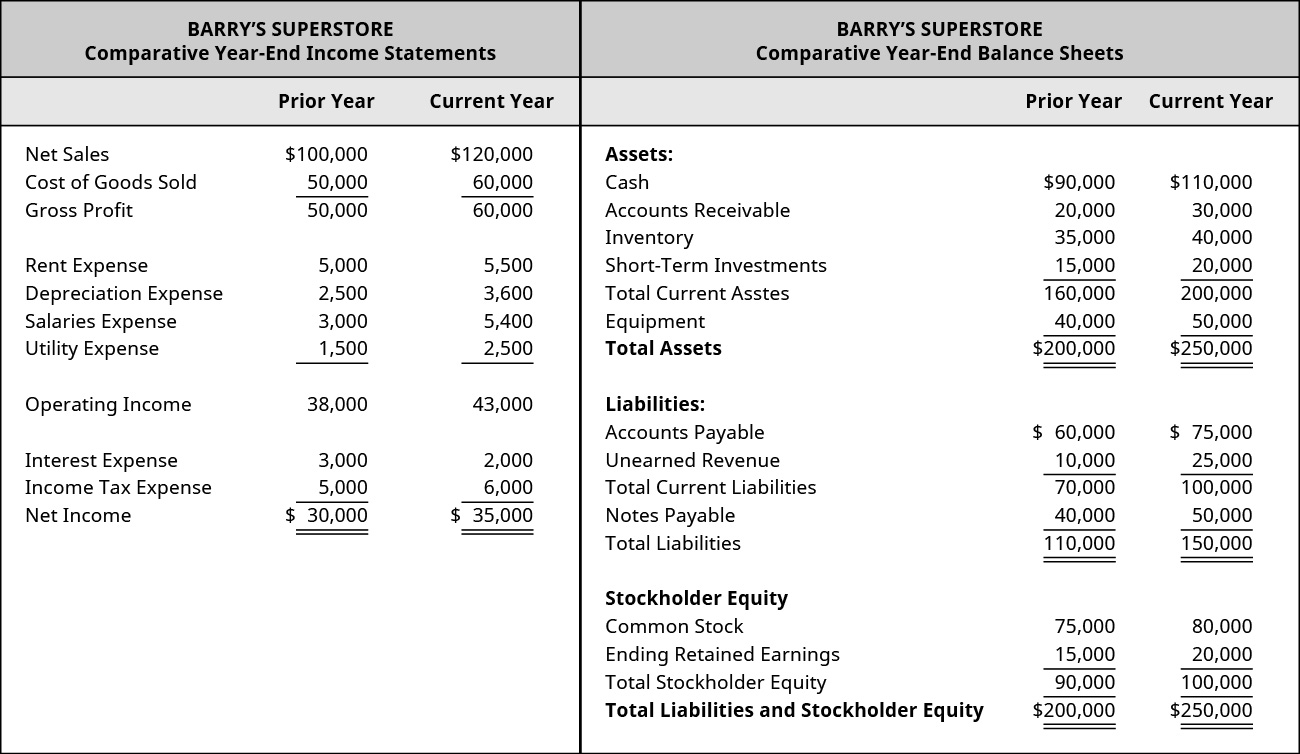

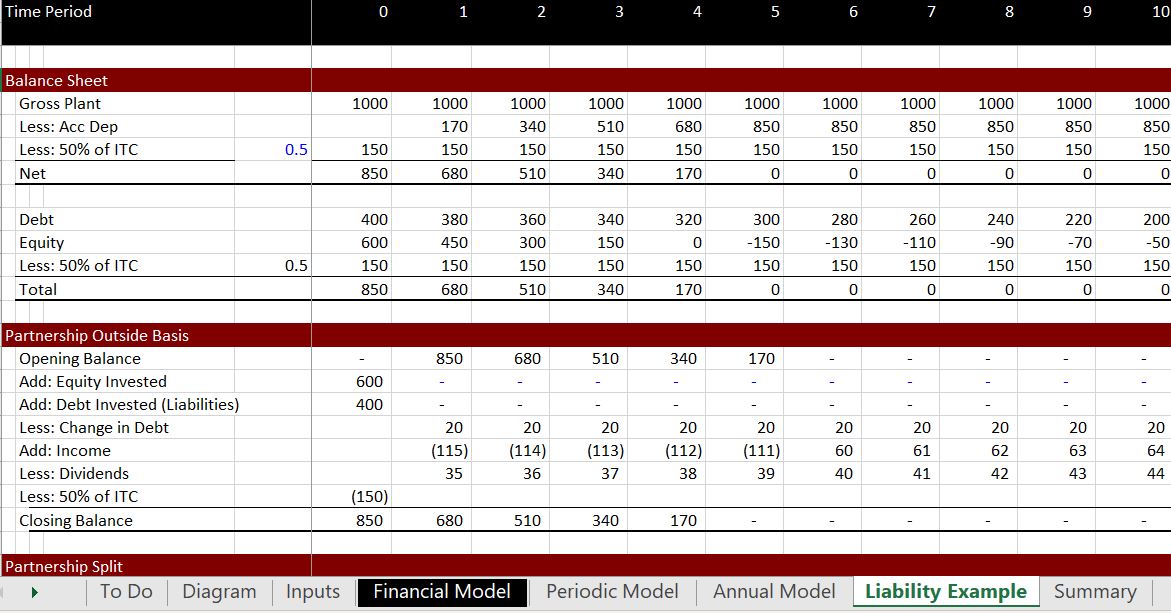

Tax basis financial statements. Most businesses financial statements report financial performance using u.s. This document provides a non. Lesson 2 reporting on ocboa financial statements completion of this lesson will enable you to:

For income tax purposes, revenue is. Income tax basis financial statements are financial statements that are reported for entities that have more of a complex situation. All nontaxable income will be required to.

A basis of accounting that the entity uses to file its tax return for the period covered by the financial statements regulatory basis: The main differences between financial statements prepared using the income tax and the accrual basis of accounting are: A basis of accounting that the entity uses to file its tax return for the period covered by the financial statements regulatory basis:

Along with the financial penalty, the judge barred mr. Choosing the right model for your business. This reporting is used for tax purposes and focuses on.

Recognize the general reporting considerations for income tax basis financial. Documents shown during trial ranged from spreadsheets to signed financial statements. Which financial statement is right for your business?

James to win an enormous victory against mr. A basis of accounting that the. In one example, the attorney general's legal team showed that trump's.

A basis of accounting that the. Here’s a look inside donald trump’s $355 million civil fraud verdict. Virtually every business must file a tax return.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)