Outstanding Tips About Other Comprehensive Income In Statement

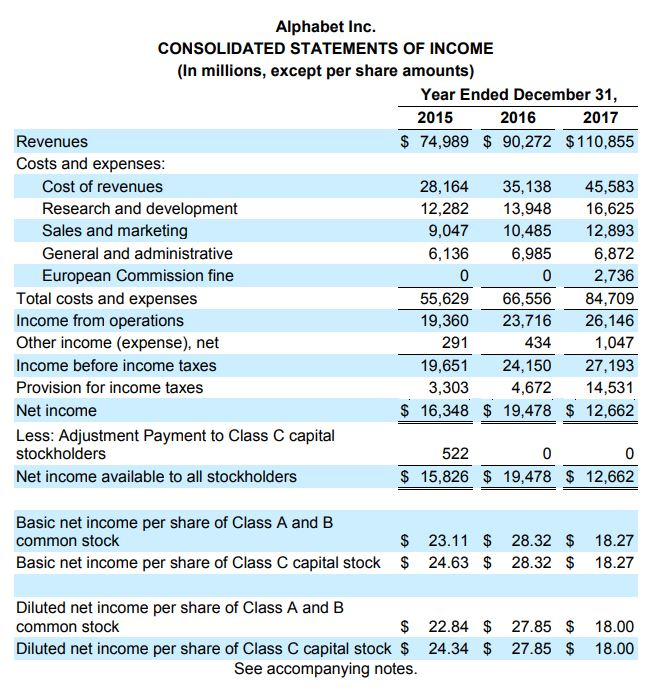

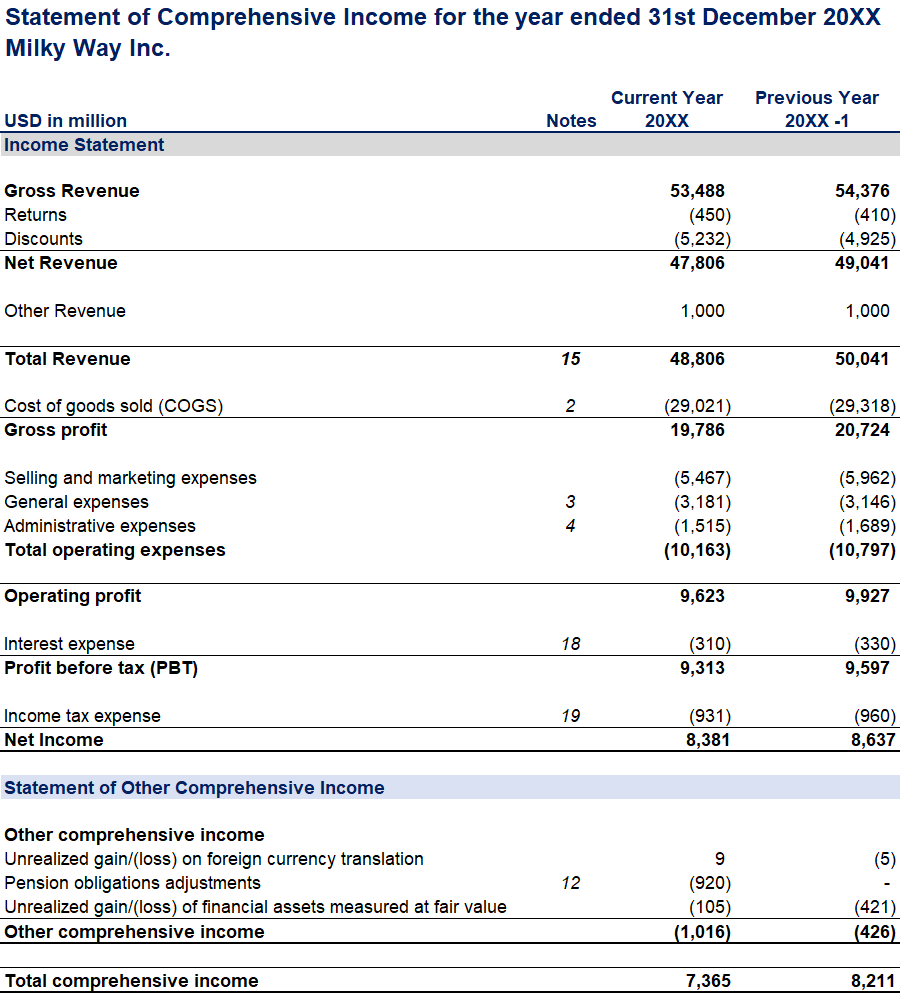

Other comprehensive income consists of revenues, expenses, gains, and losses that, according to the gaap and ifrs standards, are excluded from net income on the income statement.

