Here’s A Quick Way To Solve A Info About Suspense Account In Profit And Loss

A suspense account is an account temporarily used in a general ledger to carry doubtful amounts which can either be a payment or a receipt.

Suspense account in profit and loss. A suspense account is a temporary holding account for a bookkeeping entry that will end up somewhere else once the final and correct account is determined. A suspense account is an account used to temporarily store transactions for which there is uncertainty about where they should be recorded. But where as in case of retirement and death of the partners, firm has to settle the amounts during the financial year.

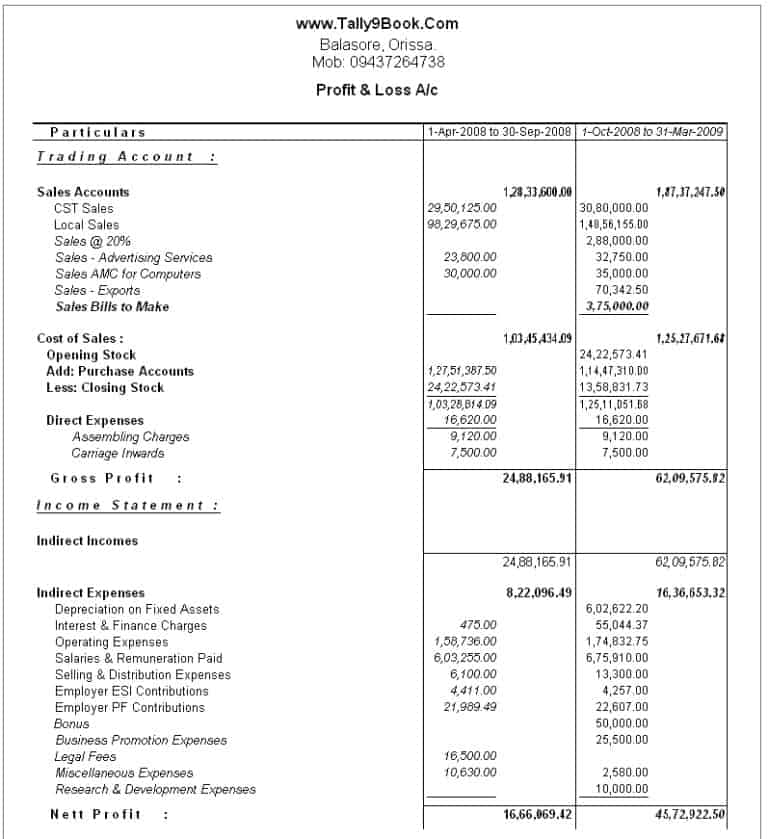

Given that there is a suspense account for each type of movement, it is enough to look at the account statement of the relevant suspense account. Once you save the details, you can use the. Journal entries to suspense accounts is done to remind the ca’s later to adjust them as technically these values should be zero, when we generate balance.

Suspense accounts are used when your trial balance is out of balance or when you have an unidentified transaction. Bill kimball when a transaction with no valid document is recorded, it causes a mismatch in the account balances. So firm has to transfer profits up to the date.

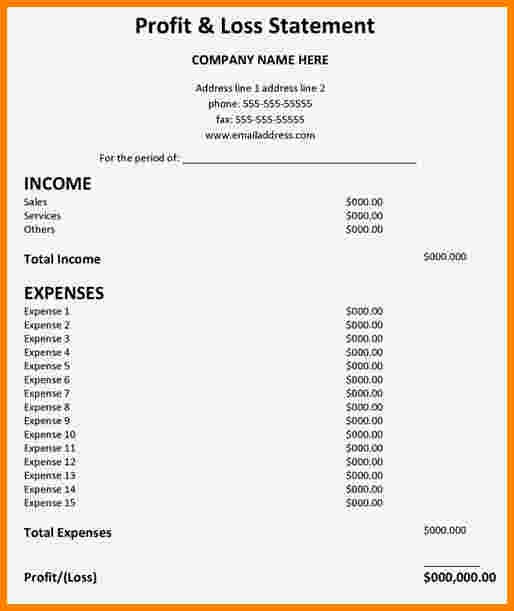

13 rows the draft statement of profit or loss showed a profit of $141,280 for the year ended 30. The very purpose of profit and. Definition of suspense account a suspense account is a general ledger account in which amounts are temporarily recorded.