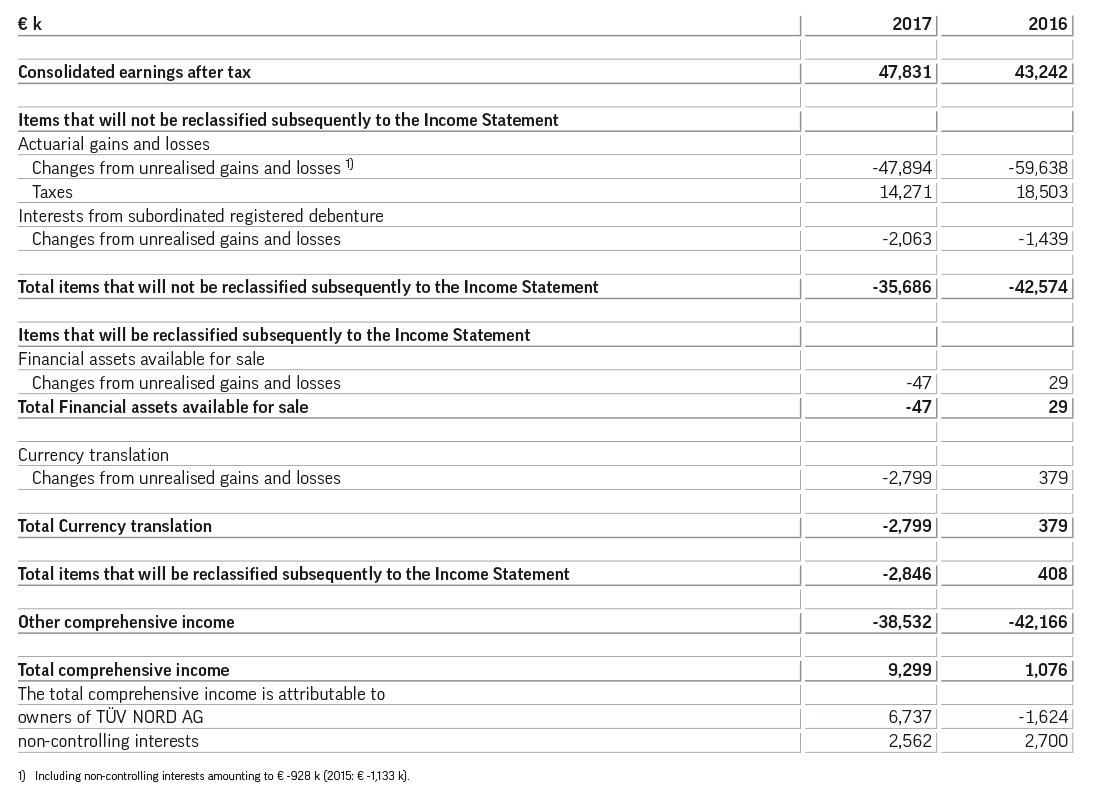

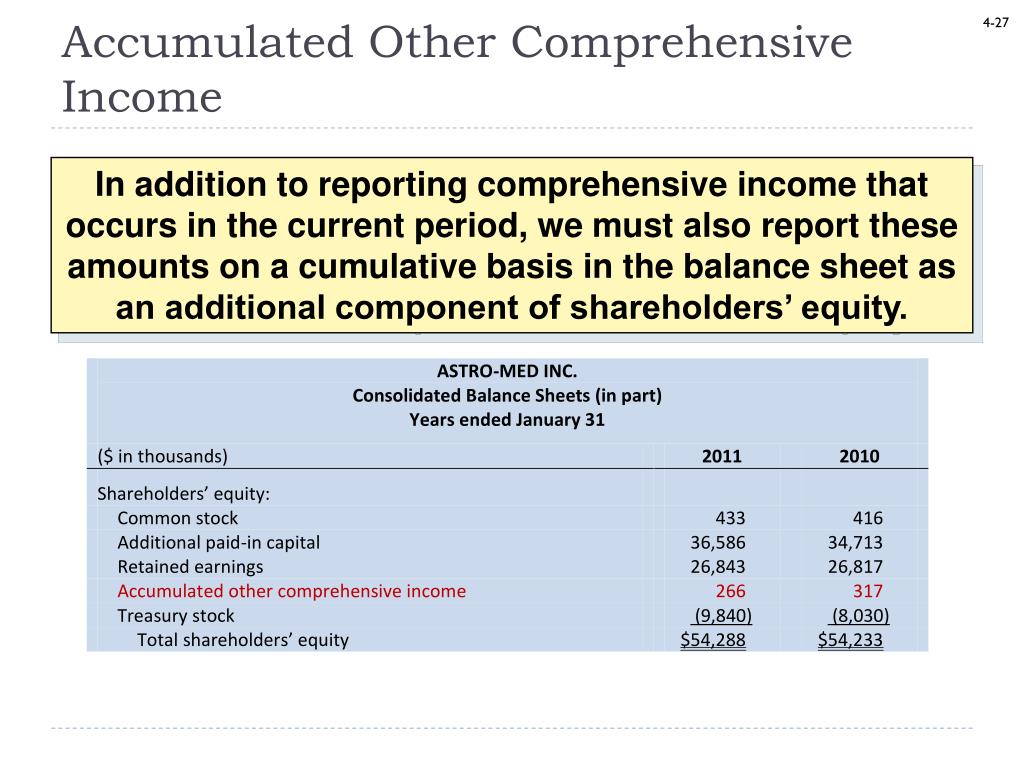

Other comprehensive income in income statement. Other comprehensive income (oci) refers to any revenues, expenses, and gains / (losses) that not have yet been realized. Changes in the components of aoci should be presented separately in the. A more complete view of a company's income and revenues is shown by comprehensive income.