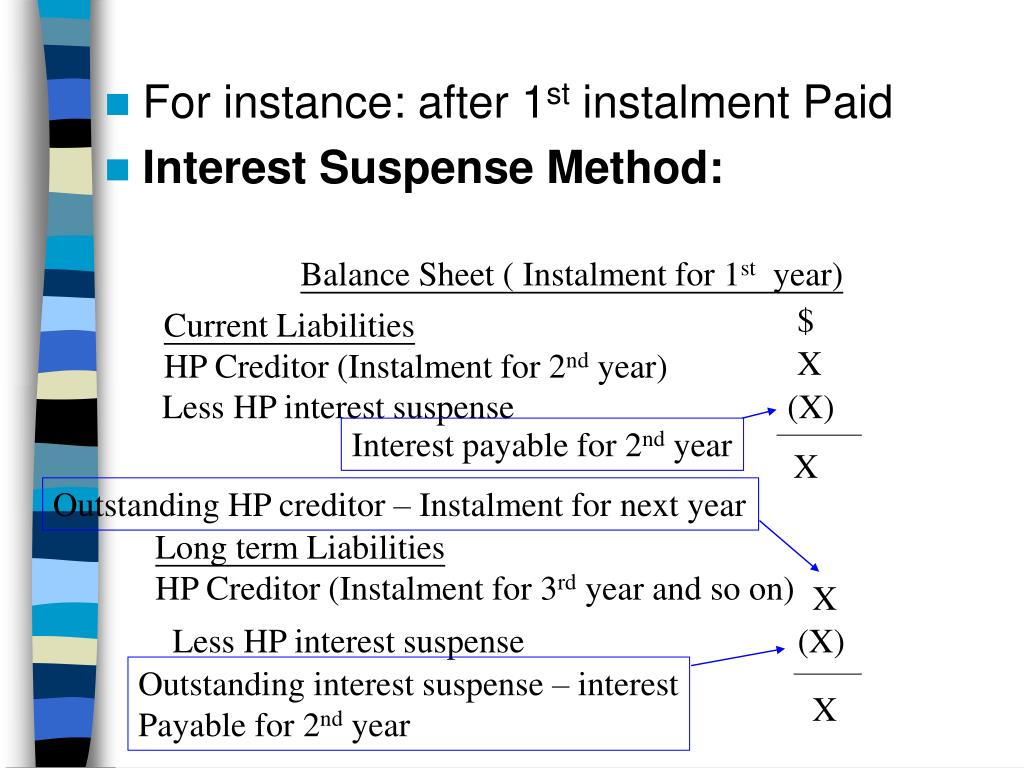

An entity prepares a profit and loss suspense account when either the partner is retired or in case of the death of a partner at any time before the. A suspense account is a temporary account created to adjust the difference in the trial balance due to the occurrence of an error or errors in the books of an account pending. There are two reasons why a suspense.

Why do we prepare profit and loss account? Toward the end of the accounting. Suspense account is a temporary resting place for an entry that will end up somewhere else once its final destination is determined.

The suspense account is used because the. Clearing suspense accounts is especially important for the company to know what its actual profits and losses are at the end of the year. A suspense account could be located in any one of these sections of an organization's chart of accounts:

A suspense account is a temporary account where entries with discrepancies and doubtful factors are parked. Despite considerable efforts, if the. The following are the most common causes of a mortgage suspense account.

In accounting, suspense account is a general ledger account where ambiguous transactions are temporarily recorded when an appropriate classification cannot be. A suspense account is an account in the general ledger used to temporarily store transactions that require further analysis and rechecking before a permanent. These kinds of transactions are recorded under a.

What is profit and loss suspense account and how it is treated in partners capital account and balance sheet?