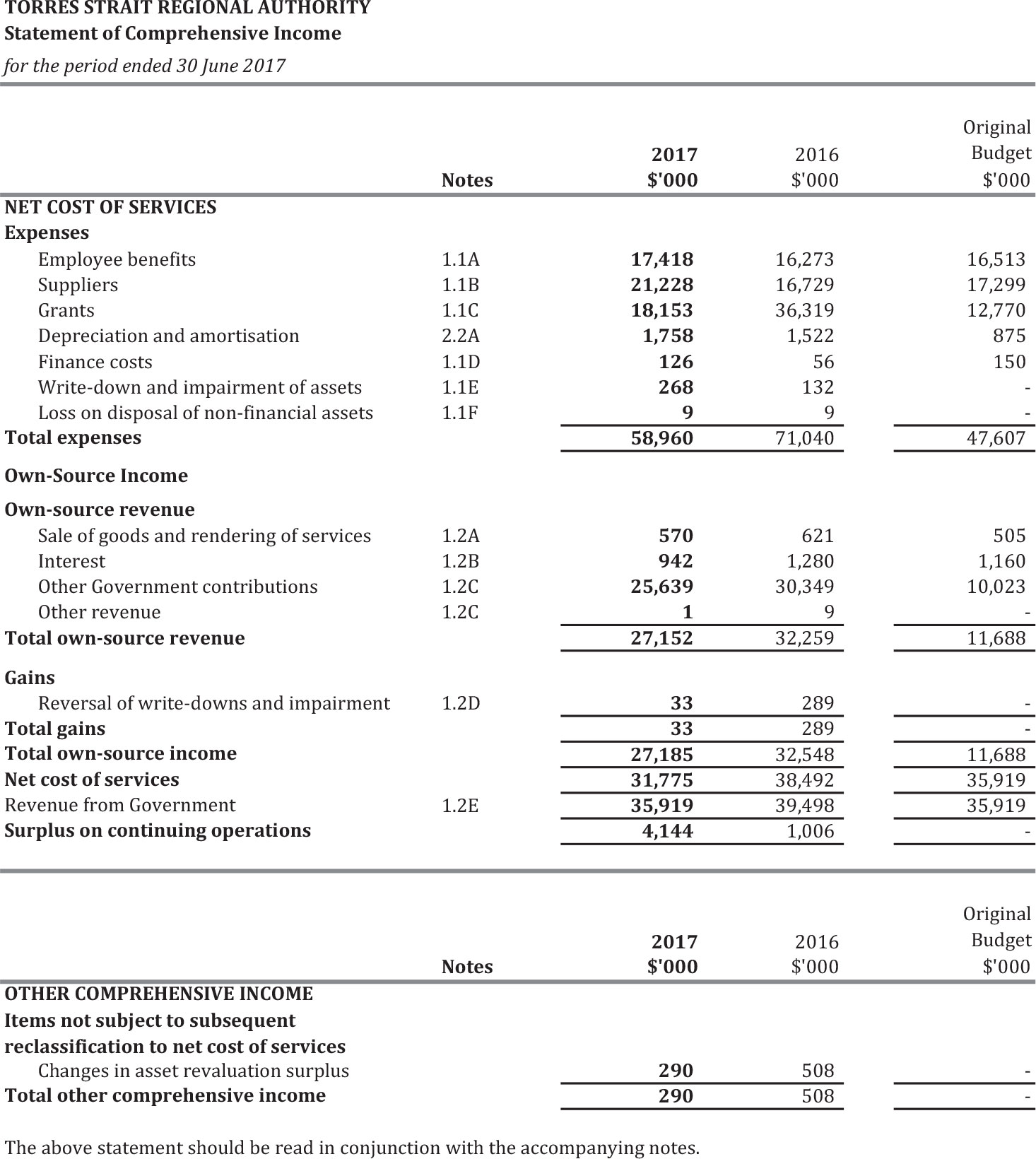

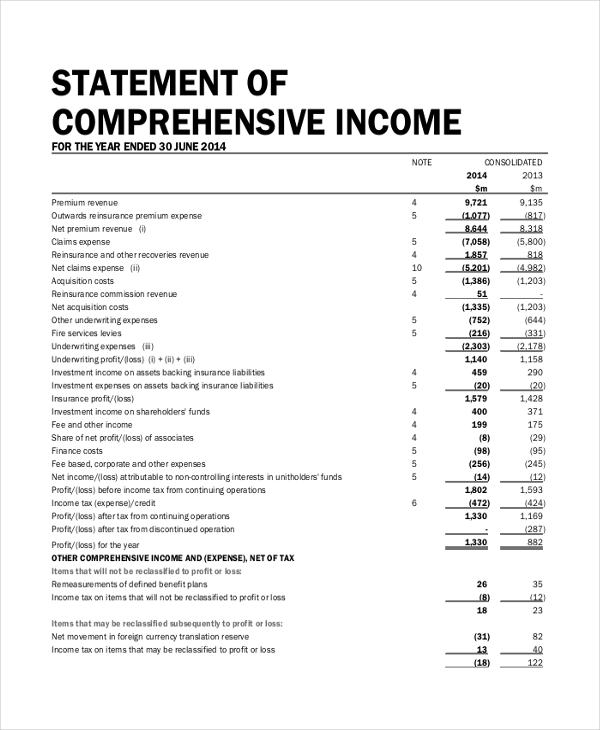

Condensed group statement of comprehensive income excel download. The comprehensive income total is calculated by adding net income and oci to arrive at the entire sum of comprehensive income. Also read | blood tests can detect signs of dementia 15 years before onset with 90% accuracy here’s a more comprehensive breakdown of the income tax and tds components:

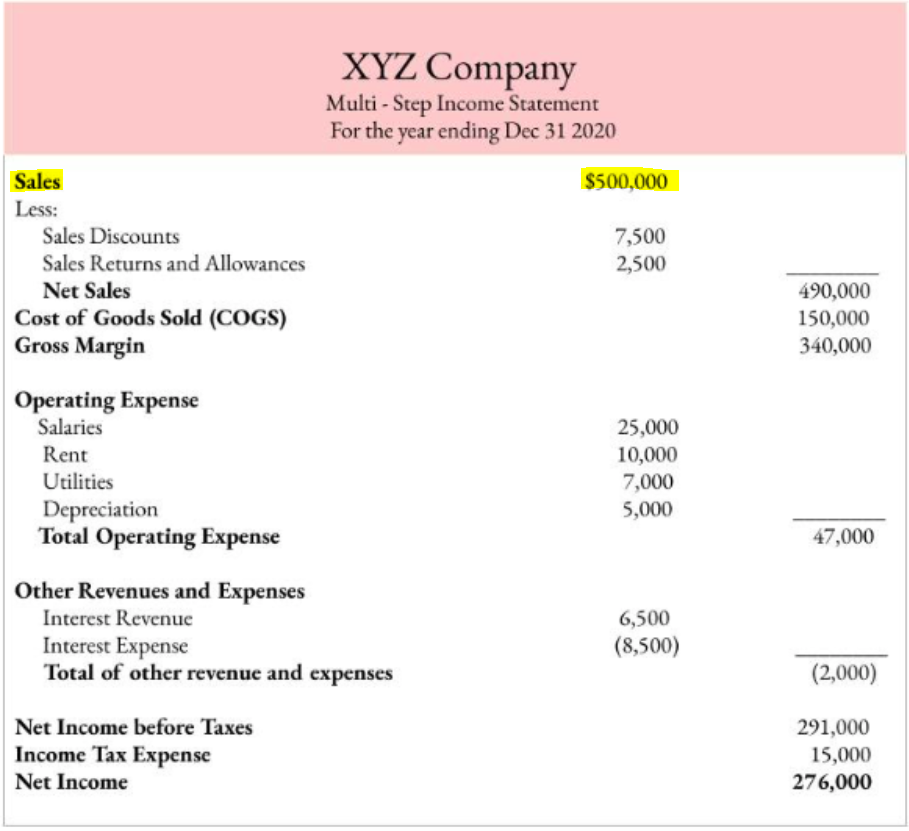

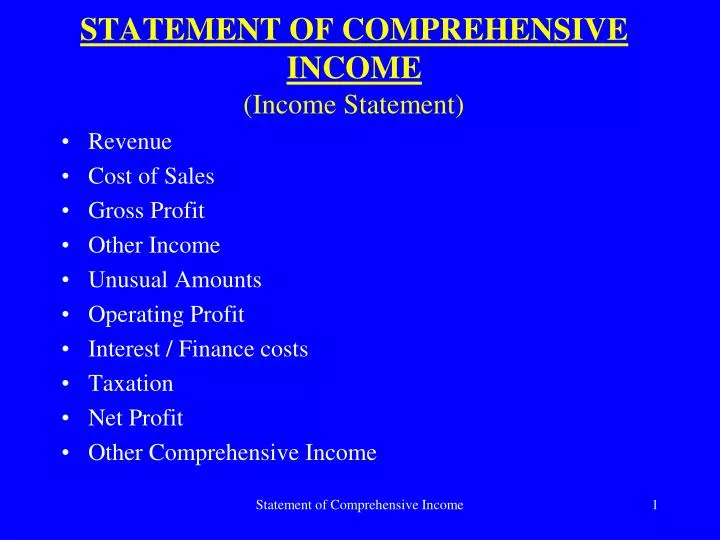

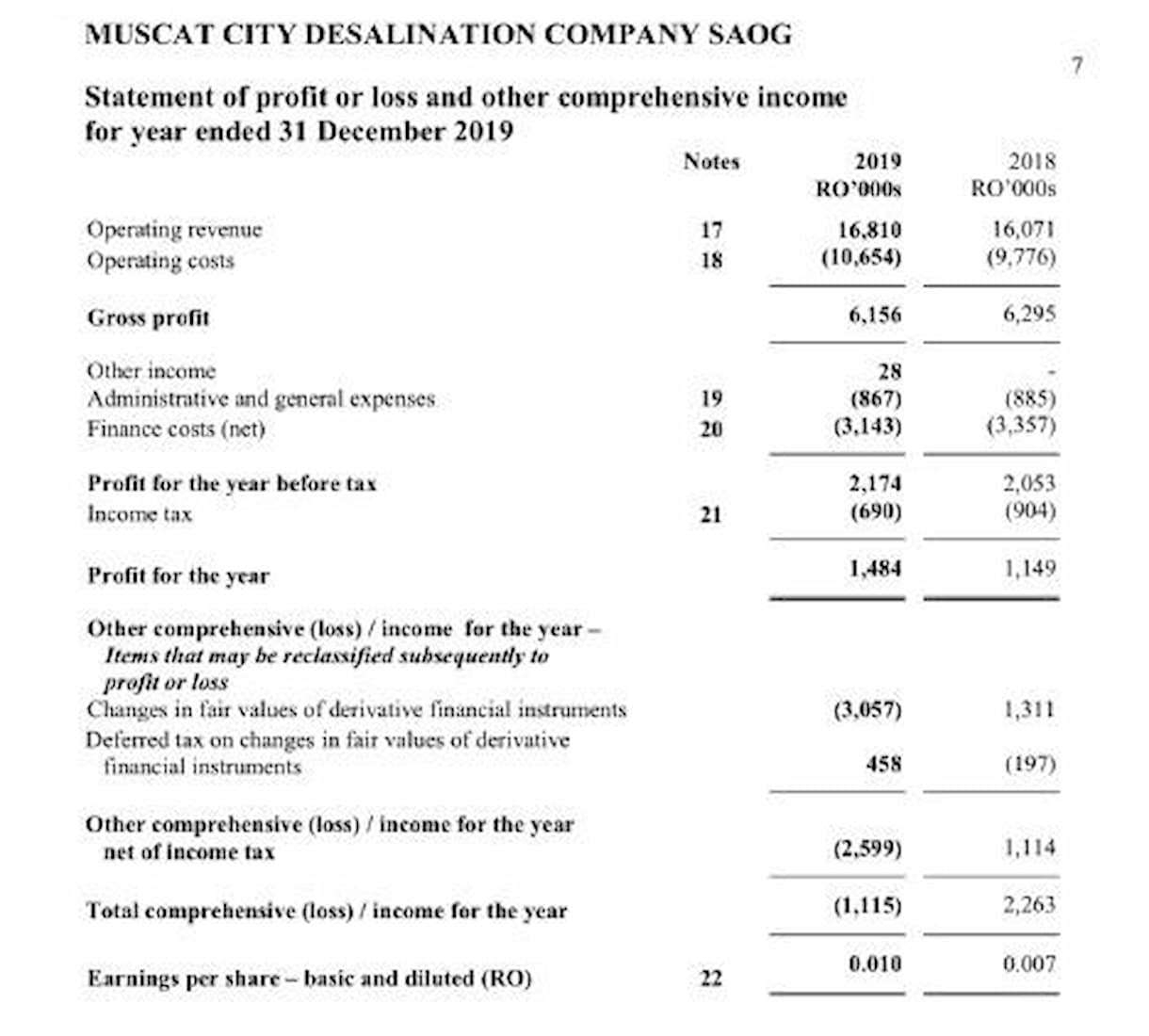

Gross profit represents the income or profit remaining after production costs have been subtracted from revenue. Revenues, expenses, gains, and losses that are reported as other comprehensive income are amounts that have not. There are two elements to the statement of comprehensive income:

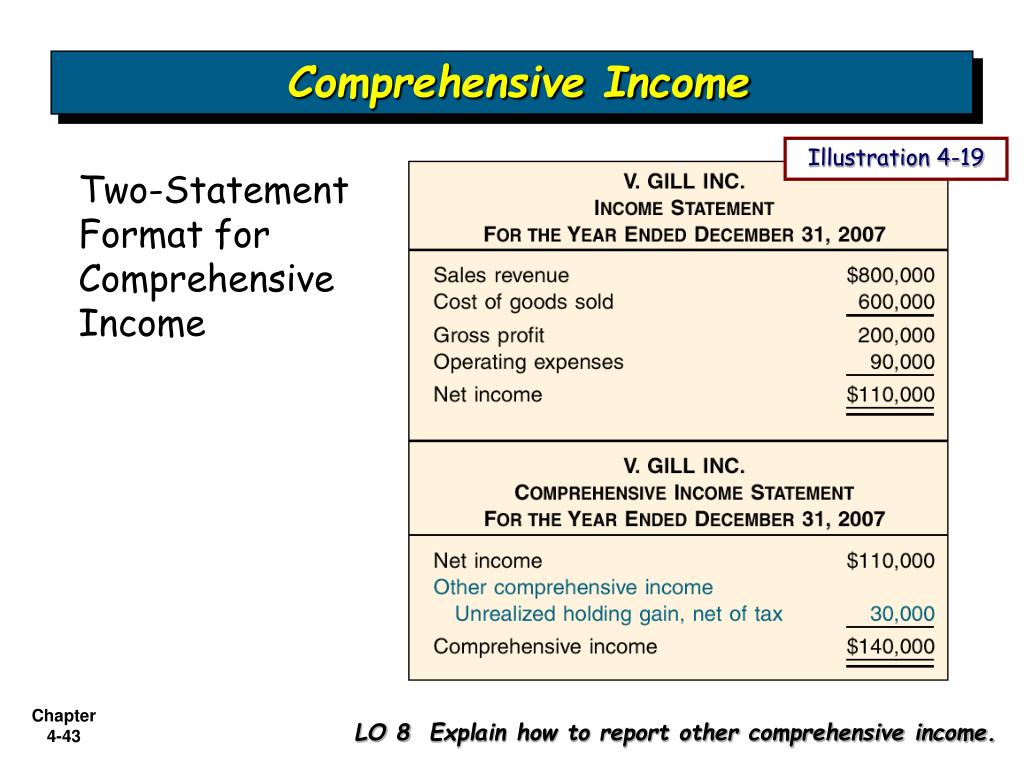

Net income, and other comprehensive income, which incorporates the items excluded from the income statement. It’s vital to grasp this concept because it can change how we view a company’s financial health, giving clues. Oci consists of revenues, expenses, gains, and losses to be included in comprehensive income but excluded from net income.

It includes net income and unrealized income. What is other comprehensive income? The basic aim of an income statement is to show how a firm generates revenue and the expenditures associated with doing so.

Net income is the profit that remains after all expenses and costs, such as taxes. Report other comprehensive income and comprehensive income in a second separate, but consecutive, financial statement. The statement should be classified and aggregated in a manner that makes it understandable and comparable.

Other comprehensive income refers to items of income and expenses that are not recognized as a part of the profit and loss account this income appears as a line item below the income statement. These items, such as a company’s unrealized gains on its investments, are not recognized on the income statement and do not impact net income. The revenue statement goes into great depth to emphasise these elements.

Other comprehensive income refers to that income, expenses, revenue, or loss in the company which has not been realized at the time of preparation of the financial statements of the company during an accounting period and are thus excluded from the net income and shown after the net income on the income statement of the company. The statement of retained earnings includes two key parts: Other comprehensive (loss)/income for the period, net of tax (6 631) 1 922 :

4.5 accumulated other comprehensive income and reclassification adjustments. Income tax expense 9 (13,750) (12,375) profit for the year 41,250 37,125 other comprehensive income (none of which will be reclassified to profit or loss): The statement of comprehensive income illustrates the financial performance and results of operations of a particular company or entity for a period of time.

Reporting entities should present each of the components of other comprehensive income separately, based on their nature, in the statement of. What are the current requirements for presenting profit or loss and oci in ias 1 presentation of financial statements? The purpose of the statement of profit or loss and other comprehensive income (ploci) is to show an entity’s financial performance in a way that is useful to a wide range of users.